Featured

Medicare Plan G Coverage

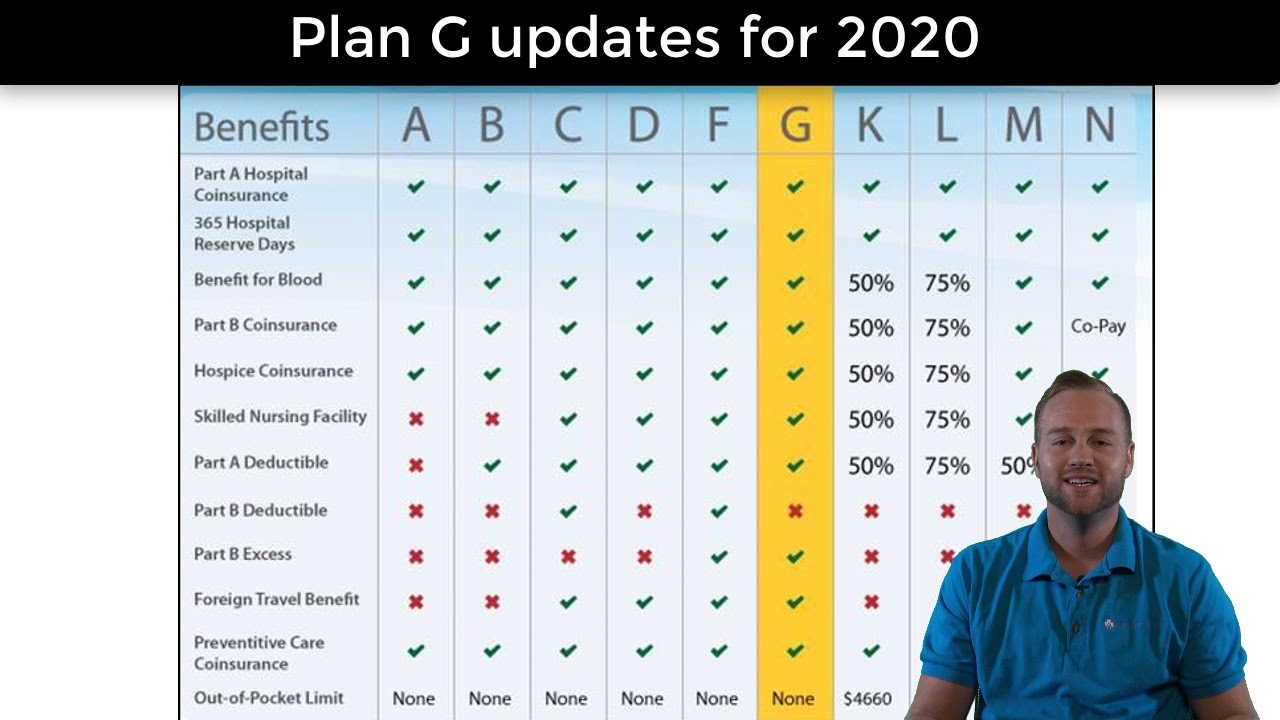

Medicare Supplement Plan G like other Medigap plans A through N is standardized by the federal government. Plan G has recently become one of the most comprehensive and popular supplement plans giving recipients plenty of coverage that Medicare itself does not cover.

Medicare Supplement Plan G 2020 Updates Coverage And Deductible Youtube

Medicare Supplement Plan G 2020 Updates Coverage And Deductible Youtube

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to with one exception.

Medicare plan g coverage. It offers great value for beneficiaries who are willing to pay a small annual deductible. The benefits are all provided affordably as well. The following are the healthcare costs that Medigap Plan G covers.

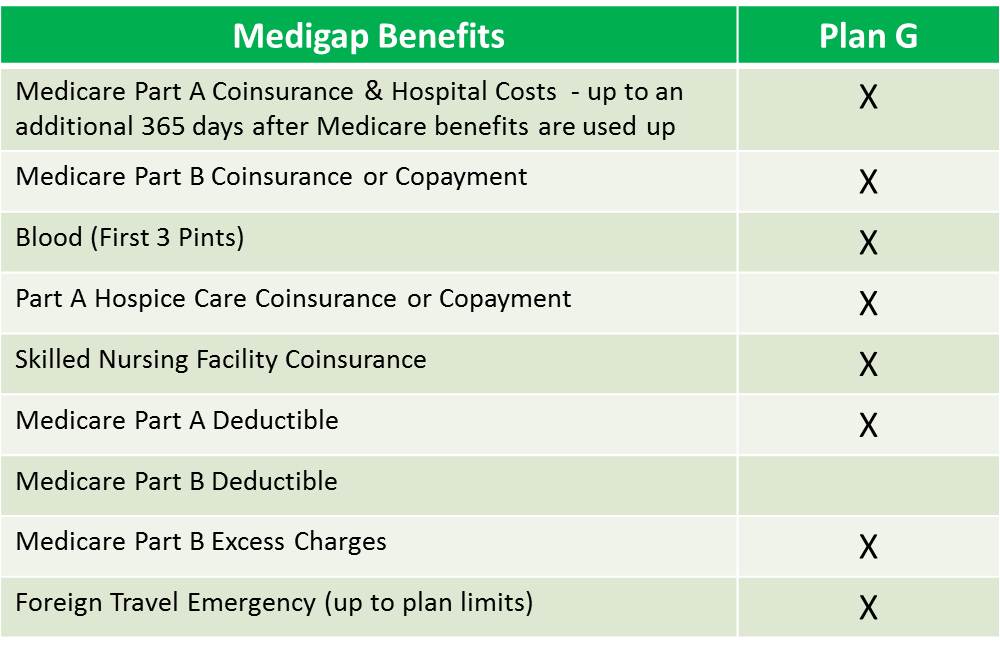

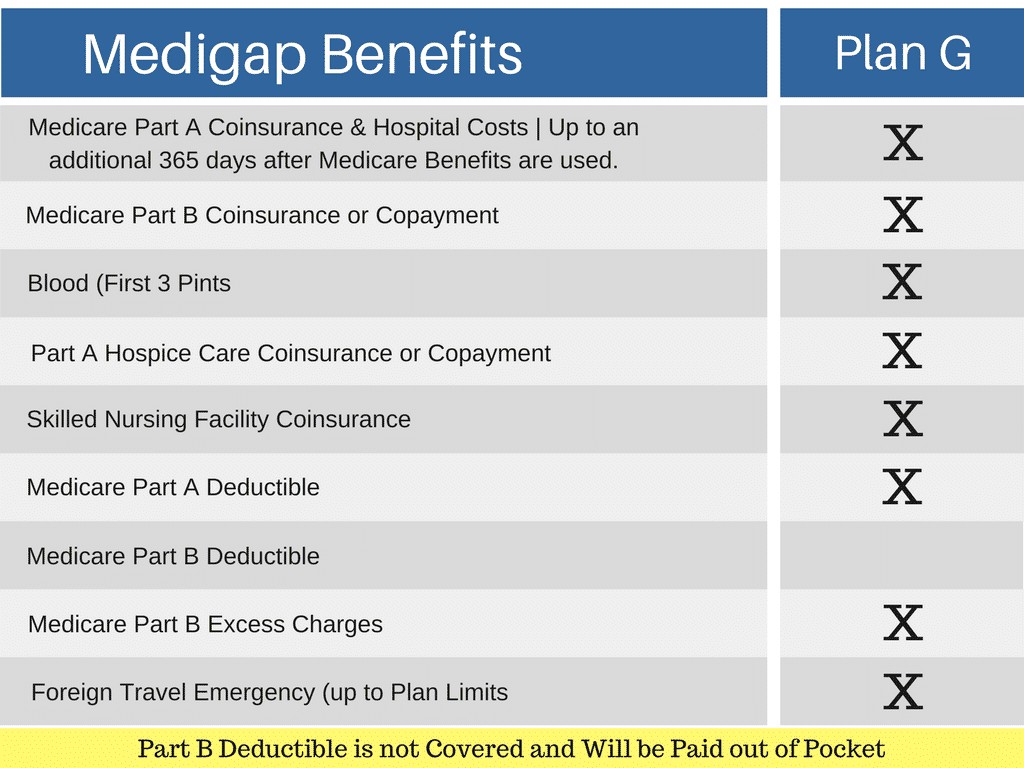

It pays for your hospital deductible copays and coinsurance. Medicare Part A coinsurance and hospital costs for an extra 365 days. Medicare Supplement Plan G covers.

Plan G pays for the gaps eg deductibles copays coinsurance and excess charges that are baked into Original. Plan G has essentially the same benefits as Plan F except for the Part B. Plan G covers everything listed on the benefits chart.

Medicare Plan G covers more than most Medicare supplement insurance Medigap plans. Medicare Plan G is a Medigap policy also known as supplemental Medicare insurance. With Plan G you will need to pay your Medicare Part B deductible.

Plan G covers many costs and this is why its the second most popular supplemental insurance plan behind Plan F. Medicare Plan G is the most comprehensive coverage you can buy if you became eligible for Medicare after December 31 2019. Find affordable quality Medicare insurance plans that meet your needs.

Still each Medicare Supplement policy is regulated by the government and has to provide the same coverage. 12 rader Plans F and G also offer a high-deductible plan in some states. Many companies that offer Medicare Supplement policies are free to set premium rates.

Medicare Plan G coverage is very similar to Plan F. These plans administered by private medical insurance companies help cover out-of-pocket costs in Medicare. Medicare Supplement Plan G in particular offers the broadest coverage for new Medicare beneficiaries.

Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out Part A deductible 1484 in 2021 Part A hospice care coinsurance or copayment. Like other plans Plan G fills in the gaps that Original Medicare leaves uncovered. Medicare Supplement Plan G Coverage.

Thankfully Medicare Supplement Plans also known as Medigap help fill in the gaps. Find affordable quality Medicare insurance plans that meet your needs. Annons Shop Medicare plans from Aetna Humana UnitedHealthcare Wellcare Cigna Kaiser more.

Recipients of Plan G will receive coverage for. The Part B deductible for 2021 is 203. There are currently 10 lettered Medigap policies A B C D G F K L M and N and Plan G is one of the best because it provides comprehensive coverage.

When you enroll in Medigap Plan G coverage you pay an annual deductible and your plan provides coverage for any gaps in Medicare coverage for expenses that would normally require additional payment on your part including deductible and copay amounts for hospital stays and skilled nursing facilities. After that Plan G provides full coverage for all of the gaps in Medicare. In their initial research phase many people compare Plan G to Plan F which covers the Part B deductible.

Medicare Part A coinsurance and hospital costs up to 365 days after your Medicare benefits are used up Medicare Part B coinsurance or copayments first 3 pints of blood for transfusions Medicare Part A hospice care coinsurance or. Annons Shop Medicare plans from Aetna Humana UnitedHealthcare Wellcare Cigna Kaiser more.

Medicare Plan G What You Need To Know Ensurem

Medicare Plan G What You Need To Know Ensurem

Medicare Supplement Plan G What Are The Facts Gomedigap

Medicare Supplement Plan G What Are The Facts Gomedigap

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medicare Supplement Plans Texas Illustrated Guide To Medicare In Texas

Medicare Supplement Plans Texas Illustrated Guide To Medicare In Texas

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Comments

Post a Comment