Featured

What Is Cal Cobra Extension

The second is when a second qualifying event occurs. It may also be available to people who have exhausted their Federal COBRA.

Cal Cobra Laws For California Employees Ca Employment Help

Cal Cobra Laws For California Employees Ca Employment Help

The extension is for a maximum of 36 months from the date the individuals federal COBRA benefits began.

What is cal cobra extension. 2 It lets you keep your health coverage for a total of up to 36 months. In order to qualify for extended coverage a qualified beneficiary must have elected COBRA during the first qualifying event and must have been receiving COBRA coverage at the time of the second event. When your Cobra exhausts you may be eligible for another 18 month period of the same coverage through a Cal-Cobra extension.

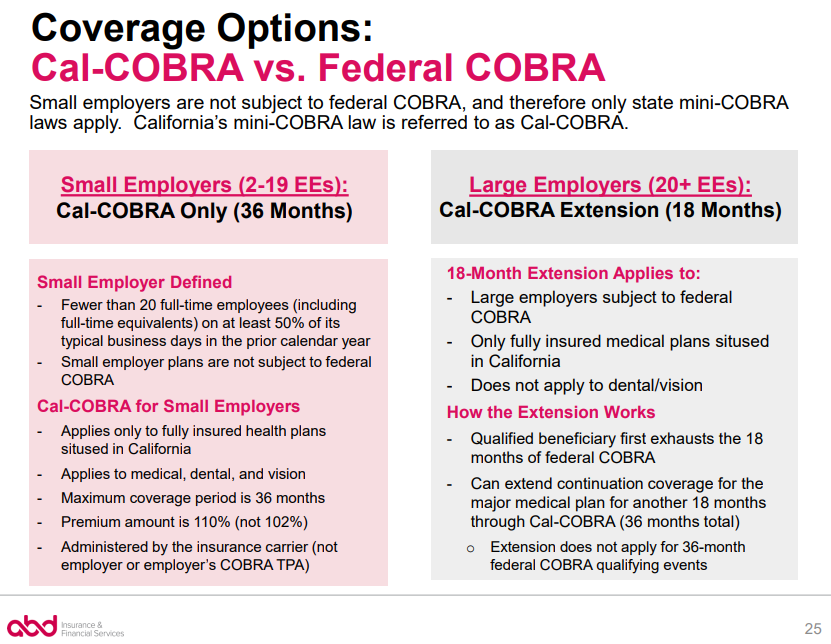

Small Employer 2 to 19 employees. Can I extend my COBRA continuation coverage. Cal-COBRA is different from the federal program in two ways.

On March 11 2021 President Biden signed the American Rescue Plan Act of 2021 ARPA. You are eligible for Cal-COBRA extension if a. The provision does not extend your policys life beyond the normal 18 months though.

COBRA an acronym for the federal Comprehensive Omnibus Budget Reconciliation Act has become shorthand of sorts for an employees right to continue her employer-provided group health insurance coverage when she leaves her job. The extended 36-month period is only for spouses and dependent children. The first is when a qualified beneficiary is disabled.

In California if your employer has two to 19 employees you may be covered by Cal-COBRA. The carrier or administrator should be able to confirm if a Cal Cobra extension. The employees job ends.

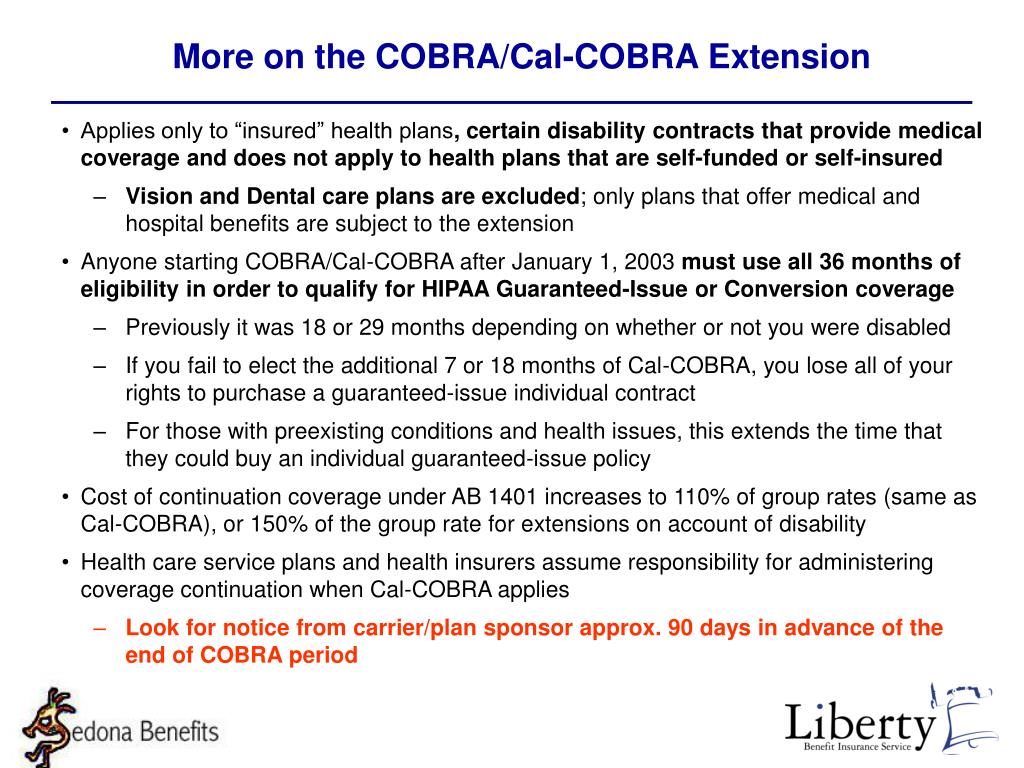

Cobra typically lasts up to 18 months but you may also have a Cal-Cobra extension which can extend it to another 18 months. Also once federal COBRA is exhausted Cal-COBRA may extend continuation coverage up to a combined total of 36 months of. CA has an extension of continuation to 36 months under AB 1401 2003 which provides for continuation with a switch from federal COBRA to Cal-COBRA after 18 months for an additional 18 months coverage.

Cal-COBRA may also be. Just like Cobra Cal-Cobra requires that the underlying. If you are entitled to an 18 month maximum period of continuation coverage you may become eligible for an extension of the maximum time period in two circumstances.

Thus the extension doubles the 18-month maximum COBRA period that normally applies to individuals losing health coverage due to termination of. Latest Stimulus Bill Means Major Changes to COBRA Continuation and Benefits. When you extend your federal COBRA coverage under state Cal-COBRA you have the opportunity to continue the same health plan as under federal COBRA.

The reason you elected Cal-COBRA was due to disability that Social Security determines to have started within 60 days of filing for Cal-COBRA. The Consolidated Omnibus Budget Reconciliation Act COBRA is a United States federal law that among other things requires employers of 20 or more employees to offer continuation of coverage to employees and their dependents when a qualifying event that results in the loss of group eligibility occurs. Cal-COBRA is California law that has similar provisions to federal COBRA.

1 California law requires most companies to extend COBRA benefits for a total of 36 months when a person is entitled to fewer than 36 months of federal COBRA coverage. However the Cal-COBRA extension is for people who left the workforce due to a Social Security level of disability. Cal-Cobra can provide an additional 18 months after Cobra ends if eligible.

1 Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees. However if you have non-medical coverage under COBRA dental and vision care from a specialized health plan you cannot continue this under state Cal- COBRA. The preceding calendar year or the preceding calendar quarter if the employer was not in business during any part of the preceding calendar year.

ARPA is the latest COVID-19 relief stimulus bill and it includes several benefits-related provisions which are discussed in more detail below. When an employer offers a group health insurance plan such as medical dental or vision insurance the employee and covered dependents Qualified Beneficiaries are provided an opportunity to continue their current plan at the individualfamilys expense when they have a qualifying event. With Cal-COBRA the group policy must be in force with 2-19 employees covered on at least 50 percent of its working days during.

Some companies are exempt from this requirement. Eligibility for Cal-COBRA extends to indemnity policies PPOs. If the company is eligible generally requires being domiciled in California employees can elect a Cal-Cobra extension when they run out of the original 18 months.

Obviously groups 2-19 fall under full Cal-COBRA and get a straight 36 months. Cal-COBRA is a California Law that lets you keep your group health plan when your job ends or your hours are cut. Cal-COBRA is a state law in California that applies to employers with group health plans that cover between two and 19 employees allowing employees to keep their benefits for up to 36 months following a qualifying life event such as the following.

Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees.

Https Www Goigoe Com Docs 11 04 20cobra 20legislative 20update Pdf

Cobra Small Employer Exception Abd Insurance Financial Services

Cobra Small Employer Exception Abd Insurance Financial Services

Cobra Vs Cal Cobra What S The Relationship And What S The Difference Susan Polk Insurance Agency Inc San Luis Obispo California

Cobra Vs Cal Cobra What S The Relationship And What S The Difference Susan Polk Insurance Agency Inc San Luis Obispo California

Https Www Coveredca Com Pdfs Forsmallbusiness Cc Cobra Rights Pdf

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Https Www Infinisource Com Assets Media 7305 Cdi 20on 20cal Cobra Pdf

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Https Www Calpers Ca Gov Docs Initial Cobra Notice Pdf

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Https Www Seyfarth Com Dir Docs News Item Fc4f720f C5d6 481c 97a1 Fdeb1530af74 Documentupload Pdf

Ppt Outline Of Topics Powerpoint Presentation Free Download Id 679087

Ppt Outline Of Topics Powerpoint Presentation Free Download Id 679087

Ppt Outline Of Topics Powerpoint Presentation Free Download Id 679087

Ppt Outline Of Topics Powerpoint Presentation Free Download Id 679087

Cal Cobra Shrm Whitepaper Knowledge Base

Cal Cobra Shrm Whitepaper Knowledge Base

Comments

Post a Comment