Featured

100 Coverage Dental Insurance

Spirit Choice Dental Insurance. 50 coverage after deductible some limits apply for major services.

Orthodontics are only covered under the High coverage option at.

100 coverage dental insurance. The comprehensive network of dental insurance providers they can connect you with means that youll have access to an ample selection of plans that can be customized to offer full coverage. Amalgam filling primary and permanent teeth One Surface. 80 coverage after deductible some limits apply for basic services.

You will have dental insurance within three dayswhich is a short waiting period compared to other options. Dental plans can vary even between insurers. Negotiated fees typically range from 30 - 45 less than the average charges in a dentists community for similar services.

A participating dentist is a general dentist or specialist who has agreed to accept negotiated fees as payment in full for covered services. The monthly premiums vary by state. Because many insurance policies have annual limits and these limits usually arent nearly enough to cover implants.

A routine dental visit can cost over 100. Negotiated fees refers to the fees that in-network dentists have agreed to accept as payment in full for covered services subject to any. In many cases dental plans include 100.

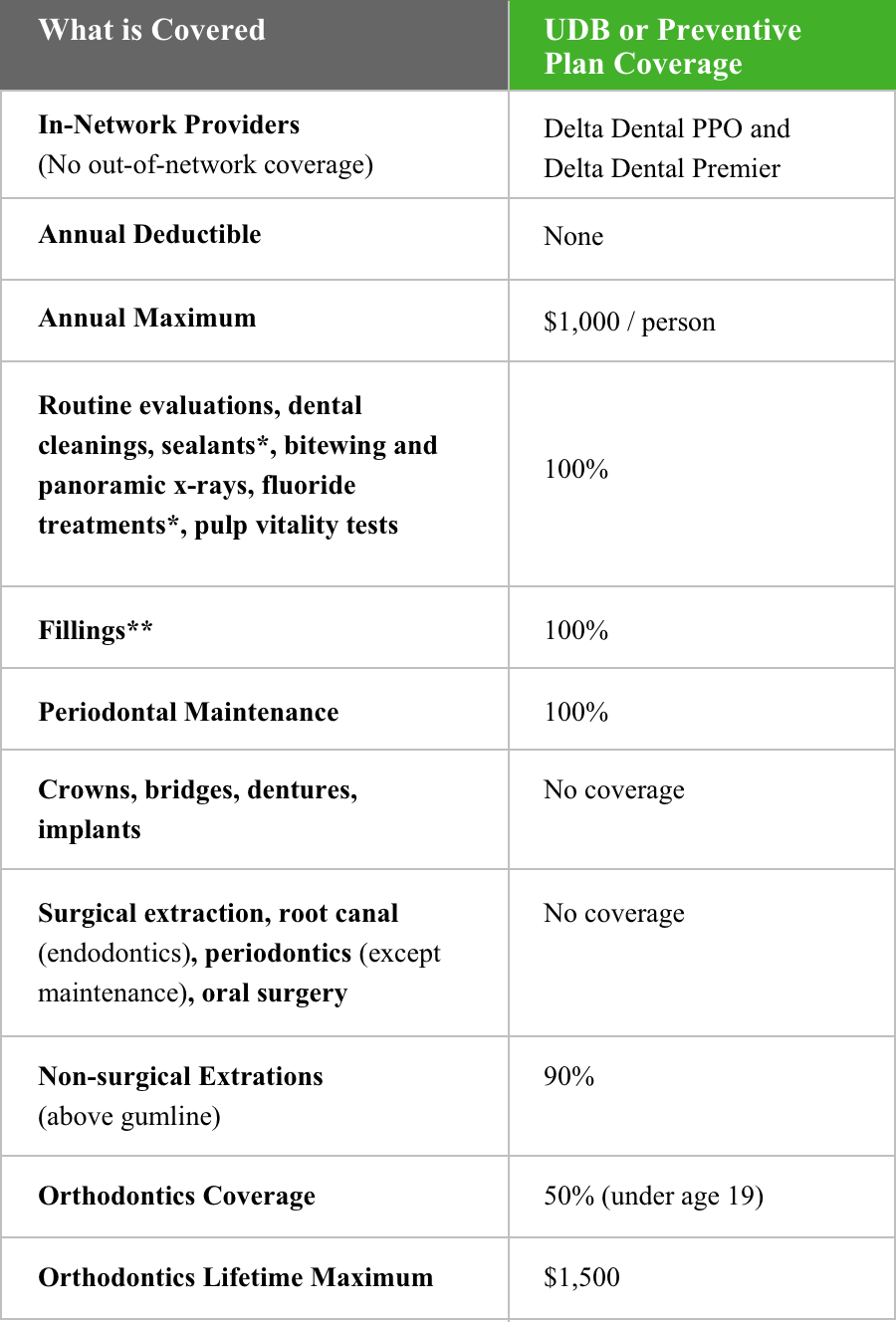

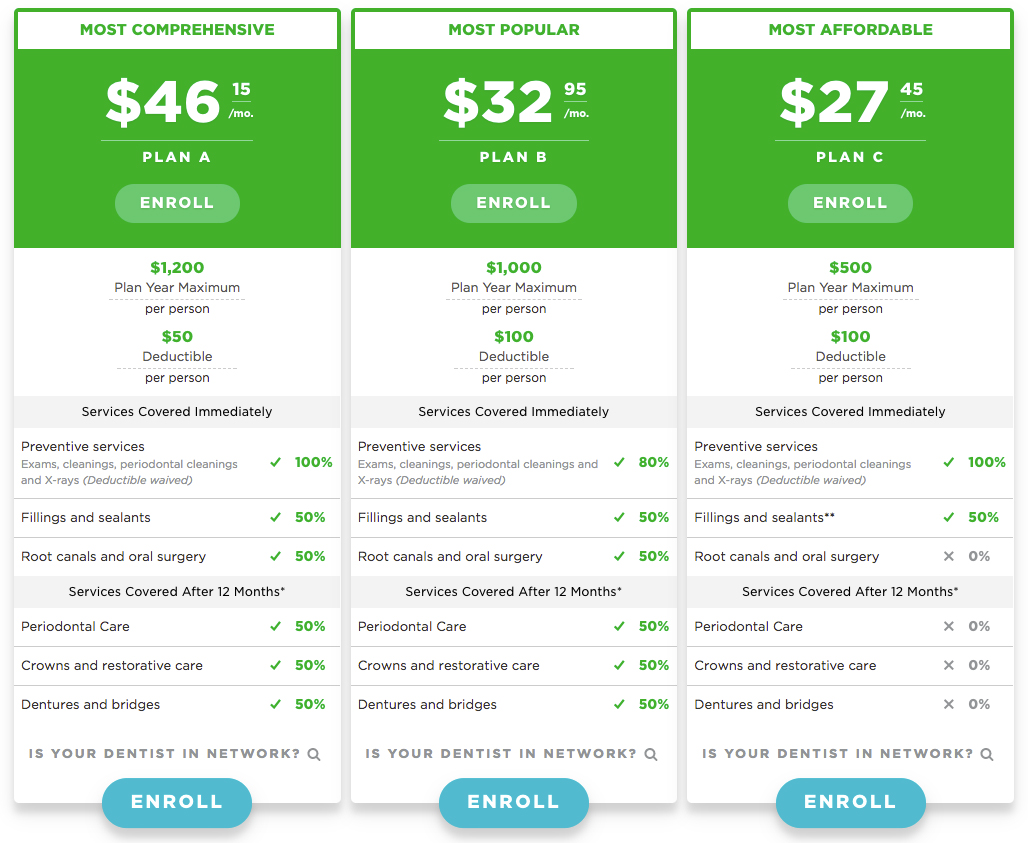

Preventative basic and major. These three types of dental insurance typically follow the 100-80-50 rule which means that your coverage will pay 100 percent of the cost of routine preventative care 80 percent for fillings and other basic procedures and 50 percent for crowns bridges and other more extensive operations. You might expect dental insurance to be included in.

The cost of seeing an NHS dentist in Scotland and Northern Ireland. Most annual limits range from 1000 to 1500. Humana Individual dental and vision plans are insured or offered by Humana Insurance Company HumanaDental Insurance Company Humana Insurance Company of New York The Dental Concern Inc CompBenefits Insurance Company CompBenefits Company CompBenefits Dental Inc Humana Employers Health Plan of Georgia Inc.

So far this is essentially the same deal as youd get with other dental. Or Humana Health Benefit Plan of Louisiana Inc. In Scotland and Northern Ireland patients pay 80 of the dentists fee to a maximum of 384 per treatment.

The biggest downside to a dental insurance policy is that there are annual maximums. The plan covers 100 of preventive care 50 to 70 of basic services and 30 to 50 of major services. That means they cover preventive care at 100 basic procedures at 80 and major procedures at 50 or a larger co-payment.

EHealth dental plans are competitively priced for as little as 1029 monthly with different types and levels of coverage. Most dental plans have an annual dollar maximum. You pay a deductible on your indemnity dental insurance after which the insurance provider will cover a part - typically between 50 and 80 of reasonable and customary dental costs as well as 100 of your preventative care.

No Charge No Charge No Charge No Charge. Some dental insurance plans cover implants but even if you find a carrier that offers dental insurance it may not be the best option for you when it comes to reducing the cost of your implants. It may also include fluoride treatments and sealants plastic tooth covering to prevent decay.

Indemnity dental insurance is an insurance package where the policyholder can choose his or her own dentist and the insurance provider will be the one to pay that. Preventive dental care includes diagnostic and preventive services like regular oral exams teeth cleaning and x-rays. When choosing a full coverage dental plan read the details carefully.

Both plans offer coverage for implants. Insurance providers will pay up to 100 of preventative dental care. 100 coverage after deductible some limits apply for preventive services.

If you need a dental procedure that isnt considered preventative care your dentists office sends your insurer a bill. In general dental coverage is broken out by preventive basic and major services. Oral Examination and diagnosis Full Mouth x-rays once every 5 years Prophylaxis once every 6-months Vitality Test Emergency Pain Relief.

Most dental insurance plans follow the 1008050 payment structure which dictates how much the insurer pays for each type of service. This means that once you hit that annual maximum you will no longer have any coverage for the rest of the year and will have to pay out of pocket 100. No waiting period for preventive care and other waiting period for basic and major services waived with proof of prior dental insurance.

Diagnostic Services- 100 Savings. There are several features of indemnity dental insurance plans for individuals that make these plans different from many other types of dental coverage. Restorative Dentistry- 100 savings.

And even a small cavity can triple the cost at a minimum. You will not have this issue with a dental savings plan since there are not any annual maximums. Under this structure all dental work falls into one of three categories.

With indemnity dental insurance you can visit any dentist there are no networks or approved providers. Your insurer then charges you for the. Their 24-hour approval is among the quickest in the industry and they also provide exceptional customer support.

Spirit Network Dental Insurance. Dental insurance can pay for things like annual cleanings minor oral health fixes or big-dollar dental claims for crowns and bridges. Each treatment is priced individually and a scale and polish for example costs 1112.

Most plans follow the 100-80-50 coverage structure. You will have a one-time lifetime deductible of 100 and the annual maximum coverage is 5000. Discount plans offered by HumanaDental Insurance Company or Humana Insurance.

Many dental plans cover 100 for preventive dental services with the exception of a copay at the time of the visit.

What S Typically Covered On My Dental Plan And What S Not

What S Typically Covered On My Dental Plan And What S Not

Twu Local 100 Healthplex Dental Plan Documents Twu Local 100

Dental Insurance Vs Dental Discount Plans Compared

Dental Insurance Vs Dental Discount Plans Compared

Dental Plans Producer Connection

Dental Plans Producer Connection

State Of Wisconsin Etf Delta Dental Of Wisconsin

State Of Wisconsin Etf Delta Dental Of Wisconsin

Bluecare Dental Classic For Individuals And Bluecare Vision Insure With Integrity

Bluecare Dental Classic For Individuals And Bluecare Vision Insure With Integrity

Dental Insurance Benefits For Small Business Delta Dental

Dental Insurance Benefits For Small Business Delta Dental

The Beginner S Guide To Group Dental Insurance

The Beginner S Guide To Group Dental Insurance

Dental Insurance That Covers Everything Dentalplans Com

Dental Insurance That Covers Everything Dentalplans Com

Read This Before Booking Dental Insurance In Germany Sib

Read This Before Booking Dental Insurance In Germany Sib

Dental Insurance 101 Where We Answer Your Most Common Questions Bite Size Pediatric Dentistry

Dental Insurance 101 Where We Answer Your Most Common Questions Bite Size Pediatric Dentistry

Coverage To Help You Keep Smiling Surebridge Dental Insurance Plans

Coverage To Help You Keep Smiling Surebridge Dental Insurance Plans

Comments

Post a Comment