Featured

- Get link

- X

- Other Apps

Whats Commercial Insurance

Commercial property insurance also covers theft and acts of vandalism. It can cover medical expenses and disability income for the insured.

Commercial Umbrella Insurance The Hartford

Commercial Umbrella Insurance The Hartford

Commercial insurance refers to a policy that is meant to protect a business from future risks.

Whats commercial insurance. Some of the most popular types of commercial insurance. Commercial Car Insurance. Commercial flood insurance which covers flood damage caused by rain snow hurricanes or.

The type of insurance coverage under this category is slightly different since it involves other risks. Thanks for sharing the information A commercial insurance is a backup support that can be used when situations are adverse and you need an instant solution to recover your loss caused to your business. These solutions aim to offer a safety net for business operations and assets when the need arises.

Commercial insurance is a general term referring to a number of specific types of business insurance coverage that protect a company in the case of accident disaster crime or liability. Commercial health insurance is any type of healthcare policy that is not administered through a government program. Small business owners can purchase different types of commercial insurance coverage which compensate them for financial losses arising from a.

Learn what is covered and not covered by a commercial general liability insurance policy. Commercial auto insurance is a policy that covers physical damage and liability not covered by a personal insurance policy. TXInsurance May 9 2010.

Commercial property insurance policies are similar to personal property insurance. Also known as private-funded insurance these plans primarily are provided through benefits plans provided by employers. Contents insurance covers business contents such as goods stock and equipment.

Commercial auto insurance which helps cover you and your employees on the road if youre driving for business. Coverage may include business property damage loss of income due to a business interruption legal issues theft and employees grievances. As Investopedia notes business owners can purchase a.

Property insurance covers property that you own from direct damage. Plain and simply commercial insurance is insurance that protects businesses. Commercial insurance also called business insurance can shield your business from costly risks like injuries theft property damage and lawsuits.

Youll need to judge your stocks. A definition of commercial insurance. In a very short word Yes.

Buildings insurance covers the repair or rebuild of a business premises for events such as fire and flooding. The government is a business and they have to be insured like any other commercial business. Although sometimes used interchangeably with commercial insurance general liability.

Commercial business insurance is coverage for businesses and corporations generally designed to cover the business its employees and ownership. It covers businesses against losses arising from things like damage to property or injury to employees and is a term commonly used to label core business insurance covers like public liability and employers liability. General liability insurance covers bodily injury or property damage you cause others.

Business owners need to assess the risks their company faces and choose commercial insurance policies that protect against those specific risks. Commercial insurance is a type of business insurance that offers solutions for industrial sectors including but not limited to construction manufacturing telecom textiles logistics etc. Commercial business insurance refers to a broad type of insurance policy designed to protect businesses from risk.

Most operate for profit although some commercial health insurers are non-profit organizations. Commercial health insurance is health insurance provided and administered by non-governmental entities. These are passengers the driver and the standard financial cover of damages to the vehicles.

Types of Commercial Insurance General Liability Insurance. You can tailor your commercial insurance policy and add optional coverages such as. 4 Basic Commercial Insurance Coverages You Need General Liability Insurance.

A commercial property insurance policy can include. Since there are so many types of businesses with different needs and situations commercial insurance can come in many shapes sizes and colors. The motor insurance policy covers a car you own for commercial purposes especially as a taxi or a cab.

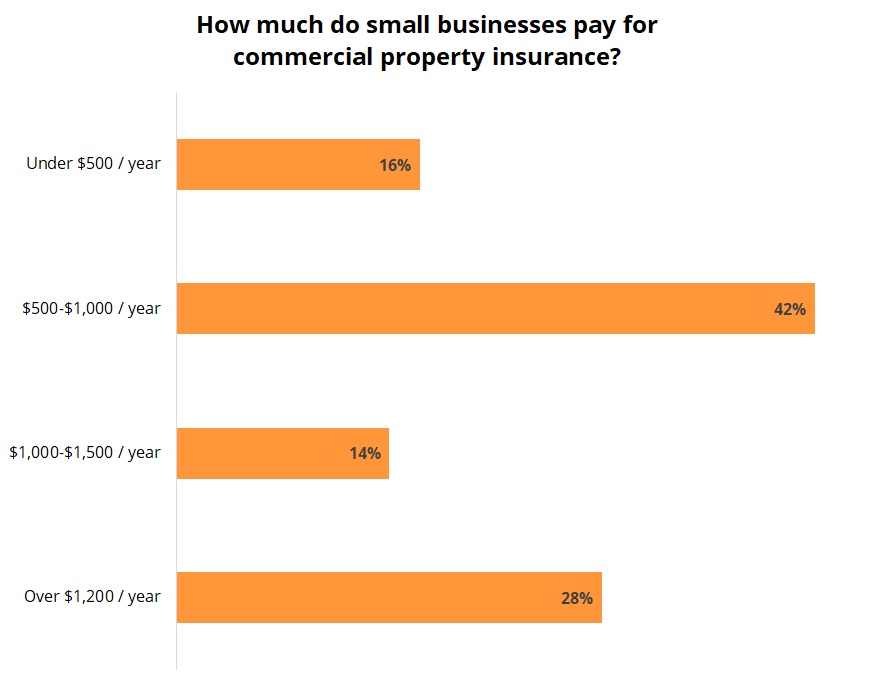

A commercial property insurance policy typically covers loss to your business property due to fire lightning wind and hail.

Commercial Auto Insurance Requirements Options

Commercial Auto Insurance Requirements Options

Commercial General Liability Insurance Iii

Commercial General Liability Insurance Iii

/agents-versus-brokers-and-how-they-make-money-462383-color-V2-cc2b7ad3db6c4ee5a0d2302843c1213f.png) Insurance Agents Versus Brokers How They Make Money

Insurance Agents Versus Brokers How They Make Money

What Is Commercial Insurance Commercial Insurance Explained

What Is Commercial Insurance Commercial Insurance Explained

/man-at-the-table-fills-in-the-form-of-health-insurance--healthcare-concept--vector-illustration-flat-design-style--682211990-bcd44344bfb04adc91f0d35376838b10.jpg) Commercial Health Insurance Definition

Commercial Health Insurance Definition

32 Commercial Insurance Ideas Commercial Insurance Commercial Business Insurance Business Insurance

32 Commercial Insurance Ideas Commercial Insurance Commercial Business Insurance Business Insurance

How A Commercial Auto Policy Is Different From Personal Policy

How A Commercial Auto Policy Is Different From Personal Policy

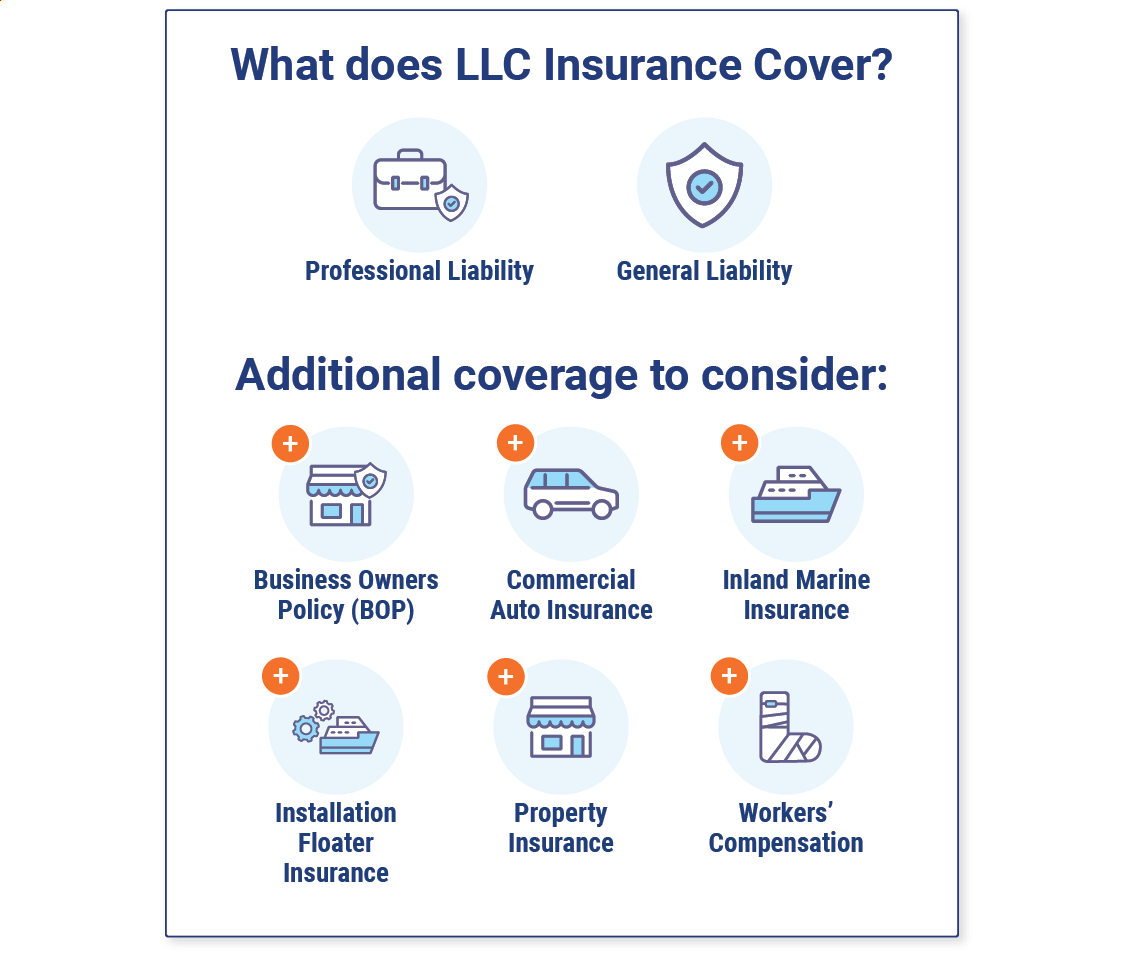

Llc Insurance Coverage Requirements Costs Quotes Trusted Choice

Llc Insurance Coverage Requirements Costs Quotes Trusted Choice

Everything You Need To Know About Certificates Of Insurance Bcs Compliance

Everything You Need To Know About Certificates Of Insurance Bcs Compliance

What Is Commercial Insurance An Introduction Landesblosch

What Is Commercial Insurance An Introduction Landesblosch

Commercial Property Insurance Cost Insureon

Commercial Property Insurance Cost Insureon

What S The Difference Between Personal And Commercial Auto Insurance Harry Levine Insurance

What S The Difference Between Personal And Commercial Auto Insurance Harry Levine Insurance

What Is Commercial Auto Insurance Youtube

What Is Commercial Auto Insurance Youtube

Comments

Post a Comment