Featured

- Get link

- X

- Other Apps

Individual Vs Family Deductible

So your total out-of-pocket cost for the service is 80. There are differences in how health plans work for families versus individuals.

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

At that point the family deductible is considered to be met.

Individual vs family deductible. Deductibles might range anywhere from about 0 to 8550 for an individual or 0 to 17100 for a family. It could take as little as one visit or over the course of many months to meet your deductible. How Does an Individual or Family Deductible Work.

An individual deductible is a deductible that applies to only one person on the policy. ACA Out-of-Pocket Maximum 2019. Generally plans with a higher deductible will have lower premiums because you spend more of your own money on care and the insurance company pays less.

Whats the difference between individual and family deductible. The downside is that coverage only applies to one person until the family deductible is met. Individual Deductible Family Plans.

Depending on the type of plan you have there could be separate deductibles for prescriptions andor separate deductibles per family member. This example uses a sample plan. But under new rules that took.

The main difference between individual and family coverage is how the annual deductible is computed. When you have a family maximum deductible once the amount that all members of the plan have paid cumulatively towards a deductible meets the deductible then the plan considers the deductible as being met. Lets say each member of a family of four each has a 1000 deductible.

Once the family deductible is met for the year insurance begins paying for the entire family. 5500 The maximum amount of money you pay. That leaves 30 for you to pay in addition to the 50 deductible.

7350 for an individual and 14700 for a family. 7150 for an individual and 14300 for a family. The amount you owe for health services before your plan begins to help pay.

First each member of your family will have an individual deductible. Where To Find Your Out-of-Pocket Maximum. A low deductible health plan may be referred to as an LDHP.

Most medical insurance plans specify an individual deductible. Co-pay coinsurance and cost of services may vary according to plan type. ACA Out-of-Pocket Maximum 2018.

You may also have multiple deductibles such as one just for prescription drugs. The first deductible is what is called an embedded deductible meaning that there are two deductible amounts within one plan. Traditionally an HDHP wouldnt begin to pay benefits for any family member until the family deductible had been met.

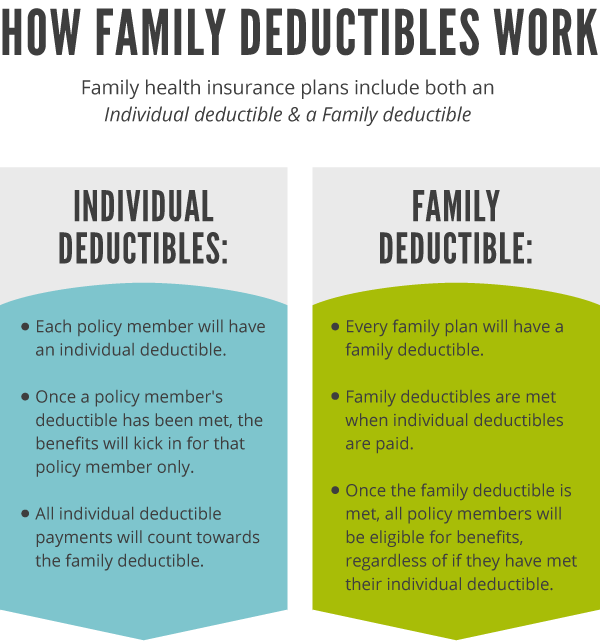

Individual Versus Family Deductible. When you have a family deductible the individual deductible applies per person until the family deductible amount is reached. To understand individual and family deductibles youll first need to understand how insurance.

ACA Out-of-Pocket Maximum 2017. For example lets say you have five family members an individual deductible of 1500 and a family deductible of 3000. 7900 for an individual and 15800 for a family.

Some family insurance has separate deductibles for each individual and then a family deductible limit. This is the amount that you must. The family deductible helps to keep overall costs more manageable especially for a larger family.

Together the family will also have a higher deductible. Individual deductibles focus on the amount towards a deductible that each individual in the plan has paid. The single deductible is embedded in the family deductible so no one family member can contribute more than the single amount toward the family deductible.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How. The benefit of an individual deductible is they are lower than family deductibles so you can receive full cost coverage sooner. For example if your individual deductible is 300 the plan will begin covering your expenses after you have paid 300 out.

The difference between the traditional type of health insurance deductible system and the family deductible in an HDHP health plan is that the individual deductible is sometimes eliminated in family HDHP coverage. Together the family will also have a higher deductible. A plan might have a 5000 deductible for each family member and a 10000 deductible limit for the whole family.

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Embedded Deductibles Source Of Consumer Confusion Center On Health Insurance Reforms

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

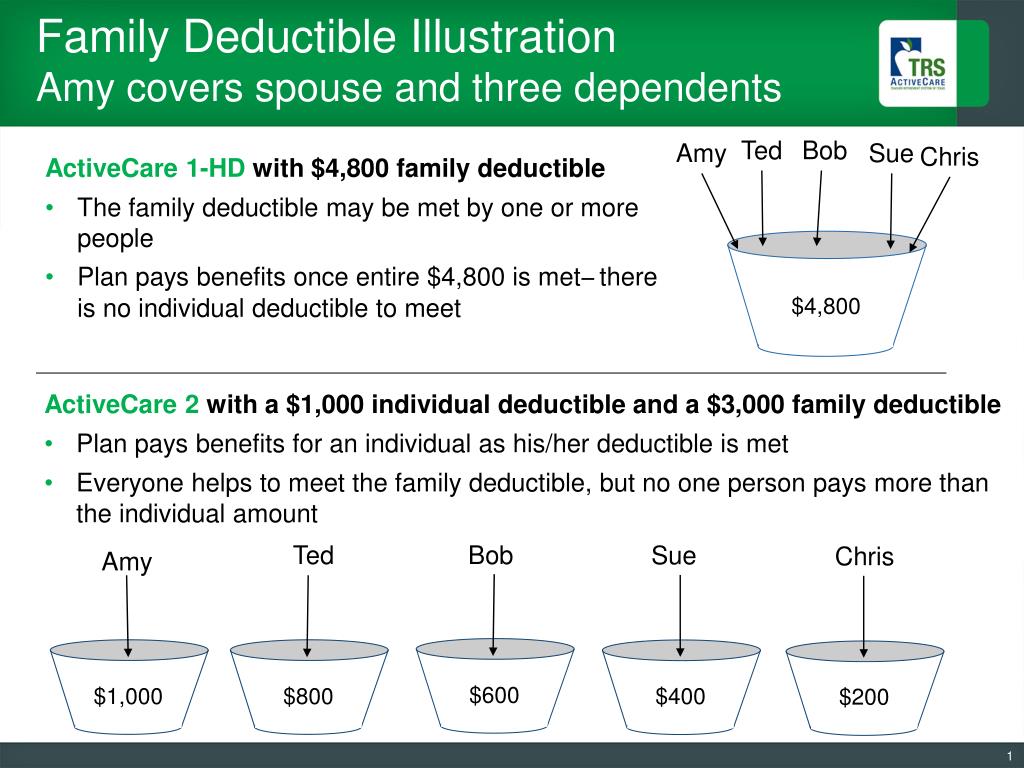

Ppt Family Deductible Illustration Amy Covers Spouse And Three Dependents Powerpoint Presentation Id 5810534

Ppt Family Deductible Illustration Amy Covers Spouse And Three Dependents Powerpoint Presentation Id 5810534

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

25 Awesome Individual Deductible Health Insurance

What S The Difference Between Family And Individual Deductibles

What S The Difference Between Family And Individual Deductibles

What S The Difference Between Individual And Family Deductibles Max Out Of Pocket

What S The Difference Between Individual And Family Deductibles Max Out Of Pocket

Https Www Mtu Edu Hr Current Docs Aggregate Vs Embedded Plans Pdf

Https Www Heritagegrp Com Uploads Embedded 20v 20non Embedded 20deductibles Pdf

Health Insurance Deductible Individual Vs Family Guide At Insurance Partenaires E Marketing Fr

Health Insurance Deductible Individual Vs Family Guide At Insurance Partenaires E Marketing Fr

Individual Health Insurance Health Insurance Individual Vs Family Deductible

Https Www Mtu Edu Hr Current Docs Aggregate Vs Embedded Plans Pdf

Comments

Post a Comment