Featured

How To Decline Medicare Part B

You can delay Part B until you or your spouse stop working or lose that. To indicate that you want to decline Part B the back side of that page has a spot to specify that you wish to decline Part B.

Opting Out Of Medicare Part A And Part B

Opting Out Of Medicare Part A And Part B

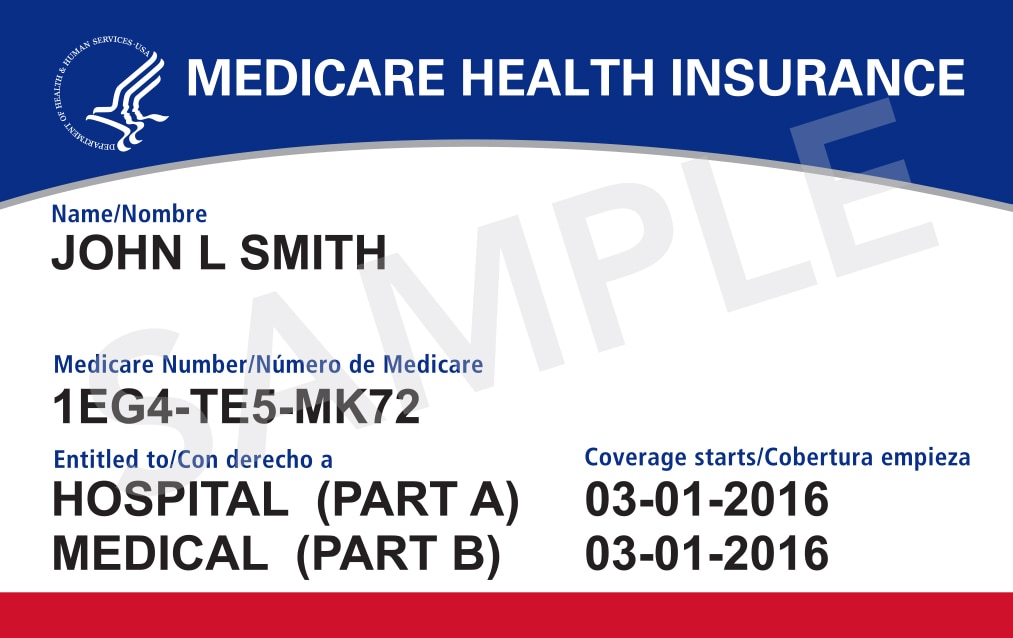

If you are enrolled automatically into Medicare Part B but dont want the coverage then you will need to opt out of Part B as soon as you receive your Medicare card.

How to decline medicare part b. If you owe a late-enrollment penalty. To find out more about how to terminate Medicare Part B or to schedule a personal interview contact us at 1-800-772-1213. Write down who you spoke with when you spoke to them and what they said.

However since this is a serious decision you may need to have a personal interview. You cannot get Medicare part B without having part A. It is important however that you decline your Part B coverage before the required deadline for doing so.

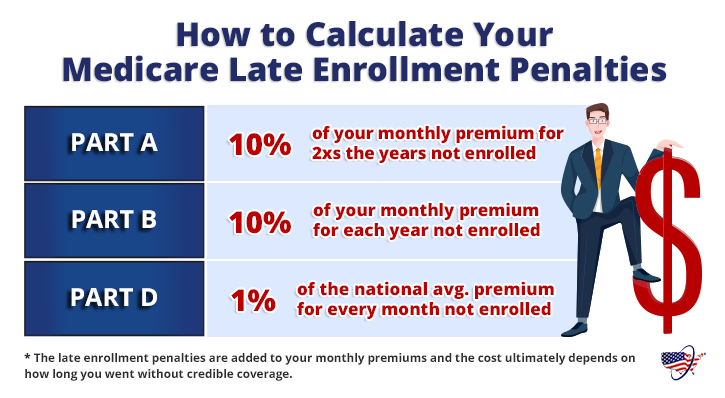

Otherwise youll be liable for the monthly premium that comes with it. Declining your Medicare Part A and Part B benefits completely is possible but you are required to withdraw from all of your monthly benefits to do so. Additionally you will face a significant penalty for signing up after age 65 if you do decline Medicare part A.

If you keep it you will keep Part B and be required to pay Part B. If you were automatically enrolled in Parts A and B and sent a red white and blue Medicare card you will have received instructions that come with the card for dropping Part B. You may then have to pay a late-enrollment penalty for Medicare Part B because you could have had Part B and did not enroll.

Remember that if you do not enroll in Medicare Part B during your Special Enrollment Period youll have to wait until the next General Enrollment Period which happens from January 1 to March 31 each year. Call the Social Security Administration at 800-772-1213 and ask if you can decline Part B without any penalties. To avoid this cancel and sign in to.

Also be aware that if you dont sign up for Part B during your eight-month window the late penalty will date from the end of your employer coverage not. Youll need to complete the form during an interview with a representative of the Social Security Administration SSA. If the representative at the Social Security Administration says you can decline Part B you.

Declining Part B Coverage. Videos you watch may be added to the TVs watch history and influence TV recommendations. In general if you have Medicare based on disability you should decline Part B only if You have health insurance from an employer for whom you or your spouse actively works and the employer has 100 or more employees.

Be sure you send the card back. If your current employer coverage is primary and you choose to turn down Part B you should. This means you can no longer receive Social.

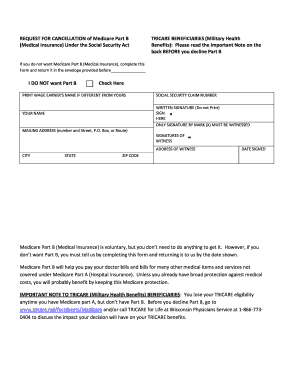

How to cancel Medicare Part B The Part B cancellation process begins with downloading and printing Form CMS 1763 but dont fill it out yet. In that circumstance the individual can sign up for. Outside of these parameters you qualify for Medicare Part B if youre 65 or older or have end-stage renal disease ESRD.

A Special Enrollment Period occurs anytime you have a qualifying situation and lets you enroll in Medicare Part A andor Part B outside of the annual enrollment periods. Unlike with Part A this will not cause you to lose your Social Security benefits. This is because you do not pay taxes for Medicare Part B.

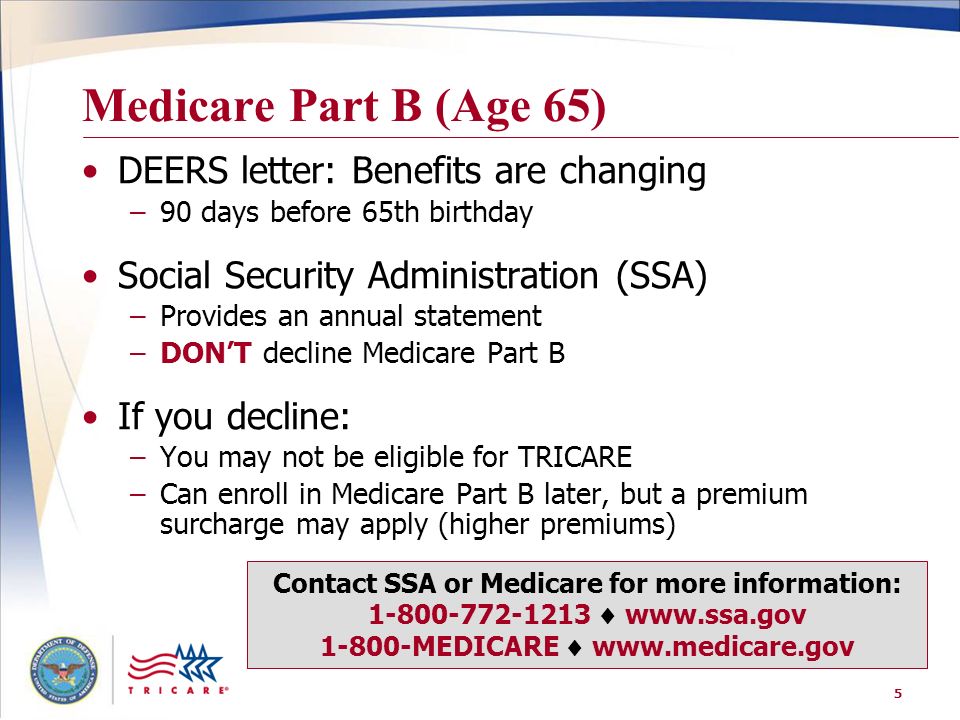

If you are an active-duty service member or the spouse or dependent child of an active-duty member you may delay Part B enrollment and keep your TRICARE coverage. If you decline Part B coverage you may be faced with late penalties when you sign up at a later time. Or alternatively if you are automatically enrolled because you are receiving one of these benefits then you can actually decline Medicare Part B coverage by following the instructions that you are given via the letter from Social Security that accompanies your Medicare ID card.

A Social Security representative will help you complete Form CMS 1763. If playback doesnt begin shortly try restarting your device. The one time individuals should decline Medicare part A is if they continue to work beyond age 65 and have employer provided health insurance.

Youre covered as a family member on somebody elses group health plan at work and the employer has 100 or more employees. Before you decline Part B go to wwwtricaremilfactsheetsMedicare andor call TRICARE for Life at Wisconsin Physicians Service at 1-866-773- 0404 to discuss the impact your decision will have on your TRICARE benefits. Also allows you to postpone your one-time Medigap open enrollment period until a later time when you may want to.

This allows you to save the cost of your Part B premium. You can voluntarily terminate your Medicare Part B medical insurance. If you live in Puerto Rico you will need to sign up for Part B.

If you sign up late for Part B youll pay a lifelong late penalty fee every month on top of your regular Part B premium. If you do not want Part B because you still have creditable group coverage from your employer when you get your Medicare enrollment package for Parts A B it will include a page to which your new Medicare card will be attached.

Do I Need Medicare Part B What Is Part B Boomer Benefits

Do I Need Medicare Part B What Is Part B Boomer Benefits

Was Your Medicare Claim Rejected Here S How To Appeal Diatribe

Was Your Medicare Claim Rejected Here S How To Appeal Diatribe

Medicare Part B Coverage For Diabetes Supplies Accu Chek

Medicare Part B Coverage For Diabetes Supplies Accu Chek

Https Www Medicarerights Org Pdf Partb Enrollment Pitfalls Problems And Penalites Pdf

How To Avoid The Medicare Part B Late Penalty Aarp Medicare Plans

How To Avoid The Medicare Part B Late Penalty Aarp Medicare Plans

Using Tricare And Medicare Ppt Download

Using Tricare And Medicare Ppt Download

How To Appeal A Higher Medicare Part B Premium Boomer Benefits

How To Appeal A Higher Medicare Part B Premium Boomer Benefits

Cancellation Part B Form Fill Out And Sign Printable Pdf Template Signnow

Cancellation Part B Form Fill Out And Sign Printable Pdf Template Signnow

Https Ncler Acl Gov Getattachment Resources Medicare Enrollment Covid Practice Tip Final Pdf Aspx Lang En Us

Https Www Securityhealth Com Media Member Compliance C 20 20medicarehandbook1 Ashx

Should I Get Parts A B Medicare

Should I Get Parts A B Medicare

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

How To Avoid The Medicare Part B Late Penalty Aarp Medicare Plans

How To Avoid The Medicare Part B Late Penalty Aarp Medicare Plans

Medicare 101 2016 Borchard Foundation Training Series Part

Medicare 101 2016 Borchard Foundation Training Series Part

Comments

Post a Comment