Featured

- Get link

- X

- Other Apps

Covered California Income Guidelines 2020

Ad Insure Your Salary Against Illness Or Injury. These companies meet all the state and federal requirements for health plans plus additional standards set by Covered California.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

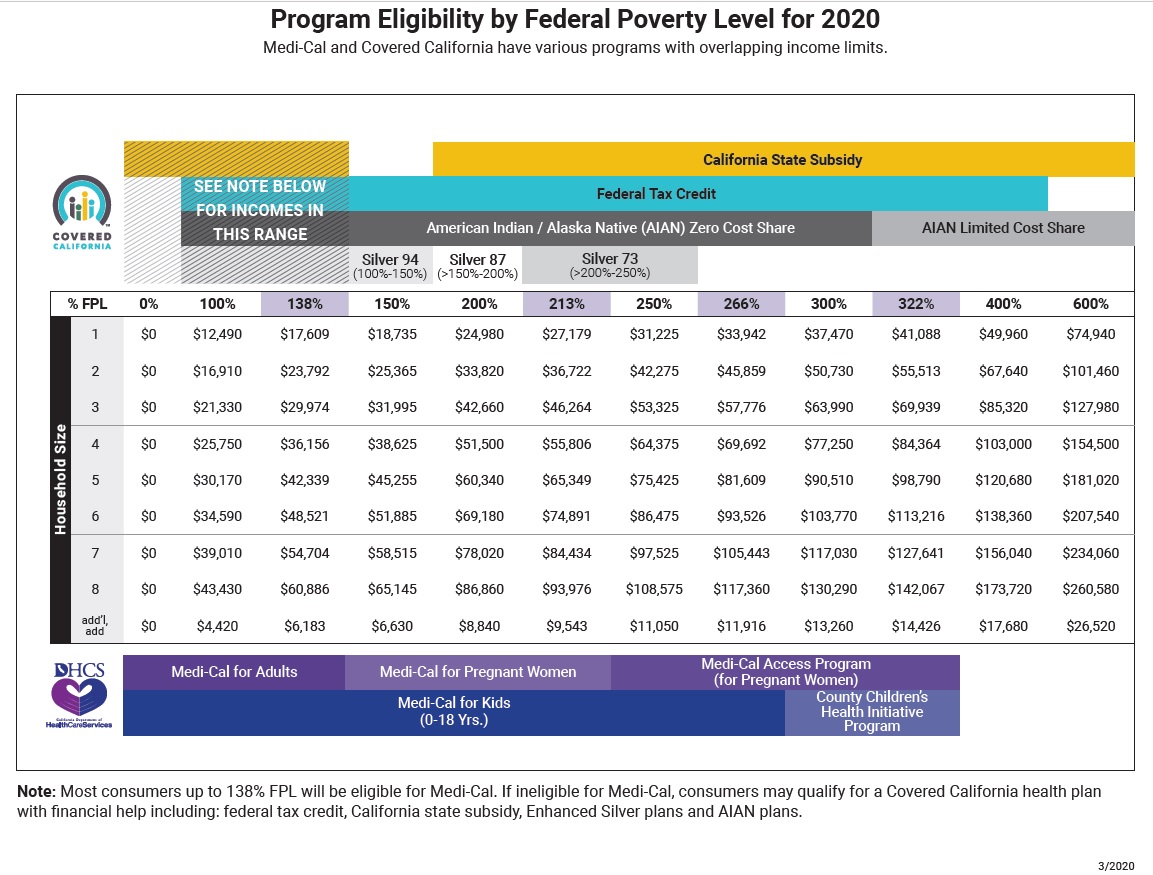

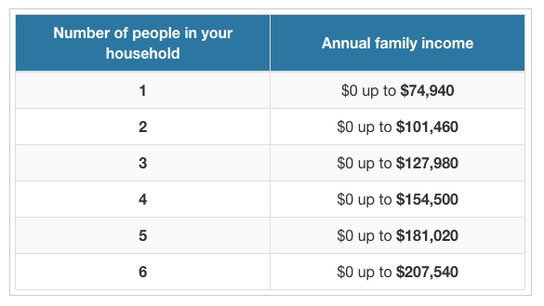

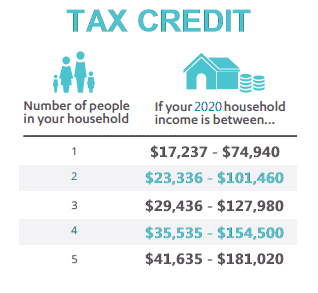

In 2020 that number will be 49460 for an individual 67640 for a couple and 103000 for a family of four.

Covered california income guidelines 2020. An estimated 23000 Covered California enrollees whose annual household income falls below 138 percent of the federal poverty level FPL which is less than 17237 for an individual and35535 for a family of four. Can anyone get Covered California. Previously those who made above 400 of the federal poverty line FPL were not eligible for premium tax credits.

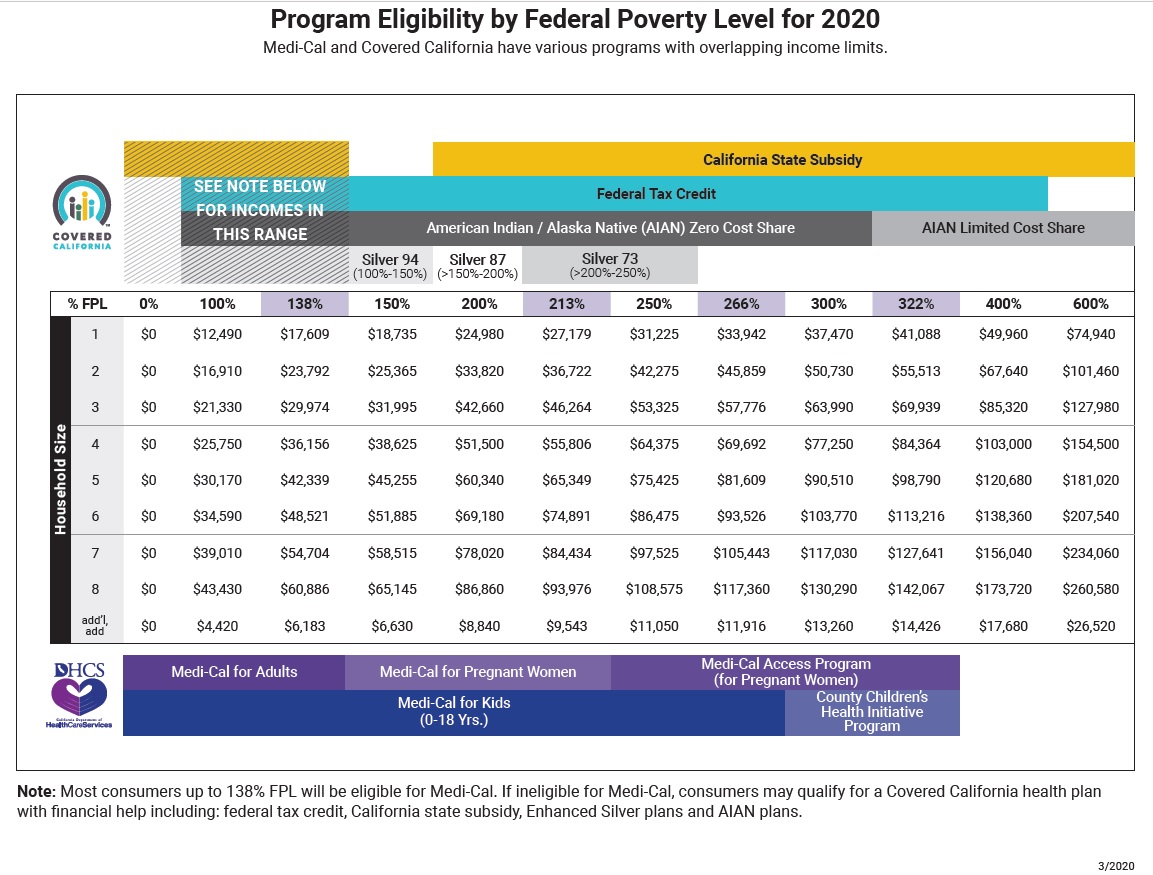

If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. How to Estimate Your Income. You can start by using your adjusted.

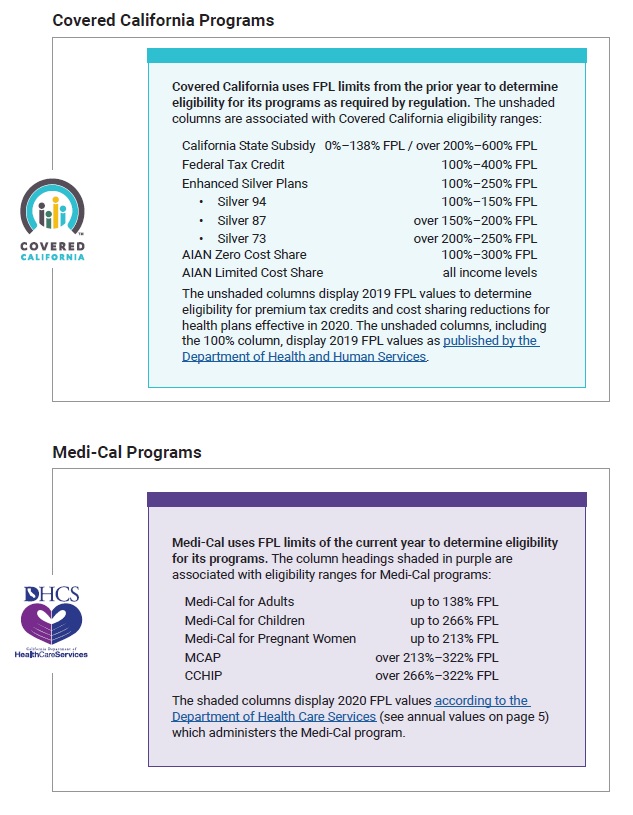

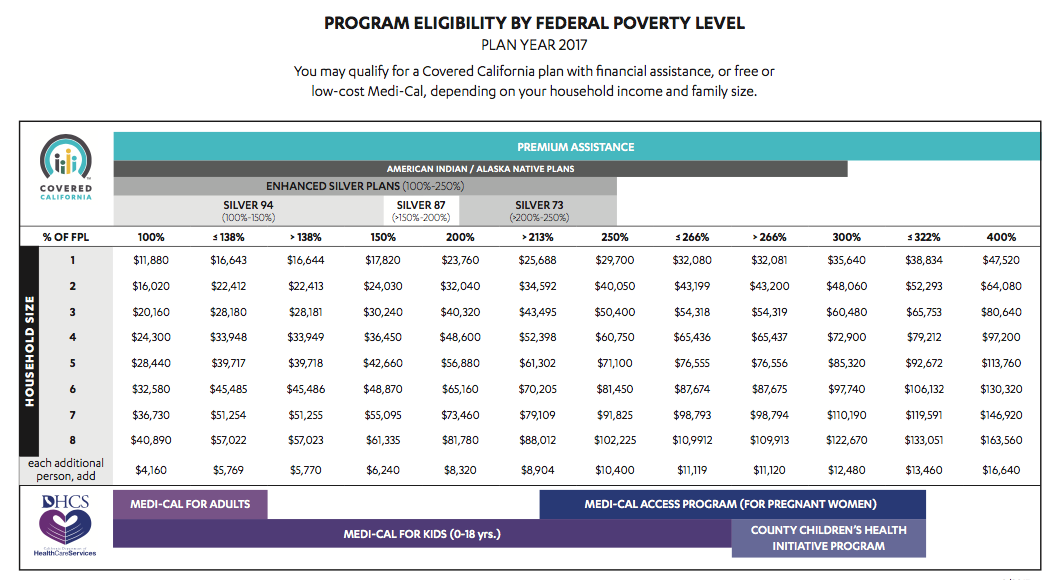

Federal tax credit California state subsidy Enhanced Silver plans and AIAN plans. Medi-Cal and Covered California have various programs with overlapping income limits. Varied Adaptable Cover To Suit You Your Familys Requirements.

Covered California Programs Medi-Cal Programs Percentage of income paid for premiums based on household FPL Based on second-lowest-cost Silver plan Household FPL Percentage Percent of Income 0-150 FPL 0 household income 150-200 FPL 0-2 household income. Effective July 1 2020 through June 30 2021 participants from households with incomes at or below the following levels may be eligible for free or reduced-price meals or free milk. Twice Per Month annual income divided by 24.

2020 State Income Limits Briefing Materials California Code of Regulations Title 25 Section 6932. You could even qualify for low-cost or free health coverage through Medi-Cal. Varied Adaptable Cover To Suit You Your Familys Requirements.

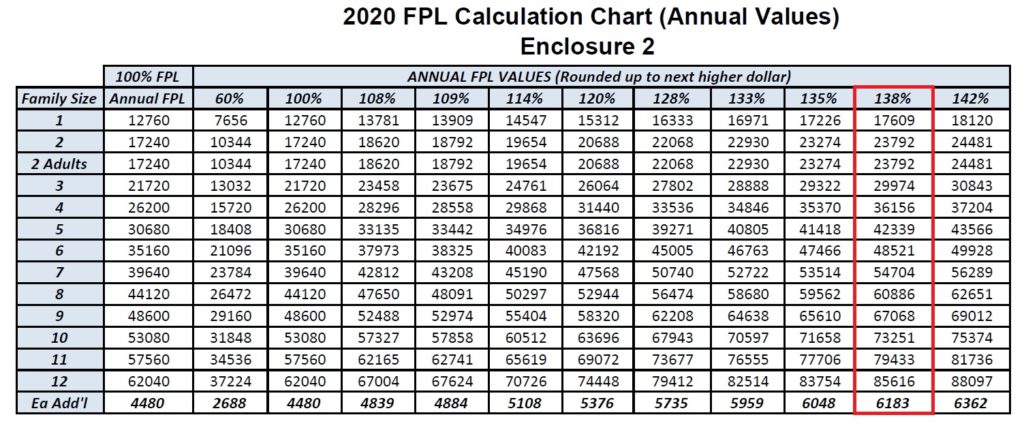

Most consumers up to 138 FPL will be eligible for Medi-Cal. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. The 100 column display 2020 FPL values as published by the Department of Health and Human Services.

PROGRAM DESIGN DOCUMENT PROPOSED AMENDMENT 1 Page 2 of 5 November 21 2019 2 Meets all eligibility requirements of the federal advance premium tax credit authorized under Section 36B of the Internal Revenue Code and its implementing regulations except that the income requirements of that section shall not apply to. If you make 601 of the FPL you will be ineligible for any subsidies. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

Protect Your Financial Stability. Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. Its the only place where you can get financial help when you buy.

Covered California Health Plans. Ad Insure Your Salary Against Illness Or Injury. The state of California will.

In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. Keyboard_arrow_right Coming Soon see all. Ninety percent of people who have signed up with Covered California get financial help and you could be one of them.

The state of California is making new financial help available to almost a million Californians many for the first time. The tax subsidy program serves to help lower the cost of health insurance for low and middle-income Californians. Protect Your Financial Stability.

1 80 percent of MFI or 2 80 percent of state non-metropolitan median family income. The new income calculations are based on annual figures and the following formulas. May 21 2020 2 Meets all eligibility requirements of the federal advance premium tax credit authorized under Section 36B of the Internal Revenue Code and its implementing regulations except that the income requirements of that section shall not apply to an applicable return filer whose household income is above 400 percent and at or.

Monthly annual income divided by 12. However due to adjustments that. The subsidies are for individual Californians who earn.

In 2020 those who make between 400 to 600 of the FPL are eligible for subsidies. In order to be eligible for assistance through Covered California you must meet an income requirement. Covered California Annual Report and FY 2020-21 Budget for Board Approval Draft Version as of May 29 2020 less than 138 percent of the Federal Poverty Level as well as those whose earn.

California also will offer new subsidies in 2020 aimed at making health coverage more affordable for middle-income individuals and families. Youll need it when you file your 2020 taxes. In general most low-income limits represent the higher level of.

Visit their websites for up-to-date COVID-19 information.

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Covered California 2020 Open Enrollment Official Website Assemblymember Richard Bloom Representing The 50th California Assembly District

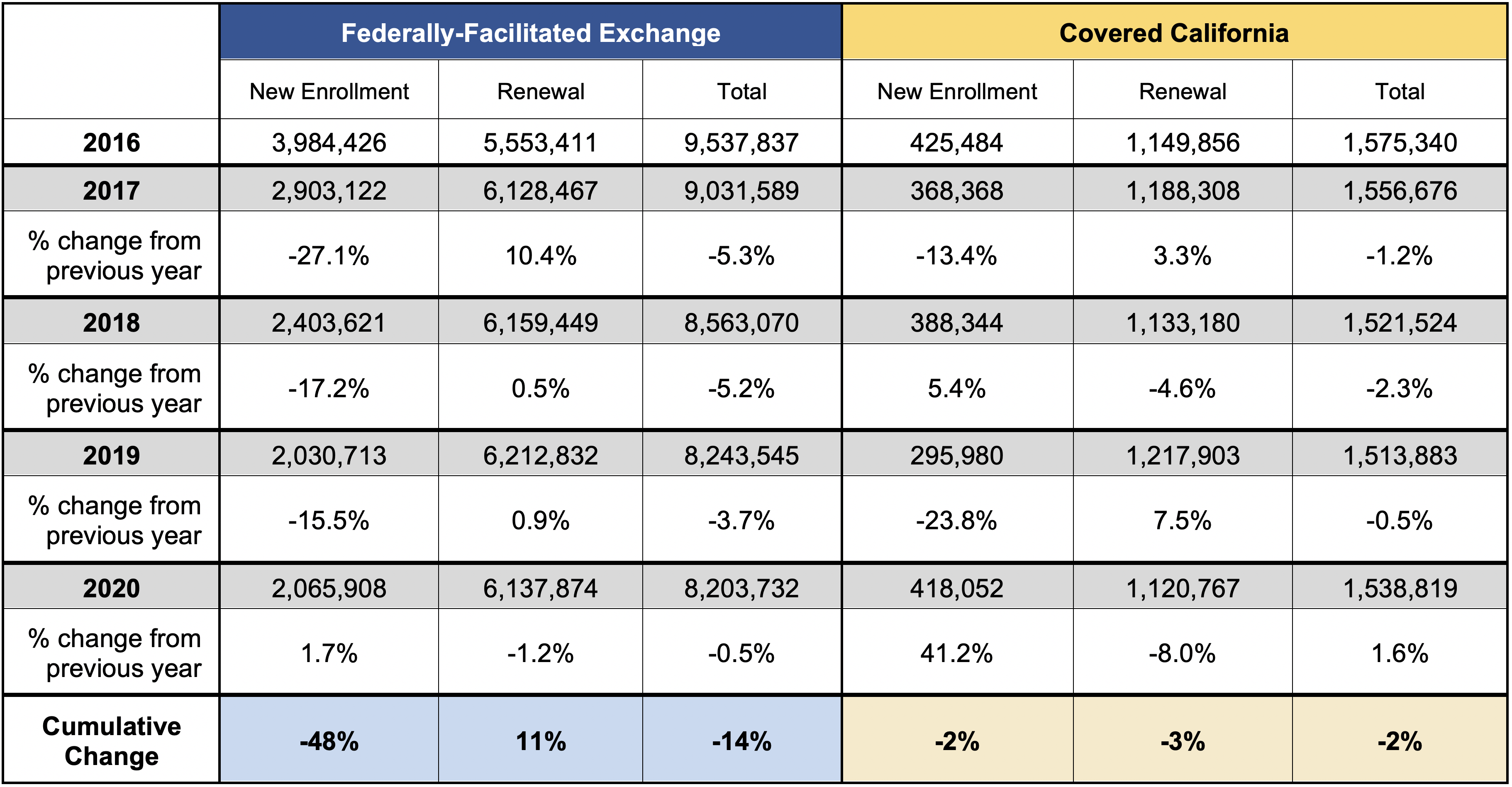

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Covered California Income Limits Explained

Covered California Income Limits Explained

Covered California Q A Covered California Archives

Covered California Q A Covered California Archives

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

How Do I Know If I Qualify For Covered California Or Medi Cal

How Do I Know If I Qualify For Covered California Or Medi Cal

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Covered California Health Insurance Income Guidelines

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Https Hbex Coveredca Com Toolkit Webinars Briefings Downloads Fpl Webinar Slides Final Pdf

Comments

Post a Comment