Featured

- Get link

- X

- Other Apps

Covered California Independent Contractor

However employers cannot get around California wage and hour laws by simply declaring that an employee is an independent contractor or by making the employee sign an agreement stating that she is an independent contractor. Self-Employed Covered Under CARES Act.

Risk Insurance Hiring Independent Contractors Amtrust Financial

Risk Insurance Hiring Independent Contractors Amtrust Financial

Superior Court of Los Angeles into state law.

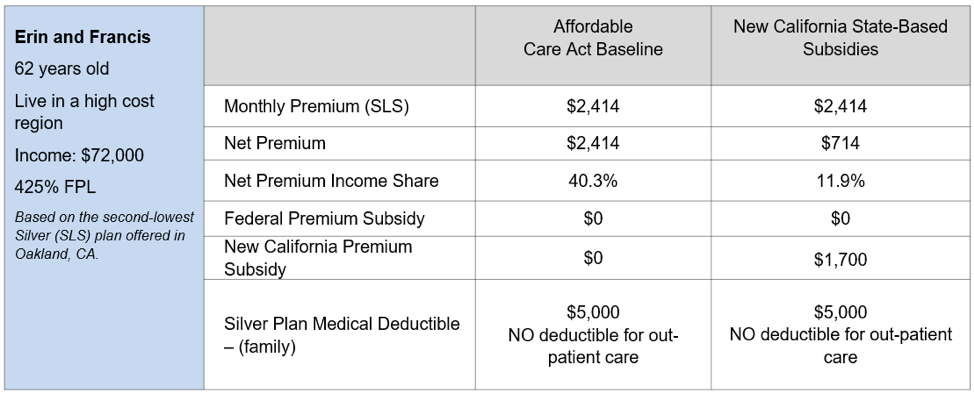

Covered california independent contractor. Longshoremen harbor workers and employees on defense bases. Its the only place where you can get financial help when you buy health insurance from well-known companies. Dramatically changing decades of settled law in California Dynamex created a so-called ABC test requiring companies to satisfy each of three strict criteria in order to establish independent contractor status.

For example a company that primarily does delivery or transportation must classify its drivers as employees They are part of the companys core business. The employer only controls the result of the work but not how the work is accomplished. I a certificate of authority issued by the California Department of Insurance CDI under 699 et seq.

For more information please visit the Labor Workforce Development Agency Employment Status Portal. I a certificate of authority issued by. A health plan through Covered California is a great option for people who work for themselves.

What youll pay depends on your estimated net. Aspiring entrepreneurs around the world recognize California as a startup and business hub where innovation and ideas flourish. In the performance of this Agreement Covered California and Contractor shall at all times be acting and performing as an independent contractor and nothing in the Agreement shall be construed or deemed to create a relationship of employer and employee or partner or joint venture or principal and agent between Covered California and Contractor.

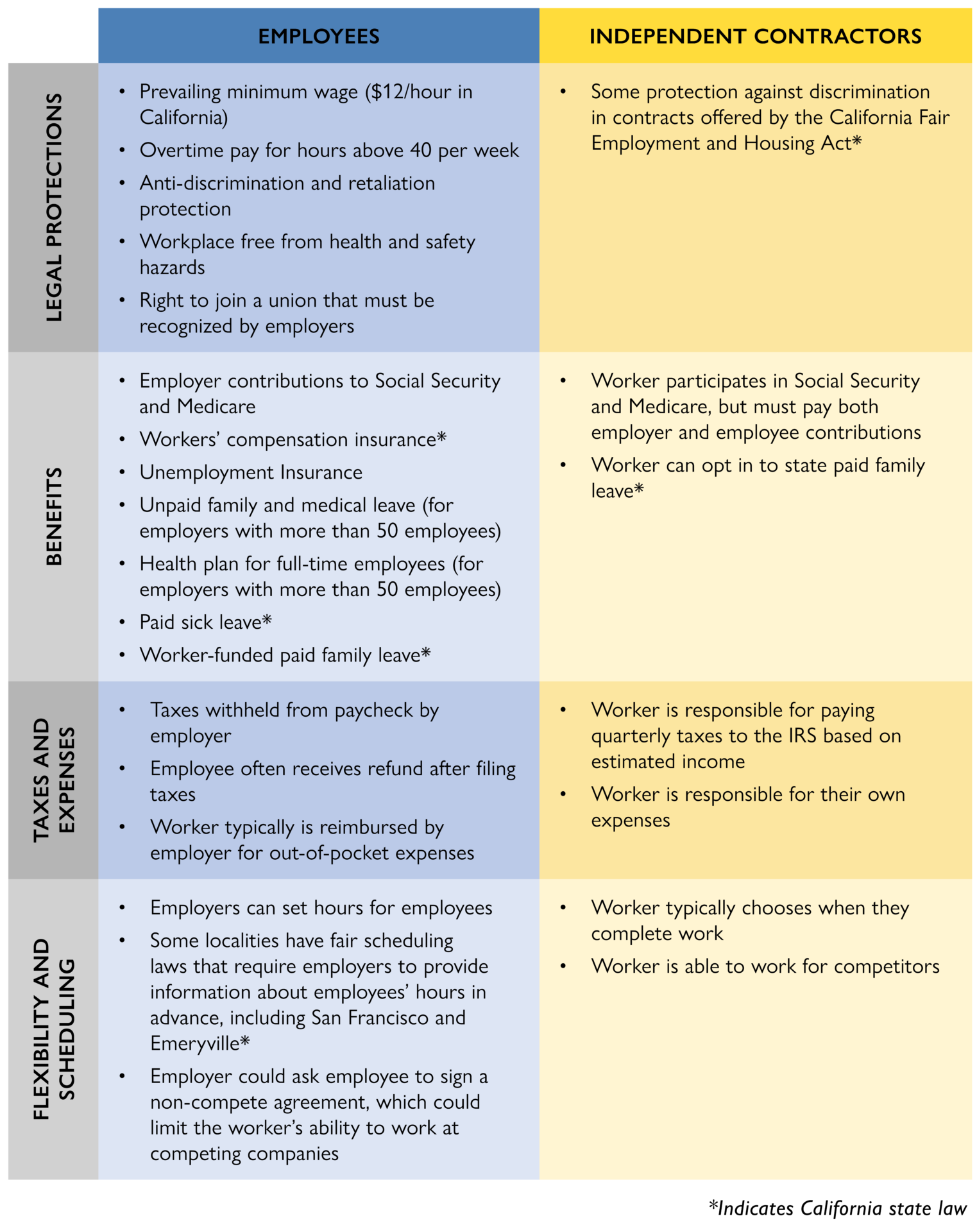

Even before last weeks election lawmakers had exempted about 100 kinds of independent contractors including doctors dentists lawyers songwriters hair stylists architects youth sports. In September of 2019 Governor Newsom signed Assembly Bill AB 5 into law. It is important to know that independent contractors are not protected by Californias anti-discrimination laws.

In its capacity as an independent contractor Contractor agrees and represents and Client agrees as follows. Contractor is a Health Insurance Issuer authorized to provide Covered Services to Enrollees under applicable laws rules and regulations pursuant to. Contractor is a Health Insurance Issuer authorized to provide Covered Services to Enrollees under applicable laws rules and regulations pursuant to.

Independent contractors or freelancers who apply to be recipients of the aid generally are required to provide evidence of past. Federal employees seamen and railroad employees. Covered California 2017 -2020 Individual Market QHP Issuer Contract 2020 Plan Year Amendment 2 D.

The new law addresses the employment status of workers when the hiring entity claims the worker is an independent contractor and not an employee. The test under FEHA is largely similar to the Manner. 4 There are times when the risk of injury should be placed on the person doing the work and other times the risk should be on the person hiring.

To validly classify someone as an independent contractor under California law the company must prove that the workers job functions fall outside the companys core business. The ABC test is a California Labor Code that is used to determine whether a worker is covered by California wage. Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act.

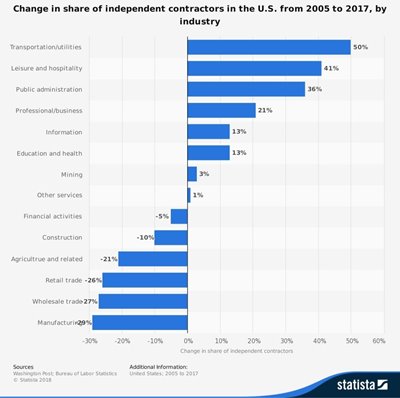

FEHA provides its own definition of an independent contractor at 12940 subdj5. Independent contractors are not covered by Californias overtime and other wage and hour laws. Its no wonder California is also a fertile ground for independent contractors.

AB 5 Changes Californias Independent Contractor Law. Freelancers independent contractors and other people who dont have staff make up a big percentage of Covered California users. Of the California Insurance Code or ii a licensed issued by the Department of Managed Health Care DMHC pursuant to the Knox-Keene Health.

Independent Contractor Status Contractor is an independent contractor and neither Contractor nor Contractors employees or contract personnel are or shall be deemed Clients employees. If you have one or more employee other than a spouse family member or owner use Covered California for Small Business. According to a study of the UC Berkeley Labor Center the rate of independent contracting as the workers main job was 85 of the workforce in California in 2016.

In addition to independent contractors the following categories of workers are not covered by California workers compensation. A California independent contractor is a person who works for a specific fee and result. Californias Fair Employment and Housing Act FEHA however protects independent contractors against workplace harassment.

In enacting AB 5 California incorporated the ABC test for employee status laid out in 2018 by the California Supreme Court in its decision in Dynamex Operations West inc.

Expanding Benefits And Protections For Today S Workers California S Ab5 Brings Attention To Classification The Aspen Institute

Expanding Benefits And Protections For Today S Workers California S Ab5 Brings Attention To Classification The Aspen Institute

Gig Companies Face California Crackdowns That Uber Lyft Escape

Gig Companies Face California Crackdowns That Uber Lyft Escape

Health Coverage Of California Workers Most At Risk Of Job Loss Due To Covid 19 Uc Berkeley Labor Center

Health Coverage Of California Workers Most At Risk Of Job Loss Due To Covid 19 Uc Berkeley Labor Center

How To Report A Fluctuating Income To Covered California

How To Report A Fluctuating Income To Covered California

Independent Contractor Vs Employee Explained California Law 2021

Independent Contractor Vs Employee Explained California Law 2021

What Type Of Income Is Counted For Covered California Aca Plans

What Type Of Income Is Counted For Covered California Aca Plans

O Xrhsths Berkeley Labor Center Sto Twitter Our New Brief Finds That The Vast Majority Of Independent Contractors Will Be Covered Under The Abc Test Codified By Ab5 Ca S Law That Strengthens

O Xrhsths Berkeley Labor Center Sto Twitter Our New Brief Finds That The Vast Majority Of Independent Contractors Will Be Covered Under The Abc Test Codified By Ab5 Ca S Law That Strengthens

California S Self Employed And Small Business Employees Experienced Large Health Coverage Gains Under Aca Uc Berkeley Labor Center

California S Self Employed And Small Business Employees Experienced Large Health Coverage Gains Under Aca Uc Berkeley Labor Center

California S Contract Worker Law Could Add Health Coverage For Some But Put Others At Risk Los Angeles Times

California S Contract Worker Law Could Add Health Coverage For Some But Put Others At Risk Los Angeles Times

Covered California Releases Regional Data Behind Record Low 0 8 Percent Rate Change For The Individual Market In 2020

Covered California Releases Regional Data Behind Record Low 0 8 Percent Rate Change For The Individual Market In 2020

Who Is An Independent Contractor In California Wrapbook

Who Is An Independent Contractor In California Wrapbook

Https Hbex Coveredca Com Insurance Companies Pdfs 2020 Qhp Ind Clean Final Model Pdf

Comments

Post a Comment