Featured

- Get link

- X

- Other Apps

Small Business Tax California

Governor Newsom signs 62 billion tax cut for small businesses visits local shops with Danny Trejo California small businesses are drivers of economic growth creating two-thirds of new jobs and employing nearly half of all private sector employees. Helpful contact information within our department or other agencies.

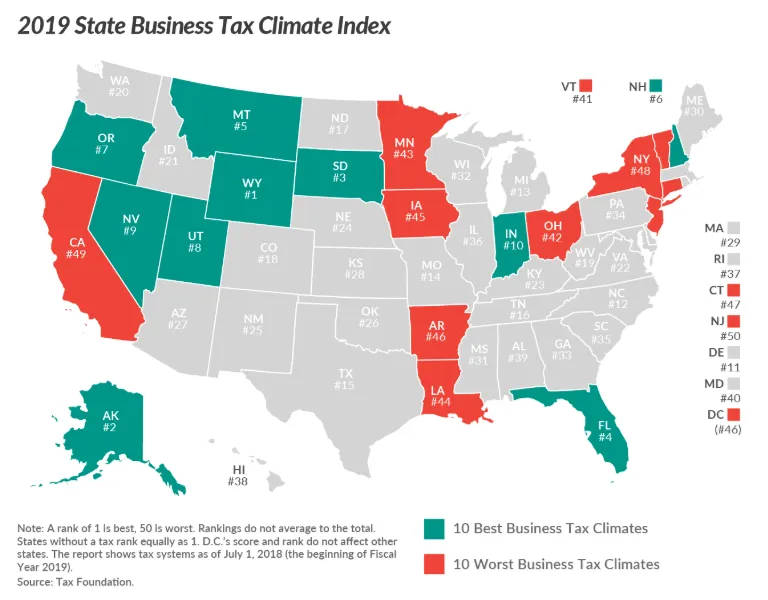

California Ranked Among The Worst For Small Business Soper Wheeler Company Soper Wheeler Company

Our Small Business Liaison helps small businesses with.

/shutterstock_226534159-5bfc361d46e0fb00517de65f.jpg)

Small business tax california. There is a California state tax on business income for corporations and LLCs that elect to be treated as corporations. People interested in starting a business in California. The Section 179 deduction allows business owners to deduct up to 1040000 of property placed in service during the tax year.

If your business collects between 10000 and 120000 in sales tax per month. 14 rader Small Business Relief Payment Plans for Sales and Use Tax. Small businesses can elect to expense assets that cost less than 2500 per item in the year they are purchased.

If your business collects less than 10000 in sales tax per month then your business should file returns on an annual basis. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World Wide Web. Assistance in Running your Business.

Contact the Small Business Liaison Email FTBSmallBusinessLiaisonftbcagov. 147 million for the Main Street Small Business Tax Credit to assist small businesses that have hired and retained workers since the second quarter of 2020. For low-margin retailers a tax bill amounting to roughly 10 of their California revenue plus interest and.

Tax Credits Deductions Taxable Income. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. Net taxable income from business activity in California is subject to this rate.

Need help with business taxes. Gavin Newsom announced an expansion to the states COVID-19 Small Business Relief Grant program and more than 6 billion in tax cuts for small businesses. 95 million to jumpstart Californias tourism industry one of the largest economic drivers in the state that was particularly impacted by the pandemic.

30 percent of corporate taxes are due by April 15 40 percent by June 15 and the remaining 30 percent by Dec. The federal corporate income tax by contrast has a marginal bracketed corporate income taxCalifornias maximum marginal corporate income tax rate is the 9th highest in the United States ranking directly below Maines 8930. Do you run a small business in California.

Higher than the national average this rate is 884. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax which applies to all retail sales of goods and merchandise except those sales specifically exempted by law. California has a flat corporate income tax rate of 8840 of gross income.

The corporate tax rate in California is 884 percent and C corporations must pay their taxes in installments. You can read more about the de minimis safe harbor election in this IRS FAQ. Accounting Play has brought to you the California Small business Taxes chapter for basics and Tax layers info.

The sales tax borne by consumers thus becomes a gross receipts tax on businesses.

Small Business Tax Rate 2021 Guide For Business Owners

Small Business Tax Rate 2021 Guide For Business Owners

/shutterstock_226534159-5bfc361d46e0fb00517de65f.jpg) Taxes In California For Small Business The Basics

Taxes In California For Small Business The Basics

State Corporate Income Tax Rates And Brackets For 2020

State Corporate Income Tax Rates And Brackets For 2020

Applications Open For Small Business Hiring Tax Credit Advocacy California Chamber Of Commerce

Applications Open For Small Business Hiring Tax Credit Advocacy California Chamber Of Commerce

California Sales Tax Small Business Guide How To Start An Llc

California Sales Tax Small Business Guide How To Start An Llc

California Governor Extends Small Business Tax Deadlines

Tax Tips For Small Business Owners In California

Tax Tips For Small Business Owners In California

How To Deal With Small Business Taxes In California 1 800accountant

How To Deal With Small Business Taxes In California 1 800accountant

Gov Newsom Extends California Small Business Tax Deadlines Kpbs

Gov Newsom Extends California Small Business Tax Deadlines Kpbs

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

California Small Business Hiring Tax Credit

California Small Business Hiring Tax Credit

California Legislature Ok S Tax Break For Small Businesses

California Legislature Ok S Tax Break For Small Businesses

California Gives Small Businesses Tax Extension Amid Pandemic Kqed

California Gives Small Businesses Tax Extension Amid Pandemic Kqed

Comments

Post a Comment