Featured

How Much Is Truvada With Insurance

Those payments will disappear when the task. Prices are for cash paying customers only and are not valid with insurance plans.

Bay Area Reporter Generic Truvada Now Available

Most private insurance will be required to cover drugs like Truvada that offer protection against HIV infection without making plan members share the cost.

How much is truvada with insurance. A generic version of. For many people who need it most Truvada is too expensive. GoodRx lists the following estimated price ranges for this medication.

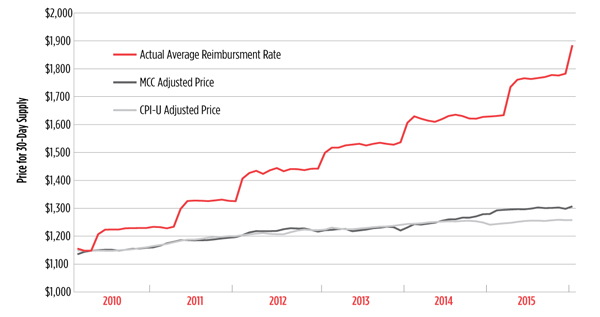

Most health insurance plans will cover PrEP when prescribed by a licensed healthcare provider. To more than 20000 over the past 15 years. With a monthly price tag approaching 2000 many private health plans have put the drug in a specialty drug tier with high copayments or coinsurance.

How much Truvada costs is based on several factors. Truth is if you have insurance monthly copays for Truvada typically run between 10 and 50 depending on the plan though some people may pay a percentage of the actual pharmacy price. Truvada is expensive it costs about 1300 per month but it is covered under most insurance plans and the drugs manufacturer offers payment assistance Without insurance PrEP costs about 1300.

In the Post-Donut Hole also called Catastrophic Coverage stage Medicare will cover most of your drug costs. If an individual has a standalone PDP PrEP medications in general not just Truvada have an average annual cost of between 2276 and 2430 according to the American Journal of Public Health. In May pharmaceutical giant Gilead Sciences reached an agreement with the Trump administration to donate its PrEP medication Truvada for up to 200000 uninsured people a year until 2025.

Costs around 1600 a. The cost for Truvada oral tablet 100 mg-150 mg is around 1933 for a supply of 30 tablets depending on the pharmacy you visit. Uninsured patients have several payment assistance programs available but might have to pay for lab testing.

Gilead the manufacturer of Truvada for PrEP offers the Gilead Copay Card to reduce the cost of PrEP to 0 per prescription for commercially insured patients. Most insurance companies cover all or part of the treatment. If you havent yet met your drug.

Experts say that out-of-pocket expense is preventing a lot of people from taking the PrEP treatment to prevent HIV infection. Truvada costs around 2000 for a one-month supply. Based on your insurance carrier and medication tier the cost of Truvada will vary.

Studies have shown that Truvada can reduce the risk for HIV by up to 99 if taken correctly. In 2016 the Donut Hole begins once youve spent 3310 in one year. Exactly how much you pay for Truvada depends on your Medicare Advantage or Part D plan.

In the Donut Hole also called the Coverage Gap stage youll pay more for your prescriptions. Does Insurance Cover Truvada. Although researchers are still evaluating other dosing schedules PrEP if most effective if you take it every day.

You should always check with your insurance company to find out if they cover the medication and what the co-pay cost will be. How Much Does Truvada Cost with Insurance. How much does Truvada cost.

Truvadas annual list price has nearly tripled in the US. People who dont have health insurance or whose. Unfortunately Truvada is expensivethe cash price for a 30-day supply is about 2000 and continues to climb.

Many Health Plans Now Must Cover Full. It can cost less than 100 per year elsewhere. These can include your prescribed treatment regimen the insurance plan you have the pharmacy you use and your location.

Without insurance the HIV antiretroviral drug Truvada the only medication approved for pre-exposure prophylaxis PrEP in the US. Truvada costs 2000 a month. Out-of-pocket costs for Truvada up to 7200 per year.

Thats not an uncommon circumstance. It doesnt cover the costs of doctor visits or lab tests.

Resources For Covering The Costs Of Prep And Pep Pleaseprepme

Resources For Covering The Costs Of Prep And Pep Pleaseprepme

How Much Does Prep Cost Prep Daily

How Much Does Prep Cost Prep Daily

Gilead Will Donate Truvada To U S For H I V Prevention The New York Times

Gilead Will Donate Truvada To U S For H I V Prevention The New York Times

Does Medicare Provide Cover For Truvada Benefits Costs And More

Does Medicare Provide Cover For Truvada Benefits Costs And More

Truvada Is Available For Free Here S How You Can Get It Pbs Newshour

Truvada Is Available For Free Here S How You Can Get It Pbs Newshour

Truvada For Hiv Prep Prescription Fills Drop 30 Since 2015 Goodrx

Truvada For Hiv Prep Prescription Fills Drop 30 Since 2015 Goodrx

Truvada Drug Cost And Hiv Prep Treatment

Truvada Drug Cost And Hiv Prep Treatment

8 Things You Didn T Know About Truvada Pbs Newshour Weekend

8 Things You Didn T Know About Truvada Pbs Newshour Weekend

Examining The Truvada Breakthepatent Debate Gilead Responds

Examining The Truvada Breakthepatent Debate Gilead Responds

How Much Does Prep Cost Prep Daily

How Much Does Prep Cost Prep Daily

How Much Does Truvada Cost Or When Your Peo Insurance Goes Sideways Clear Health Costs

How Much Does Truvada Cost Or When Your Peo Insurance Goes Sideways Clear Health Costs

Prep For Hiv Prevention Costs And Coverage Not The Only Barriers Healthcity Bmc

Prep For Hiv Prevention Costs And Coverage Not The Only Barriers Healthcity Bmc

Prep Pricing Problems Treatment Action Group

Prep Pricing Problems Treatment Action Group

Comments

Post a Comment