Featured

Ppo Insurance Cost

The average monthly cost of a PPO health insurance plan for a 40-year-old is 517 which is 21 more expensive than an HMO policy. 2021-2022 HMO PPO SAVER PLAN INDEMNITY.

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

If you qualify you can save even more with the Silver plan including an Advanced Premium Tax Credit and Cost-Sharing Reductions.

Ppo insurance cost. 3 This includes all types of Medicare Advantage plans. HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. In the past insurers would price your health insurance based on any number of factors but after the Affordable Care Act the number of variables that impact your health insurance costs decreased significantly.

The average premium paid by a Medicare Advantage beneficiary in 2018 was 3555 per month. You may also have a co-payment of about 10 - 30 for certain services or be required to cover a certain percentage of the total charges for your medical bills. Those discounts are the deepest when you visit a PPO network dentist.

Premiums can vary slightly by location but less significantly than some of the other factors. You want the freedom to choose almost any medical facility or provider for your healthcare needs. How much does a PPO plan cost.

Since PPO plans provide the most flexibility for the insured most individuals will find that they have the most expensive monthly premiums. You will also need to meet a separate out-of-network deductible. Learn more about our Preferred Provider Organization plans.

A slightly higher monthly premium but a lower deductible than a Bronze plan. 899 752 147 Employee spouse. A PPO plan will offer you a variety of choices from a network of dentists.

If the PPOs range for Apple is between 325 and -580 for the last year and Amazons PPO range is between 265 and -45 it is evident that Apple is more volatile because it has a 905 point. From 2010 to 2017 the average premium paid by a PPO beneficiary in a plan that included prescription drug coverage was 55 for a local PPO and 41 for a regional PPO. 1199 927 272 Employee family.

However eligible emergency care is always covered even out-of-network. Coverage level Total monthly cost UK pays You pay Employee only. For example your PPO may have an out-of-pocket limit of 1000 for your in-network costs and an out-of-pocket limit of 4000 for your combined in-network and out-of-network costs.

Higher monthly premium but. Insurance companies develop a network of dentists who agree to charge you fees that are lower than their usual rates. A PPO plan may be right for you if.

A single person on an employer-sponsored plan pays an average of 548 in monthly insurance premiums. In states and for products where applicable the premium may include a 1 administrative fee. Those out-of-network services will be covered at a higher cost to you and will have to submit claims yourself.

You have options and flexibility. With Aetnas PPO health insurance plans youll never have to choose between flexibility and savings. Families contributed an average of 6015 toward the cost which means employers picked up 71 of the premium bill.

What influences ACA plan costs. Average Cost of PPO Dental Insurance As you shop for PPO dental insurance there are 2 types of expenses you should be mindful of premiums and out-of-pocket costs. 599 564 35 Employee children.

In 2021 the average cost of individual health insurance for a 40-year-old across all metal tiers of coverage is 495. With a PPO you have access to a. Kaiser Family Foundation estimated the employees pay an average annual employer-sponsored premium of 1186 for single coverage and 5547 for a family plan.

What is the average cost of health insurance on a PPO. A PPO plan can save you more money. Family plan premiums cost more than 20000 on average but employers pay nearly 15000 of that amount on average with the employee picking up the rest.

If you have purchased an association plan an association fee may also apply. Disability life insurance. This fee is non-refundable as allowed by state.

For example in 2019 monthly premiums in the Northeast averaged 655 but 626 in the Midwest. Premiums are the amount you pay. Singles pay 6576 per year and families pay 17978.

This means a family pays an average of 1498 per month for an HMO plan. And for a family the premium in the Northwest averaged 1929 compared to 1804 in the South. You could reach the combined limit by spending 1000 on in-network services and 3000 on out-of-network services or by spending 4000 on out-of-network services.

You get it all from no referrals to broad networks to competitive discounts and more. Some plans may also charge a one-time non-refundable enrollment fee. For a single worker in 2019 the average premium was 7188.

Ppo Blue Cross And Blue Shield Of Texas

Ppo Blue Cross And Blue Shield Of Texas

Compare Hmo Ppo And Cdhp Plans Healthcare Healthinsurance Savingmoneyoninsurance Best Health Insurance Health Insurance Healthcare Plan

Compare Hmo Ppo And Cdhp Plans Healthcare Healthinsurance Savingmoneyoninsurance Best Health Insurance Health Insurance Healthcare Plan

Hmo Vs Ppo What S The Difference

Hmo Vs Ppo What S The Difference

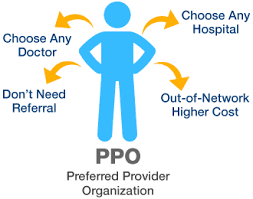

What Is A Ppo About Ppo Health Insurance Medical Mutual

What Is A Ppo About Ppo Health Insurance Medical Mutual

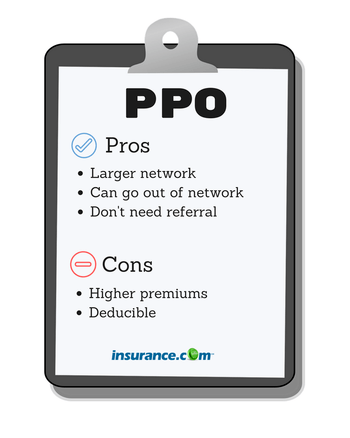

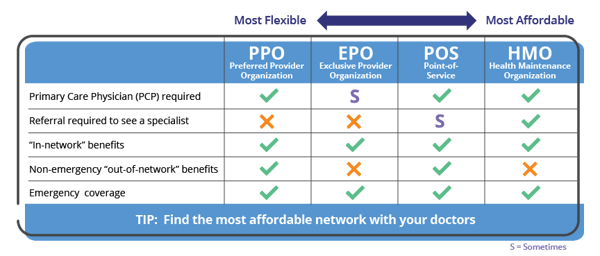

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Comparing Costs And Rates Of Hmo To Ppo Plans In California

How Much Does Individual Health Insurance Cost Ehealth

How Much Does Individual Health Insurance Cost Ehealth

You Re Aging Off Of Your Parents Health Insurance Plan Now What Thinkhealth

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Shop Affordable Ppo Health Insurance Plans In All 50 States Forhealthinsurance Com Health Insurance

Shop Affordable Ppo Health Insurance Plans In All 50 States Forhealthinsurance Com Health Insurance

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

How Do Commerical Ppo Vs Hmo Insurance Plans Work Dr Wenjay Sung Podiatrist

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Comments

Post a Comment