Featured

Non Employer Dental Insurance

This may cost an employer more in the long run than if dental benefits were offered. Negotiated fees refers to the fees that in-network dentists have agreed to accept as payment in full for covered services.

Dental Insurance Waiting Periods Anthem Com

Dental Insurance Waiting Periods Anthem Com

Youll want to crunch the numbers.

Non employer dental insurance. But about 50 of companies still choose to offer their employees dental insurance. About two-thirds of people who do have. Plans can include no deductibles for in-network preventive services and cost savings for choosing to use in-network providers.

One in 4 Americans doesnt have dental insurance and of those over 65 half have no coverage according to the National Association of Dental Plans NADP. Although small businesses are not required to offer dental benefits to employees you might consider several ways that small business dental benefits could help your company save money. When you do youll have.

Dont put essential dental procedures on hold while you wait for insurance to kick in. The maximum annual carryover amount can be between 1000 and 2500 depending on the plan option. For costs and details of coverage contact a Cigna representative.

All group dental insurance policies and dental benefit plans contain exclusions and limitations. The lowest price in our area for a person of our sample demographic was 1199month. A dental savings plan also known as a dental discount plan is similar to an in-house dental plan.

For example dental insurance often makes the most sense if youre relatively free from dental problems. If you have it although the cost of the dental policy may be free youll still pay tax on it. If you need to cover just checkups and maybe a minor procedure like a filling youll have no problem.

Like health insurance you pay a monthly premium and need to meet a deductible before the insurance. In fact only 53 percent of companies that offered health insurance in 2014 provided any sort of dental benefits and only 35 percent of such companies offered vision insurance. Employer-provided dental insurance plans still have monthly premiums deductibles annual limits and other potential restrictions.

Employers arent legally required to offer dental or vision benefits to either full- or part-time employees. Some employers offer private dental plans for employees so check if this is an option. When it comes to small business dental insurance not much has changed in 2020.

The key difference and advantage is that a dental savings plan gives you access to a whole network of dentists versus just one. With this dental insurance plan there is no deductible but there is a waiting period. How Much Does Dental Insurance Cost.

Various types of dental plans are available. However this is still much cheaper than paying for the policy yourself. If your employer offers dental insurance coverage as part of their benefits package its generally cheaper than purchasing it on your own.

While each persons circumstances are unique there are a few options you should consider if you dont have health insurance from your employer. Dental insurance can be completely employer-paid 100 percent employee-paid or be arranged as a shared cost between employee and employer. And certain of its subsidiaries.

There are three ways to approach dental care if you dont have employer-based coverage - purchase your own private insurance opt instead for a discount plan or simply pay for services out of. Small businesses are generally not required to offer dental insurance to employees. Dental insurance typically does not cover cosmetic dental procedures or teeth whitening.

Cigna Dental EPO and PPO plans are insured andor administered by CHLIC with network management services provided by Cigna Dental Health Inc. For cosmetic dental procedures like teeth whitening coverage is usually not provided by employer plans and is rarely provided by any type of dental insurance. Our best dental insurance plans with no waiting period roundup reviews cost.

As a result vision and dental insurance benefits granted by an employer-sponsored plan are the exception not the rule. The cost estimates provided may be different from your actual costs for several reasons including but not limited to your unique dental circumstances and the decisions made by you and your dental professionals as to what services you will receive deviations between the anticipated scope of services and the services actually provided and the characteristics of your particular. Employees without dental benefits may postpone or forgo dentist visits in order to save money and as a result they can end up with more severe health problems.

Negotiated fees typically range from 30 - 45 less than the average charges in a dentists community for similar services. EHealth only offers traditional dental insurance plans not dental discount programs. However it is not dental insurance.

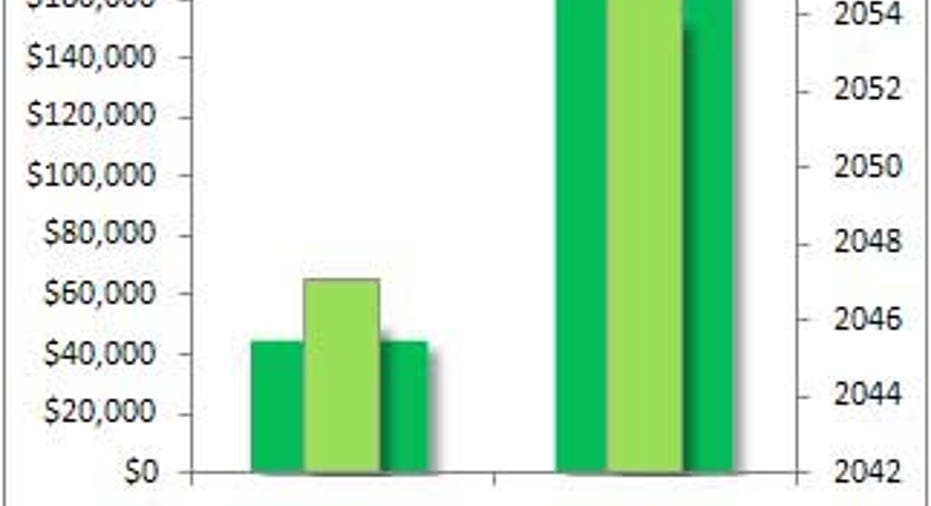

Although the eHealth site says that plans start at 8 per month there were no available plans at that price point in our area. You pay a nominal annual membership fee starting at just 80 to join a plan. Higher carryover amounts require a higher monthly plan cost.

After the waiting period you pay 100 of services after reaching the annual maximum carryover amount. This is because its known as a benefit in kind. This is different from the other services in our review.

However vision and dental insurance are not required as part of this mandate. Cigna Traditional indemnity dental plans are insured andor administered by Cigna Health and Life Insurance Company CHLIC. A participating dentist is a general dentist or specialist who has agreed to accept negotiated fees as payment in full for covered services.

Being eligible for employer-sponsored dental coverage could depend on your status as a full- or part-time employee.

Dental Insurance Chapter Dental Insurance Learning Outcomes 14 1locate And Describe The Parts Of The Mouth And The Teeth 14 2recognize Key Words Ppt Download

Dental Insurance Chapter Dental Insurance Learning Outcomes 14 1locate And Describe The Parts Of The Mouth And The Teeth 14 2recognize Key Words Ppt Download

No Dental Insurance Here Are 3 Options Fox Business

No Dental Insurance Here Are 3 Options Fox Business

/best-dental-insurance-providers-4169737_final2-a801550ef6a64ef99aed716a2503078b.png) The 5 Best Dental Insurance Providers Of 2021

The 5 Best Dental Insurance Providers Of 2021

Dental Insurance Plans Health Mybenefits Department Of Management Services

Dental Insurance Plans Health Mybenefits Department Of Management Services

Affordable Dental Insurance Plans For Individuals Cigna

Affordable Dental Insurance Plans For Individuals Cigna

Health Insurance In Germany A Guide For Expats Expatica

Health Insurance In Germany A Guide For Expats Expatica

Small Business Dental Plans Producer Connection

Small Business Dental Plans Producer Connection

Dental Insurance Benefits For Small Business Delta Dental

Dental Insurance Benefits For Small Business Delta Dental

In Network Dentist Benefits Out Of Network Dentist

In Network Dentist Benefits Out Of Network Dentist

Dental Insurance Frequently Asked Questions American Dental Association

Dental Insurance Frequently Asked Questions American Dental Association

Employee Dental Insurance Coverage Group Plans Delta Dental

Employee Dental Insurance Coverage Group Plans Delta Dental

/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png) Types Of Employee Benefits And Perks

Types Of Employee Benefits And Perks

Best Dental Insurance How To Choose Delta Dental

Best Dental Insurance How To Choose Delta Dental

/types-of-employee-benefits-and-perks-2060433-Final-65c1c14d22de4e10b4f4ea85af6bd187.png) Types Of Employee Benefits And Perks

Types Of Employee Benefits And Perks

Comments

Post a Comment