Featured

10000 Term Life Insurance Policy

However getting a 10000 term insurance policy from a good insurance company will be hard. Rate Examples for 750000 Term Life Coverage.

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

After this term premiums increase annually thereafter.

10000 term life insurance policy. Before getting into the price its worth asking who actually needs a 500000 policy. 10000 Whole Life Insurance Rates ages 20-45 All whole life premiums shown below are fixed and will not increase. While each company sets their own risk classes and rates the cost of a 5000000 term life insurance policy is primarily determined by these three factors.

Best 25000 Term Life Insurance Providers. A common rule of thumb is to have coverage thats 5 to 10 times your annual salary. Term life insurance on the other hand covers you for a set period of time like the 10 and 20-year terms referenced above so you can tailor the coverage to your temporary needs and save money.

While your options are extensive when you go up to 100000 of coverage youll find fewer companies offering term policies in the 50000 range. It is designed to provide financial cover to loved ones in the event of an untimely demise of the insured. All premium quotes are for a 10000 whole life insurance policy with fixed premiums guaranteed death benefit and guaranteed cash value growth.

The tables below detail quotes for 10- and 20-year term life policies. It will be a great place for your children and. For most people this will be much less than a dollar a day.

Other times term life insurance policies are purchased to protect financial responsibilities that may crop up later in life such as the purchase of a vacation home or your adult childs graduate school tuition. In fact a lot of life insurance companies have minimum policy amounts between 50000 and 100000. When it comes to life insurance that is absolutely not the case.

1The applicants age 2The applicants overall health or risk 3The length of the policys term. For example lets say you are 55-years old and you and your spouse finally buy that dream condo on the ocean. While it sounds great to buy a life insurance policy that does not require a physical medical exam it may not be the right choice for you.

The premium youre offered will come down to a range of factors including your age health lifestyle and occupation. A rating classification is the health rating that the life insurance company. When you purchase a 100000 life insurance policy you have a number of products to choose from but they basically boil down to two types of policies.

Term life insurance rates by policy length. The great news is that you can get do even better than a 10000 term policy. However a 100000 policy has a relatively low face value so you could secure coverage for as little as 1028 a month for a healthy woman in her 20s and 1186 for a healthy man of the.

As you can see the shorter the term length the cheaper the life insurance premiums you will have to pay each year. Do You Want to Buy 20000 of Life Insurance Protection. United of Omaha makes buying life insurance faster and easier than ever before.

That said a 25000 policy is attainable you just have to know where to look. This death benefit received by the beneficiary can be helpful to cover the future upcoming financial needs. In reality you get a 10000 whole life for the same price.

Its no secret that as we get older our mortality risk increases. You would think an organization created to advocate for seniors would ensure the products they sell are market competitive. You can get a 100000 term life policy.

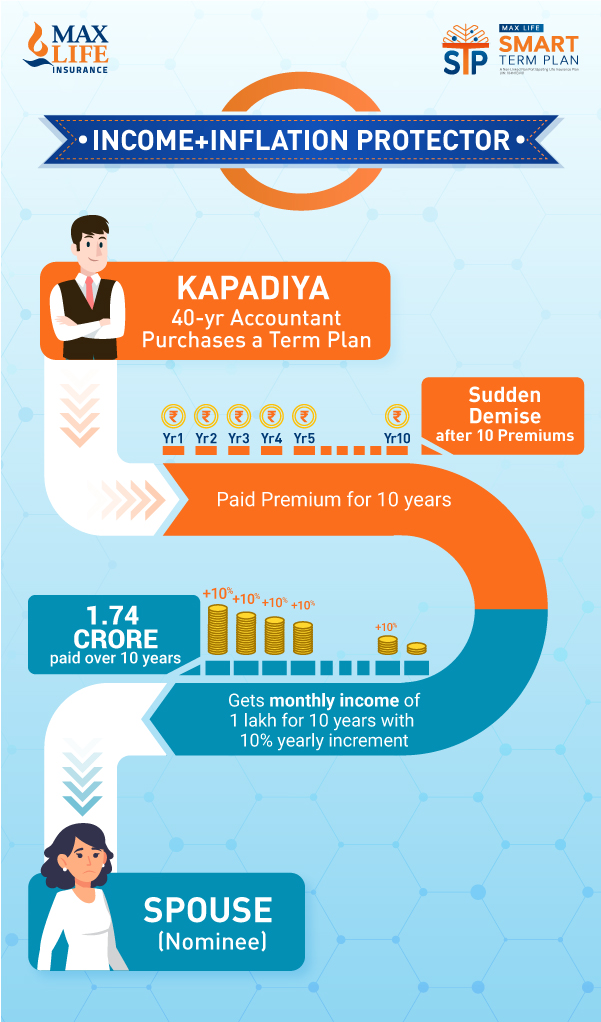

Term Life Online Affordable Life Insurance Protection for Your Family. However buying the best term insurance. The policy offers death protection by paying a certain fixed premium amount for a specific policy tenure.

Term life insurance comes with level premiums and a guaranteed death benefit offering protection for a predetermined length of time like 10- 20- 0r 30- years. You can get a free quote and apply in as little as 5 minutes. There are generally 2 categories to consider policies that require an exam and no exam policies.

As the name implies a 10 year term life insurance policy fixes your premium for an initial period of 10 years. Now that weve covered the basics lets take a look at the rates for a 750000 term life insurance policy on a 20-year term and see which companies are competitive. Those that are interested in 100000 term life insurance have several options to choose from.

If so youve come to the right place. Today its quick and easy for you to get up to 20000 of life insurance online. That would suggest that a 500000 policy could be right for someone who earns between 50000 and 100000 a year.

10000 Life Insurance Policy - Buy up to 10000 of life insurance online with no health exam needed. Plenty of companies offer small term life policies but the three providers below stand out above the rest. All life insurance rates are subject to change.

We have broken down the premiums by each rating class. How Age Affects Life Insurance Premiums. Buying a 10000 life insurance policy from Colonial Penn means you will greatly overpay for what you could be getting elsewhere for much less.

These numbers should not be misinterpreted as the rates you will definitely be offered but rather as examples that are representative of what could. 10 year term is typically the lowest priced policy any carrier offers and is good for shorter term needs such as to cover a business loan or other short term debts. How much does a 100000 life insurance policy cost.

Term Life Insurance policy is one of the simplest and purest forms of life insurance.

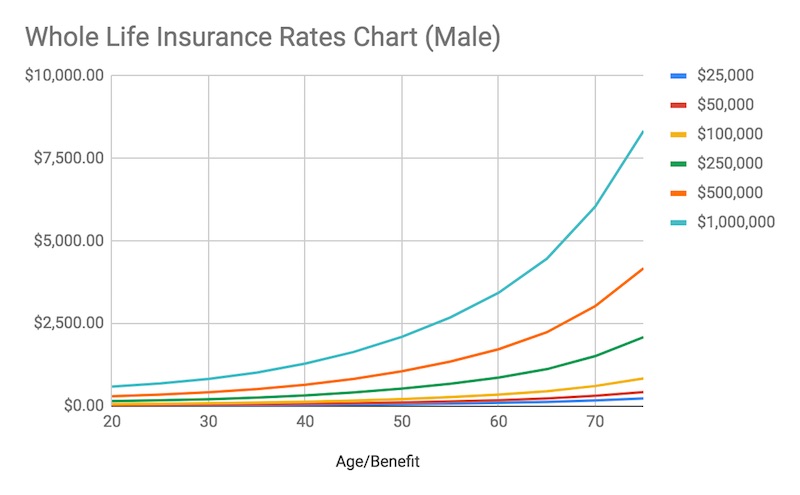

Whole Life Insurance Rates Comparison Best Life Insurance Cost In 2021

Whole Life Insurance Rates Comparison Best Life Insurance Cost In 2021

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

Whole Life Insurance 10 000 Cost 2021 Prices Best Rates

Whole Life Insurance 10 000 Cost 2021 Prices Best Rates

Afspa Ancillary Insurance Programs

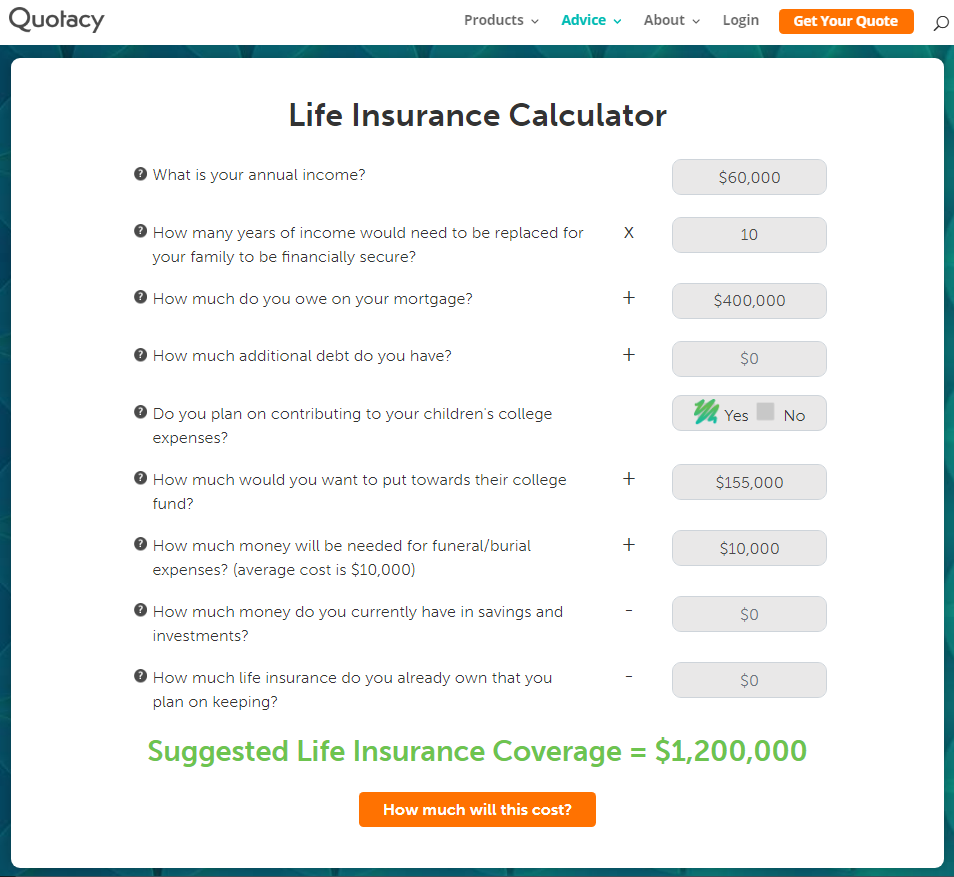

Life Insurance Cost For A Million Dollar Policy Quotacy

Life Insurance Cost For A Million Dollar Policy Quotacy

Gerber Grow Up Plan Life Insurance Review Better For Seniors Than Saving For College Valuepenguin

Smart Term Plan Online 2021 Max Life Insurance

Smart Term Plan Online 2021 Max Life Insurance

Top 5 Best Online Term Insurance Plans In India 2020 Basunivesh

Top 5 Best Online Term Insurance Plans In India 2020 Basunivesh

Life Insurance For Children A Look At The 3 Best Policies

Life Insurance For Children A Look At The 3 Best Policies

10000 Whole Life Insurance Policies Insurance

10000 Whole Life Insurance Policies Insurance

Term Life Insurance Calculator Life Insurance Calculator Quotacy

Term Life Insurance Calculator Life Insurance Calculator Quotacy

How Does Whole Life Insurance Work Costs Types Faqs

How Does Whole Life Insurance Work Costs Types Faqs

10000 Whole Life Insurance Policies Insurance

10000 Whole Life Insurance Policies Insurance

10 000 Life Insurance Sample Rates By Age

10 000 Life Insurance Sample Rates By Age

Comments

Post a Comment