Featured

1095 A 2019

Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. The Internal Revenue Service IRS issued draft form 1095-C that employers will use to report health coverage they offer to their employees as required by the Affordable Care Act ACA.

Irs 1095 A 2019 2021 Fill And Sign Printable Template Online Us Legal Forms

Irs 1095 A 2019 2021 Fill And Sign Printable Template Online Us Legal Forms

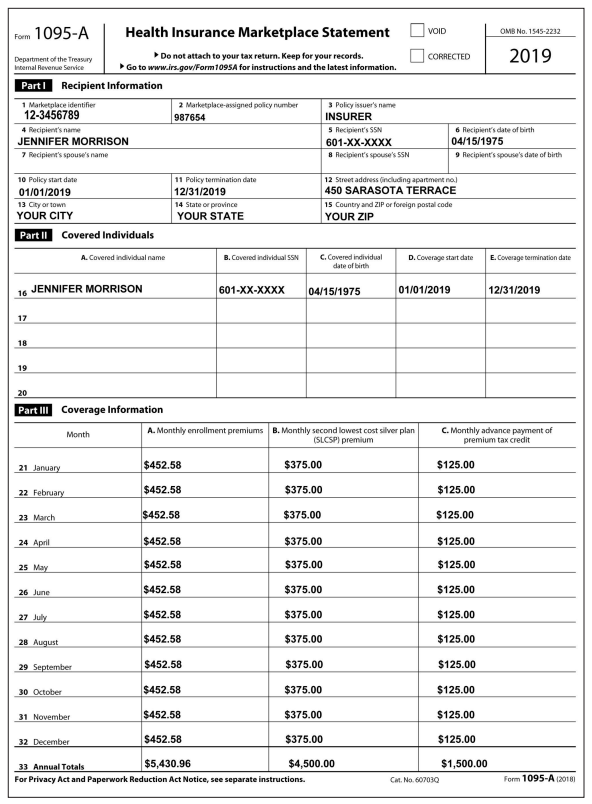

A figure called second lowest cost Silver plan SLCSP Youll use information from your 1095-A to fill out Form 8962 Premium Tax Credit PDF 110 KB.

1095 a 2019. Select Tax Forms from the menu on the left. Form 1095-A Health Insurance Marketplace Statement 2019. First you must be able to log into your Mass Health Connector online account.

As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov. Heres how to find IRS Form 1095-A on the Massachusetts Health Connector website. Log into your HealthCaregov account.

Youll need your Form 1095-A to fill out this form. If this error occurred in the Review then you must have unintentionally checked something that made TurboTax think that you had insurance from the Marketplace under the auspices of the Affordable Care Act. Form 1095a for 2019 return You are not required to enter either the 1095-B or 1095-C into TurboTax - you just put them in your tax files.

Form 1095-C Part II includes. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a. Once completed you can sign your fillable form or send for signing.

Click Save at the bottom and then Open. It comes from the Marketplace and shows both you and the IRS what you paid out-of-pocket for your insurance. Call the Health Connector at 1-877-623-6765.

Just about anyone who enrolled in a health insurance plan through the government Marketplace will need to have a copy of the form before they file their taxes. Form 1095-A also is furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace.

Internet Explorer users. 3 steps to get ready for 2019 tax filing. This Form 1095-C includes information about the health insurance coverage offered to you by your employer.

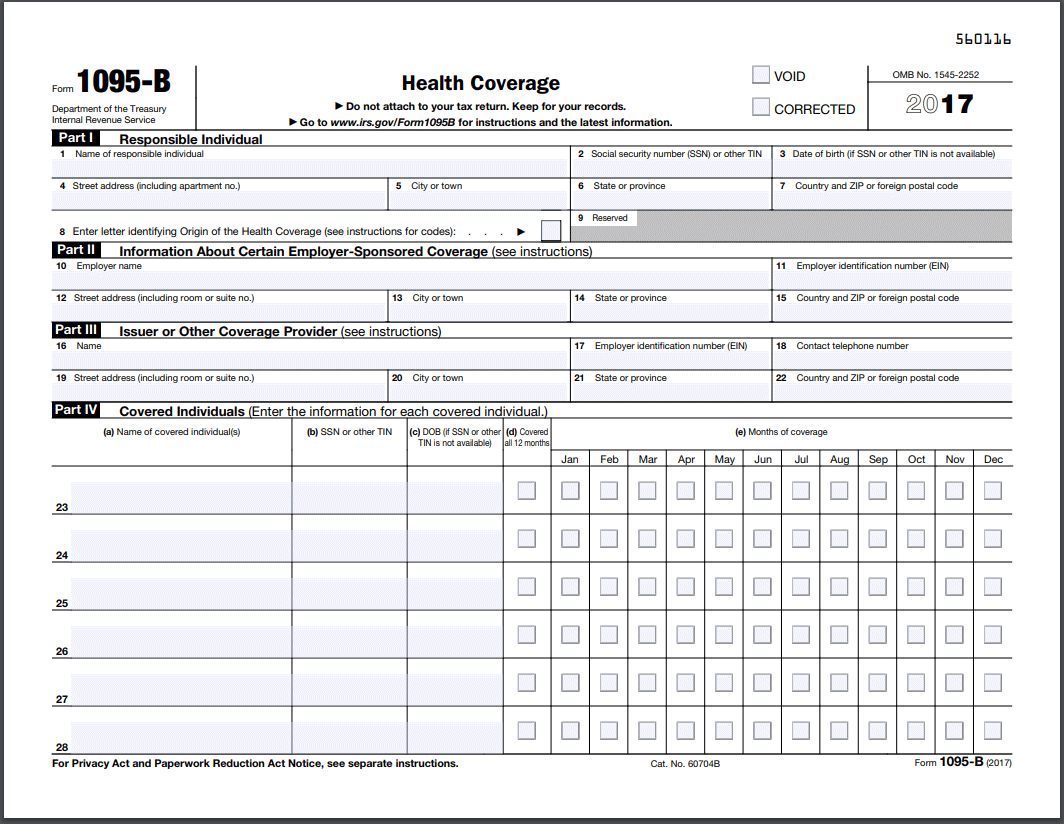

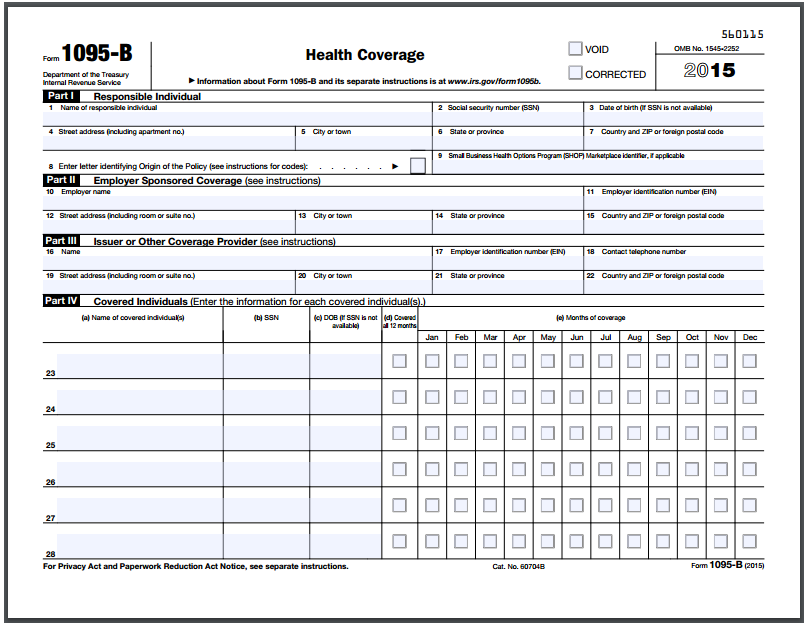

Other states that use healthcaregov will find their 1095. Form 1095-A is the Health Insurance Marketplace statement. What you need to know about the 1095-B federal tax form.

Beginning in the 2019 tax year the federal penalty for failing to enroll in health insurance was discontinued. All forms are printable and downloadable. This Form 1095-A provides information you need to complete Form 8962 Premium Tax Credit PTC.

You can get all your MA Form 1095-As going back all years. Use Fill to complete blank online IRS pdf forms for free. It may also be available online in your HealthCaregov account.

We last updated Federal Form 1095-A in January 2021 from the Federal Internal Revenue Service. This information is only for the state of Massachusetts. This federal tax form provides information about your health insurance coverage who was covered and the coverage effective date.

Fill Online Printable Fillable Blank Form 1095-A Health Insurance Marketplace Statement 2019 Form. If however the policy holder just never got a copy it is as easy as logging into your marketplace account and finding it on. Information about Form 1095-A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file.

Form 1095-C 2019 Page. The form is for the 2018 tax year for filing in early 2019. We will update this page with a new version of the form for 2022 as soon as it is made available by the Federal government.

Look for Form 1095-A. With changes to the Affordable Care Act from the Tax Cuts Jobs Act what exactly is a taxpayer supposed to do with the form 1095 they receive this year. Form 1095-A Definition.

Form 1095-A is provided here for informational purposes only. Premium tax credits used. On the 2018 Form 1095-C the plan start month box will remain optional.

If a 1095-A the kind the marketplace sends was never sent out to the policy holder then it could cause issues. You must complete Form 8962 and file it with your tax return Form 1040 Form 1040-SR or Form 1040-NR if any amount other than zero is shown in Part III column C of this Form 1095. The downloaded PDF will appear at the bottom of the screen.

60703Q Form 1095-A 2020 Form 1095-A 2020 Instructions for Recipient You received this Form 1095-A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace. The 1095 is used to help you fill out forms like form 8962 for tax credits and is used to prove you had coverage. Individual tax payors are no longer required to report or certify on their.

When the pop-up appears select Open With and then OK. Your 1095-A contains information about Marketplace plans any member of your household had in 2020 including. If you dont have your user name and password.

Under Your Existing Applications select your 2019 application not your 2020 application. It comes from the Marketplace not the IRS. This form is for income earned in tax year 2020 with tax returns due in April 2021.

A copy is sent to you and the IRS. Form 1095-C Health Coverage is used to report the type of health coverage you had dependents covered by your insurance and how many months you had coverage for in 2019 to the. Whats on Form 1095-A and why you need it.

How to find your 1095-A online. This Form 1095-B provides information about the individuals in your tax family yourself spouse and dependents who had certain health coverage referred to as minimum essential coverage for some or all months during the year. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

If you or anyone in your household had a 2019 Marketplace plan youll get Form 1095-A Health Insurance Marketplace Statement in the mail by early February. You are receiving this Form 1095-C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act.

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png) Health Insurance Form 1095 Health Tips Music Cars And Recipe

Health Insurance Form 1095 Health Tips Music Cars And Recipe

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

Corrected Tax Form 1095 A Katz Insurance Group

14 How Do Jennifer S Educator Expenses Affect Her Chegg Com

14 How Do Jennifer S Educator Expenses Affect Her Chegg Com

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Https Www Irs Gov Pub Irs Prior I1095a 2019 Pdf

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement 2020 Templateroller

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement 2020 Templateroller

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Https Info Nystateofhealth Ny Gov Sites Default Files Tax 20credits 2c 20form 201095a 2c 201095b 20webinar 20slides 0 Pdf

Comments

Post a Comment