Featured

- Get link

- X

- Other Apps

How To Be A Sole Proprietor In California

The sole proprietor isnt eligible. How to Establish a Sole Proprietorship in California 1.

There is no option to file for a DBA on the state level.

How to be a sole proprietor in california. If you want to know the requirements to obtain a real estate broker license then CLICK HERE. Sole proprietors dont always need to obtain an EIN and often use their private social security numbers instead. The first step is to obtain a real estate broker license from the California Department of Real Estate.

Even as a California sole proprietor youll likely need a business license from your city or county. Looking for an easy step-by-step guide to show you exactly how to start your business simply in the state of California as a sole proprietor. File a federal Schedule C with your federal return and file a California return with copies of your federal return and Schedule C for the year you go out of business or the year of the sole proprietors death.

The answer is yes. File a Fictitious Business Name Statement. It isnt exactly the same as or even too similar to a business that is already registered in.

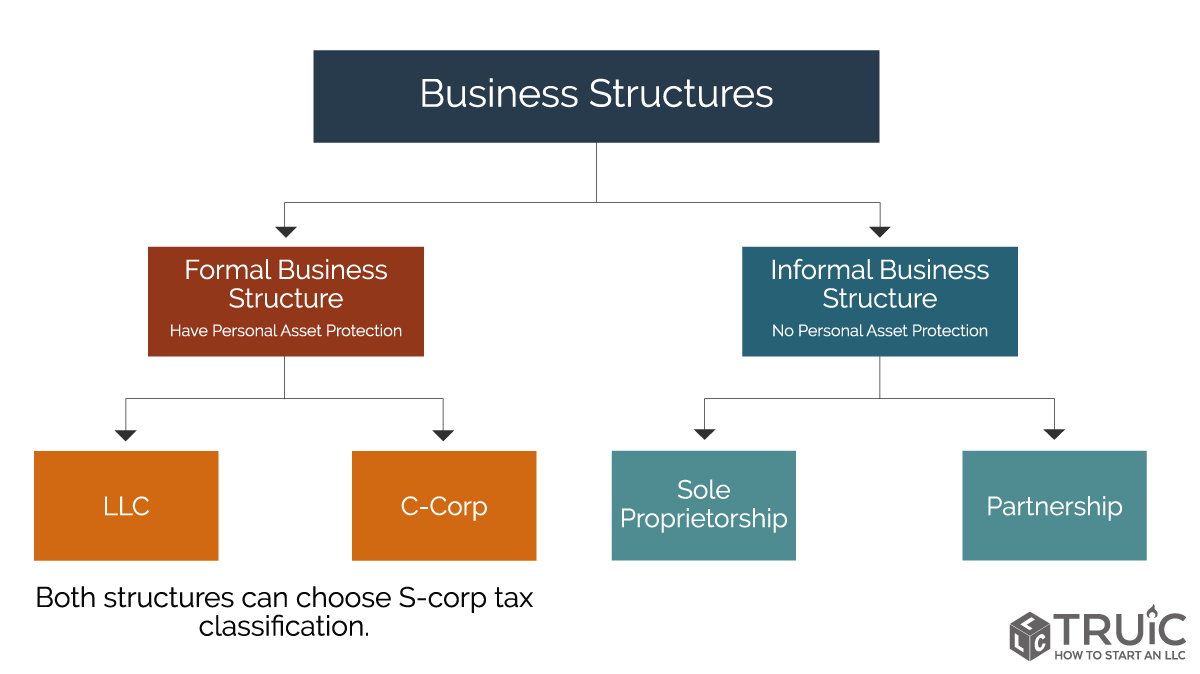

Under California law sole proprietors partnerships limited liability companies and corporations must file a DBA if they plan to operate under a different name. Establishing a sole proprietorship in California is generally a simpler process than forming a corporation or an LLC. Here is an outline of the steps you should follow to get started as a sole proprietor in California.

Furthermore sole proprietorships are the easiest business entities to form with one of the reasons being that the owner does not have to register with the California Secretary of State. Technically speaking once you are a licensed broker you can broker real estate You can do business as a sole proprietor. Theres a lot that you dont need to worry about as a sole proprietor.

There are specific steps that a sole proprietor in California can take to operate their business legally. Choose a Business Name. One crucial step is to register a DBA with the state if they want to operate under a different name other than their own.

Everything You Need to Know Sole Proprietorship in California. If youre a Sole Proprietor you need a DBA to register your business name. A doing business as DBA name is a crucial part of many sole proprietorships as it enables you to use.

Sole Proprietorship California. Get started Starting at 99 state filing fees. In California a company may use any name that is not the same as or too similar to another.

Choose a business name for your sole proprietorship and check for availability. Choose a Business Name. How to End a Sole Proprietorship.

But thats about all of the paperwork that youll need to get your business up and running. Appropriate insurance for the business. California sole proprietors dont need to.

Sole proprietors without employees usually dont need to acquire a federal tax ID. As stated previously forming a sole proprietorship is not a difficult process. Does a sole proprietor need a DBA in California.

However if he does use a DBA he may be required to register it with his state or county clerk. For more information general information about starting a sole proprietorship check out. DBA is an abbreviation for doing business as Well prepare and file all required documents to start your California DBA.

If you are looking for a specific sole proprietorship in California you can sometimes search by the entity number EIN the identification number provided by the California Secretary of State. If you use a business name that is different from your legal name. Creating a sole proprietorship in California compared to forming other types of.

Does a sole proprietor receive a salary. A sole proprietor is not required to adopt a fictitious or assumed name. You may need to obtain certain business licenses and permits file tax and employer identification documents and file a Fictitious Business Name Statement.

File tax returns for any delinquent tax years. Generally you cannot use a DBA that is already registered with another individual or company. You should also read the general section for information that is applicable in any state.

Sole proprietorships do not need to register with the state. Setting Up A Sole Proprietorship. How to Become a California Sole Proprietor DBA Acquisition.

How To Become A California Sole Proprietorship Llc Formation Rocket

How To Become A California Sole Proprietorship Llc Formation Rocket

Sole Proprietorships Vs Single Member Llcs In California Collective

Sole Proprietorships Vs Single Member Llcs In California Collective

San Francisco Business Start Faq

San Francisco Business Start Faq

How To Name A Business In California How To Start An Llc

How To Name A Business In California How To Start An Llc

How To Set Up A Sole Proprietorship In California

How To Set Up A Sole Proprietorship In California

/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg) Sole Proprietorship Definition

Sole Proprietorship Definition

How To Start A Sole Proprietorship In California 2020 Step By Step Guide To Sole Proprietor Youtube

How To Start A Sole Proprietorship In California 2020 Step By Step Guide To Sole Proprietor Youtube

Checklist Of Steps For A Sole Proprietorship In California Legalzoom Com

Checklist Of Steps For A Sole Proprietorship In California Legalzoom Com

/dotdash_Final_Sole_Proprietorship_May_2020-01-72456bd5ac0d4c868d8f55a2718dbdd2.jpg) Sole Proprietorship Definition

Sole Proprietorship Definition

Setting Up As A Sole Proprietor In California Legalzoom Com

Setting Up As A Sole Proprietor In California Legalzoom Com

Forming An Llc In California A Step By Step Guide Gusto

Forming An Llc In California A Step By Step Guide Gusto

Sole Proprietorship California A Guide For Solopreneurs Collective

Sole Proprietorship California A Guide For Solopreneurs Collective

Sole Proprietorship California Everything You Need To Know Youtube

Sole Proprietorship California Everything You Need To Know Youtube

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

Sole Proprietorship Vs Partnership Everything You Need To Know Camino Financial

/sole-proprietorship-398896_V4-26a8033028e34cbdaf5c777123c7a40b.png)

Comments

Post a Comment