Featured

Hmo Plan Meaning

Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network.

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Hmo Vs Ppo Comparison 5 Differences With Video Diffen

Wondering what an HMO insurance plan is.

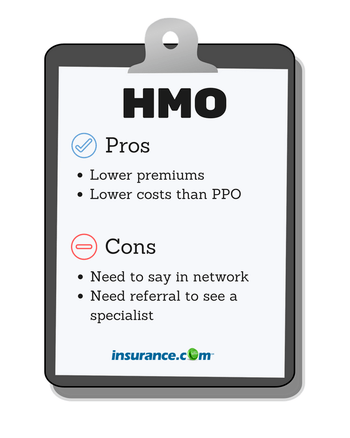

Hmo plan meaning. An HMO gives you access to certain doctors and hospitals within its network. HMO stands for health maintenance organization. One of these types of health plans.

Planning permission is needed if you want to build something add an extension or change the use of a building. This allows the HMO to keep costs in check for its members. Medicare HMO PPO Medicare also has both PPO and HMO options.

HSA-qualified plans must meet specific plan design requirements laid out by the IRS but they are not restricted in terms of the type of managed care they use. Was beinhaltet das HMO-Modell. This is known as the standard test or the self-contained flat test.

Like other plans if you reach the maximum out-of-pocket amount the plan. HMO PPO EPO or POS Higher out-of-pocket costs than many types of plans. PPO stands for preferred provider organization.

Finden Sie es direkt auf Comparis heraus. If your health plan has the HMO or health maintenance organization designation then your insurer has enrolled you in a more restrictive coverage network. While the health care you receive will be comparable to what you might receive in other plans you will first need to.

Understanding how you can benefit from HMO plans. HMO Health Insurance Plans. HMO stands for health maintenance organization.

What is HMO Planning Permission. An HMO POS plan is a healthcare plan in which people can see doctors and specialists outside of the HMOs network. HMOs were created as lower-cost alternatives to traditional payment models of medical care like Fee-for-Service plans also known as Traditional or Indemnity plans where coverage is provided no matter what provider or hospital you use.

To be defined as an HMO a building or part of a building must fall within one of the following categories. There are a number of different types of networks with HMO PPO EPO and POS being some of. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care.

Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care. Finden Sie es direkt auf Comparis heraus. A building or flat in which more than one household shares a basic amenity such as bathroom toilet or cooking facilities.

A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. But unlike PPO plans care under an HMO plan is covered only if you see a provider within that HMOs network. Like a PPO plan an HMO plan has a network of doctors and hospitals that you can use.

Finden Sie es heraus. Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. Finden Sie es heraus.

Was beinhaltet das HMO-Modell. The difference between them is the way you interact with those networks. HSA stands for health savings account and HSA-qualified plans can be HMOs PPOs EPOs or POS plans.

Short for Health Maintenance Organization HMOs are types of plans that allow you to visit a select network of doctors and specialists who work with your health insurance providerThese plans can be great for families looking for an affordable way to maintain their health care expenses. A network is made up of providers that have agreed to lower their rates for plan members and also meet quality standards. Planning permission is usually the first thing to consider in the schedule of an HMO project.

HMOs have their own network of doctors hospitals and other healthcare providers who have agreed to accept payment at a certain level for any services they provide.

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What S An Hmo Plan And Who Is It Good For The Checkup

What S An Hmo Plan And Who Is It Good For The Checkup

What Is An Hmo About Hmo Health Insurance Medical Mutual

What Is An Hmo About Hmo Health Insurance Medical Mutual

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Terms Defined Hmos Vs Ppos Empower Health Insurance

Terms Defined Hmos Vs Ppos Empower Health Insurance

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

What Is An Hmo Benefits Cost Comparison How To Enroll

What Is An Hmo Benefits Cost Comparison How To Enroll

What Is An Hmo Plan And Other Helpful Health Insurance Insider Tips Thinkhealth

Comparing Health Plan Types Kaiser Permanente

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

Comments

Post a Comment