Featured

What Is Ad&d Life Insurance

Accidental death and dismemberment insurance also called ADD insurance offers coverage for. ADD insurance short for Accidental Death and Dismemberment is also known as accident protection insurance.

Accidental Death Dismemberment Ad D Insurance

Accidental Death Dismemberment Ad D Insurance

What is ADD life insurance.

What is ad&d life insurance. Its a great way to help protect you and your family financially in the event of accidental injury or fatality. Basic Life refers to life insurance that would pay the death benefit to the beneficiary if death occurred by any reason except suicide in. ADD is a limited form of insurance that covers you only in accidents.

These policies pay out indemnity benefits when the insured becomes disabled or dies as. Please leave this field empty. You can also add an accidental death rider to your life insurance.

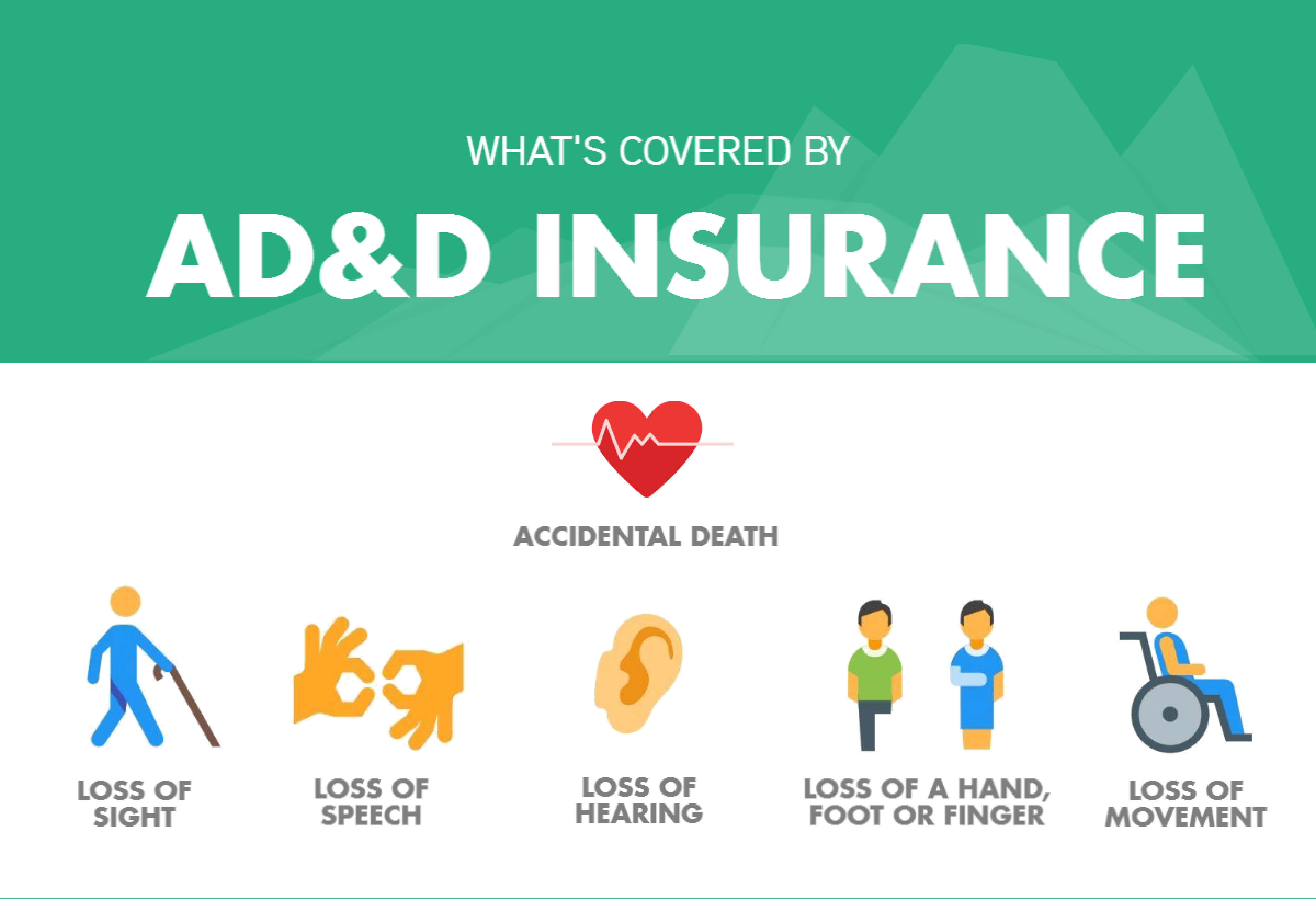

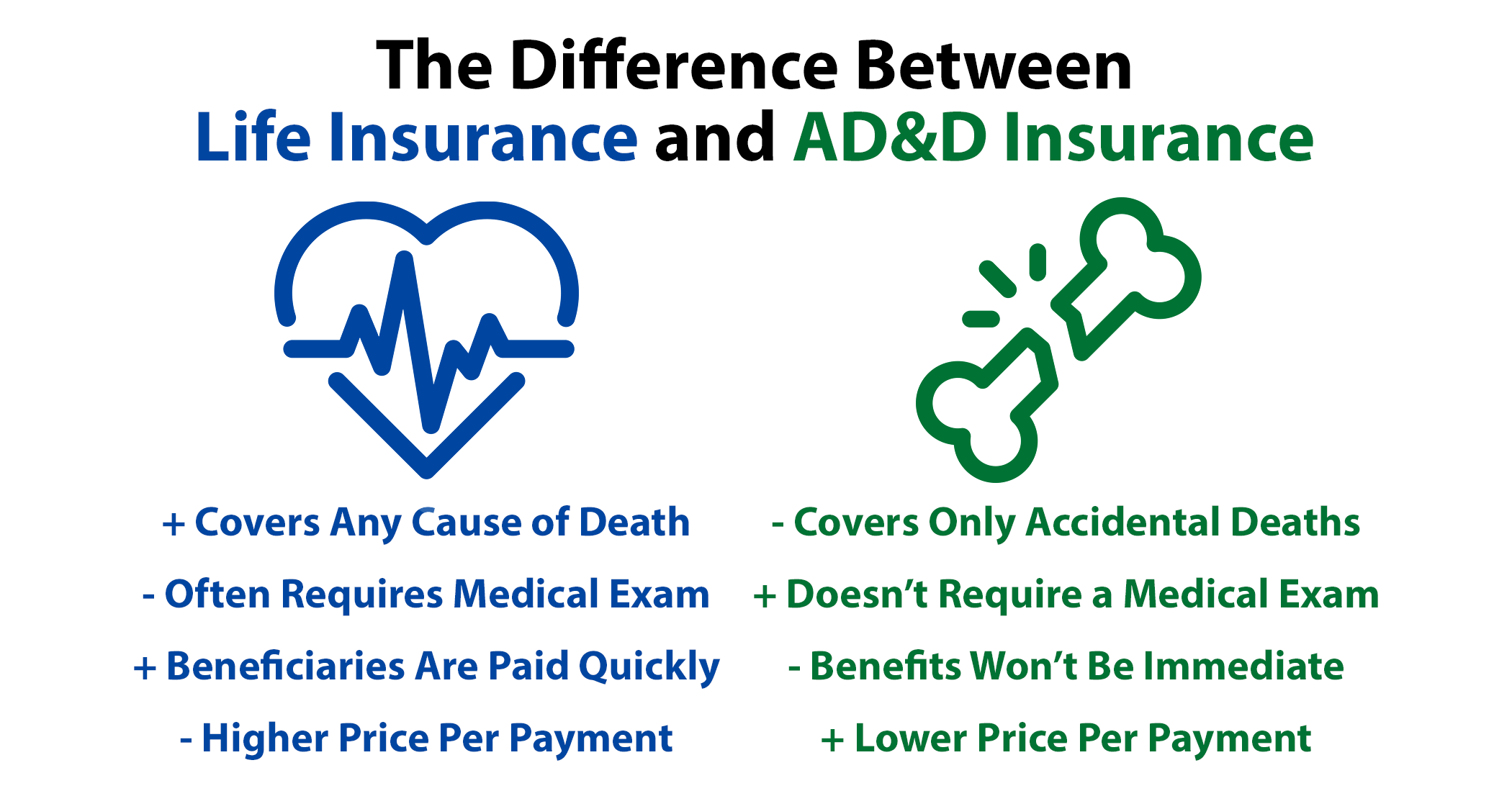

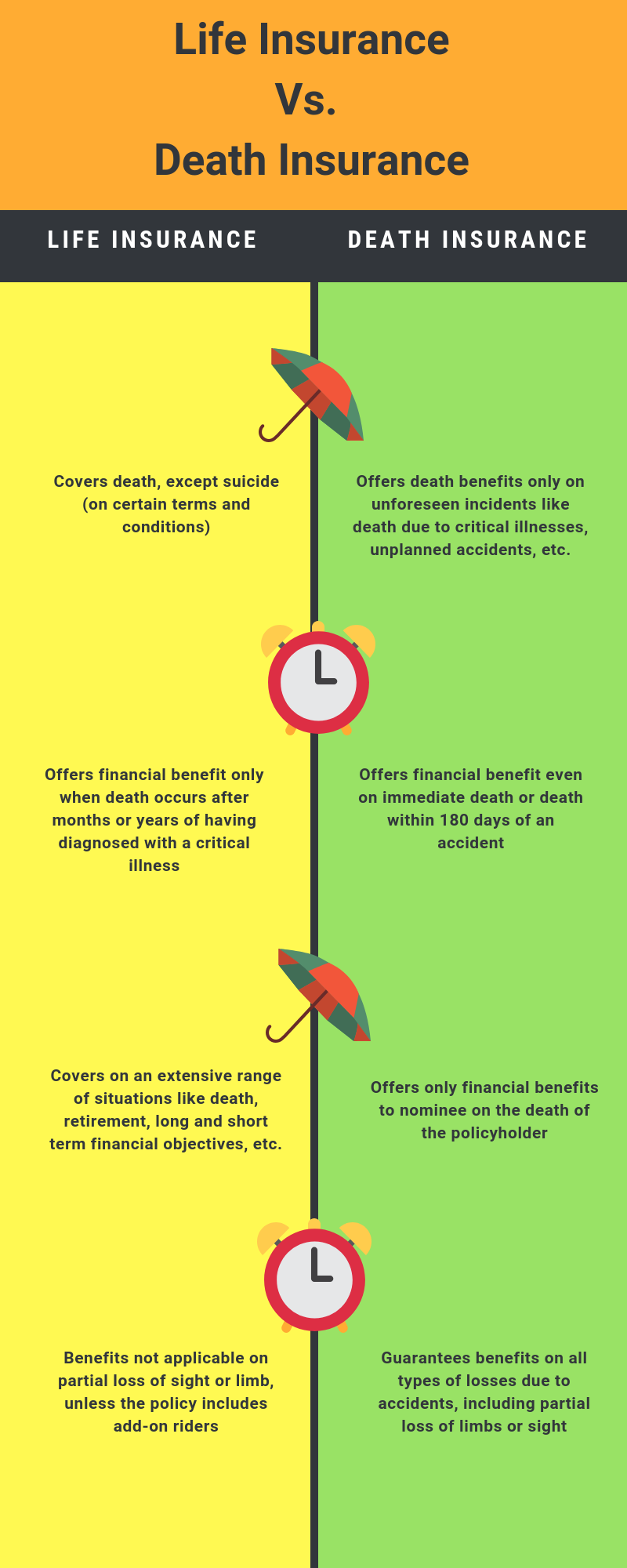

ADD Insurance Policies An ADD policy will provide a cash benefit to your beneficiaries if you die as the result of a covered accident or suffer a partial or complete dismemberment due to a covered accident. It would not pay if death or dismemberment was due to illness. However there are coverage restrictions that make accidental death and dismemberment insurance far less useful.

A life insurance rider is an addendum to a policy that provides additional coverage. The term accidental life insurance is something of a misnomer since some insurers stipulate that ADD insurance is not a type of life insurance per se. It would pay for death or loss of limbs that occurred as the results of an accident.

Many people think that Accidental Death and Disablement ADD policies are life insurance products. The main thing to remember is that ADD coverage is a supplement to life insurance which helps cover expenses after you die and disability insurance which covers you if youre injured and cant. Instead it is often purchased as an entirely separate policy with a different set of benefits and exclusions or included as a rider on an existing life health or other insurance policy.

Ask an expert if the life insurance company youve chosen offers an ADD rider. It can be an affordable way to supplement your life insurance or medical coverage if youre seriously injured or die as. Its also different from life insurance because it covers severe non-fatal injuries such as loss of a.

Yes it pays a death benefit but as the name suggests only provides coverage in the event you die due to an accident. An ADD rider pays out an extra amount if death is due to an accident but if the death is from natural causes the policy simply pays out the base amount. 8 rijen ADD VS Life Insurance.

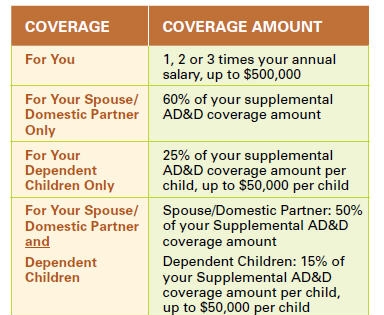

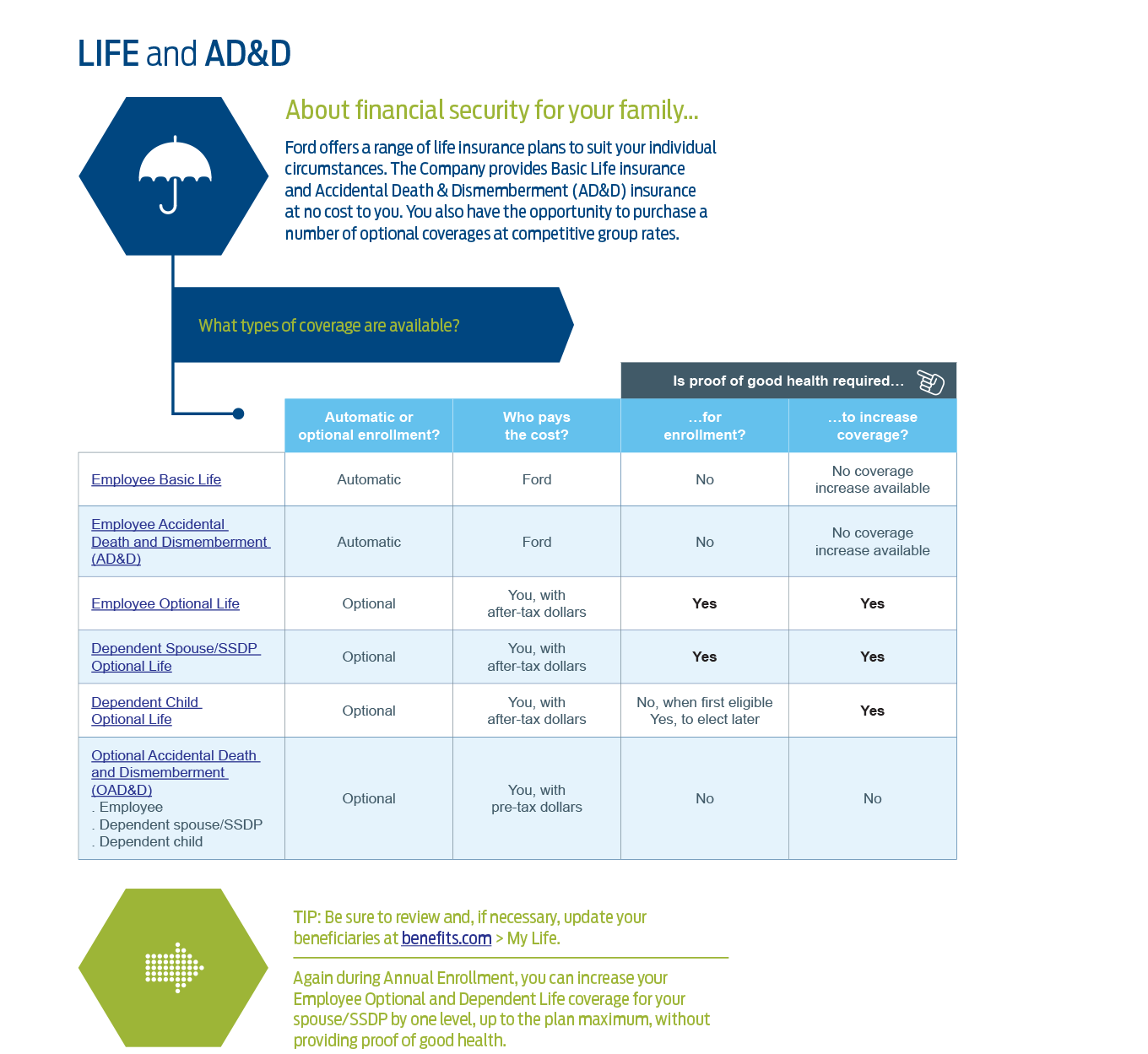

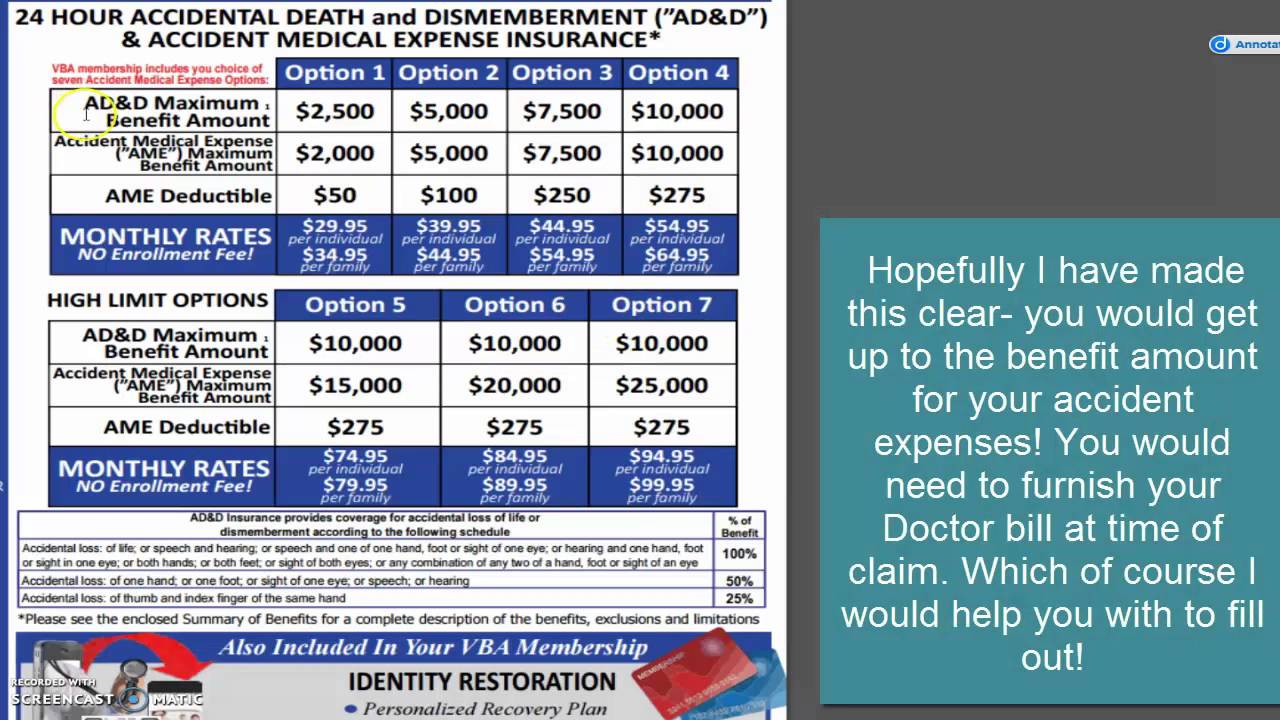

Basic Life and ADD Insurance are the names often used when offering supplemental insurance to employees. They are actually casualty insurance policies. Voluntary ADD Insurance is Accidental Death and Dismemberment Insurance that you can purchase through your place of work at group rates if you wish to do so.

An accidental death and dismemberment insurance policy ADD is not the same as a standard life insurance policy. An accidental death and dismemberment ADD insurance policy can help protect your familys finances in the event of the loss of your life or limb s. ADD pays for accidental death but life insurance pays when you.

ADD includes life insurance but only for accidental death. Accidental death and dismemberment life insurance ADD pays a cash benefit for accidental death or loss of.

What To Know About Ad D Insurance Forbes Advisor

What To Know About Ad D Insurance Forbes Advisor

Ad D Coverage Infographic Texas Bar Private Insurance Exchange Texas Bar Private Insurance Exchange

Ad D Coverage Infographic Texas Bar Private Insurance Exchange Texas Bar Private Insurance Exchange

Get To Know Your Group Term Life And Ad D Insurance Hub

Get To Know Your Group Term Life And Ad D Insurance Hub

Life Insurance Accidental Death And Dismemberment Ad D Quest Insurance The Best Value For Your Insurance Dollars

Life Insurance Accidental Death And Dismemberment Ad D Quest Insurance The Best Value For Your Insurance Dollars

Is Group Accidental Death Dismemberment Ad D Worth It Glg America

What Is Accidental Death And Dismemberment Coverage Quotacy

What Is Accidental Death And Dismemberment Coverage Quotacy

Ad D Life Insurance Coverage Reviews Youtube

Ad D Life Insurance Coverage Reviews Youtube

What Is Ad D Insurance Youtube

What Is Ad D Insurance Youtube

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Life Insurance Vs Accidental Death Insurance Explained

Life Insurance Vs Accidental Death Insurance Explained

Accidental Death Insurance The 4 Absolute Best Policies

Accidental Death Insurance The 4 Absolute Best Policies

Comments

Post a Comment