Featured

Can You Add Sibling Your Health Insurance

This means that when you file your taxes you count your sibling as a dependent. Eligible for employer-based coverage.

Can I Cover Siblings Under My Insurance Plan

Can I Cover Siblings Under My Insurance Plan

As long as you can prove to the insurance company that you have an insurable interest as well as your siblings consent you should be just fine.

Can you add sibling your health insurance. Savvy Healthcare Hustlers may consider changing insurance plans after. First if your sister is driving any car in your household on a regular basis then yes to be properly covered she would normally need to be listed as a driver on your policy. You can still add your child to your health plan even if they chose to not enroll in their employers health insurance plan.

Other beneficiary considerations for married couples without kids. The key is that you must be a dependent of the primary policyholder and simply being a sibling. Group health insurance also may allow the same but it may vary by carrier and by.

You can add your child to your plan even if you dont claim them as a tax dependent. Grim scenario right. To add your baby to your existing plan gather the babys birth certificate and social security card.

Insurable interest means youll experience financial hardship if your brother or sister passes away. However if you want to add your family members to your insurance plan at a price you are able to do this. Unfortunately most health care providers only permit the addition of your wife and children.

They may also name spouses parents brothers and sisters aunts and uncles you can even name your best friend as a beneficiary. Unfortunately most are very hesitant to do so. To do that you and your sibling need to meet certain criteria.

Group health insurance policies allow the primary policyholder to add their spouse and any dependents who live in the home. If you are a legal dependent of your sister she can add you to her group health policy but there may be a designated enrollment period which is the only time of the year when new people can be added to the policy. Depending on the circumstances your siblings may be qualifying children or qualifying relatives.

The VA for example will permit you to add a parent to your health plan as long as. A charity you love family members who you financially support a close friend or your sibling. If you feel as if the beneficiary status of the person you named may be questioned you can always get the document notarized so that there is no issue.

Is there any way to work around this. The best way to do this is ask your insurance broker HR person at work if you got insurance through work or your carrier. Life insurance rates for siblings cost 26 per month on average.

Your relationship with the proposed insured is critical in showing that you have an insurable interest. In many cases insurance coverage allows you to add any number of dependents to your policy at an additional cost that is far less than purchasing several individual policies. You can buy life insurance for siblings only if you have their consent and can prove insurable interest.

You can name a child as a beneficiary but you should be aware that life insurance companies. However your brother or sisters rates depend on their age medical history current health status and lifestyle choices. You should ask your healthcare service provider if you can add your parents and siblings.

As long as your children meet these other requirements you can usually still include them in your coverage. A small minority of insurance companies do allow parents to be added to plans. To enroll a sibling in your health insurance plan most companies will require your sibling to be a qualified dependent.

During customer research we found out that customers are more concerned about the health of their family members than their own. You may be buying a term life insurance policy to help ensure your child will be taken care of financially if you were to die. You now have a third option of buying a health insurance plan that will cover not only your parents but also in-laws siblings and even cousins.

Adding your spouse as a dependent. If she has a bad driving record then this could make your rates rise. You can add any driver to your car insurance policy including your step-sibling Adding your step-sibling to your policy may impact your insurance premiums Your step-siblings own car insurance may cover him or her when driving your vehicle.

They have not advanced to parents or siblings yet. You would need to file legal documents and show that you. Yes you can get a life insurance policy on your brother or sister if several factors are met.

You could claim your parents and siblings as dependents. Colleen King CEO of Colleen King Insurance Agency in Los Angeles says some individual health insurance plans will allow unmarried couples to be on the same plan along with any legal dependents if they are all living together or theres a court order for the one partner to provide insurance for their child. They can tell you how much it will cost and will help you get your family members signed up.

Insurable Interest You need to prove that there is an insurable interest between your brother or sister. Then contact your companys HR your insurance broker or a healthcaregov advisor if you are on a marketplace plan. For the most part dependents are considered to be minor children or in the case of new Obamacare rules children up to the.

Also the joint family system is still quite prevalent in India says. In most cases adding a spouse to your health insurance. Start shopping for coverage now.

Insurers are not mandated to include parents and due to high costs most refuse to do so. Type your ZIP code into our free and helpful tool below to compare free quotes for life insurance for siblings from companies in your area. Im a single parent.

Are Dependents Allowed On Small Business Health Insurance Plans

Are Dependents Allowed On Small Business Health Insurance Plans

Extend Onsurity Plus To Your Family

Extend Onsurity Plus To Your Family

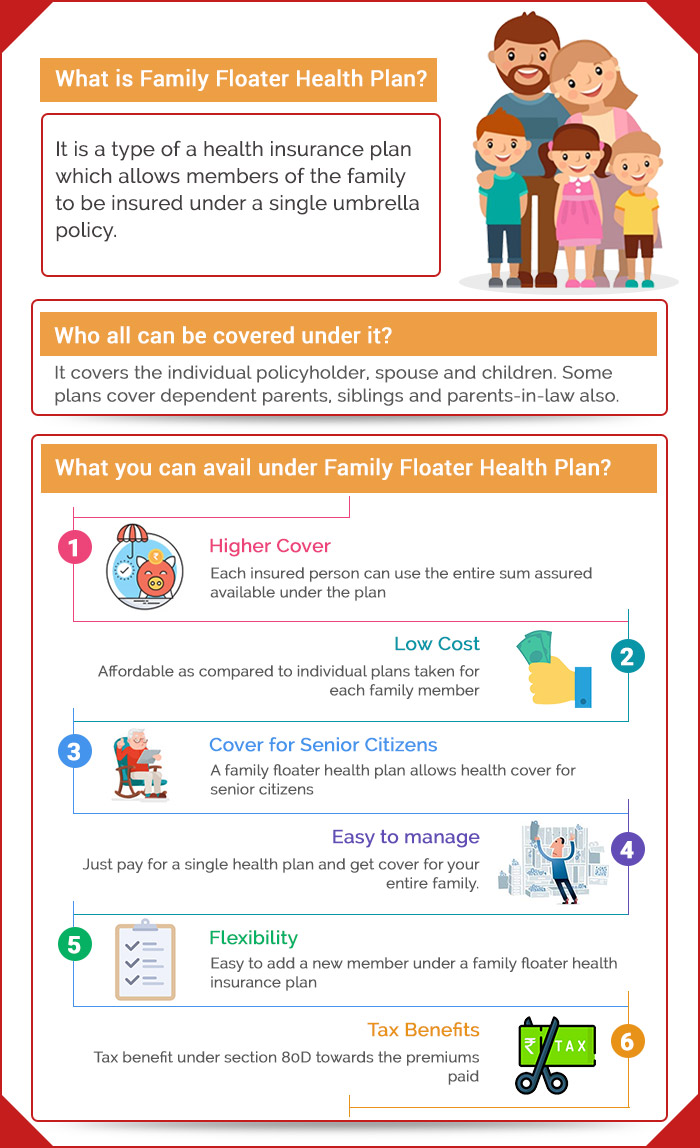

How To Pick A Right Family Floater Health Insurance Policy

How To Pick A Right Family Floater Health Insurance Policy

Everything You Need To Know About Family Floater Health Insurance Health Insurance Quote Health Insurance Health Insurance Plans

Everything You Need To Know About Family Floater Health Insurance Health Insurance Quote Health Insurance Health Insurance Plans

Who Can Be Added As A Dependent On My Health Insurance Plan Ehealth

Who Can Be Added As A Dependent On My Health Insurance Plan Ehealth

Key Facts Determining Household Size For Medicaid And The Children S Health Insurance Program Beyond The Basics

Am I Able To Add My Brother S Or Sister S Health Insurance Plan Selfhealthinsurance Com

Am I Able To Add My Brother S Or Sister S Health Insurance Plan Selfhealthinsurance Com

My Sister Mother And I Got Into An Argument With My Father He Is Attempting To Cancel Our Health Insurance Amidst A Pandemic Because We Disagree With Him Politically I Found Out

My Sister Mother And I Got Into An Argument With My Father He Is Attempting To Cancel Our Health Insurance Amidst A Pandemic Because We Disagree With Him Politically I Found Out

Who Can I Add To My Health Insurance Insurance Noon

Who Can I Add To My Health Insurance Insurance Noon

General Insurance Some Health Plans Do Not Allow Siblings In The Same Policy

General Insurance Some Health Plans Do Not Allow Siblings In The Same Policy

Family Health Insurance Plans Best Mediclaim Policy For Family

Family Health Insurance Plans Best Mediclaim Policy For Family

What Is A Family Floater Health Insurance Policy Comparepolicy Com

What Is A Family Floater Health Insurance Policy Comparepolicy Com

This Rakhi Gift Your Sister A Health Insurance Policy

This Rakhi Gift Your Sister A Health Insurance Policy

Comments

Post a Comment