Featured

What Is An Out Of Pocket Expense For Health Insurance

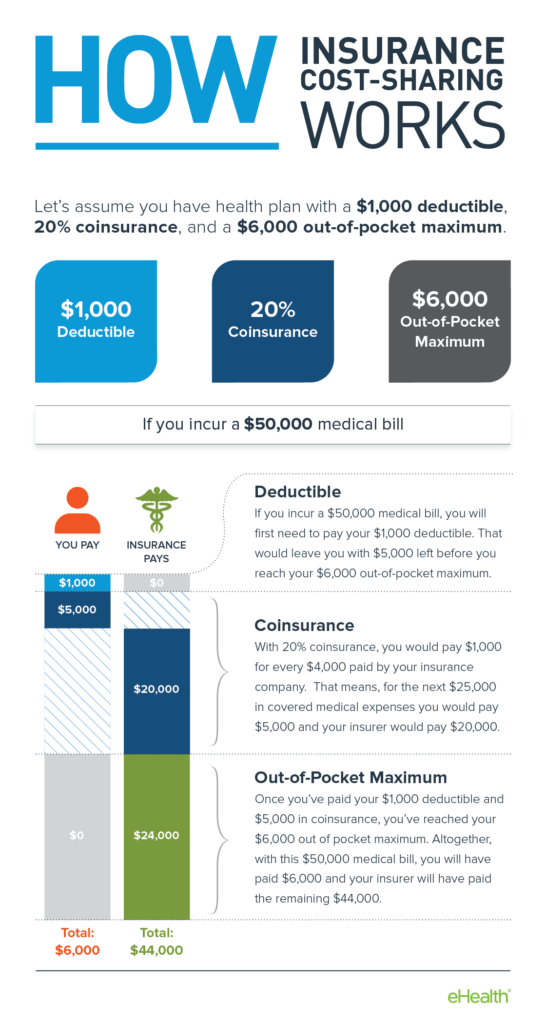

Check out our affordable health plans and calculate your premium. Out-of-pocket expenses are the costs of medical care that are not covered by insurance and that you need to pay for on your own or out of pocket In health insurance your out-of-pocket expenses include deductibles coinsurance copays and any services that are not covered by your health plan.

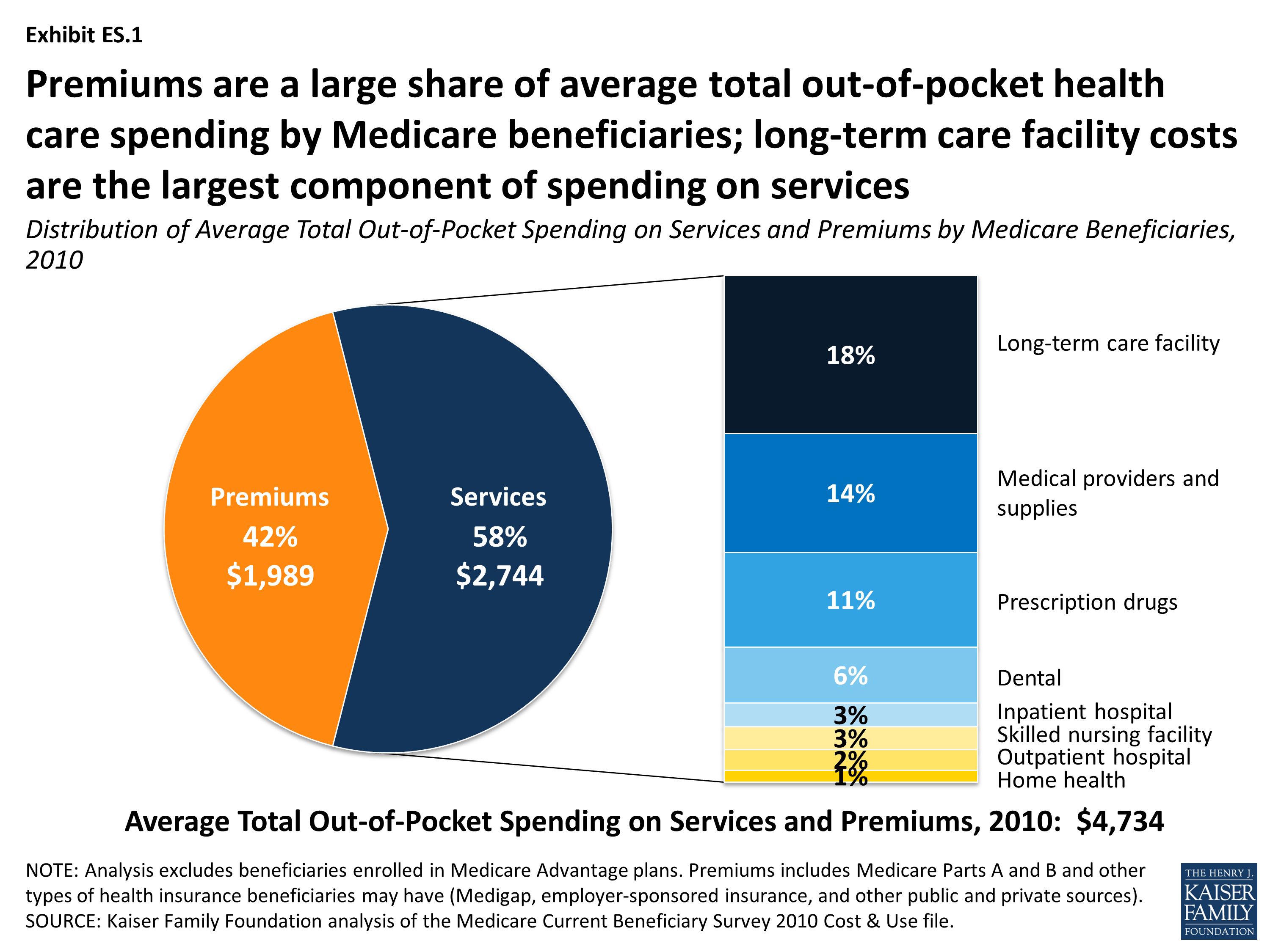

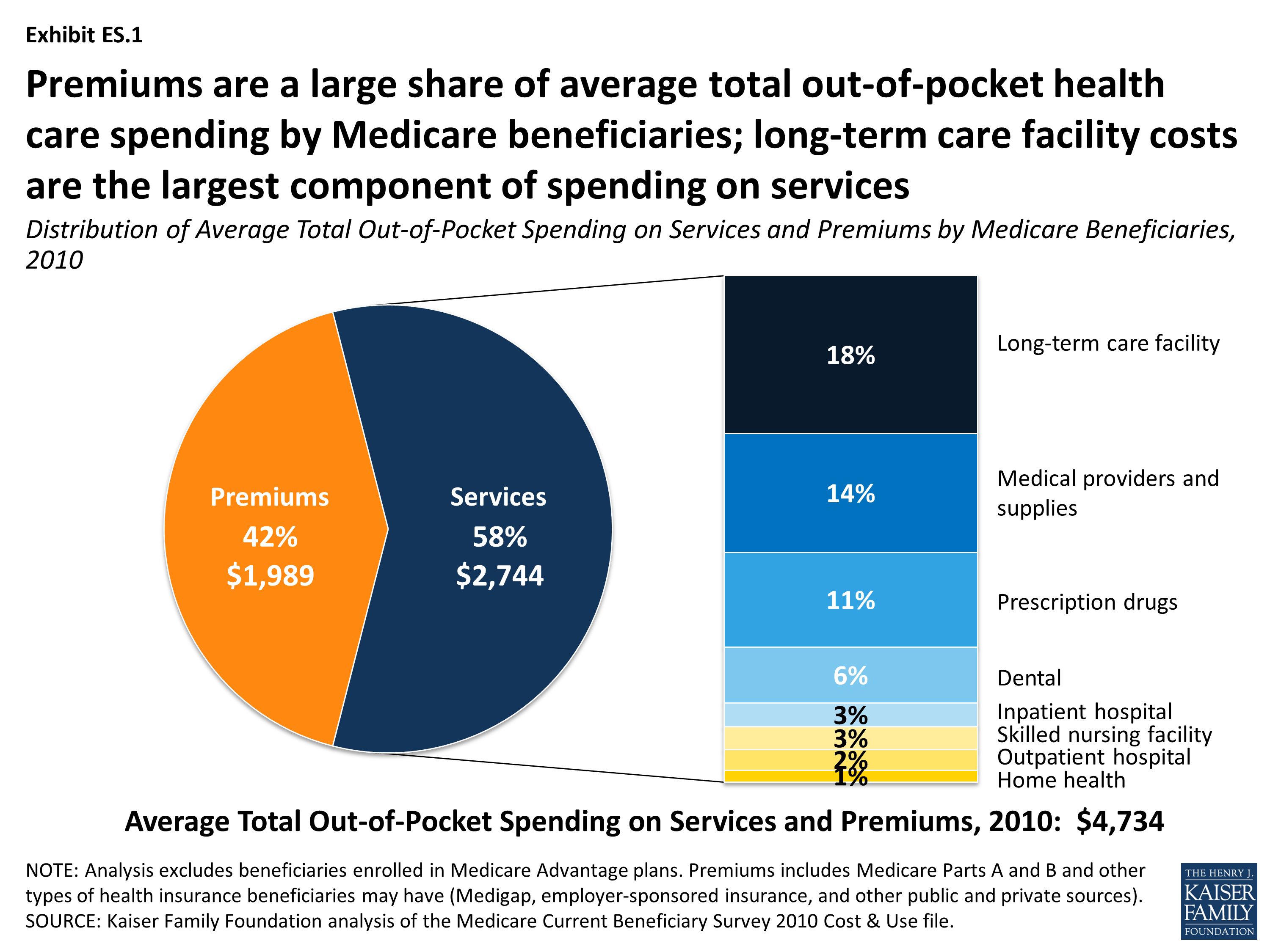

How Much Is Enough Out Of Pocket Spending Among Medicare Beneficiaries A Chartbook Kff

How Much Is Enough Out Of Pocket Spending Among Medicare Beneficiaries A Chartbook Kff

Where health insurance is concerned out-of-pocket expenses refer to the portion of the bill that the insurance company doesnt cover and that the individual must pay on their own.

What is an out of pocket expense for health insurance. Out-of-pocket maximum mean is the most a health insurance policyholder will pay each year for covered healthcare expenses. Get a Free Quote. Get a Free Quote.

An out-of-pocket expense is incurred when youre charged more for medical or hospital services than the amount you get back from Medicare if youre an Australian resident and your health cover. Get the Best Quote and Save 30 Today. Advertentie Get more out of your healthcare insurance.

- Fast Secure - Free Callback - Customizable Health plans - Worldwide Cover. The insurance company also sets a maximum amount. All health insurance plans sold in the United States are required to set a maximum limit on the amount of money you have to spend on your own or out-of-pocket in a given year.

Advertentie International Expat Health Insurance for you and your family in the Netherlands. Advertentie Compare 50 Health Insurance Plans Designed for Expatriates. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

Advertentie Compare 50 Health Insurance Plans Designed for Expatriates. Medical services that are covered by your insurance plan can still have an out-of-pocket component. Sometimes its called a MOOP for maximum out-of-pocket.

Advertentie Get more out of your healthcare insurance. Advertentie Compare Top Expat Health Insurance In Netherlands. These limits help policyholders.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. It is also called the out-of-pocket limit. Some health insurance plans call this an out-of-pocket limit.

How to choose Marketplace insurance. Out-of-pocket costs include deductibles coinsurance and copayments for covered services plus all costs for services that arent covered. - Fast Secure - Free Callback - Customizable Health plans - Worldwide Cover.

Out-of-pocket costs are costs for health care that arent reimbursed by insurance companies. Generally out-of-pocket costs include copays deductibles and coinsurance for covered services as well as expenses for services that arent covered by insurance companies. How to save on out-of-pocket health care costs.

Get the Best Quote and Save 30 Today. An out-of-pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year. Its therefore not something you can claim for.

Within the context of healthcare out-of-pocket often refers to out-of-pocket costs specifically medical expenses which you pay by yourself instead of expenses where your insurance foots the bill. If you meet that limit your health plan will pay 100 of all covered health care costs for the rest of the plan year. This fixed-dollar amount is called an out-of-pocket maximum.

For hospital claims the hospital and treating specialist should advise you in writing of the. Advertentie Compare Top Expat Health Insurance In Netherlands. Check out our affordable health plans and calculate your premium.

Advertentie International Expat Health Insurance for you and your family in the Netherlands. Your expenses for medical care that arent reimbursed by insurance.

What Is Out Of Pocket Expense What Does Out Of Pocket Expense Mean Out Of Pocket Expense Meaning Youtube

What Is Out Of Pocket Expense What Does Out Of Pocket Expense Mean Out Of Pocket Expense Meaning Youtube

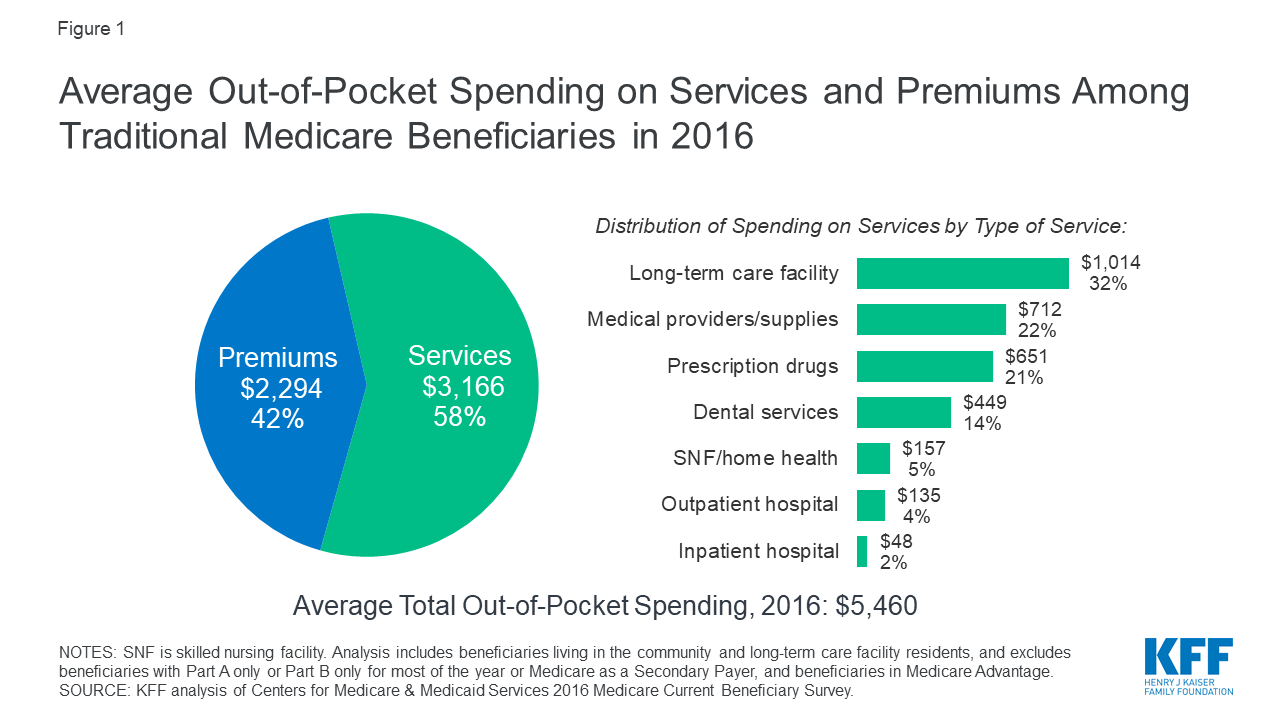

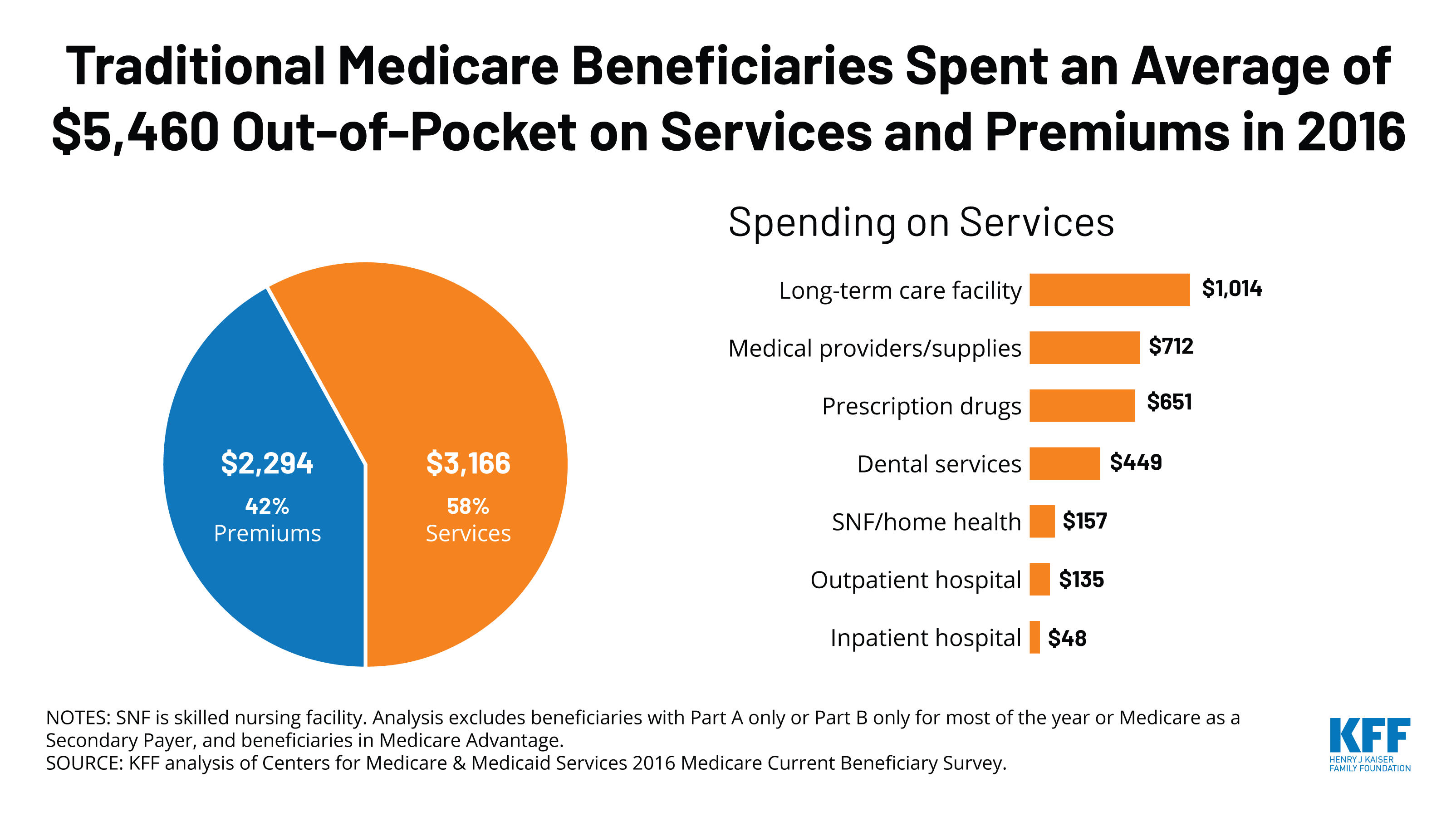

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

How Much Do Medicare Beneficiaries Spend Out Of Pocket On Health Care Kff

Out Of Pocket Costs What You Need To Know

Out Of Pocket Costs What You Need To Know

Out Of Pocket Costs For Health Insurance

Out Of Pocket Costs For Health Insurance

Out Of Pocket Expense Meaning Examples How It Works

Out Of Pocket Expense Meaning Examples How It Works

Out Of Pocket Costs Short Term Health Insurance

Out Of Pocket Costs Short Term Health Insurance

What Does Out Of Pocket Mean In Health Insurance

What Does Out Of Pocket Mean In Health Insurance

Out Of Pocket Expenses Definitions Terminology Aflac

Out Of Pocket Expenses Definitions Terminology Aflac

3 Things To Consider When Signing Up For Health Insurance

3 Things To Consider When Signing Up For Health Insurance

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

![]() An Analysis Of Who Is Most At Risk For High Out Of Pocket Health Spending Peterson Kff Health System Tracker

An Analysis Of Who Is Most At Risk For High Out Of Pocket Health Spending Peterson Kff Health System Tracker

Out Of Pocket Expenses Howstuffworks

Out Of Pocket Expenses Howstuffworks

Comments

Post a Comment