Featured

How Much Does Cobra Cost In Ca

Cobra is usually ridiculously expensive. The average annual employer-sponsored health insurance costs for family coverage is more than 22000.

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Forget that most people eligible for Cobra are losing group health coverage or starting their own business.

:max_bytes(150000):strip_icc()/173426447-KLH49-E-GettyImages-56a46e695f9b58b7d0d6f605.jpg)

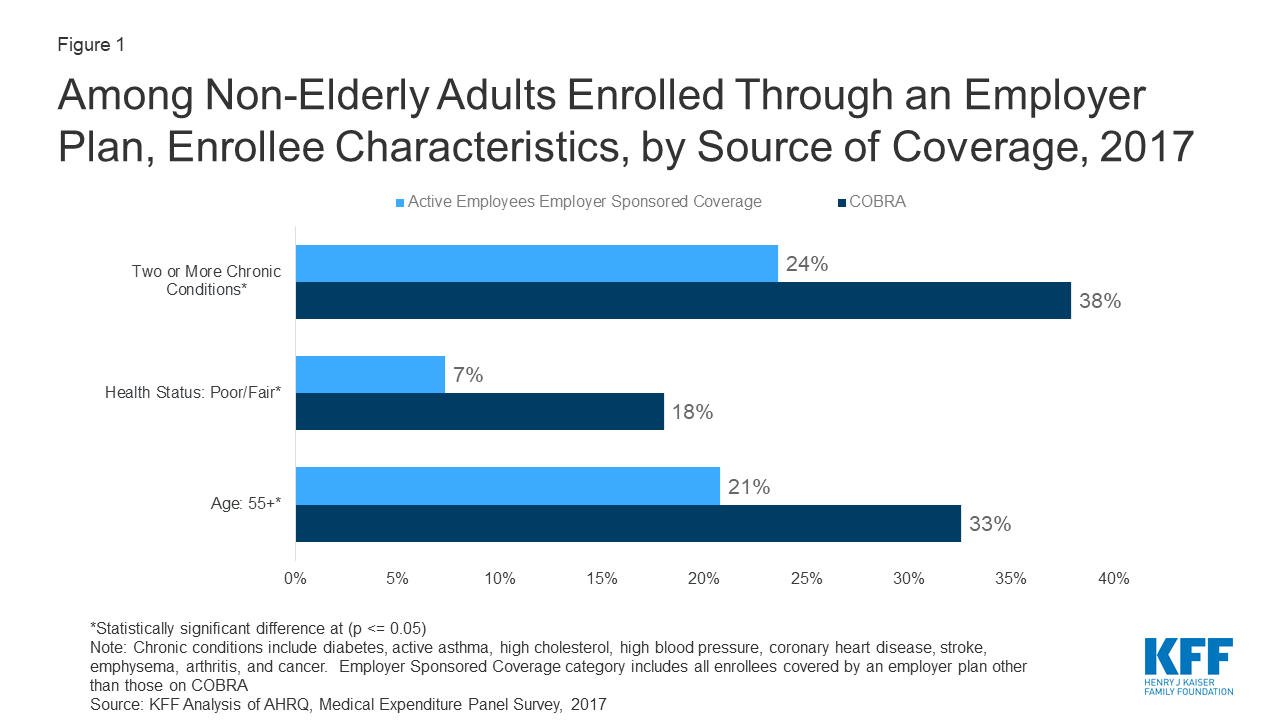

How much does cobra cost in ca. Therefore the COBRA insurance can be expensive to continue but there are a lot of available options in the insurance market to choose from. If a qualified beneficiary elects COBRA coverage they will be responsible for 100 percent of the total premium plus a 2 percent administration fee which they will pay monthly to the plan carrier or its designee. Its not unusual to see Cobra coverage running 1500-2K for a family of 4.

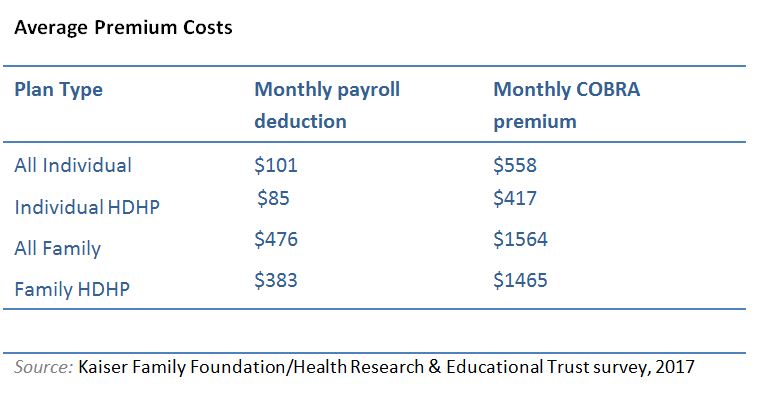

How much does COBRA cost. Under COBRA you may have to pay up to 102 of your group health plan premium including employee and employer costs plus 2 for. Employees paid on average about 5600 for that coverage.

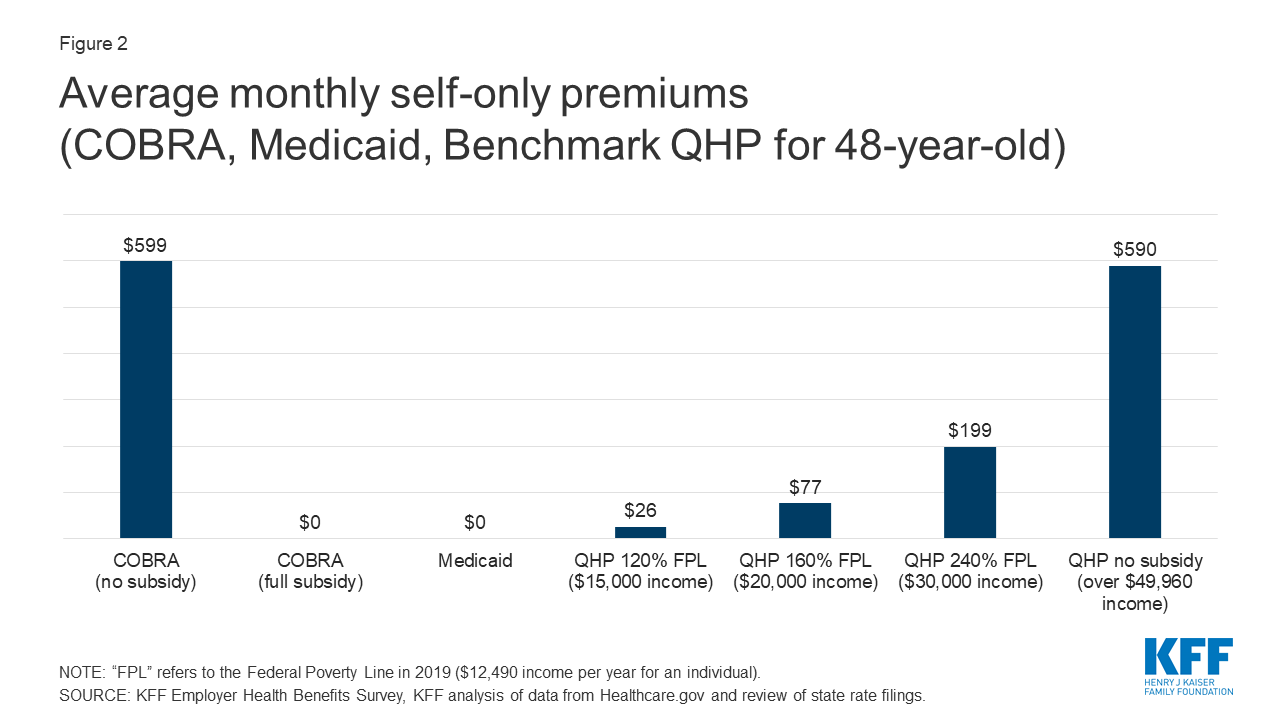

How much will you have to pay. CalCOBRA provides the same protection as COBRA in California for small employers with 2 to 19 workers. How much does COBRA cost.

How much is the monthly COBRA premium. Kaiser California Low Option COBRA COBRA Disability Associate only 49825 73272 Associate spousepartner 119581 175854 Associate children 74738 109910 Associate family 144494 212492 Your rates for coverage are monthly Kaiser California High Option COBRA COBRA Disability Associate only 54262 79797. COBRA requires you to pay 100 of the health insurance costs plus up to 2 adminstrative fee.

Once you have qualified for a COBRA health insurance coverage you may be required to pay up to 102 percent of the premiums from your own pocket. A qualified beneficiary is required to pay no more than 110 percent of the applicable rate charged for a covered employee or in the case of dependent coverage no more than 110 percent of the applicable rate charged to a. Lets say your monthly premium is around 10 then you pay 1020 per month for the COBRA coverage.

The price is based on your estimated income for the coverage year your ZIP code your household size and your age. Employers are required to notify you when you are eligible for these benefits. COBRA regulations allow employers to charge you up to 102 percent of the cost of coverage.

Without employer contributions the COBRA insurance cost for the same plan may cost families the entire 20000. According to a study from the Kaiser Family Foundation the average cost for employees with employer-sponsored family health coverage was around 6000 despite the overall cost of these plans averaging around 20000. How much COBRA costs varies by how much the plan costs the employer.

The additional two percent is the administration fee. It may also be available to people who have exhausted their Federal COBRA. Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees.

The plan carrier or its designee is not required to send a monthly bill. The monthly COBRA insurance costs depend on what a particular health insurance plan costs. Cal-COBRA is a California Law that lets you keep your group health plan when your job ends or your hours are cut.

That is because your employer no longer covers part of the cost. You no longer get any help from your former employer. When is the premium due.

Low Option California Your monthly cost COBRA COBRA Disability Associate only 54263 79799 Associate spousepartner 130221 191502 Associate children 81388 119688 Associate family 157348 231395 Kaiser California High Option North and South Your monthly cost COBRA COBRA Disability Associate only 55765 82008. Call Kent 713-703-0674 or Frank 281-855-4444 See this link for the. Calculate the total monthly cost of your health coverage.

Look for this percentage in the election notice. This makes no sense in most cases. The plan or its designee is not required to send a monthly bill.

If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance. Kaiser Family Foundation estimated that the average annual premium for employer-sponsored health insurance family coverage was more than 21000 in 2020. If COBRA is elected the cost for coverage is 100 of the total premium plus a 2 administration fee which is paid monthly by the enrollee to the plan or its designee.

Most companies pay the majority of their employees health plan premiums and the rest is deducted from your paycheck. 1967 Cobra Kit Car Built by Johnex in Brampton Ontario. Cost of coverage includes the amount you contribute the cost to the employer and an additional 2 percent as an administrative fee.

The department does not pay a share of the COBRA premium. Fun Fast Well-Built car. Under a private insurance company the average employer-sponsored coverage is around 1137 per month for family coverage and 410 per month for an individual coverage which is according to the report provided by the.

On average workers contribute 20 of the premium for individual coverage and 30 for family coverage. Small Employer 2 to 19 employees. COBRA continuation coverage is often more costly than what you paid as an active employee.

If you elect to receive COBRA benefits you will pay 100 of the total premium for your benefits plus a 2 administrative fee.

/GettyImages-478439270-ac3965e5103b400aab53ef30a4dfe8b4.jpg) How Much Does Cobra Health Insurance Cost

How Much Does Cobra Health Insurance Cost

Is Cobra Dead An Employee S View Of Cobra Cost

Is Cobra Dead An Employee S View Of Cobra Cost

How Long Does Cobra Insurance Last In California

How Long Does Cobra Insurance Last In California

Best Cheap Health Insurance In California 2021 Valuepenguin

.png) How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

Key Issues Related To Cobra Subsidies Kff

Key Issues Related To Cobra Subsidies Kff

What Is Cobra Insurance Ramseysolutions Com

What Is Cobra Insurance Ramseysolutions Com

:max_bytes(150000):strip_icc()/173426447-KLH49-E-GettyImages-56a46e695f9b58b7d0d6f605.jpg) How Much Does Cobra Health Insurance Cost

How Much Does Cobra Health Insurance Cost

Cobra Is Free For Six Months Under The Covid Relief Bill Los Angeles Times

Cobra Is Free For Six Months Under The Covid Relief Bill Los Angeles Times

What You Need To Know About Short Term Health Insurance

What You Need To Know About Short Term Health Insurance

Cobra Health Insurance Was Right For My Family But Cost A Fortune

Key Issues Related To Cobra Subsidies Kff

Key Issues Related To Cobra Subsidies Kff

Cobra Insurance Everything You Need To Know

Cobra Insurance Everything You Need To Know

Comments

Post a Comment