Featured

- Get link

- X

- Other Apps

Medicare Part A Description

Generally speaking youre eligible for Part A if youre age 65 or older have a disability or have ESRD or ALS. Nursing home care inpatient care in a skilled nursing facility thats not custodial or long-term care Hospice care.

Parts Of Medicare Why Abc Medicare Help

Parts Of Medicare Why Abc Medicare Help

It covers you during short-term inpatient stays in.

Medicare part a description. Together Medicare Parts A and B are called Original Medicare Medicare Part B. Part B medical coverage covers things like doctor visits outpatient services X-rays and lab tests and preventive screenings. Medicare Part A.

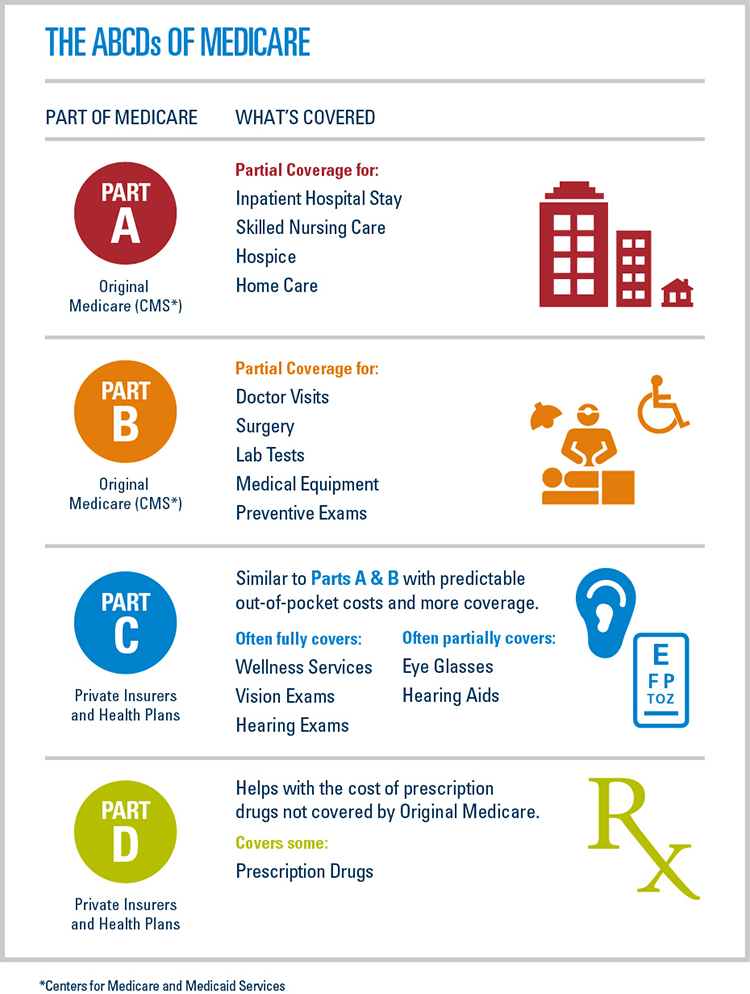

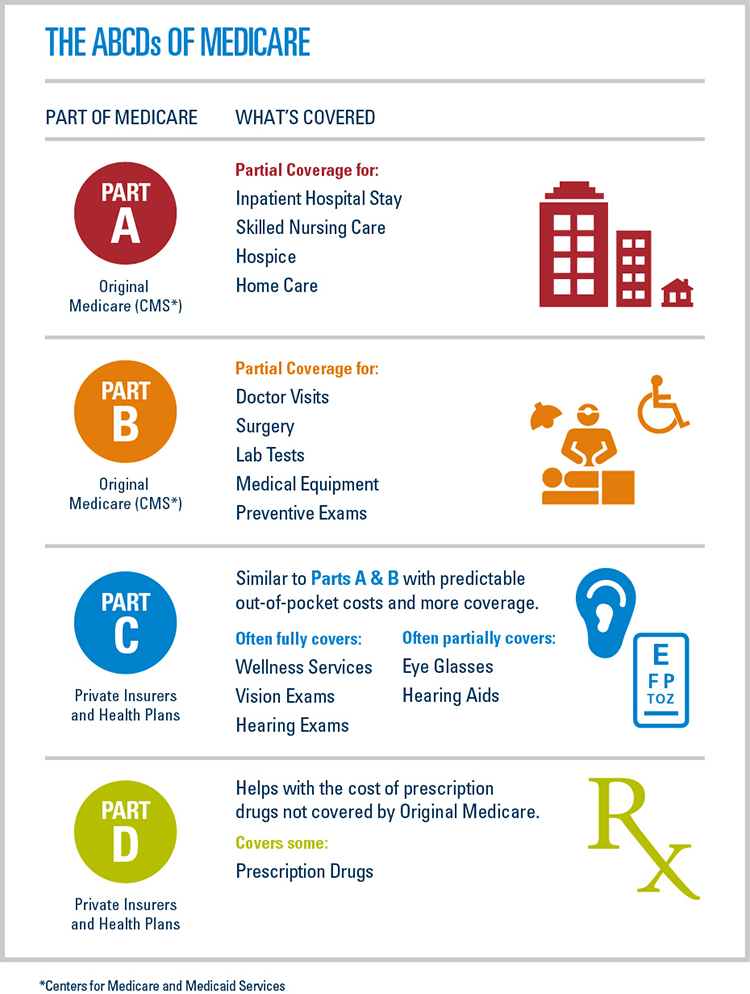

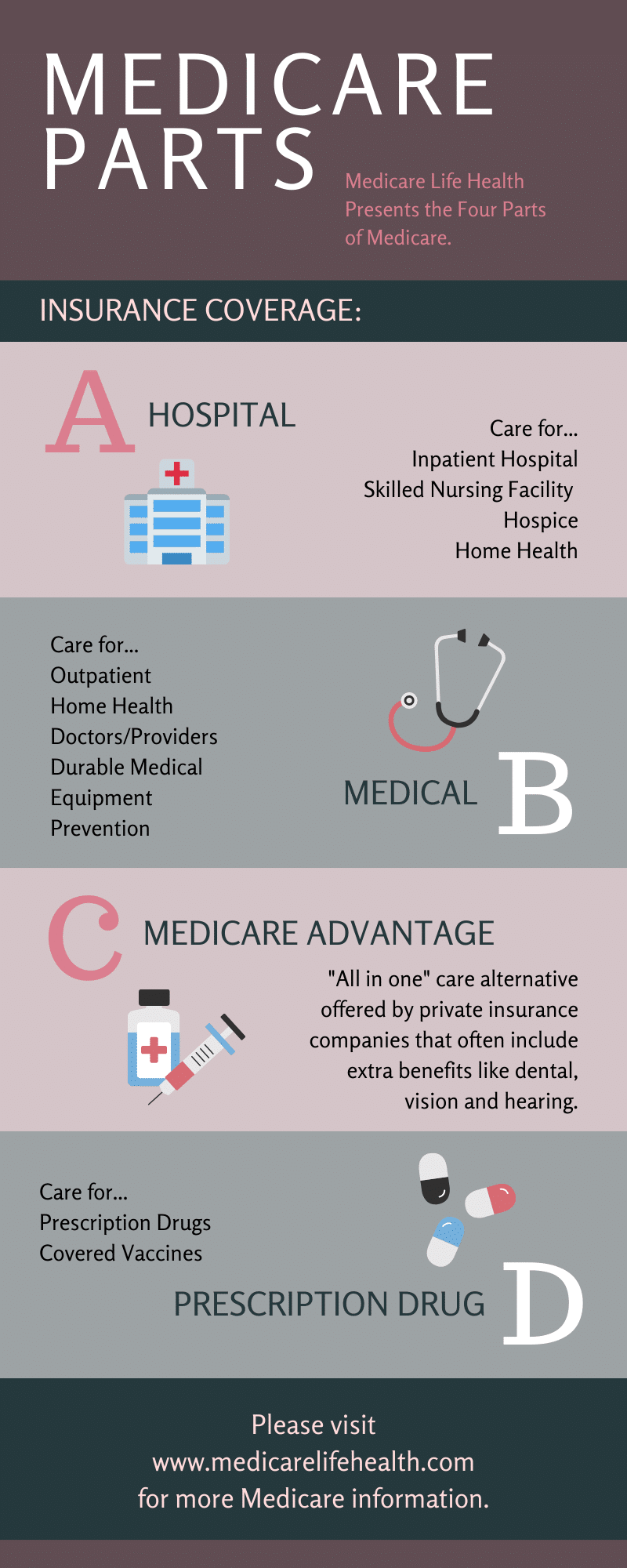

The different parts of Medicare help cover specific services. Medicare is funded by a combination of a specific payroll tax beneficiary premiums and surtaxes from beneficiaries co-pays and deductibles and general US. Currently the four parts of Medicare are.

An individual is considered to be terminally. Medicare Part A is hospital insurance. Part A benefits are subject to a.

Medicare is divided into four Parts. Youre admitted to a hospital or mental hospital as an inpatient. Medicare Part A or Medicare hospital coverage pays for care at a hospital skilled nursing facility or nursing home and for home health services.

Part A helps pay for the cost of inpatient stays in hospitals and short-term skilled nursing facilities home health services and hospice care. A B C and D. Hospices also provide Part A hospital insurance services such as short-term inpatient care.

Youre admitted to a skilled nursing facility and meet certain conditions. In general Part A covers. Skilled nursing facility care.

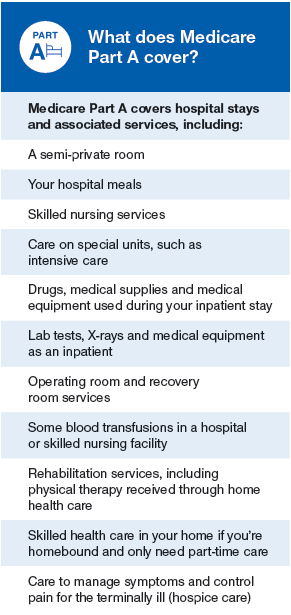

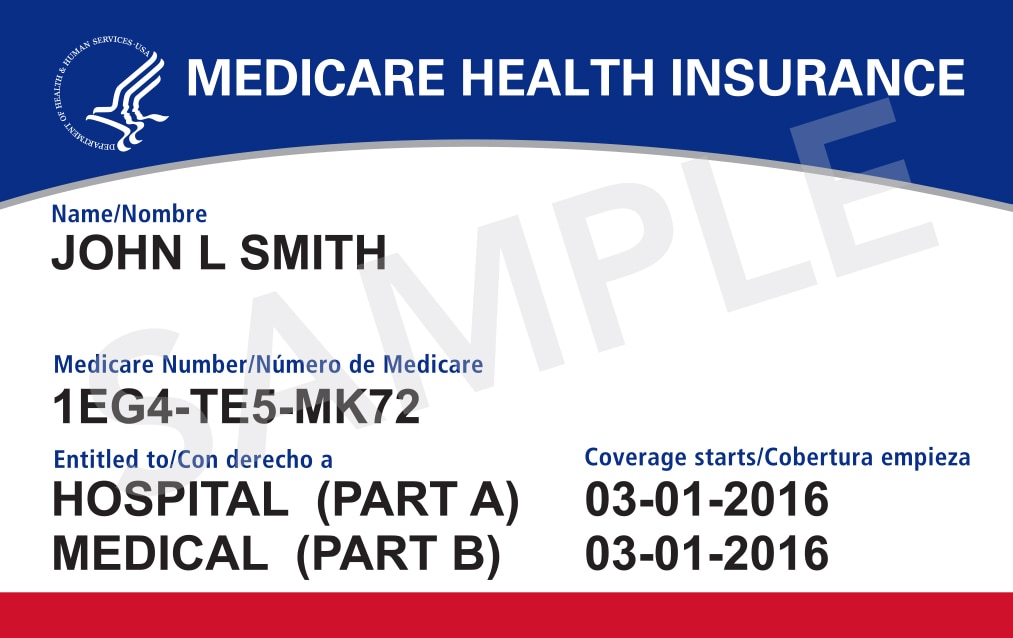

Medicare Part A is hospital insurance that provides basic coverage for hospital stays and post-hospital nursing facilities home health care and hospice care for terminally ill patients. Medicare Part B Medical Insurance Part B covers certain doctors services outpatient care medical supplies. In brief Medicare Part A covers inpatient care in facilities such as but not limited to hospitals and skilled nursing facilities.

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the US. It consists of Part A which covers hospital services and Part B which is medical insurance and covers expenses like doctor appointments laboratory tests and X-rays. Enrollees who paid Medicare taxes during their.

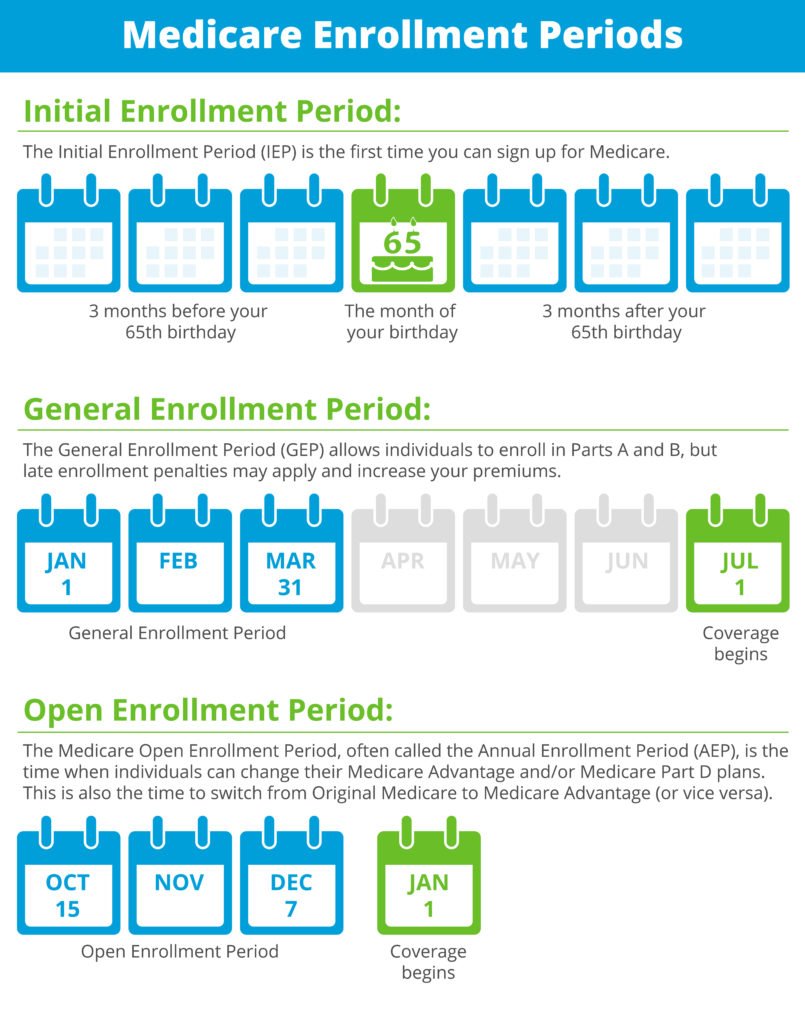

2 ways to find out if Medicare covers what you need. In order to be eligible to elect hospice care under Medicare an individual must be entitled to Part A of Medicare and be certified as being terminally ill. Original Medicare sometimes called Traditional Medicare is insurance administered by the federal government.

Medicare Part A Hospital Insurance Part A covers inpatient hospital stays care in a skilled nursing facility hospice. Part B helps pay for doctors services including those in the hospital outpatient care in or out of a hospital diagnostic tests preventive care and some medical equipment and supplies. Medicare benefits are divided into two different categories referred to as Part A and Part B.

Part A hospital coverage covers things like inpatient hospital stays some home health care and skilled nursing facility care. Medicare Part A is hospital insurance and is part of original Medicare. Part A covers inpatient hospital stays skilled nursing facility SNF stays some home health visits and hospice care.

Youre eligible if youre 65 and older or under age 65 with certain disabilities. Inpatient care in a hospital. It may cover your care in certain situations such as.

Medicare Part A is hospital insurance. Without a break for at least five years. Medicare Part A also covers hospice care and limited home health care.

Medicare Part A B C And D What You Need To Know Healthmarkets

Medicare Part A B C And D What You Need To Know Healthmarkets

What Medicare Covers What Does Medicare Cover Bluecrossmn

What Medicare Covers What Does Medicare Cover Bluecrossmn

Introduction To Medicare Part D Educational Objectives Description Of The Medicare Part D Program Youtube

Introduction To Medicare Part D Educational Objectives Description Of The Medicare Part D Program Youtube

Medicare Parts Learn The Parts Of Medicare Medicare Parts A B C D

Medicare Parts Learn The Parts Of Medicare Medicare Parts A B C D

Medicare Medicaid And Medical Billing

Medicare Medicaid And Medical Billing

Which Medicare Part Is Right For Your Loved One A Breakdown Of The Basics Of Medicare Infographic Included The Upside To Aging

Which Medicare Part Is Right For Your Loved One A Breakdown Of The Basics Of Medicare Infographic Included The Upside To Aging

What Are The Parts Of Medicare The Abcd S Explained

What Are The Parts Of Medicare The Abcd S Explained

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

4 Simple Steps To Understanding Medicare 2021 Boomer Benefits

Comments

Post a Comment