Featured

Covered Ca Income Change

Keep in mind that Tax deductions can lower your income level and. Click the Edit button next to the section that you want to change like contact information or household income.

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

It doesnt matter that your income was lower when you were covered under the individual market plan.

Covered ca income change. If your income is verified as eligible for premium assistance and then later you become Medi-Cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days. 2021 Products By Zip Code. My Medi-Cal has been discontinued and I am now able to enroll in Covered California during a Special Enrollment Period SEP how can I avoid a gap in my health coverage.

I dont know how to estimate my income for. Call Covered CA at 1-800-300-1506. Bronze Silver and Gold.

Attention Covered California members. As noted above excess premium subsidies for 2020 do not have to be repaid to the IRS regardless of why a households income. The Golden State is getting a pleasant surprise in 2021.

If you have health insurance through Covered California you must report changes within 30 days. Have a change in income. New savings are finally here.

Call your insurance agent for free assistance. 2021 Covered California Data. Covered California rates are going up 06 on average and the plan benefits are not changing very much.

It is your responsibility to report this change to Covered California. Have a child adopt a child or place a child for adoption. Get Your Estimate Apply.

Covered Californias answer is Generally no. Consequently it is important to report the income change. Add any foreign income Social Security benefits and interest that are tax-exempt.

Get married or divorced. If someones Medi-Cal coverage is cancelled due to increased income or decreased household size does that person qualify for special enrollment into Covered California. You can report your changes to Covered CA in one of the three ways below.

The American Rescue Plan is making new money available to millions of Californians. You may be eligible to receive additional financial help. 2021 Open Enrollment Net Plan Selection Profile xlsx 2021 Open Enrollment Gross Plan Selection Profile xlsx 2020 Covered California Data.

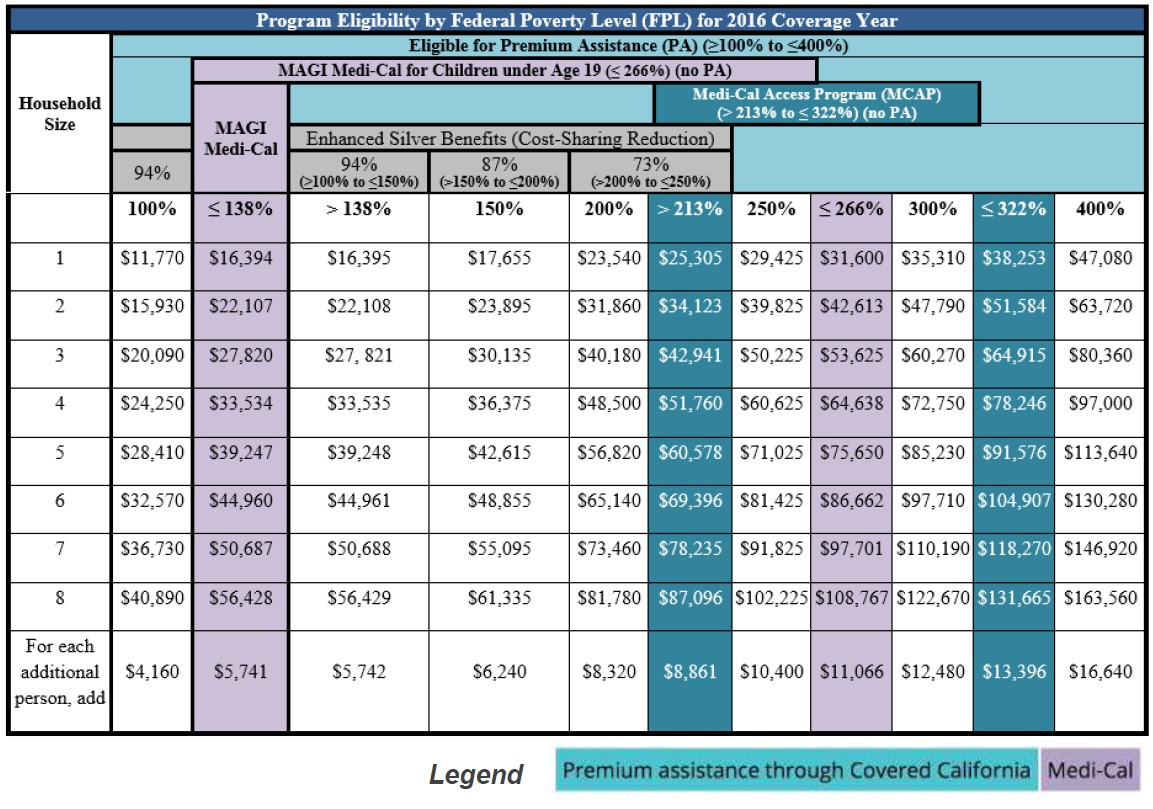

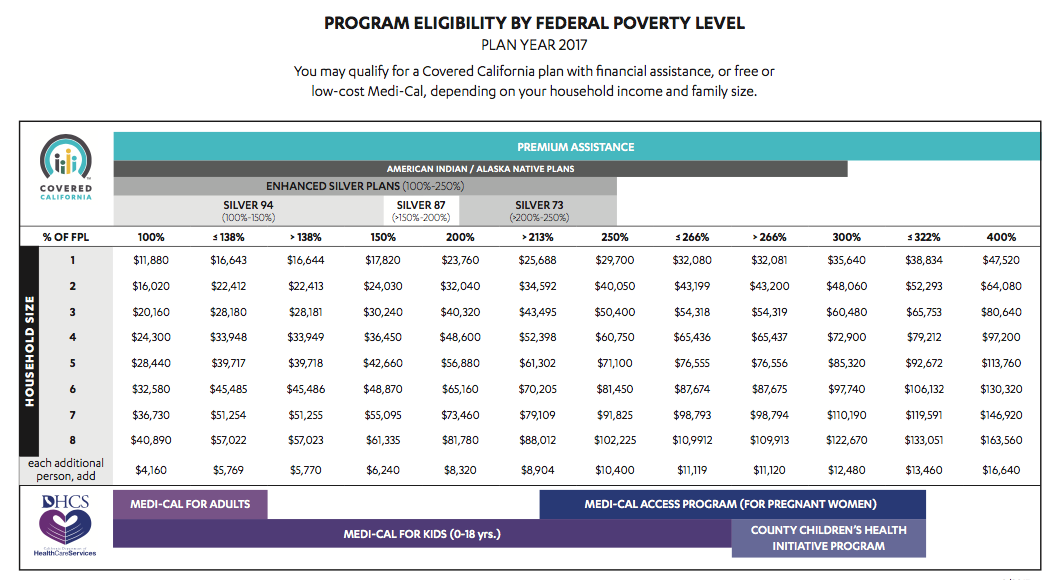

The income thresholds to qualify for the additional help from the state are 74940 for an individual 101460 for a couple and 154500 for a family of four. Then add or subtract any income changes you expect in the next year. In the eyes of the IRS annual income is annual income it can be evenly distributed throughout the year or come in the form of a windfall on December 31.

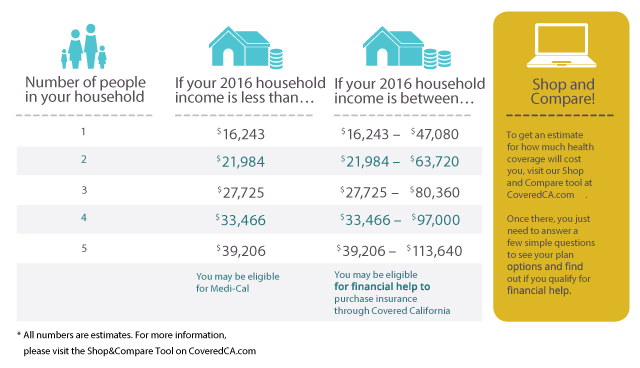

You may be eligible for more financial help to lower the cost of your health insurance. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. If your income has recently changed report it to Covered California.

You must report a change if you. Covered CA Plan Benefit Changes for 2021. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget.

Minor Benefit Changes on Bronze Silver Gold and Silver 87. To qualify the coverage must be. If youve recently had a change in income report it to Covered California.

You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040. Covered California is the states health insurance marketplace where Californians can find affordable high-quality insurance from top insurance companies. In order to be eligible for assistance through Covered California you must meet an income requirement.

Can anyone get Covered California. You are required to report a change to Covered California within 30 days if your income changes enough to impact your assistance. If your income has recently changed report it to Covered California.

If you are uncertain about your income figures it is suggested you contact your CPA or tax preparer to receive advice on how to report your most accurate income. Depending on their income. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs.

If you make 601 of the FPL you will be ineligible for any subsidies. 2021 Individual Product Prices for all Health Insurance Companies - UPDATED 9302020. Get health coverage through a.

Changes in income must be reported to Covered CA within 30 days. See how much youll save even if youve checked before because things have changed a lot. AB 174 State Subsidy Report March 2020.

This way you can be switched to the appropriate program.

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2021 Covered California Renewal And Open Enrollment Changes

Covered California Coveredca Twitter

Covered California Coveredca Twitter

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

Covered California Income Change Triggers New Health Plan Selection

Covered California Income Change Triggers New Health Plan Selection

How To Report A Change Covered California Youtube

How To Report A Change Covered California Youtube

Covered California Income Change Triggers New Health Plan Selection

Covered California Income Change Triggers New Health Plan Selection

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Reporting Changes Yourself Health For California Insurance Center

Reporting Changes Yourself Health For California Insurance Center

How Do I Know If I Qualify For Covered California Or Medi Cal

How Do I Know If I Qualify For Covered California Or Medi Cal

Comments

Post a Comment