Featured

Hsa 2500 Medical Plan

2500Individual 5000Family per benefit period. Use this calculator to determine the possible savings.

10012020 Any deductibles copays and coinsurance percentages shown are amounts for which youre responsible.

Hsa 2500 medical plan. After careful consideration we decided to change our name to match our motivation. To be HSA-qualified the embedded deductible for family HDHP coverage must be higher than the current minimum annual deductible set by the IRS. The insured pays 10 to 20 of the remaining.

If your plan has a high deductible and a high out-of-pocket maximum higher than the IRS published number its also not HSA-eligible. When you enroll in the HSA 3000 or HSA 1500 medical plan you may be eligible to open a Health Savings Account HSA through BenefitWallet our HSA administrator. This applies to high deductible health plans as well as traditional plans.

Has a non-embedded out-of-pocket limit. BENEFIT PLAN ME PPO 250080-10 HSA Compatible What Your Plan Covers and How Benefits are Paid Aetna Life Insurance Company Booklet-Certificate This Booklet-Certificate is part of the Group Insurance Policy between Aetna Life Insurance Company and the Policyholder ME PPO 250080-10 HSA Compatible MEP0070100110501 - 14011144. To be eligible to open an HSA you must have a special type of health insurance called a.

In general your health plan starts paying for eligible medical expenses after youve met your deductible meaning youve paid out-of-pocket up to the amount of the plans deductible. Plan 2500 is the only AccessTN benefi t plan that. MEDICAL PLAN 2020 HSA 2500.

If you have other family members on the policy the overall family deductible must be met before the plan begins to pay. HSA Health Insurance has changed its name to MotivHealth. You not your employer or insurance company own and control the money in your HSA.

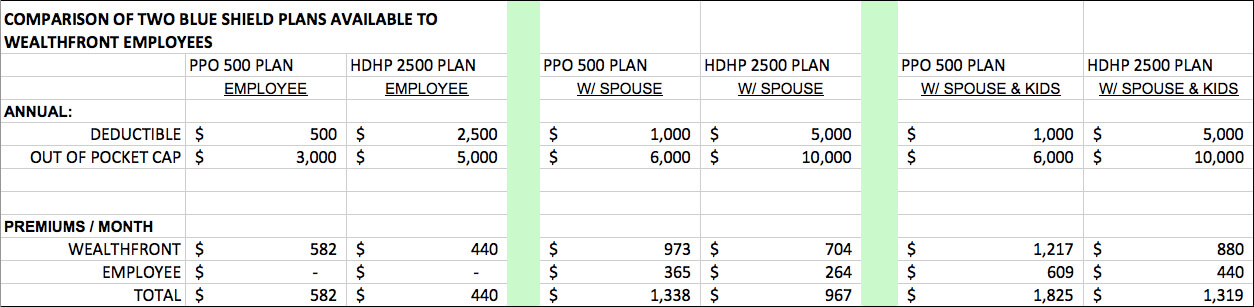

We appreciate your support as we continue to offer lower premiums and better benefits. To do a comparison I used two plans available to Wealthfront employees from Blue Shield. If you have other family.

2500single medical and drug in-network 5000family medical and drug in-network. For the calendar year 2016 a high deductible health plan is defined under 223c2A as a health plan with an annual deductible that is not less than 1300 for self-only coverage or 2600 for family coverage and the annual out-of-pocket expenses deductibles co-payments and other amounts but not premiums do not exceed 6550 for self-only coverage or 13100 for family coverage. Thats because both HSA medical plans meet the federal governments legal definition of a high deductible health plan By law you cannot contribute to a Health Savings.

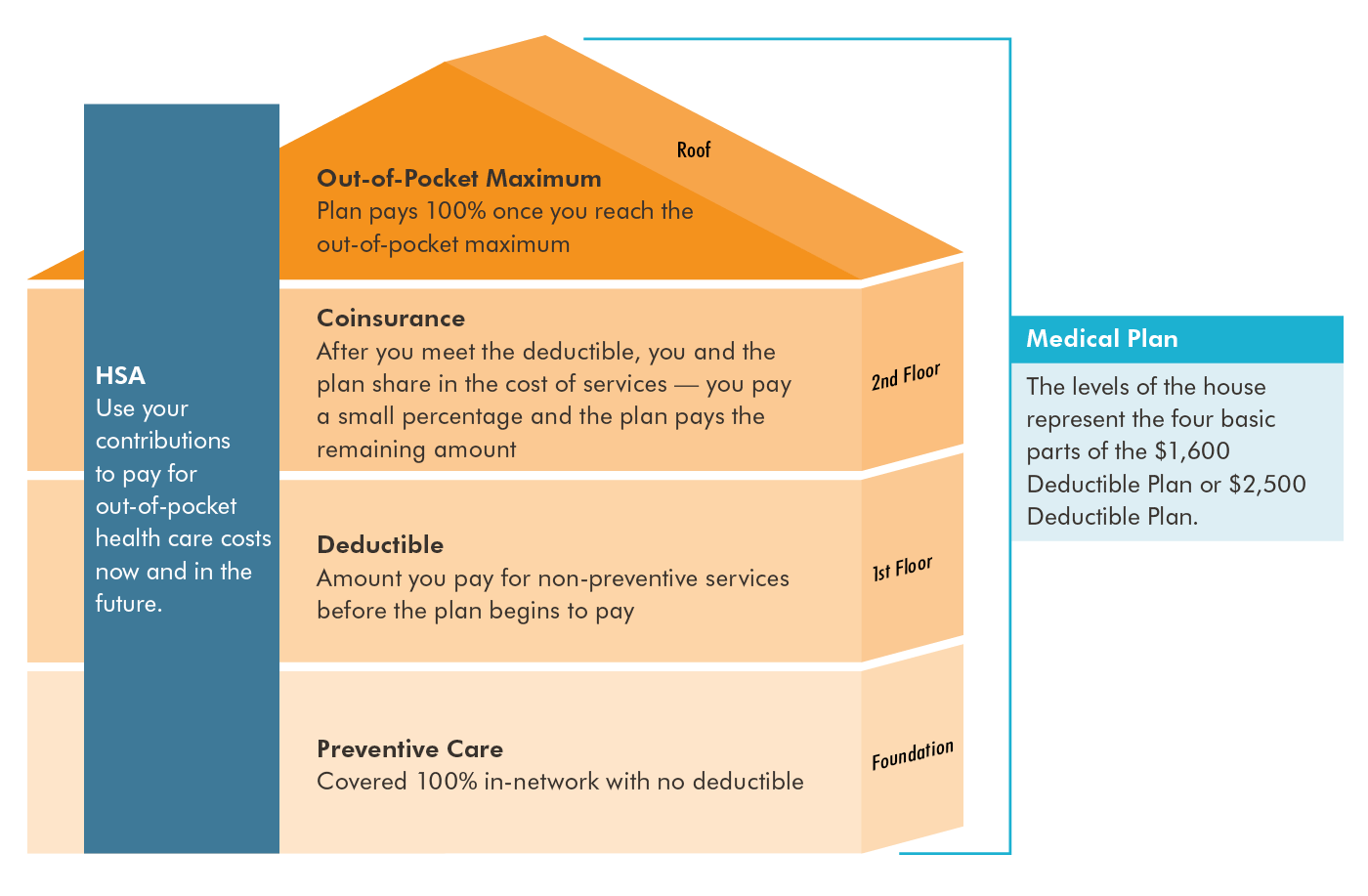

This tool is designed to help you compare a High Deductible Health Plan HDHP with a Health Savings Account HSA to a traditional health plan. Health savings accounts HSAs are like personal savings accounts but the money in them is used to pay for health care expenses. If you want to contribute to an HSA your insurance must make you take the first hits in non-preventive care.

Just like a co-pay plan in an HSA based plan you would still have a deductible co-insurance and an out of pocket maximum. The savings from the lower premiums along with the tax-free deductions could be 5000 or more every year. Highlights of your Health Care Coverage 2020 HSA 2500 Effective Date.

Since your deductible is higher in an HSA based plan you and your employer will save moneylet say that by moving to a 1500 deductible you and your employer now pay 5000 a year instead of the 6000 a year in the co-pay plan. Generally you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. The Blue Shield 500 PPO with a 500 deductible and the Blue Shield HDHP 2500 with a 2500 deductible note that each of these plans is in line with the average cost of similar policies as discussed in research by The Kaiser Family Foundation and Health Research and Educational Trust.

Our new name will be MotivHealth Insurance Company. For a health plan to be HSA-qualified it must meet the following criteria for 2018. MEDICAL PLAN 2019 HSA 2500 HERITAGE IN-NETWORK OUT-OF-NETWORK Outpatient Surgery Facility Coinsurance applies to 5000 Out of Pocket 25005000 Deductible then 20 Maximum Shared with In-Network Deductible then 40 Coinsurance applies to Shared with In-Network Out of Pocket Maximum.

If you are healthy and you dont consume much health care it almost feels like you have no. The amount of your deductible depends on the plan. A Cost-Effective HSA-Compatible Health Plan This AccessTN benefi t plan is specifi cally designed to meet the federal regulations for a High-Deductible Health Plan HDHP associated with Health Savings Accounts HSAs.

30000singlel medical and drug out-of-network 60000family medical and drug out-of-network The out-of-pocket limit is the most you could pay in a year for covered services. The minimum deductible must be no less than 1350 for individual plans. One benefit of an HSA is that the money you deposit into the account is not taxed.

As you may already know were motivated to change healthcare. Because HSAs must be paired with a high-deductible health plan your health insurance premiums are normally much lower than a typical PPO plan with a 500 or 1000 deductible. By using an HDHPHSA solution you can often realize significant savings on your insurance premiums and receive a deduction on your income taxes.

Medical Benefits apply after the calendar-year deductible is met unless otherwise noted or if the cost share is a copay. Using this guide an individual with an annual deductible of 1500 and a medical claim of 3500 pays the first 1500 to cover the annual deductible. Are tre services vered before you meetr deductible.

However another individual covered by your family plan would have to incur 2500 of medical costs before your plans after-deductible benefits would kick in.

Https Www Allwayshealthpartners Org Getmedia 7d61bed8 360f 4b65 Ac5d 549ebfa677bd Complete Hmo Hsa 2500 3045 Enhanced Flexrx 010121 Sbc

Think Carefully Before Signing Up For A High Deductible Health Plan

Think Carefully Before Signing Up For A High Deductible Health Plan

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

Http Www Ehealthinsurance Com Ehealthinsurance Benefits Ifp Mt Mt Clearchoice Hdhp Hsa2500 0408 Pdf

Comparing Health Plan Types Kaiser Permanente

Https Static1 Squarespace Com Static 5b23bf528ab7224cc2475950 T 5e615675b31a8842f3d928bf 1583437437703 Ahppremierhsa2500 Pdf

Hsa Standard Zion 2500 Clearwater Heath Plan

Hsa Standard Zion 2500 Clearwater Heath Plan

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Hsa Plans Page Exp Agent Healthcare By Clearwater

Hsa Plans Page Exp Agent Healthcare By Clearwater

Https Www Commercebank Com Media Cb Pdf Employee 2021 Blue Cross And Blue Shield Cdhp 2500 Plan And Hsa Sbc Pdf La En Hash A6e1108abc808234668e58bff24fe6c77aed47fd

Hsa Premier Clearwater Heath Plan

Hsa Premier Clearwater Heath Plan

Hsa Plans Page Clearwater Heath Plan

Hsa Plans Page Clearwater Heath Plan

Https Allwayshealthpartners Org Getmedia C4b40a70 E236 4cdf 9308 Be633186663e Complete Hmo Hsa 2500 3045 Enhanced 010120 Sbc

Comments

Post a Comment