Featured

Health Insurance Employer Contribution Rules

Typically both employers and employees contribute to the cost of the premium. California health insurance companies require that an employer contribute at least 50 percent of the employee only monthly cost or premium So for example if the monthly cost for one employee not including dependents is 300 then the employer must pay at least 150.

Small Employer Health Insurance 7201.

Health insurance employer contribution rules. Employee contributions are health plan contributions from employees that are deducted from their paychecks. The Health Insurance Portability Accountability Act HIPAA makes it illegal to assess health insurance premiums based on health factors. The cafeteria plan nondiscrimination rules are discussed in Box 15.

A few states like New York allow you to contribute whatever you would like going as low as 0 percent contribution. The contributions are pre-tax and can either be voluntary or mandatory if you are required to receive benefits from an employer. Most private sector health plans are covered by the Employee Retirement Income Security Act ERISA.

If you have a health insurance plan through your employer its likely that you have to pay for at least a portion of your premiums. It is not permissible to charge some employees more than any other similarly situated individuals based on medical conditions claims experience receipt of health care services genetic information or disability. HIPAA does allow an employer to make distinctions in benefits that are offered and in the cost of benefits.

Health insurance plans generally allow qualified dependents to be added to any plan. Employee Contribution What Is Employee Contribution. The special rule that addresses cost is at Code I25g.

Insured health benefits will not be discriminatory if the ER contribution amount for non-highly compensated participants non-HCPs is at least 75 of the ER contribution amount for the similarly-situated HCP with the highest-cost coverage. The Section 125 rules require that employers provide a uniform election with respect to employer contributions A contribution structure that charges more to certain non-HCPs for the same benefit whether for employee or dependent coverage does not provide a uniform election with respect to employer contributions. Some states allow employers with up to 100 employees to buy coverage through the Small Business Health Options Program or SHOP Marketplace.

However for group health insurance plans it is optional for employers to pay for the health insurance. For employees who have dependents on their insurance plan the contribution is 6850. Regardless of size all employers that provide self-insured health coverage to employees must file an annual return reporting certain information for each covered employee and provide the same information to covered individuals.

For employers with lower paid populations this often means the employer must contribute a significant amount towards the total cost. In most states employers are required to contribute or pay for at least 50 percent of each employees health insurance premiums although this depends on the state the business is located in. Your employee contribution is the portion of the premium that you have to pay to a health insurance provider for your coverage but contributions are normally taken out automatically by your employer.

This requirement is meant to encourage more employees to join the plan and prevent whats known as adverse selection where only those prone to sickness are motivated to sign up creating a much higher-risk group for the insurer. Most insurers and health plans require employers to cover at least half of the premium cost for covered employees. Employer contributions must satisfy the comparability rules unless HSA contributions are made through a cafeteria plan in which case the nondiscrimination rules in Code 125 must be satisfied.

Similarly situated means the same tier eg self-only family coverage. To 445 euro health insurance contributions by 01 contributions to hospital charges from 798 to 10 euro per day the tobacco tax by 18 per cigarette packet and the maximum health insurance contribution basis by 90 to. As an employer the amount you have to contribute to your employees group health plan varies by insurance carrier.

Also those individuals who manage plans and other fiduciaries must meet certain standards of conduct under the fiduciary. Given the language of New York Insurance Law 4235 c 1 A it is the position of the Department that any required employee contribution no matter how minimal requires opting out of coverage by the employee. An HSA has a maximum contribution of 3400 from both the employee and the employer for single employees.

For further information you may contact Principal Attorney Alan Rachlin at the New York City office. Are employers required to offer health insurance to employee dependents. Among other things ERISA provides protections for participants and beneficiaries in employee benefit plans participant rights including providing access to plan information.

Employer contributions that are not provided through a cafeteria plan. The Affordable Care Acts employer mandate requires applicable large employers to offer at least one health plan that provides affordable minimum value coverage to its full-time employees and minimum essential coverage to their dependents to avoid penalties. Insurance carriers generally require that companies contribute to at least half of employee premiums.

Employees age 55 or older have an additional 1000 catch-up contribution.

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

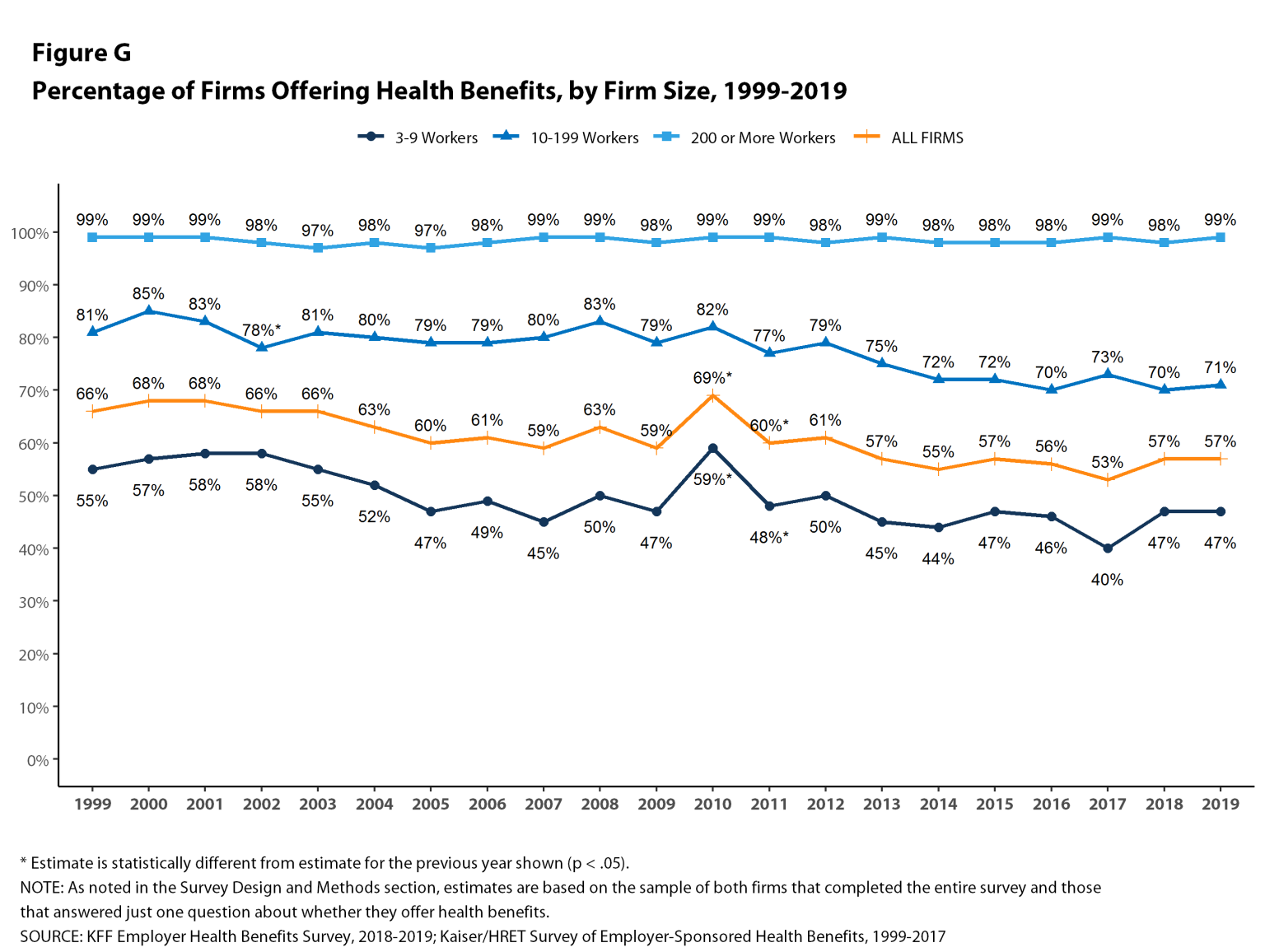

What Percent Of Health Insurance Is Paid By Employers

What Percent Of Health Insurance Is Paid By Employers

How Do Employer Health Insurance Contributions Work Gusto

How Do Employer Health Insurance Contributions Work Gusto

Health Insurance Coverage In The United States Wikipedia

Health Insurance Coverage In The United States Wikipedia

Statutory Health Insurance Gkv Spitzenverband

Statutory Health Insurance Gkv Spitzenverband

Percentage Of Health Insurance Employers Pay Costs More

Percentage Of Health Insurance Employers Pay Costs More

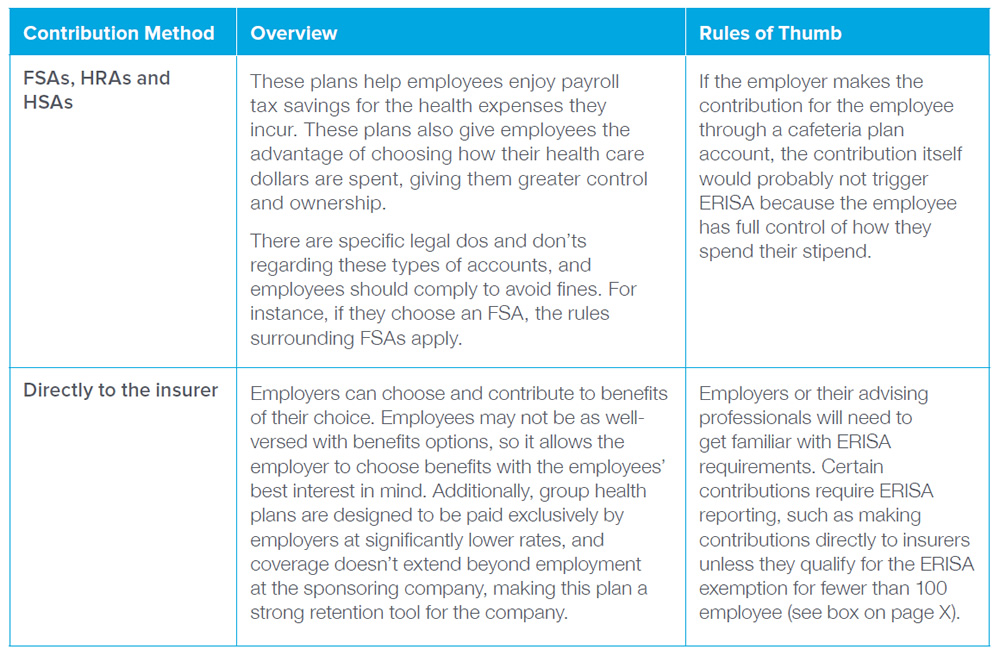

Faq Defined Contribution For Employee Health Care Benefits Advisories Aflac

Faq Defined Contribution For Employee Health Care Benefits Advisories Aflac

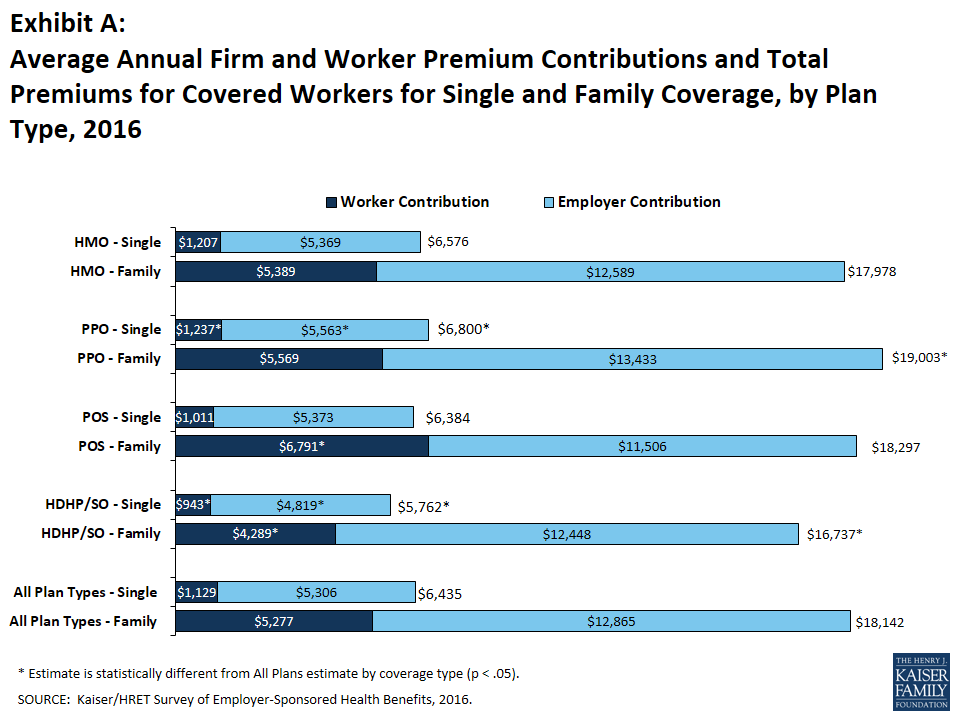

Ehbs 2016 Summary Of Findings 8905 Kff

Ehbs 2016 Summary Of Findings 8905 Kff

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Small Business Health Insurance Requirements 2021 Ehealth

Small Business Health Insurance Requirements 2021 Ehealth

Comments

Post a Comment