Featured

Aca Premium Tax Credit Calculator

But the American Rescue Plan changed the rules for 2021 and 2022. What is the Credit.

Health Care Premium Tax Credit Taxpayer Advocate Service

Health Care Premium Tax Credit Taxpayer Advocate Service

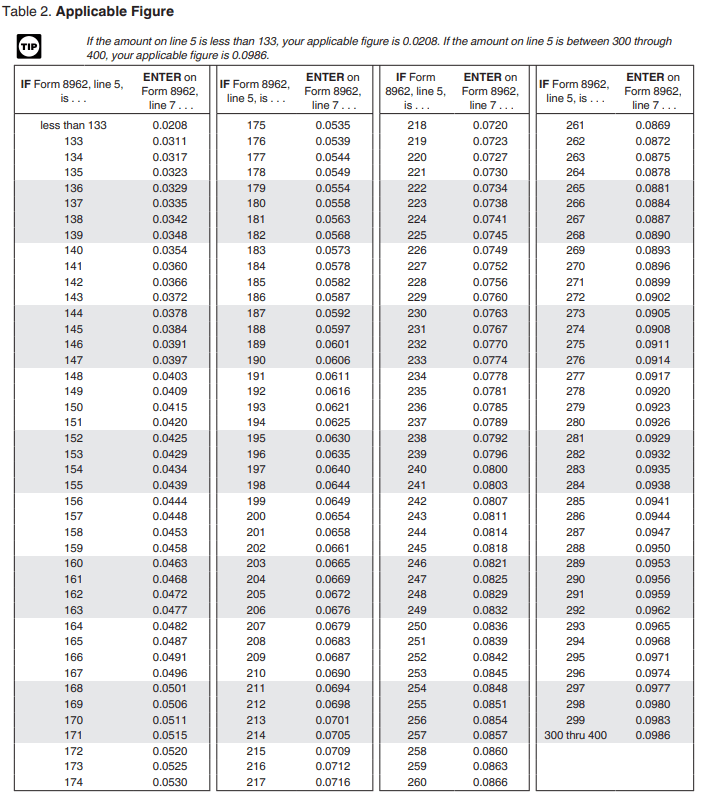

The premium for your benchmark plan minus your contribution amount.

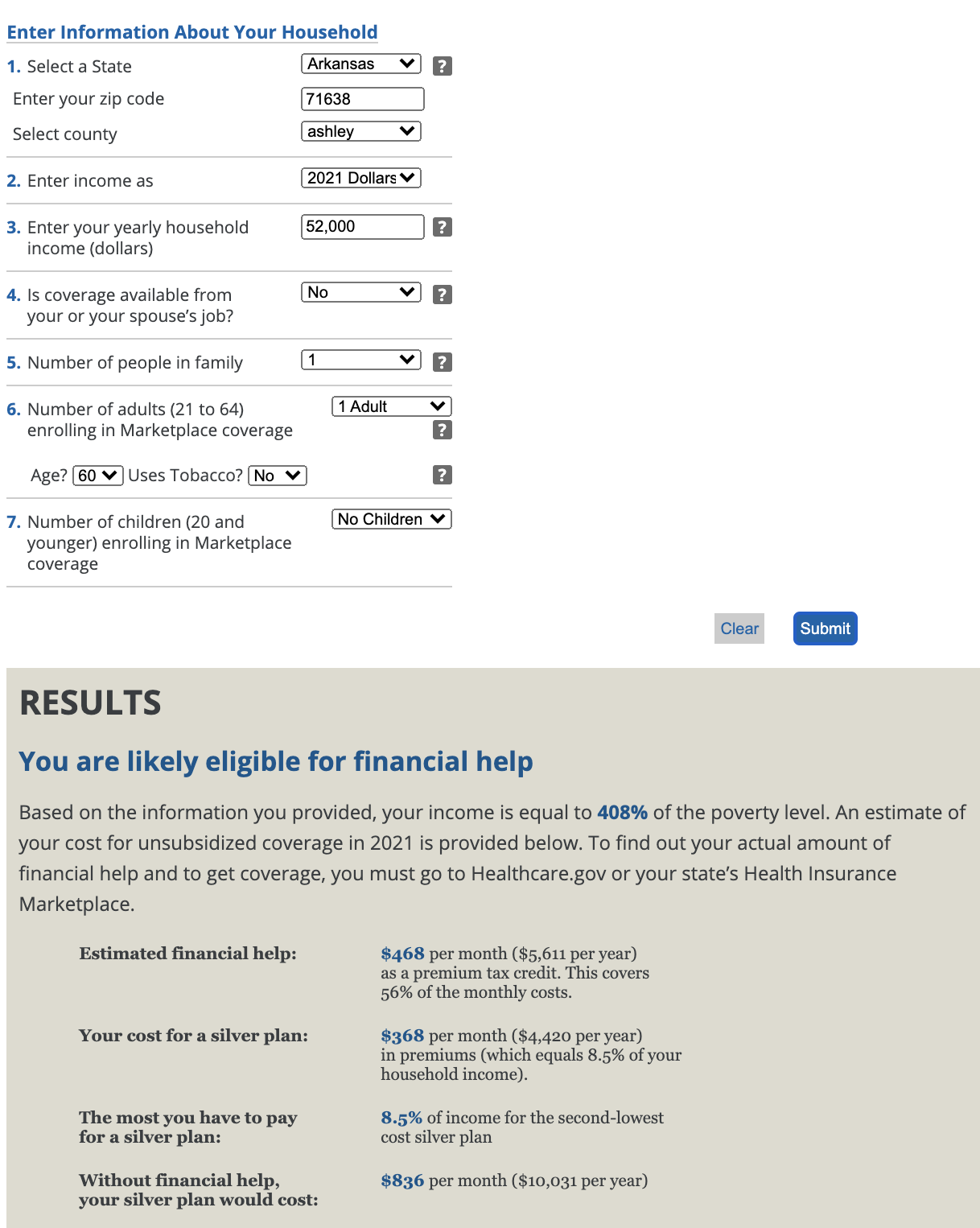

Aca premium tax credit calculator. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. Instead of an income cap the new rules allow for premium subsidies. What is the Estimator.

Calculating the ACA tax credit The ACA tax credit whether taken monthly to reduce the health insurance premium or calculated with the federal tax return is based on a straight forward formula. The premiums for the plan in which you andor your family members enroll or. ACA Premium Calculator Healthcare Open Enrollment should be simple and easy.

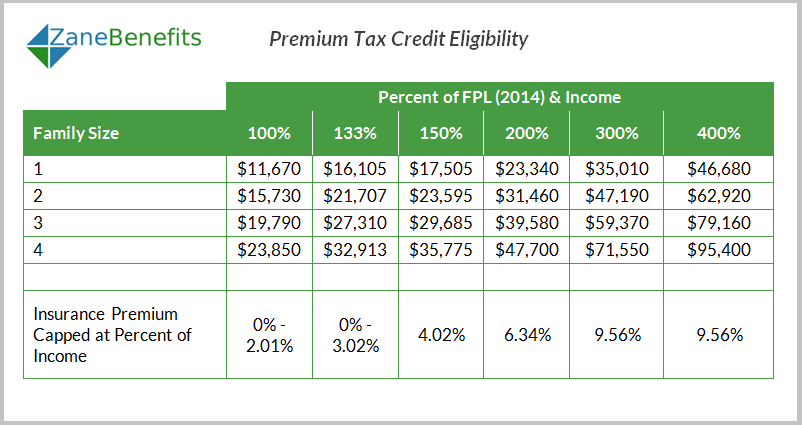

Premium subsidies under the ACA are available for households with income up to 400 of the poverty level. The MAGI is pivotal to calculating the tax credit and part of the formula can be found on Form 8962 Premium Tax Credit reconciliation. You qualify for subsidies if pay more than 85 of your household income toward health insurance.

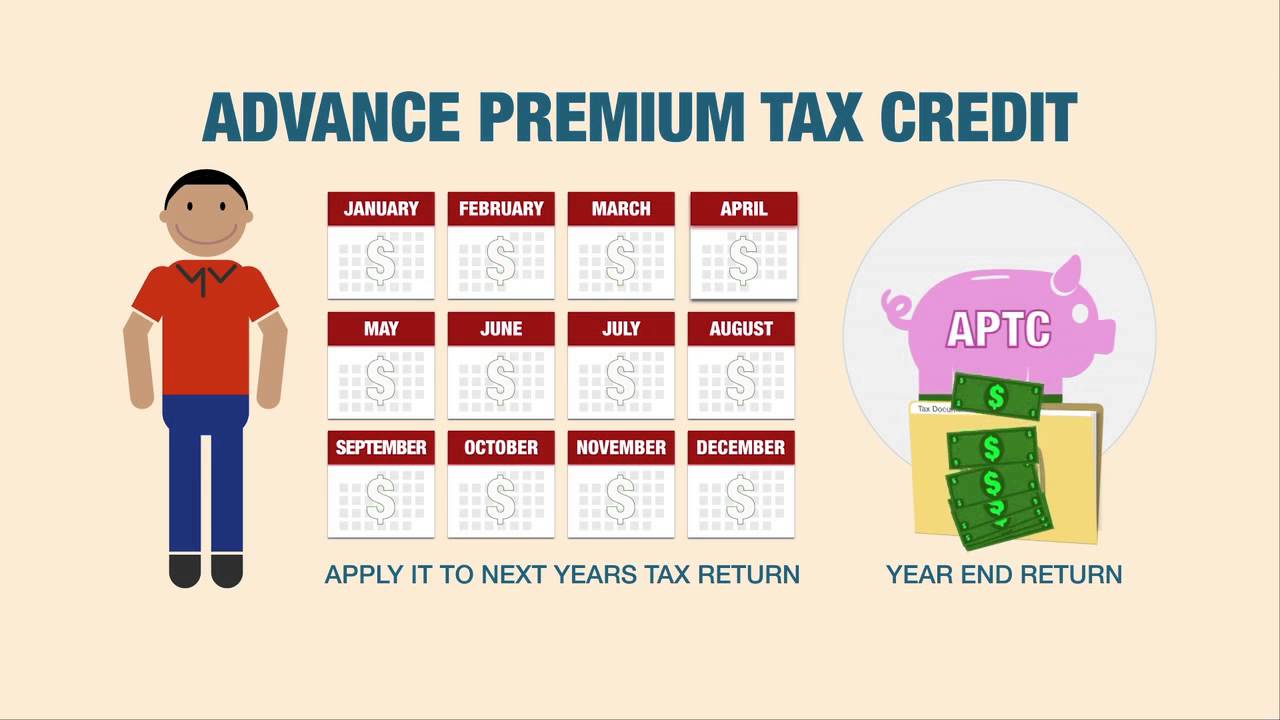

2020 Obamacare Premium Tax Calculator By A Noonan Moose on October 28 2019 In 2020 the federal government will once again offer a Premium Tax Credit PTC to qualifying taxpayers who buy health coverage from an approved health insurance exchange. To receive a PTC you must split the uprights between making too little and too much income. You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace.

The increase of their expected contribution toward ACA health insurance and the corresponding decrease in their premium tax credit will be. On march 11 2021 president biden signed into law a 19 trillion coronavirus relief package known as the american rescue plan act. The Taxpayer Advocate Service developed the Premium Tax Credit Change Estimator to help you estimate how your premium tax credit will change if your income or family size change during the year.

2021 obamacare premium tax credit calculator updated for 2021 american rescue plan act by a noonan moose on november 2 2020. The contribution amount is the amount you are considered to be able to afford to pay for health insurance. Or just use one of the ObamaCare subsidy calculators found below for a quick estimate on marketplace cost assistance.

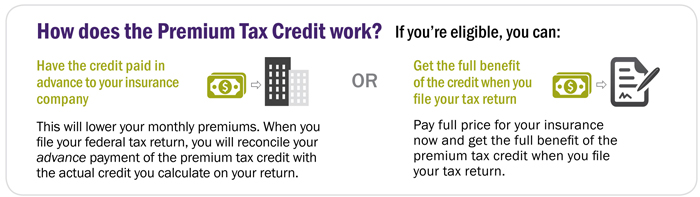

Premiums will drop on average about 50 per person per month or 85 per policy per month. Use this quick health insurance tax credit guide to help you understand the process. With the ACA the IRS pays Premium Tax Credits to your insurance company every month to lower the cost of your insurance.

You must estimate what your MAGI will be this year to get credits. The premium tax credit is the lesser of. The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace.

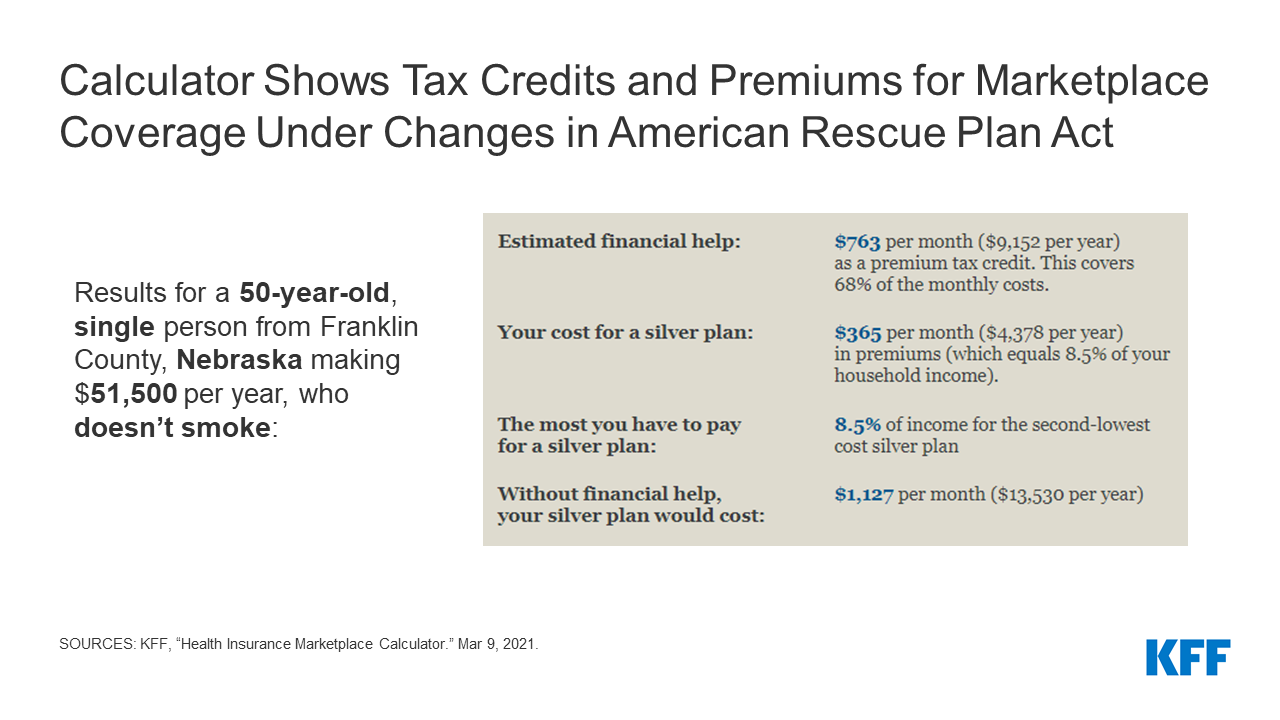

Premium subsidy eligibility extends well into the. The types of assistance offered under the Affordable Care Act are. For a family of four thats 104800 in 2021 for 2021 coverage the 2020 poverty level guidelines are used.

For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. How does the premium tax credit work. Before the American Rescue Plan was enacted a single individual in the continental US.

This new law substantially changes the formula for calculating the premium tax credit in tax. If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings. 3 Thats certainly not low-income by any stretch of the imagination.

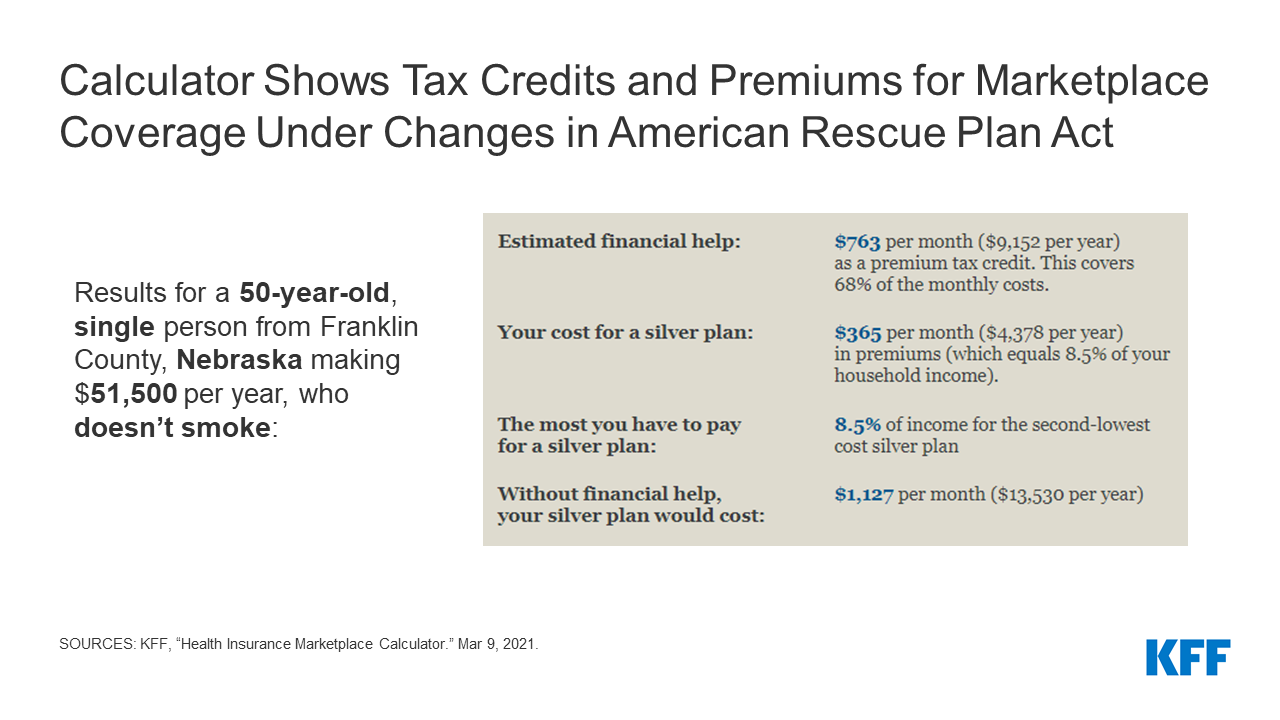

The Health Insurance Marketplace Calculator updated with 2021 premium data and to reflect subsidies in the American Rescue Plan Act of 2021 provides estimates of health insurance premiums and. Our ObamaCare calculator will help you calculate tax credits and subsidies for health insurance sold on the Health Insurance Marketplace. 50000 560 40000 328 1488 This represents 15 of the 10000 increase in their income.

Was ineligible for subsidies in 2021 if their income exceeded 51040. It is difficult to estimate what your income will be let alone understand adjustments and modifications that make MAGI for ACD tax credits so powerful. For a family of four the income limit was 104800.

This calculator is a helpful start. It would be the amount you pay if you enroll in your. Understanding the relationship between Income Health Insurance Premiums and ACA subsidies is important in navigating the insurance marketplace and making wise and beneficial choices.

To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level.

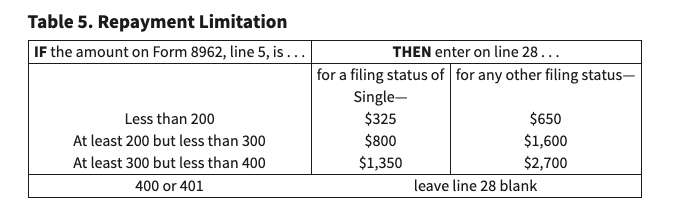

Advanced Tax Credit Repayment Limits

Advanced Tax Credit Repayment Limits

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Updated Kff Calculator Estimates Marketplace Premiums To Reflect Expanded Tax Credits In Covid 19 Relief Legislation Kff

Updated Kff Calculator Estimates Marketplace Premiums To Reflect Expanded Tax Credits In Covid 19 Relief Legislation Kff

Premium Tax Credits Health Affairs

Premium Tax Credits Health Affairs

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

What Are Premium Tax Credits Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Everything You Need To Know About Premium Tax Credits

Everything You Need To Know About Premium Tax Credits

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Premium Tax Credit Charts 2015

Premium Tax Credit Charts 2015

Key Facts Premium Tax Credit Beyond The Basics

Comments

Post a Comment