Featured

- Get link

- X

- Other Apps

Medicare Supplement Plans California

Medicare Supplement insurance plans in California may offer added protection such as covering some of Medicares coverage gaps like deductibles copayments and coinsurance. Original Medicare and Medicare Supplements dont cover prescription drugs.

Cost Of Supplemental Health Insurance For Seniors

Cost Of Supplemental Health Insurance For Seniors

The Part B deductible is set by Medicare and can change but at this time it is 18300 per year.

Medicare supplement plans california. It starts the day you are both enrolled in Original Medicare and are age 65 or older. Finding the right California Medicare plan or supplement can be challenging. The Medicare Supplement Plan G is offers the exact same benefits of the Plan F except that you will pay the Part B deductible.

Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost. Average in-network out-of-pocket spending limit. Average drug deductible in 2021 weighted.

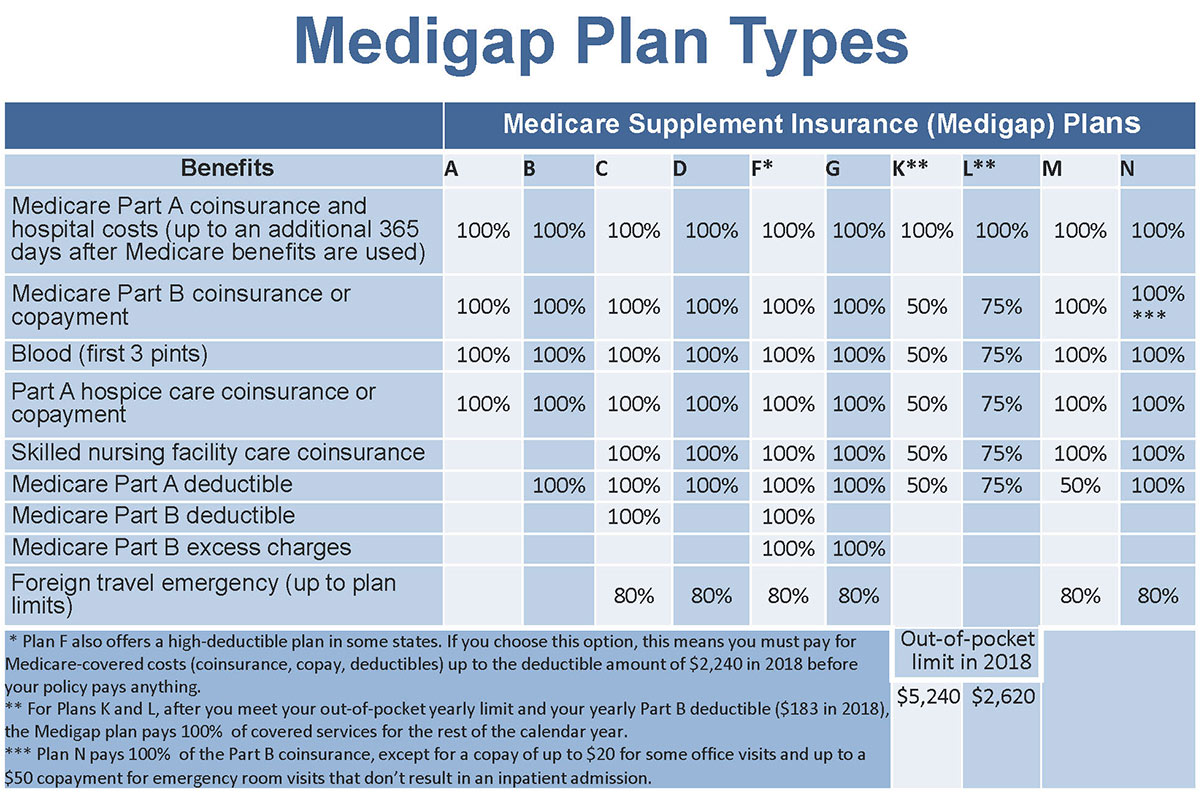

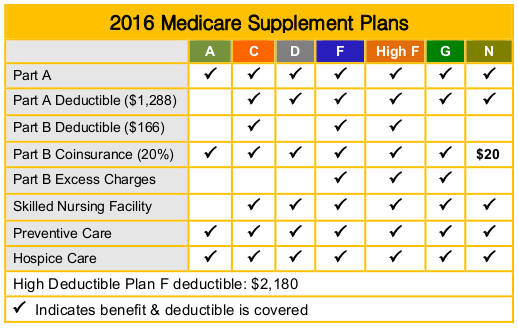

For example all Medicare Supplement plans cover Medicare Part A coinsurance and hospital costs up to additional 365 days after Medicare benefits are exhausted. Plan F covers every single gap in Medicare coverage and all seniors have to do to protect themselves is pay one affordable monthly premium. The below Medicare Advantage plans are rated 45 out of 5 stars in California.

In California in 2021. The best Medicare Supplemental plans in California are the ones you can comfortably pay for. Most Popular Medicare Supplement Plans in California Like many other states California residents prefer Medigap Plan F to all of the other available plans.

Alignment Health Plan Platinum HMO Aetna Medicare Choice Plan PPO Part D in California. Medicare Part A has 60 lifetime reserve days. On average seniors will pay about 150 for a Medicare Supplement plan.

Medicare Supplements is an online guide to choosing the best Medicare supplement plans in California. We dont charge anything for our services since all the Medicare Supplement Plans compensate us directly. However private insurers set the premiums which vary among plans and insurance companies.

We are always available by phone or email to help you with enrollment and plan. Average monthly premium cost in 2021 weighted. This represents a -1094 percent change in average premium.

The Medicare Supplement Plan California that offers the most coverage for the lowest premium is the Medigap Plan G. Want help staying healthy and active too. This represents a 1398 percent change in plan options.

Your Medigap OEP is one of the few times you qualify for guaranteed issue rights. The figure takes into account those who are. You can see any doctor who accepts Medicare without a referral while getting the extra coverage you need.

Medicare Supplement or Medigap plans in California are available through private insurance companies and theyre designed to help cover expenses incurred under Original Medicare Part A and Part B including copayments coinsurance and deductibles as well as other out-of-pocket costs. The reason for this is quite simple. Keep in mind that if you have Medicare Part C Medigap plans cant be used to pay for.

There are a number of Medicare Supplement Plans available to those with Basic Medicare. 424 Medicare Advantage plans are available in 2021 compared to 372 plans in 2020. The site offers all the latest updates from our Medicare expert as well as helps customers choose the best Medicare Supplement plans or Medigap plans in California.

Guide to Choosing the Best Medicare Supplement Plans in California Last updated Monday May 17 2021 1924 ET Source. We live right here in Southern California and work with nearly every supplement and plan in the state. Taking the time to compare quotes however can help you identify the health insurance plans you can afford.

Medicare Supplements Stay Up-to-date with Changes and New Information on Medigap Plans in California for 2021. About Medicare Supplements. A Medicare Supplement plan in California could help you pay Medicare out-of-pocket costs such as copayments coinsurance and deductibles.

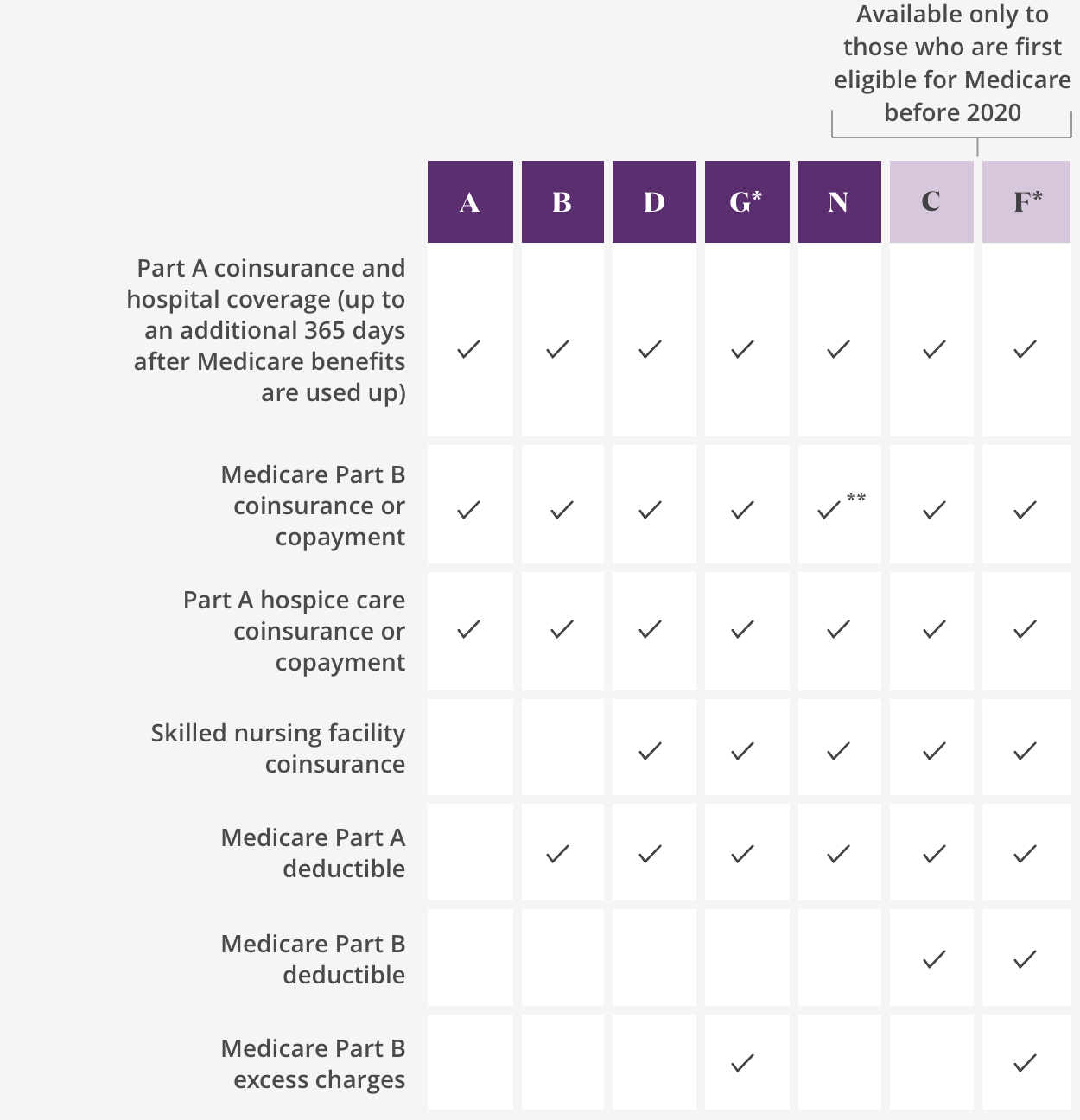

The average premium for California Medicare Advantage plans that include prescription drug coverage in 2021 is 20 per month. Each plan is labeled by letters A B C D E F G K L M and N. There are many resources on this website that will really help you make sense of Medicare in California and your options.

Medicare Supplement plans Medigap in California Medicare Supplement insurance with Anthem Blue Cross gives you great options in California. Benefits are standardized and labeled by letter for Medicare Supplement plans. The average monthly Medicare Advantage premium changed from 2239 in 2020 to 1994 in 2021.

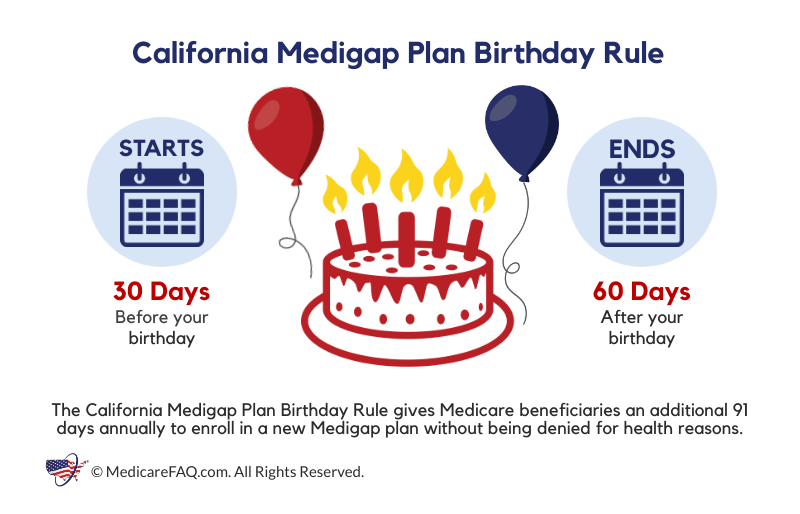

10 Zeilen Each Medicare supplement insurance policy sold in California offers the basic benefits of. Below is an explanation of the Medicare program. The best time to sign up for a Medicare Supplement plan in California is during your 6-month Medigap Open Enrollment Period OEP.

Palm Harbor FL United States 05172021 SubmitMyPR It is good news for Californian residents especially for those who are planning to enroll in Medigap Plans. Coverage will not work well for you if you cannot afford it. We help folks everyday to navigate the Medicare.

Some Medicare Advantage plans do but not all. The California Department of Insurance CDI regulates Medicare Supplement policies underwritten by licensed insurance companies. In California you have access to the same 10 standardized Medigap Plans that most states receive.

California Medicare Part D Medicare Advantage Medicare Supplements

California Medicare Supplemental Insurance Plans Rates

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Best Medicare Supplement Plans In California 2020 Ca Comparison Chart

Best Medicare Supplement Plans In California 2020 Ca Comparison Chart

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

California Medicare Supplement Insurance Aetna Medicare

California Medicare Supplement Insurance Aetna Medicare

Medigap Plans 2021 What Is Medigap Insurance In 2021

Medigap Plans 2021 What Is Medigap Insurance In 2021

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Medicare Supplement Plans San Diego Compare Plans

Medicare Supplement Plans San Diego Compare Plans

Medicare Supplement Plan Chart 2016 Senior Benefits Solutions

Medicare Supplement Plan Chart 2016 Senior Benefits Solutions

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Medicare Supplement Plans In California For 2021 Medicarefaq

Medicare Supplement Plans In California For 2021 Medicarefaq

Medicare Supplement Plans 2021 The 3 Best Plans

Medicare Supplement Plans 2021 The 3 Best Plans

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Comments

Post a Comment