Featured

How To Request Cobra Insurance

Complete the following information and mail to the address shown on the. To exhaust COBRA continuation coverage you or your dependent must receive the maximum period.

How To Sign Up For Cobra Insurance 8 Steps With Pictures

How To Sign Up For Cobra Insurance 8 Steps With Pictures

If youre eligible for COBRA because of a reduction in the hours you work or you involuntarily lost your job you may qualify for help paying for your COBRA premiums called premium assistance from April 1 2021 through September 30 2021 under the American Rescue Plan Act of 2021 based on how long your COBRA coverage can last.

How to request cobra insurance. The employee and his or her family members may each elect to continue health coverage under COBRA request the premium assistance and request. To request a copy contact EBSA at. If you are newly eligible under the relief bill your employer is required to notify.

Second you must have been enrolled in health insurance coverage through your employer in order to have the opportunity to stay on that health plan coverage. COBRA Continuation of Coverage. Your employer is required to send you a COBRA signup forms within 45 days of your layoff.

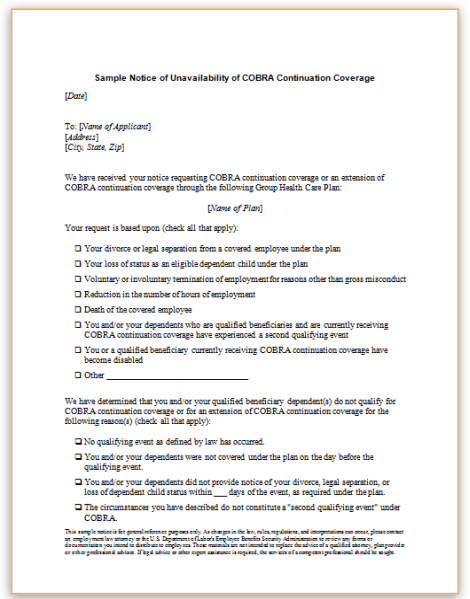

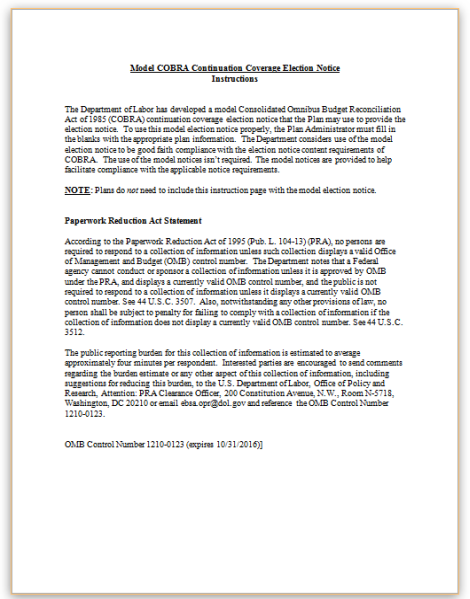

How long COBRA coverage must last are included in the booklet. How to enroll in COBRA In general employers have 60 days to notify you of your COBRA eligibility. When an individual experiences any of the situations that qualify him or her for COBRA coverage the human resources department insurance administrator or other responsible party at the employer through which they were receiving health insurance is required to advise him or her of the option to enroll in COBRA.

If you do not receive the forms you. How to apply for COBRA. Third generally you must to.

Other billing issues arose too. Verify why and when you have been terminated and double check for any discrepancies between your version of. If you qualify you should get a written notice of your eligibility for COBRA.

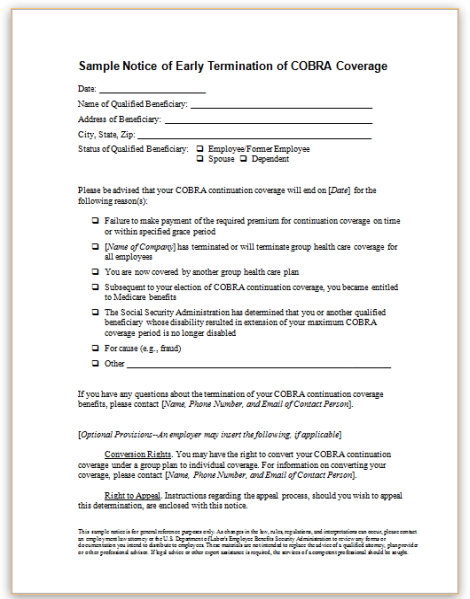

Your received premium payment is a signal of accepting coverage. A monthly billing statement will be sent to you from the plan. To sign up for COBRA insurance start by notifying your insurance company that youre eligible for COBRA through a qualifying event such as a divorce or job loss.

You have 60 days to decide whether to sign up for COBRA. Then when you receive your election notice from your insurance company review the price of your COBRA coverage to see if you can afford it. DO NOT SEND MONEY WITH THIS FORM.

If so return the completed election notice to your insurance. After that a notice is sent to the employee requesting acceptance or denial of the insurance continuation. The employer must notify the health plan within 30 days when you lose or quit your job die or become entitled to Medicare.

How do I sign up for COBRA insurance. Or call toll-free 1-866-444-3272. Call the COBRA administrator to get their version of events Next you should call your COBRA administrator to get their version of events.

How to Get COBRA Insurance Paperwork If you are eligible for COBRA the signup process is fairly simple. If you need to reach me regarding this request I can be reached at the address above by phone at xxx-xxx-xxxx or by email at xxx. Normally eligible employees have 60 days to accept coverage.

The applicant person requesting review of a denial of premium assistance may either be the former employee or a member of the employees family who is eligible for COBRA continuation coverage or the COBRA premium assistance through an employment-based health plan. It takes multiple parties to put a COBRA insurance plan into place. The Centers for Medicare and Medicaid Services offer information about COBRA provisions for public-sector employees.

Generally premium assistance means that youll have a 0 monthly premium. COBRA or the Consolidated Omnibus Budget Reconciliation Act typically allows people who leave a company with 20 or more employees to stay on their workplace insurance plan if they can pay both. If you can answer 5 questions over the phone we can get you a quote in 5 minutes.

Be sure you show your correct address for future billings. Since the COBRA plan I opted for was the exact same plan I had been on at my employer I thought that my physical therapist had processed my claims without any issue during this time. If you need to reach me regarding this request I can be reached at the address above by phone at xxx-xxx-xxxx or by email at xxx.

Since the COBRA plan I opted for was the exact same plan I had been on at my employer I thought that my physical therapist had processed my claims without any issue during this time. COBRA health insurance coverage has a few requirements. Notice no later than 60 days after the loss of coverage.

Other Billing Issues Arose Too. First an employer needs to speak with the health insurance provider to inform them that an employee is eligible for COBRA. An Employers Guide to Group Health Continuation Coverage Under COBRA.

We know many people want to understand how cobra insurance works what are the cobra insurance rules and coverage and how much it costs so give us a call today or request a call back by submitting your information via our website. Our agents are ready. Request special enrollment in a group health plan or a Marketplace plan if you have a new special enrollment event such as marriage the birth of a child or if you exhaust your continuation coverage.

Request for Continuation of Coverage COBRA. Your health insurance plan will send you information about how to extend coverage via COBRA. First your employer must have offered health insurance coverage and you be enrolled in those health insurance benefits.

My Handout For A Workshop On Massachusetts Health Insurance Options A

My Handout For A Workshop On Massachusetts Health Insurance Options A

Faqs About Portability Of Health Coverage And Hipaa Part 2 Of 3

Faqs About Portability Of Health Coverage And Hipaa Part 2 Of 3

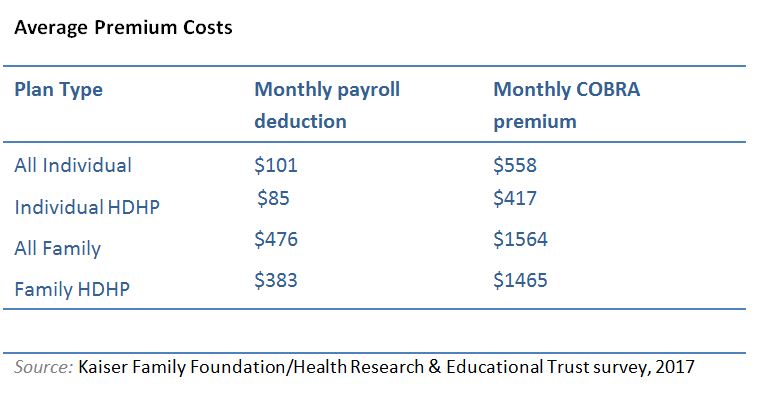

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

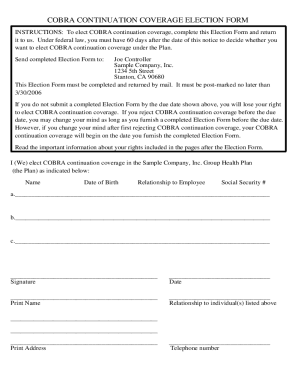

2013 2021 Cobra Medical Coverage Continuation Form Fill Online Printable Fillable Blank Pdffiller

2013 2021 Cobra Medical Coverage Continuation Form Fill Online Printable Fillable Blank Pdffiller

2013 2021 Cobra Medical Coverage Continuation Form Fill Online Printable Fillable Blank Pdffiller

2013 2021 Cobra Medical Coverage Continuation Form Fill Online Printable Fillable Blank Pdffiller

Cobra Subsidy Information For Workers New York State

Cobra Subsidy Information For Workers New York State

Https Www Dol Gov Sites Dolgov Files Ebsa About Ebsa Our Activities Resource Center Faqs Cobra Continuation Health Coverage For Employers Pdf

Cobra How To Log Into Your Member Portal And Make Your Election 24hourflex

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Comments

Post a Comment