Featured

- Get link

- X

- Other Apps

Are All Medicare F Plans The Same

Medicaregov - How to compare Medigap policies. Medicare will however pay for one pair of very basic eyeglasses after a cataract surgery.

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

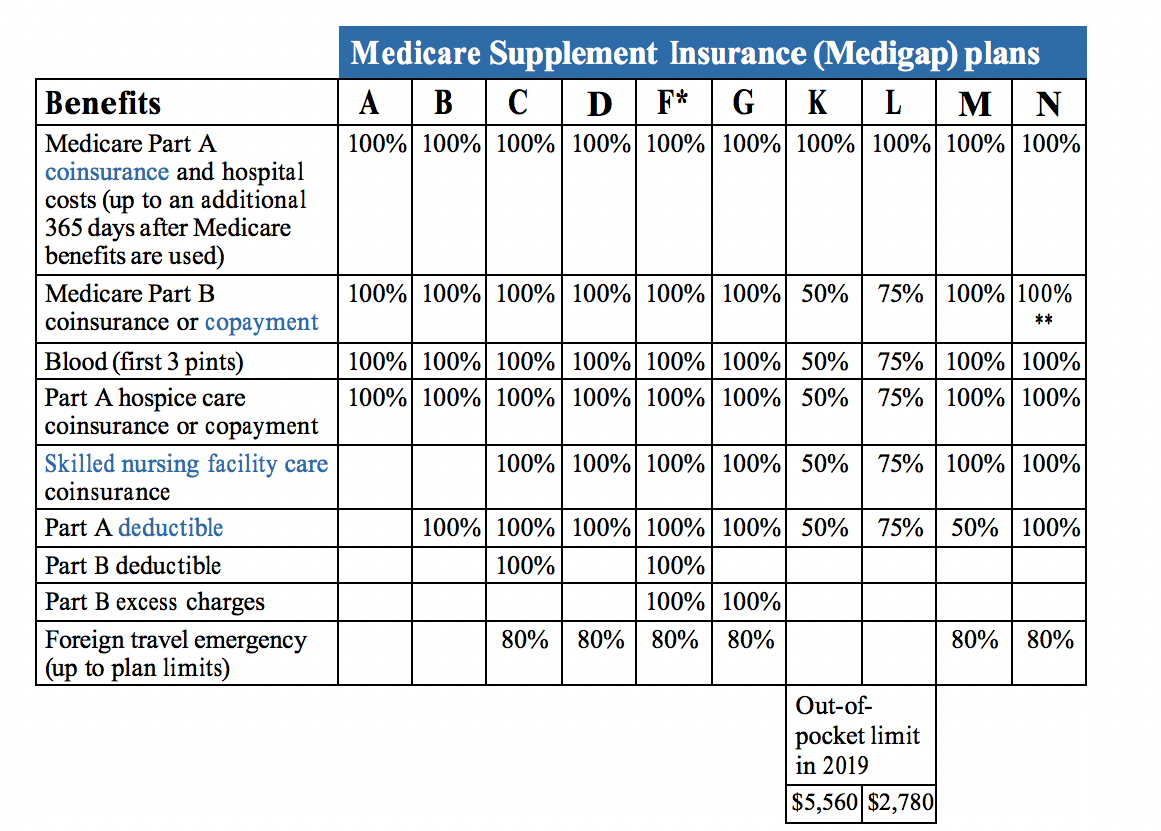

Each of the 10 Medigap plans is identified by a letter.

Are all medicare f plans the same. Yes they are all the same because Medicare Supplements Are Now Standardized. Every Medigap plan has the same defined benefits - you will not get one that pays 100 anymore cant buy Plan F or C anymore but Plan G is the closest - look at the chart. Each Medigap plan must offer the same benefits as all other plans with the same letter though plan premiums may be different.

This means you should be comparing the Medicare Plan F cost between insurance companies annually and looking for the cheapest Medigap Plan F. Protect the best years ahead. Shop 2020 Medicare plans.

However keep in mind that even though basic benefits are the. A B C D F G K L M and N. This means that regardless of where you live or which insurance company you purchase from youll get the exact same basic benefits for a Plan F sold anywhere in your state note that there is also a high-deductible version of Plan F discussed below.

Anzeige Find your best rate from over 4700 Medicare plans nationwide. The answer is no if the matter is routine. Medicare Part B covers doctors visits and other outpatient medical services.

Shop 2020 Medicare plans. Medicare Part F is a comprehensive plan that fills in many missing benefits of Plans A B. Plan F basic benefits like other Medigap plans are standardized in most states.

Medicare Part F Benefits Outline of Coverage. One exception is that Medicare supplement Plan F will cover up to 50000 in foreign travel emergency benefits. Of the ten Medicare Supplement plans Medicare Supplement Plan F offers the most comprehensive coverage which is why many people prefer it.

Is Medicare Plan F still available. Thus Plan F is the same across all carriers although the monthly premiums will vary for individuals. Still you may have choices in Medicare Supplement insurance plans.

Anzeige Find your best rate from over 4700 Medicare plans nationwide. Medicare Supplement Insurance Plan F is standardized by the federal government. 11 Zeilen In Arizona the same plan ranges from 5375 to 1418 a 279 percent difference.

What Benefits Does Medicare Supplement Plan F Cover. This means that the 9 basic benefits of Plan F will be the same no matter where you live or what Medicare Supplement Insurance company you buy it from. You may have also heard of something called Medicare Supplement Plan F.

Look to a Medicare insurance broker in your area - they can help you with specific companies -. Since this care occurs outside the US Medicare obviously does not cover that. All Plan A out-of-pocket costs are covered under the extensive Plan F.

Experts have calculated that in 2014 an estimated 56 of beneficiaries had Medicare Plan F coverage. Obviously if you werent eligible for Medicare prior to January 1 2020 Medicare Supplement Plan F wont be a plan option. The good news is that benefits for Plan F with one Medigap company will be exactly the same as benefits with a Plan F from a different company.

If you choose Plan F youll essentially only pay your monthly premium and have no out-of-pocket costs for your covered medical expenses. Medicare has several options or parts you can enroll in to obtain health insurance coverage. Are all Medicare Supplement Plan F plans the same.

Make the best coverage decision for yourself. Plan F is still available to beneficiaries who were Medicare-eligible prior to the plan. Unlike some of the other Medicare Supplement plans Part F eliminates all out-of-pocket costs associated with a doctor and medical services covered under B.

Private companies that Medicare approve offer Medigap plans. Across providers plans with the same. Protect the best years ahead.

Starting in 1992 the federal government came out with 11 plans labeled A through L each with their own distinct coverage level and associated benefits. However eligibility rules changed in.

Is Medicare Plan F Going Away What You Need To Know Everyday Health

Is Medicare Plan F Going Away What You Need To Know Everyday Health

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Compare Plans Empower Medicare Supplements

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan F Call 1 844 752 7256 Ads Lifestyle

Medicare Supplement Plan F Call 1 844 752 7256 Ads Lifestyle

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

Medigap Plans F G N Going Away Medicare Plan Saver

Medigap Plans F G N Going Away Medicare Plan Saver

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Saving Money By Comparing Medicare Supplement Insurance Plans

Saving Money By Comparing Medicare Supplement Insurance Plans

Comments

Post a Comment