Featured

Blue Cross Plan F

Advantages of Anthem Blue Cross Plan F Anthem Medigap Plan F helps cover expenses that your original Medicare doesnt cover such as deductibles and. These policies help with Medicare out-of.

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

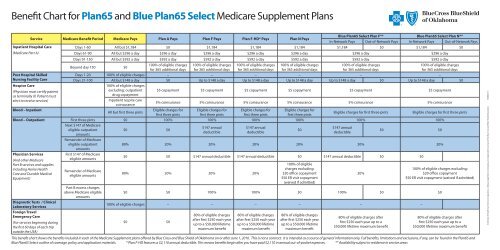

BCBS Plan F a popular Medicare supplement plan option offered by Blue Cross Blue Shield goes beyond even traditional Medigap plans.

Blue cross plan f. High-deductible plan F Plan F also has a high deductible option. Medicare Supplement Plan F. Learn more about the most popular Medicare Supplement Plan F with the Blue Cross Blue Shield of North Carolina BCBSNC Authorized Agency- NC Health Plans.

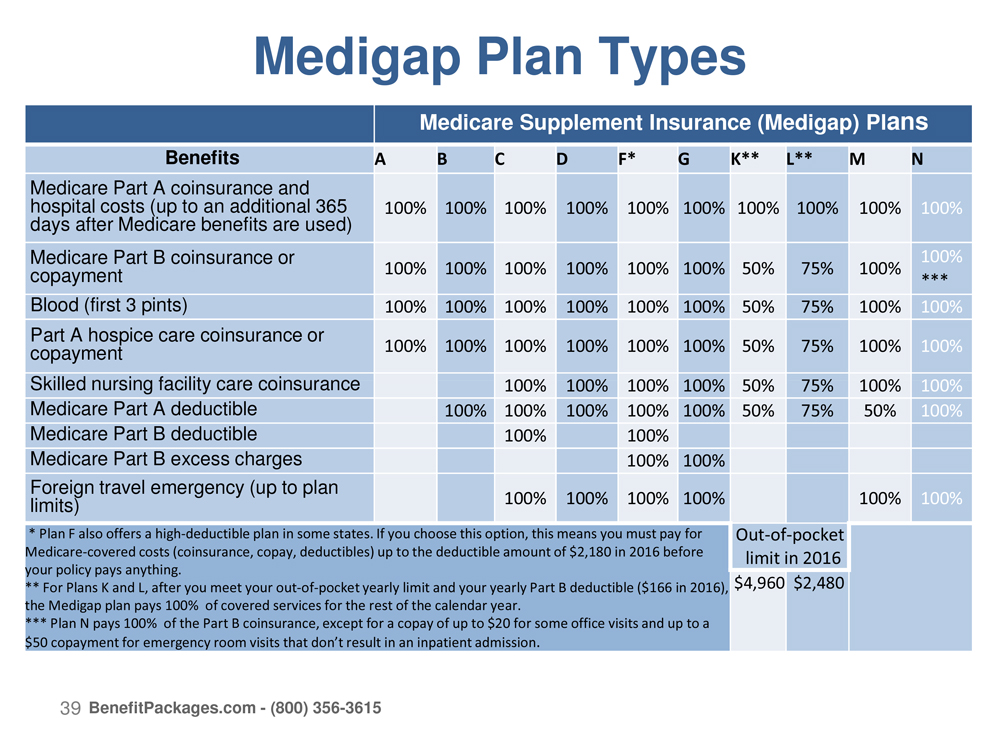

Skilled nursing facility coinsurance. This additional coverage gives you. Dental exams and cleanings at no additional cost.

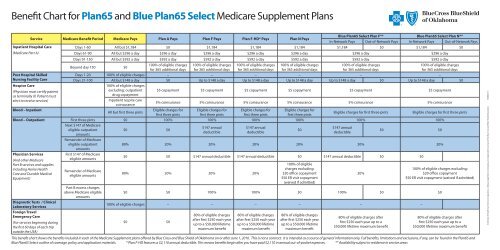

100 coverage for Medicare-covered services including deductibles copays and coinsurance. The plan pays for all remaining costs for days 61-90 370 a day and days 91 and beyond 740. You will be going to a new website operated on behalf of the Blue Cross and Blue Shield Service Benefit Plan by a third party.

Plan F gives you first-dollar coverage for all Medicare-approved services. You will be good to go. Select Blue Cross Blue Shield Global or GeoBlue if you have international coverage and.

Whether you have a hospital stay or a diagnostic exam or a doctors visit you will simply present your Medicare card along with your Plan F supplement card. This plan covers all the benefits offered by traditional Medigap Plan F with the exact same network of doctors but now includes new vision and hearing benefits. Blue Cross Medicare Supplement Plan F includes supplemental Medicare coverage for medical services covered in Part B including outpatient and medical services in or out of the hospital.

Part B Excess 100. Care from any Medicare provider anywhere in the United States--without a referral. Because of these changes Blue Cross now offers Plan G which is comparable in benefits and available at a less expensive price than Plan F.

The most noteworthy addition to Innovative F is a 750 hearing aid coverage. Basic benefits including 100 Part B coinsurance. Coverage can begin as early as April 1 2021.

It covers medical expenses during your foreign travel You can benefit from several different plan options Guaranteed renewal each year. The protection of your privacy will be governed by the privacy policy of. In cases where service costs exceed 250 this plan.

View Plans Apply. Your Medicare Part A deductible 1484 and coinsurance is paid in full. Private insurance companies such as BlueCross BlueShield offer Medigap policies to new enrollees.

Blue Cross Blue Shield members can search for doctors hospitals and dentists. Medicare supplement plans that cover the Part B deductible Plans C F and highdeductible F will no longer be available for individuals who turn 65 or become eligible for Medicare on or after Jan. Individual.

Easily paired with Blue Cross dental and prescription drug coverage. 100 coverage for Medicare-covered services including deductibles copays and coinsurance. With Plan 65 Plan F you are covered 100 for all Medicare-approved covered services.

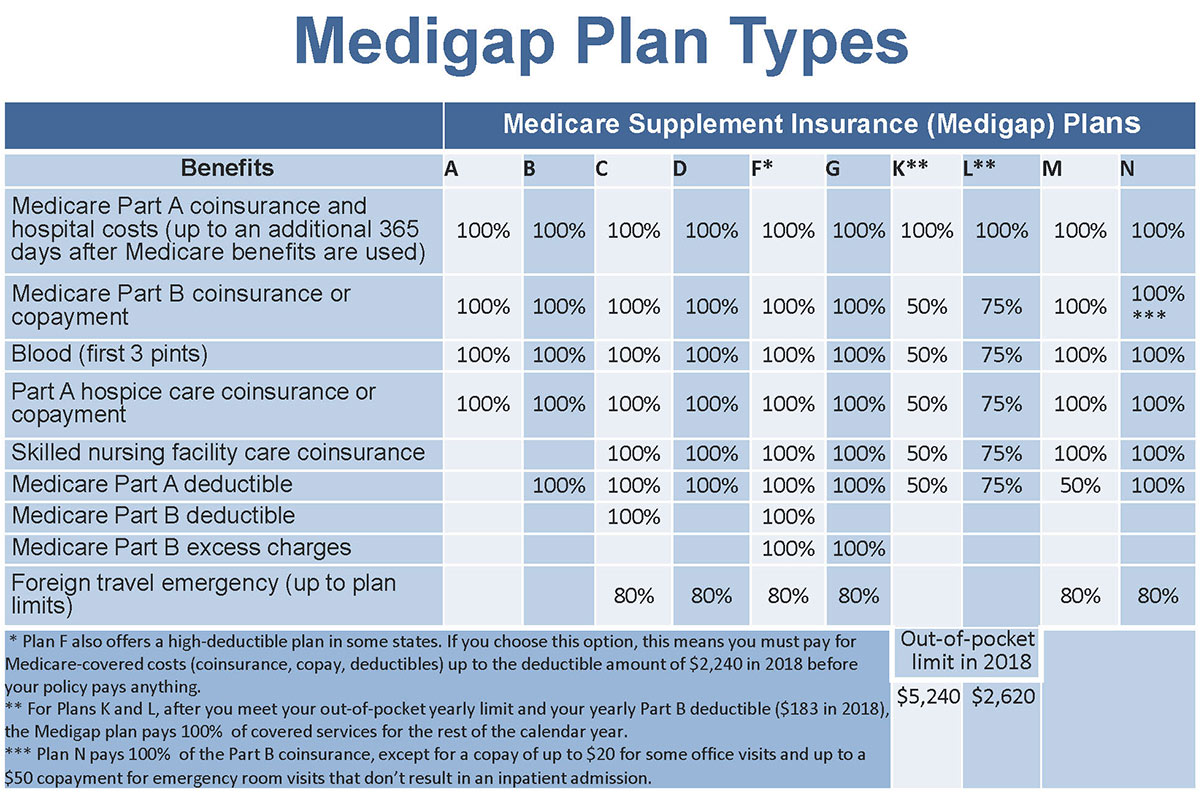

Outside the United States. The panel above briefly outlines the coverage. Because of its broad array of coverage its easily the most popular among Medicare recipients.

Care from any Medicare provider anywhere in the United Stateswithout a referral. It also covers physician services speech and physical therapy durable medical equipment diagnostic tests supplemental Medicare coverage for skilled nursing facility care home health care approved services and hospice care. Get Quotes and Apply Online.

For a little more than 15 a month you can add dental vision and hearing coverage to your Medicare Supplement plan. There are two more options in California for an Innovative F plan. Medicare Supplement Insurance High Deductible Plan F provides total protection.

Compare Anthem Blue Cross Medicare Supplement Plan F with Other Medicare Supplements If you are shopping for a Medicare Supplement Plan F Anthem Blue Cross is one option. As you can see the difference between these two plans is that Plan F includes the Part B deductible while Plan G does not. According to a report from Americas Health Insurance Plan Plan F had over 6 million enrollees in 2014.

Innovative F Medigap is a Medicare Supplement plan offered by Anthem Blue Cross in California and Nevada. That means after day 60 in the hospital when Medicare benefits decrease youre covered. Call The MAIR Agency Today.

Starting Feb 1 2021 Blue Cross will offer this package to all Medicare Supplement members. This Medigap plan will help you pay your portion of the costs of your Medicare Part A and Medicare Part B benefits. In the United States Puerto Rico and US.

While monthly premiums for this option may be lower you must pay a deductible before Plan F. With Plan 65 Plan F you are covered 100 for all Medicare-approved covered services. Plan 65 Plan F.

With Medicare Supplement Insurance Plan F from Blue Cross Blue Shield of Oklahoma you can expect to pay a monthly premium all hospitalization costs beyond the additional 365 days after the Lifetime Reserve are used up all costs after 101 days of skilled nursing care an annual 250 deductible for foreign emergency care and 20 percent of costs within the first 50000.

Medicare Coverage Options Blue Cross Blue Shield

Medicare Coverage Options Blue Cross Blue Shield

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Blue Cross Blue Shield Plan F Bcbs Plan F Hea

Blue Cross Blue Shield Plan F Bcbs Plan F Hea

Top 10 Medicare Supplement Insurance Companies

Top 10 Medicare Supplement Insurance Companies

Anthem Blue Cross And Blue Shield Group Retiree Plan F Cbia

Anthem Blue Cross And Blue Shield Group Retiree Plan F Cbia

Https Www Bcbstx Com Provider Pdf Id Card Quick Guide Pdf

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Https Www Bluerxalatenn Com Sales Documents 89029 89193 Planfeoc Pdf 6207432e 32e9 E443 E45f 55436f2891f0 T 1591642428720

Bcbs Medicare Supplement Plan F Rates Rating Walls

Bcbs Medicare Supplement Plan F Rates Rating Walls

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Https Www Bcbsvt Com Sites Default Files 2020 02 280 519 Vermont Blue 65 Plan F Certificate Of Coverage Group V10 Pdf

Https Www Bcbsm Com Content Dam Microsites Medicare Documents 2020 Medigap Medicare Supplement Outline Of Coverage Pdf

Comments

Post a Comment