Featured

How Much Does Plan F Medicare Cost

With this plan youll owe an annual deductible of 2370 before Medigap pays out but the monthly premiums are. Advertentie Find affordable quality Medicare insurance plans that meet your needs.

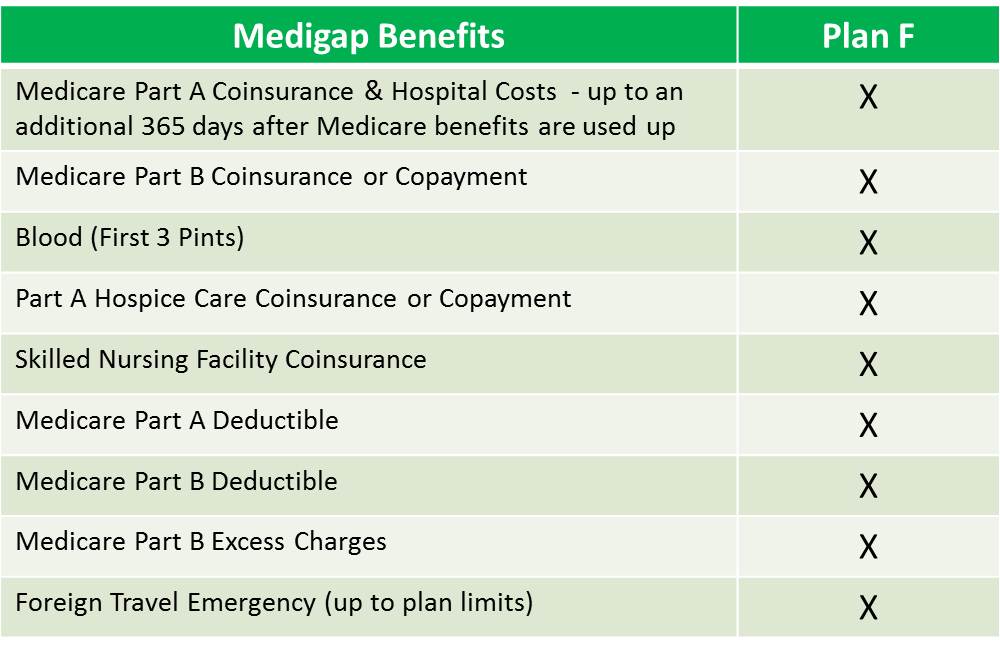

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Plan F cost varies by several factors.

How much does plan f medicare cost. While monthly premiums for this option may be lower you must pay a deductible. In many areas we find pricing around 130 to 140 a month for a female turning 65 but its always important to get quotes for Medicare Plan F cost in your area. Part A hospital inpatient deductible and coinsurance.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. Find your best rate from over 4700 Medicare plans nationwide. Once the annual deductible is met the plan pays 100 of covered services for the rest of the year.

Advertentie Find affordable quality Medicare insurance plans that meet your needs. 1 Plans F and G offer high-deductible plans that each have an annual deductible of 2370 in 2021. One of the few aspects that this Medigap plan does not cover is an out-of-pocket limit.

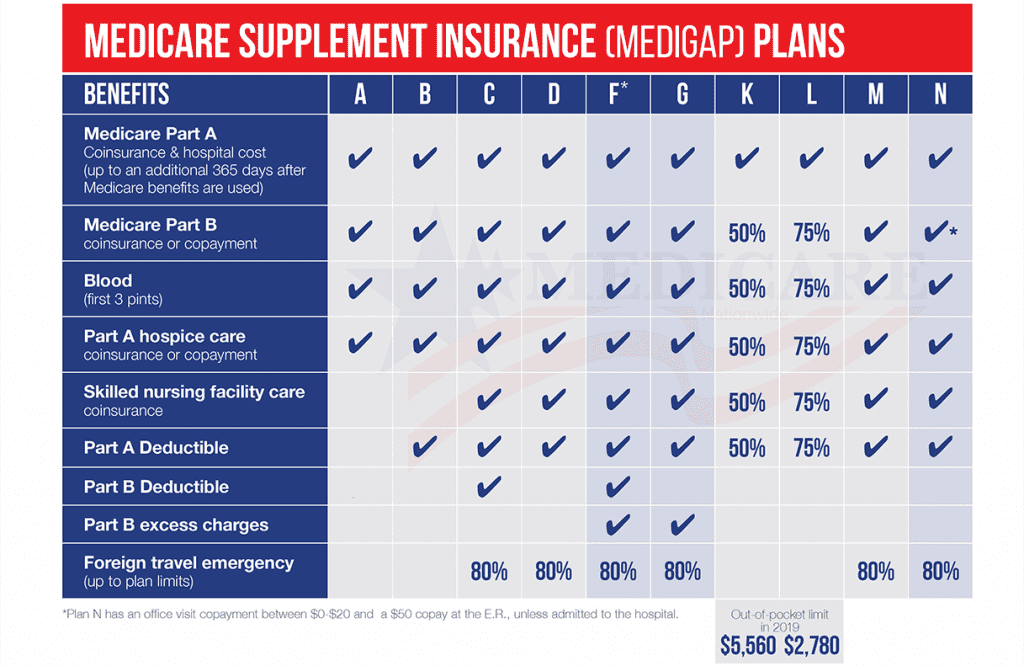

The Difference Between Plan F Extra and Medicare Advantage Ancillary Benefits. Plan F is often compared with Plan G and Plan N. The average cost of Innovative Plan F is around 130-230 per month.

Medigap Plan F also includes a high-deductible option available in many areas. Medigap Plan F used to be the most popular Medicare Supplement plan. Find your best rate from over 4700 Medicare plans nationwide.

Costs for Medicare Plan F vary by area gender zip code and tobacco status. Now Plan F does not cover this cost completely but it does offer you as much coverage as any Supplement plan can and will provide. Walt Medicare supplement Plan F does not offer any benefit for gym membership.

Medicare Supplement Plan F covers up to 80 of the health care expenses incurred abroad. - Free Quote - Fast Secure - 5 Star Service - Top Providers. In comparison with other Medigap plans Medigap Plan F is one of the most comprehensive in terms of coverage.

Since gym memberships are not part of original Medicare Plan F will not be of any help. It covers you for up to 80 for each time you need to be transported to a foreign medical facility and that can go along way toward making your medical expenses more affordable. Advertentie Compare Top Expat Health Insurance In Netherlands.

Innovative Plan F is equal in comparison. Plan F options have always been the most expensive Medigap plan with the most coverage. Get the Best Quote and Save 30 Today.

With Plan F you need to pay just 20 of the healthcare expenses when out of the country. 1484 deductible for each benefit period. Get the Best Quote and Save 30 Today.

It is the most comprehensive plan out there. 21 rijen The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F. If you paid Medicare taxes for less than 30 quarters the standard Part A premium is 471.

52 rijen But how much does Medicare Supplement Insurance Plan F cost. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1 2020. You must have turned 65 before 2020 to purchase Plan F.

Advertentie Compare Top Expat Health Insurance In Netherlands. It should be noted that Original Medicare does not offer coverage for these costs. The price for Plan F starts around 150 but can go as high as 300 for those who are older.

12 rijen The average premium for Medicare Supplement Insurance Plan F in 2018 was 16914 per month or. Plan F is a Medigap policy and is designed to cover your share of Medicare covered expenses such as hospital deductible and the 20 coinsurance for outpatient services. High-deductible plan F Plan F also has a high deductible option.

If you paid Medicare taxes for 30-39 quarters the standard Part A premium is 259.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Cost Of Supplemental Health Insurance For Seniors

Cost Of Supplemental Health Insurance For Seniors

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement Plans Ohio Ohio Medigap Plans

Medicare Supplement Plans Ohio Ohio Medigap Plans

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

High Deductible Plan F High Deductible Medigap Plan Medicarefaq

What Is The Average Cost Of Medicare Supplement Insurance In Decatur Il

What Is The Average Cost Of Medicare Supplement Insurance In Decatur Il

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Plan F Vs Plan N What Most People Don T Know Clear Medicare Solutions

Comments

Post a Comment