Featured

Compare Blue Advantage And C Plus

A savings of up to. Blue Cross Blue Shield makes it easy for you to compare plans on their website.

Https Www Bcbsm Com Content Dam Microsites Campaigns Plans Statemedicare 2021 Evidence Of Coverage Book Pdf

There is a 352 per day coinsurance payment for inpatient hospital stays for days 61 to 90.

Compare blue advantage and c plus. If you are paying 185 for a select plan not good for travel moving HMOPPO process potential loss of benefit if someone gets in the mix that is not in the plan not so low risk plus 4320 for Part D and approx. There is an annual deductible of 1408 for inpatient hospital stays. The HMO products are offered by Blue-Advantage Plus.

Some planseven require a person to pay only the Medicare Part B premium and 0 forprescription drug. Primary Care Doctor Visit Copay. The big difference between Medicare Advantage and Original Medicare plus a Medigap policy is when you pay.

Blue Advantage PPO is a Medicare-approved PPO plan. Blue Select offers two tiers of in-network benefits. 5 copay per visit.

All the benefits come from one plan so you dont need to manage multiple plans. Its options include two levels of Medicare Advantage Plans. Full coverage for Medicare-eligible hospital stays.

Enrollment in BlueRx PDP depends on CMS contract renewal. As a result inpatient costs can come as quite a surprise. C Plus SM is a Medicare Select Plan and is a private insurance plan regulated by the Alabama Department of.

No referrals needed to see specialists. To compare Medicare plans between Cigna and Blue Cross Blue Shield we needed to get local because the plans available to you from each company depend on the local BCBS insurer where you live. C Plus SM is a Medicare Select Plan and is a private insurance plan regulated by the Alabama Department of.

You may choose from either tier but for quality and savings choose from Tier 1. Also these plans go up each year. Blue Advantage PPO is a Medicare-approved PPO plan.

Enrollment in Blue Advantage PPO depends on CMS contract renewal. There is a fixed. You pay nothing per day for days 8-90.

At the end of the day I enrolled in the Blue Advantage Plan because of the coverage exclusions in the C Plus Plan G. Enrollment in Blue Advantage PPO depends on CMS contract renewal. I feel robbed out of a Medicare Select Plan.

We pulled example plan information from Dallas Texas to give you an idea of the benefits and costs of plans offered by each company. Choose Blue Select if you want savings along with access to our largest network of doctors specialists and hospitals. Kaiser Permanentes Medicare Advantage plan is easy-to-use and pays for hospital coverage medical services such as doctors visits drug coverage preventative care and more.

You simply answer a few questions about your age location health status and needs and youll be presented with. 7 Two tiers of in-network benefits to choose from. BlueRx PDP is a Medicare-approved Part D plan.

BlueCross BlueShield and Humana offer Medicare Advantage Plans Prescription Drug Plans PDPs and Medigap plans. A Comparison of C Plus and Blue Advantage Benefits MBG-37 6-2005 An Independent Licensee of the Blue Cross and Blue Shield Association. Enrollment in Blue Medicare Advantage depends on contract renewal.

BlueCross BlueShield and Humana are each a well-known health insurance company and have received similar customer ratings on Best Company. Copays for doctor and specialist visits can add up fast too. Standard Medicare Advantage and Medicare Advantage Plus with expanded coverage and services.

BlueRx PDP is a Medicare-approved Part D plan. 225 copay per day for days 17. No waiting period for pre-existing health conditions.

After day 91 there is a 704 daily coinsurance payment for each lifetime reserve day used. With Medicare Advantage you pay most costs at the point of service. 0 copays for doctor visits outpatient services and emergency room visits after Part B deductible.

Its a great choice as a stand-alone drug plan or it can be paired with a Medicare Select plan C Plus for more comprehensive coverage. You are looking at 250 plus 145 for Medicare B. If Medicare pays C Plus pays.

0 copay for days 91 and. This is not a comprehensive listing of your benefits. Blue Cross and Blue Shield of Kansas City is an independent licensee of the Blue Cross and Blue Shield Association.

Here are Some C Plus Plan Highlights. If you want coverage thats like what youve had before there are Medicare Advantage plans. Also included on the other side of this comparison.

Enrollment in BlueRx PDP depends on CMS contract renewal. Medicare Advantage onthe other hand has a lower premium but higher out-of-pocket costs. C Plus Medicare Select plans work hand-in-hand with Original Medicare picking up as a supplement to help fill the gaps that Medicare alone does not cover.

These plans cover the medical and hospital benefits of Medicare Parts A and B plus prescription drug coverage and may offer dental and vision care. Blue Cross and Blue Shield of Kansas Citys Blue Medicare Advantage includes both HMO and PPO plans with Medicare contracts. Shown below are the C Plus benefits compared with benefits from our new Medicare Advantage product Blue Advantage.

Other Part A costs1. Compare Enroll CPlus. BlueRx PDP is a Medicare-approved Part D plan.

When compared with other Medicare providers these ratings are high. Blue Advantage Complete PPO 0 per month Enroll Now Blue Advantage Premier PPO 170 per month Enroll Now. Enrollment in Blue Advantage PPO depends on CMS contract renewal.

Blue Advantage PPO is a Medicare-approved PPO plan. Enrollment in BlueRx PDP depends on CMS contract renewal.

Ppo Blue Cross And Blue Shield Of Illinois

Ppo Blue Cross And Blue Shield Of Illinois

Difference Between C And C Head To Head Comparison

Https Www Bcbstx Com Provider Pdf Bma Physician Pdf

Medicare Advantage Insure With Integrity

Medicare Advantage Insure With Integrity

Https Www Bluecrossmn Com Sites Default Files Dam 2020 09 P11ga 20973610 Press 20 20x22063r01 20 20h2446 001 20blue 20cross 20strive 20medicare 20advantage 20choice 508 Pdf

Https Providers Bcbsal Org Portal Documents 10226 306297 Attention Medicare Beneficiaries 12389437 Ed99 4e25 A6c1 7eee8b035cec Version 1 4

Http Www Troyrecreation Org Sneakers 20flyer Pdf

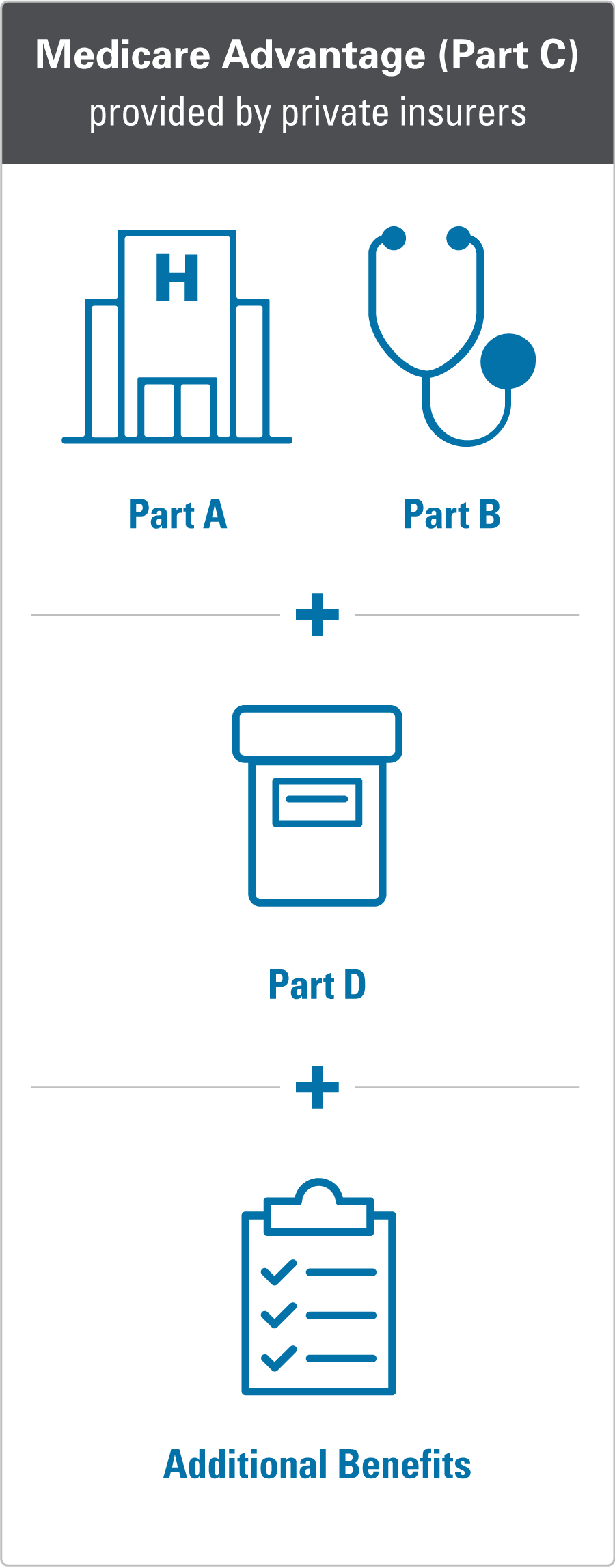

Medicare Advantage Part C Blue Cross Blue Shield

Medicare Advantage Part C Blue Cross Blue Shield

Https Www Bcbstx Com Provider Pdf Id Card Quick Guide Pdf

Find A Drug Or Pharmacy Blue Cross Nc

Find A Drug Or Pharmacy Blue Cross Nc

Https Www Bluecrossmn Com Sites Default Files Dam 2020 09 P11ga 16941319 Pdf

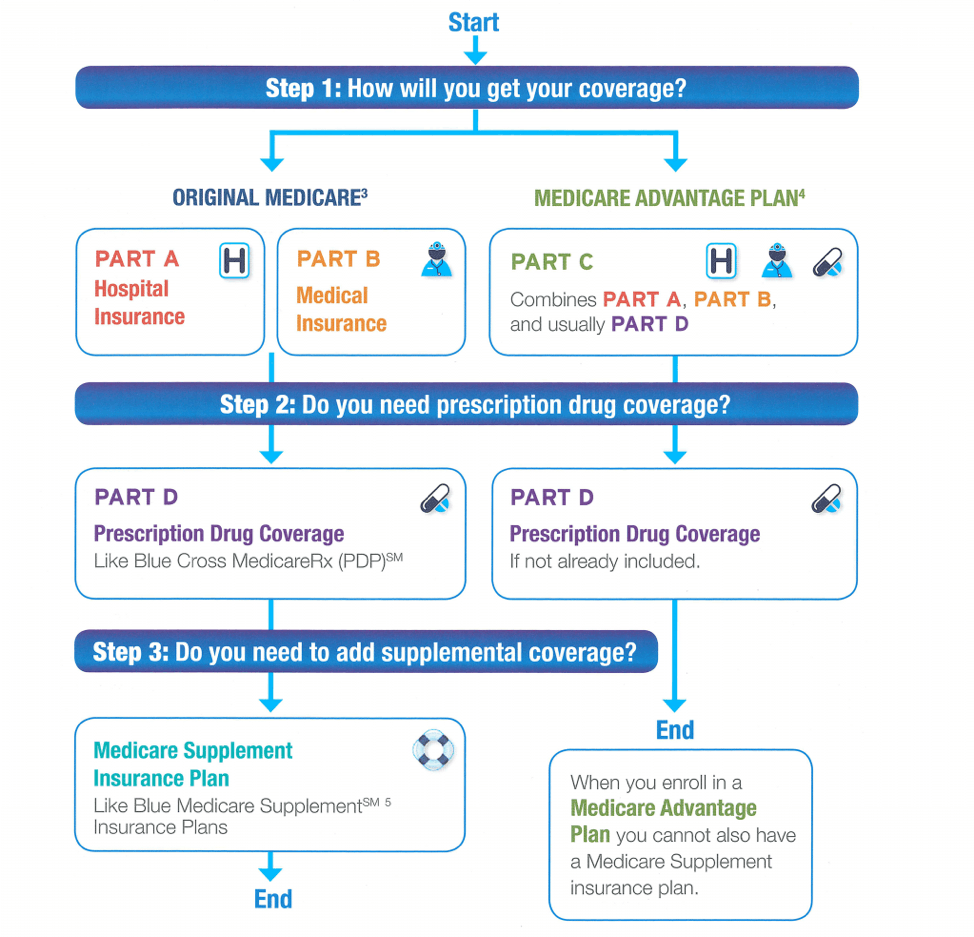

Medicare Coverage Options Blue Cross Blue Shield

Medicare Coverage Options Blue Cross Blue Shield

Comments

Post a Comment