Featured

Can You Have 2 Vision Insurance Plans

We offer two vision plans to fit your budget or vision needs. Having two health insurance plans is perfectly legal and many people have multiple health insurance policies under certain circumstances.

When an employee has two different insurance plans at the same time they have dual coverage.

Can you have 2 vision insurance plans. I would suggest adding up the total of the annual premium and compare it to the benefit available. That is one routine exam per year and one pair of glasses or contact lenses. If you and your family are covered by both Surency and another vision carrier or medical plan that offers vision coverage Surency coordinates benefits with the other benefits carrier.

Especially if you have two different carriers. 4 Zeilen If a member is covered by more than one vision plan whether it be another carrier or another. Receive two separate sets of service.

If your employer offers vision care insurance you may only have one opportunity per year to sign up during the annual open enrollment period. Instead the two plans which are called primary and secondary coordinate provider payments so they dont pay more than 100 of the costs. Vision Benefits for covered members typically include.

Depending on your benefit plan and state laws you may. If a member is covered by more than one vision plan whether it be another carrier or another VSP plan and has duplicate coverage they may. Be aware that some individual plans charge a.

In this case the member is coordinating benefits Can you have two. Generally if you are covered as an employee and as a dependent of an employee at another company the coverage through your employer is primary. Lurker wroteShe can but if you get caught youre going to be raped.

For the latter out-of-pocket costs are higher and you need to pay for servicesgoods up front then submit the receipts for partial reimbursement. How your vision coverage works also depends on the type of insurance its classified as. It also doesnt mean a member makes money off the dual coverage.

If you want the plan to cover both you would have to get glasses one year and contact lenses the next. Having two plans doesnt mean a doctor gets reimbursed the same amount twice. When you are covered by two or more dental insurance plans youll need to designate one insurance plan as your primary plan and one as your secondary plan.

They cover almost nothing on top of. Ive been in dental insurance for 20 years and dont see people doing this very often. Generally the plan that covers you as the primary account holder will be the primary plan while the plan which covers you as a dependent will be your.

Updated July 13 2018 -- For Administrators and Employees. Dual coverage limitations are built into your dental plan and into the. Combined dental and vision insurance plans.

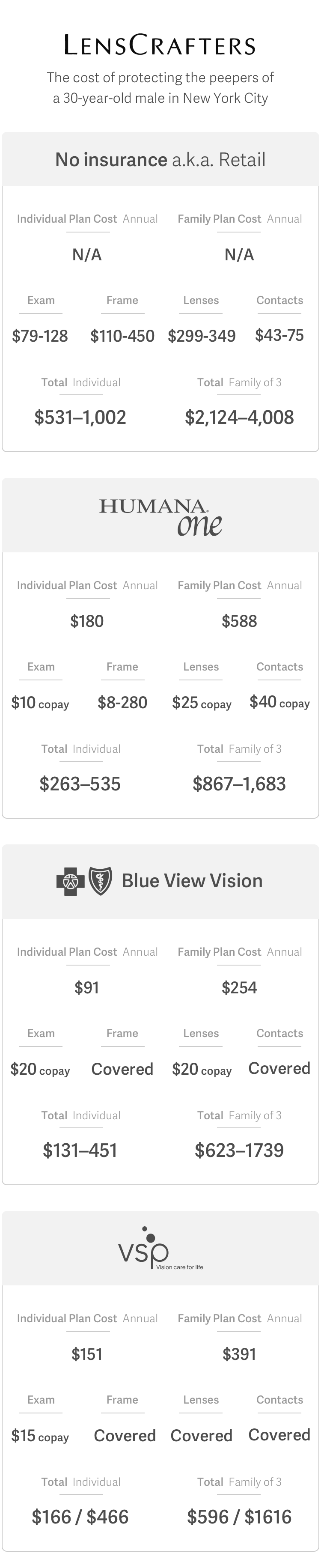

Why would I have two plans. There are a few different reasons why. As with medical plans large providers such as Vision Service Plan and EyeMed have two tiers of coverage in-network and out-of-network.

You can buy vision insurance in two ways. Choose to have both plans pay for one set of services. Whether or not it would be a good idea depends on the cost of the premium and the benefits available.

You can have both and you can use one to pay for glasses and one for contacts. Standalone vision insurance plans. I receive benefits up to the full amount you paid for the procedure ii experience a lesser co-pay than if you only had one plan or iii receive no additional benefit from your secondary plan.

The plans are outlined below for all in-network vision care services. Vision usually doesnt coordinate benefits. Vision insurance as a standalone plan has those same benefits and even more flexibility as you can choose a plan that covers glasses contacts or both.

Vision plans have only one benefit. Your primary plan is the plan that will pay out benefits first. Blue 2020 Exam Plan Get routine vision care at our most affordable rate.

If either of them find out you will be in trouble. Its against the terms of insurance companies. One plan will be designated as the primary plan and will pay first the other will be designated as the secondary plan and will.

You cannot have two insurance policies for one person. On dental I think it would depend on if your employer pays any of the premium and how much work you think you need. Or you could get both at one time and pay for either the contacts or eyeglasses out-of-pocket.

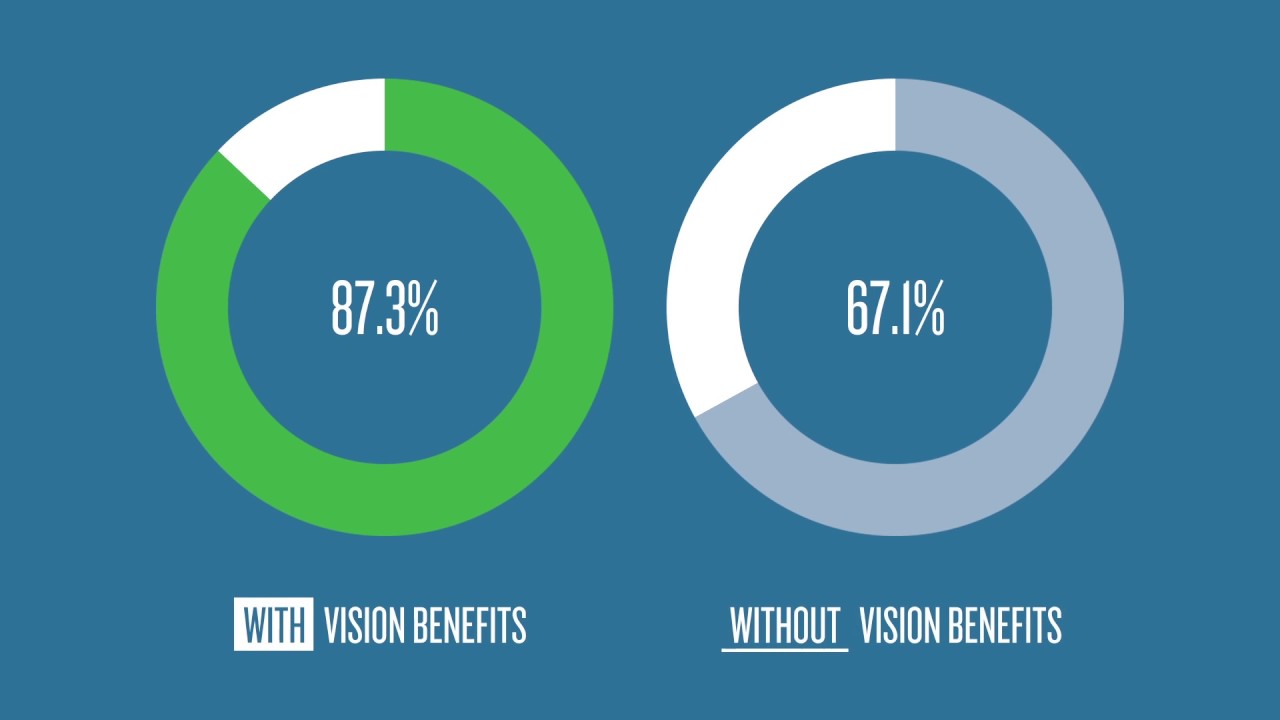

Yes you can have two health insurance plans. As nice as it might sound dual coverage does not mean you will receive twice the benefits.

Vsp Vision Insurance Frequently Asked Questions Vsp Faq

Vsp Vision Insurance Frequently Asked Questions Vsp Faq

/coordination-of-benefits-1850523021ff453f8f4f2e19a99324ea.png) Coordination Of Benefits With Multiple Insurance Plans

Coordination Of Benefits With Multiple Insurance Plans

Vision Insurance Faq What To Know Now That You Have Vsp Vision Insurance Part 2 Vsp Vision Plans

Vision Insurance Faq What To Know Now That You Have Vsp Vision Insurance Part 2 Vsp Vision Plans

Can You Have Two Health Insurance Plans Ehelath Insurance

Can You Have Two Health Insurance Plans Ehelath Insurance

What Is Vision Insurance And What Does It Cost

What Is Vision Insurance And What Does It Cost

Insurance Eye Desire Eye Care And Optical Boutique

Insurance Eye Desire Eye Care And Optical Boutique

Vision Eye Insurance Accepted Eye Care Plans Lenscrafters

Vision Eye Insurance Accepted Eye Care Plans Lenscrafters

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

4 Options For Best Vision Insurance For Kids 2021 Benzinga

4 Options For Best Vision Insurance For Kids 2021 Benzinga

/vsp-vision-carecopy-90433708ceb04461a8b0b823cbbc9c8e.jpg)

Comments

Post a Comment