Featured

- Get link

- X

- Other Apps

Hmo With Deductible

Was beinhaltet das HMO-Modell. This covers the basic prescription benefit only and does not cover enhanced drug benefits such as medical benefits or hospital benefits.

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

With a PPO the deductible like the monthly premium is typically higher than an HMO.

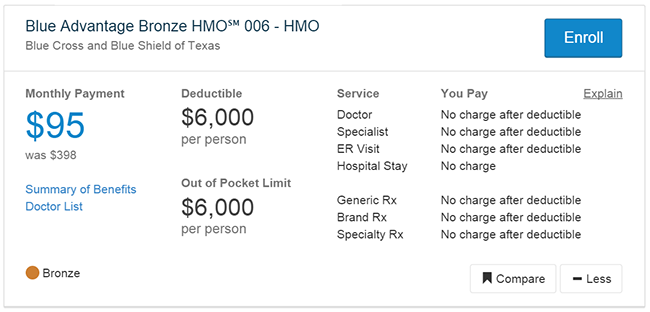

Hmo with deductible. A personal doctor for routine medical care. Medicare Advantage HMO plans generally have their own in-network deductible amounts which can start as low as 0. Finden Sie es direkt auf Comparis heraus.

It pairs with an HRA that can be used to pay for eligible medical services and prescription drugs. Was beinhaltet das HMO-Modell. Deductibles of at least 1400 for an individual or 2800 for a family are the minimum deductibles youll see in these plans.

In fact youll find high deductible plans in both HMOs and PPOs. At this point the HDHPHSA is 418 cheaper. Over 70 of Marketplace plans have deductibles under 3000.

Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. Count on a copay with an HMO. A Health Care FSA can be opened to.

20000 from deductible 20 of remaining 180000 56000 under HDHPHSA. PPOs typically have a higher deductible but theres a reason why. Instead the organization charges a co-pay for each clinical visit test or prescription.

If your plan covers prescription drugs. This plan has a higher cost per paycheck but is offset by having a lower deductible and out-of-pocket maximum. Your Kaiser Permanente Deductible HMO Plan with a health reimbursement arrangement HRA is not just health coverage its a partnership in health.

Finden Sie es heraus. The deductible is at least 1400 for an individual or 2800 for a family but not more than 6900 for an individual and 13800 for a family in 2020. UPMC for Life HMO Deductible with Rx HMO has a monthly drug premium of 2200 and a 0 drug deductible.

In the 80s and 90s it was common to see HMOs with no deductible at all. 20000 HDHPHSA 120000 Traditional. The maximum for families is 12700.

The most common form of this type of coverage is an HMO Health Maintenance Organization plan. One hospitalization at 200000. The telltale sign of HDHPs is that you will have a larger deductible to meet than a standard deductible plan.

DEDUCTIBLE HMO PLAN WITH HRA Section 2 With the Kaiser Permanente Deductible HMO Plan with HRA you can manage your personal and financial health. 120000 from deductible 20 of remaining 80000 136000 under Traditional. Well youre paying for access to a greater network of providers and more flexibility with who you can see and where you can see them.

Today HMO plans with 1000 deductibles are common in the individual market HMOs have become the predominant plans in many areas and are frequently offered with deductibles of 5000 or more. You receive preventive care services at little or no cost to you and online features let you manage most of your care around the clock. This deductible plan is paired with a health reimbursement arrangement HRA so you can use tax-free dollars contributed by your employer to pay for your health services1 You also get convenient access.

Even if you choose a high deductible catastrophic plan your out-of-pocket costs should not exceed this limit. But this has been changing as time goes by. The HRA doesnt cover dental or vision.

This UPMC for Life plan offers a 2200 Part D Basic Premium that is not below the regional benchmark. Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. Finden Sie es heraus.

Instead of the typical amount on large claims often ranging from 500 to 10000 sometimes there is simply no deductible that is required to. You pay more health care costs yourselfuntil you hit your deductible and insurance kicks in and shares the cost. In addition to low premiums there are typically low or no deductibles with an HMO.

Finden Sie es direkt auf Comparis heraus. High-Deductible Health Plan HDHP As its name implies this plan has a higher deductible than a traditional insurance plan but the monthly premium is usually much lower. Deductible met under both plans.

What Is An Hmo Shbp Health Maintenance Organization Ppt Download

What Is An Hmo Shbp Health Maintenance Organization Ppt Download

Finally Insured Our Simple Affordable Rv Healthcare Plan

Finally Insured Our Simple Affordable Rv Healthcare Plan

Https Hf Org Applications Sbc Form Cfm Year 2020 Entity Hfhp Plan 4495

What Is An Hmo Benefits Cost Comparison How To Enroll

What Is An Hmo Benefits Cost Comparison How To Enroll

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Hmo Vs Ppo Selecting The Right Plan For Your Employees Clarity Benefit Solutions

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

What Is An Hmo About Hmo Health Insurance Medical Mutual

What Is An Hmo About Hmo Health Insurance Medical Mutual

Https Tuftshealthplan Com Documents Brokers 2020 Benefit Summaries Ri Advantage Hmo 4000

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical

Comparing Health Plan Types Kaiser Permanente

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Hmo Vs Ppo Plans What Are The Differences Drwencke Ascent Sports Chiropractic Inc

Https Account Kp Org Business Broker Ca Plans Ever Lg Deductible Hmo Plans Faqs Ca En Pdf

Comments

Post a Comment