Featured

Anthem High Deductible Plan F

And Anthem Health Plans of Virginia Inc. The anthem High F will cover 100 of costs once a consumer spends 2070.

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

High-deductible Health Plans High-deductible health plans are designed to accompany the newest health care innovationa health savings account.

Anthem high deductible plan f. In Virginia our service area is all of Virginia except for the City of Fairfax the Town of Vienna and the area east of State Route 123. Foreign travel emergency care. Medicare Supplement plans are offered by Anthem Health Plans of New Hampshire Inc.

Plan F Anthem Medicare Supplement. Anthem Insurance Companies Inc. 3 Pints of Blood.

Plan F covers all gaps in deductibles for Medicare coinsurance and copays you normally would pay out of pocket. Although Anthem Blue Cross does not offer Plan F to all seniors or in all states see above where offered the plan covers the following. A high deductible version of Plan F is also.

Part B Excess Charges. How do we analyze if this is a good option. Medicare Plan F is the most comprehensive of the 10 standardized supplements sold by Anthem Blue Cross.

In other words with the high deductible F plan your Original Medicare is primary. High Deductible Plan F covers all of the costs for an additional 365 additional hospital days. Anthem does offer Plan F.

The benefits are the same as any other carrier. Innovative F Medigap is a Medicare Supplement plan offered by Anthem Blue Cross in California and Nevada. A higher deductible plan means lower monthly payments.

When you sign up for a plan you may be able to choose between a high or low deductible plan. This deductible increases a bit every year but in 2020 it is 2340. This plan covers all the benefits offered by traditional Medigap Plan F with the exact same network of doctors but now includes new vision and hearing benefits.

High Deductible Plan F covers all of the costs of 3 pints of blood per calendar year. 3 Pints of Blood. The industry calls this a first-dollar coverage which means you wont have to get your wallets out for Medicare Part A and Medicare Part B services.

If you choose this option youll need to pay for all out-of-pocket Original Medicare costs until you reach a designated amount 2300 in 2019 before your policy pays anything. The HDHP features a single and family two or more people plan year deductible that applies to your medical behavioral health and prescription drug benefits Note that the entire family deductible must be met before the plan pays for covered services for any enrolled family member. Last Day to Enroll in Medigap High F.

Skilled Nursing Facility SNF care coinsurance. Medicare Part A covers hospital costs after a 1200 deductible and Medicare Part B covers 80 of doctors and testing costs. Anthem Medicare Supplement Plan G.

Part B Excess Charges. Lets start by looking at the plan. Out of pocket in a year.

Part B excess charges. There is also a high deductible version of Plan F. So Medicare will pay its share of your claims and send the remainder to Anthem.

The only difference between Plan F and Plan G is that Plan G doesnt cover the Medicare Part B deductible. Part B excess charges. Once you reach the deductible the plan covers the left-over costs going forward keeping the monthly premium low.

After the deductible is met you pay 20. The difference is the beneficiary agrees to pay the deductible before full coverage kicks in. The most noteworthy addition to Innovative F is a 750 hearing aid coverage.

The first 3 pints of blood or equal amounts of packed red blood cells per calendar year unless this blood is replaced. The concept of a High Deductible plan F supplement sometimes called Medigap is a simple one. High Deductible Plan F covers all of the costs for an additional 365 additional hospital days.

High Deductible Plan F covers all of the costs of 3 pints of blood per calendar year. Updated on April 6 2021 High Deductible Plan F is an alternative version of the standard Plan F. Anthem Insurance Companies Inc.

The coverage is exactly the same except that you have a deductible before your Plan F coverage kicks in. Costs for the high-deductible Plan F may also include monthly premiums which are usually lower than the premiums for the standard plan because of the higher deductible amount. Anthem Medigap High Deductible F and G plans are no longer available for new members effective January 1 2014 in Wisconsin Virginia Ohio Nevada New Hampshire Missouri Maine Kentucky Indiana Connecticut and Colorado.

You might be able to buy a high-deductible version of Medicare Supplement Plan G which is very similar to Plan F in 2020. Anthem Medicare Supplement Plan F. You will pay the two deductibles A and B and the 20 coinsurance until you meet the High Deductible and then the plan functions as F plan with very little out of pocket for covered benefits.

By pairing one of Anthem Blue Cross and Blue Shields HSA-qualified HDHPs with an HSA youll pay lower premiums and have an account designed to help you pay for qualified medical expenses. With SmartChoice you have the freedom to use the doctor of your choice including over 40000 Prudent Buyer physicians and specialists. The first 3 pints of blood or equal amounts of packed red blood cells per calendar year unless this blood is replaced.

SmartChoice is a low plan premium high deductible F plan. It offers the comprehensive coverage of our most popular Medicare supplement plan Senior Classic F after you meet the annual plan deductible. The plan covers you at 100 onceif you spend 2110 in Medicare A and B costs.

A deductible is simply the total youll pay out-of-pocket for health care services before a plan begins paying for those expenses. Plan F will cover. Part B precautionary care coinsurance.

Here is how High Deductible F works-This is a very simplified version but you will get the point. The High Deductible is just over 2K for on the High Deductible F plan with Anthem Blue Cross. Anthem Medicare Supplement Plan N.

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

Ca Medicare Learn About Anthem Blue Cross Medicare Plans For Seniors

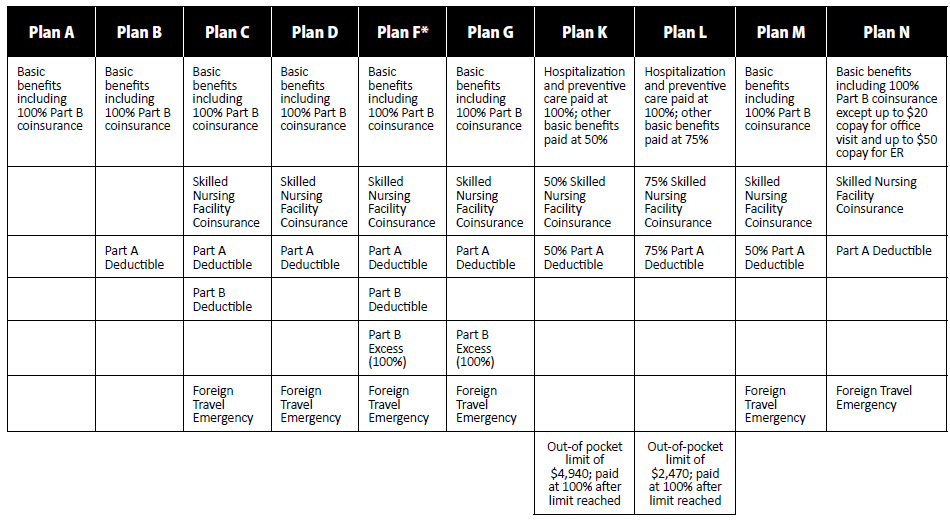

Http Barricks Com Outlineofcoverage Pdf

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

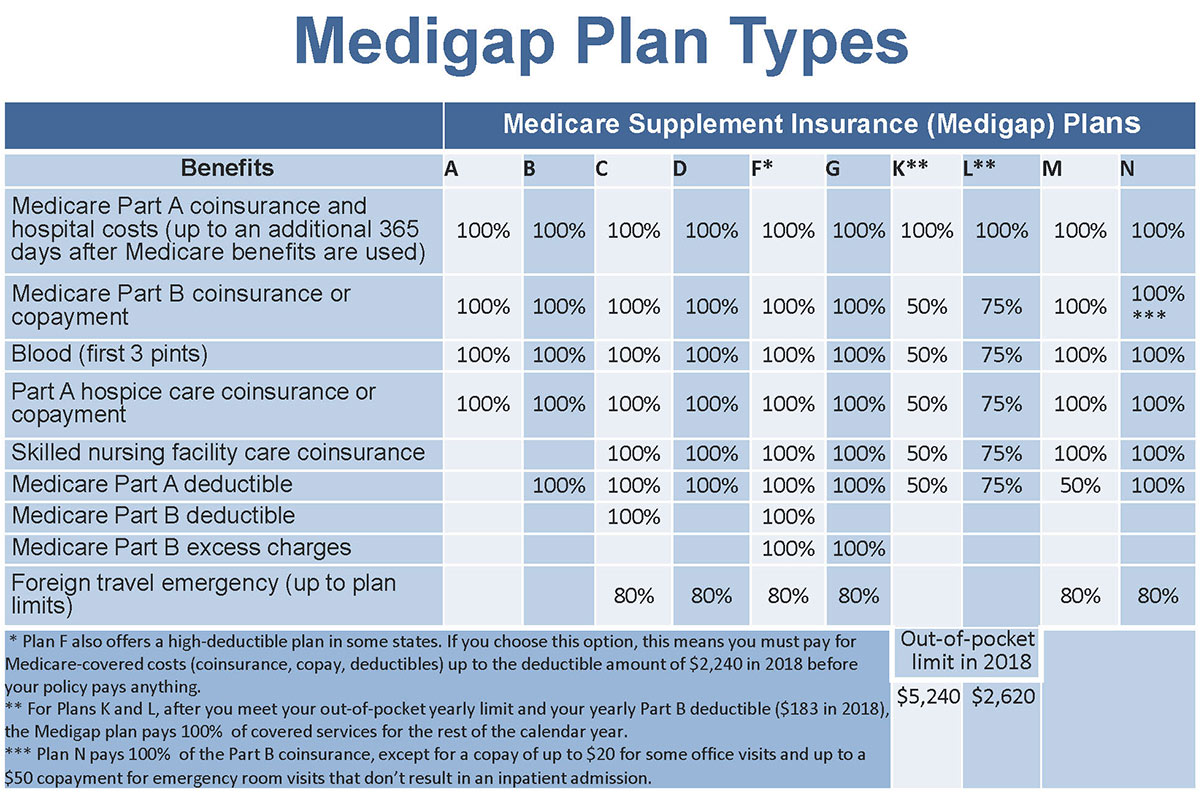

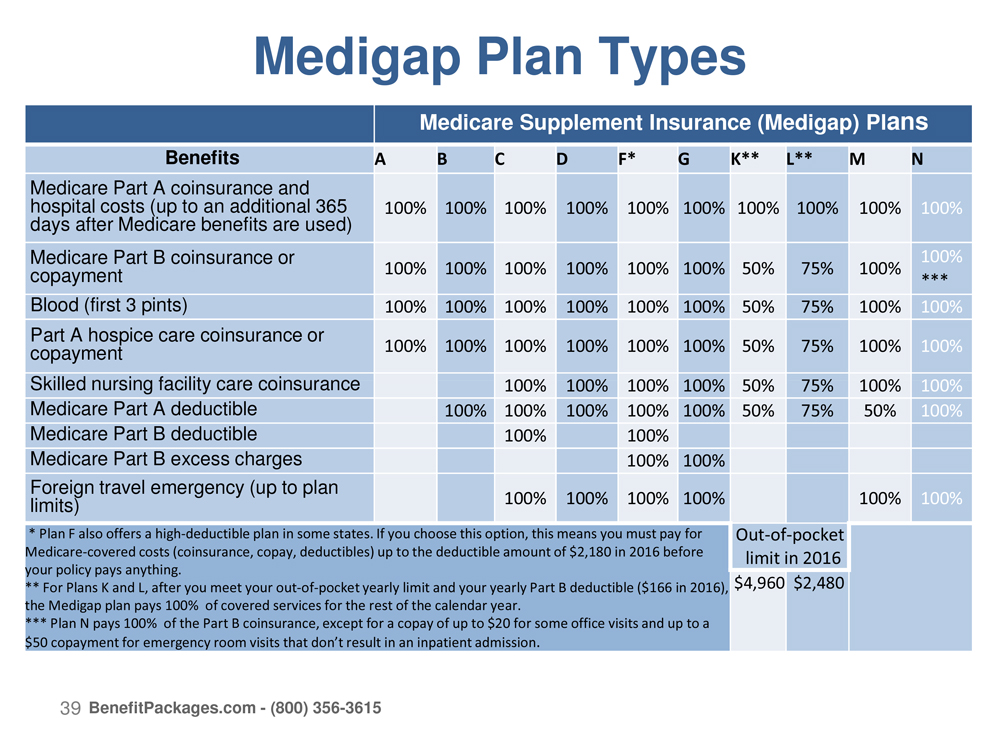

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

Medicare Supplements For Mature Members Of Blue Cross Benefitpackages Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

How Does High Deductible Medigap Plan F Work Medicaresupplement Com

Bcbs Medicare Supplement Plan F Rates Rating Walls

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans L An Updated Review

Anthem Medicare Supplement Plans L An Updated Review

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

High Deductible F Plan For Medicare Coverage

High Deductible F Plan For Medicare Coverage

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

Anthem Blue Cross Medicare Supplement Senior Healthcare Direct

High Deductible Plan F High Deductible Medicare Supplement

High Deductible Plan F High Deductible Medicare Supplement

High Deductible Medicare Supplement Crowe Associates

High Deductible Medicare Supplement Crowe Associates

Comments

Post a Comment