Featured

Insurance Pay For Breast Reduction

The insurance companies want to see that you are having symptoms due to the size of your breasts. The estimated percent of women who would choose to a breast reduction if it were paid for is upwards of 20 to 30.

Will Insurance Cover Breast Reduction Surgery Allina Health

Will Insurance Cover Breast Reduction Surgery Allina Health

The payments made to the chiropractor.

Insurance pay for breast reduction. Fortunately the women of America came out on top thanks to Congress. However patients must meet a number of criteria before their insurance will pay for this surgery. Estimated weight of tissue to be removed from each breast which often ranges from 300 to 800 grams per breast.

The average cost is 6000-plus according to plastic surgery organizations But the woman my mother told me about had the surgery and loved it and her insurance paid for it. Having children can take a toll on womens bodies leaving them with unwanted sagging or deflated breasts excess skin pockets of fat on their tummy and reduced. Unfortunately large breasts alone without symptoms are not enough.

It is important that you look closely at your particular insurance. You can make Aetna pay for your breast reduction surgery as long as you meet the Aetnas requirements set under in CPB Clinical Policy Bulletin 0017 for Breast Reduction Surgery and Gynecomastia Surgery. Make sure you know up front any fees associated with having your insurance.

For example some insurance policies will pay 100 percent of the breast surgery. Breast reduction is one of the most popular procedures that plastic surgeons do and typically breast reduction patients are very happy with their results. Youll need to get your breast.

The condition is not life threatening. When Will Insurance Pay for a Breast Reduction. Whenever a treatment like a breast reduction is deemed medically necessary there is the potential that insurance will cover it.

Insurance companies will typically refuse to pay for any purely cosmetic surgery. Plastic and Reconstructive Surgerys recent research showed that insurance carriers breast reduction standards are not necessarily in line with medical science and professional opinions. Some insurance companies will pay up to 80 percent and require you to pay 20 percent.

If the end result is. Prices will be different but the national average for a breast reduction procedure itself not including hospital stays or anesthesia costs is around 7000 - 8000 out-of-pocket before insurance is applied. That is the case for some of the patients we see here in North Texas.

After pregnancy childbirth and breastfeeding many women are looking for ways to return their body to a pre-baby appearance. A plastic surgeon who performs breast reduction surgery on a regular basis will work diligently with you to get your insurance company to cover the procedure. Even though health insurance doesnt typically cover cosmetic plastic surgery unless to repair the body after an injury or accident reconstruction surgery for breast cancer treatment or fix a birth defect -- in some cases breast reduction surgery can be added to this list.

The good news is there are several options when it comes to paying for your breast reduction. Criteria commonly used to evaluate coverage include. So the good news is that in some or most cases breast reduction surgery may be covered by your health insurance.

Find out ahead of time what types of payments you will have to make in order to get your insurance company to cover the cost of a breast reduction. Again that price may be different based on your coverage level and out-of-pocket maximum. As long as your insurance company receives all of the medical necessity and pre operative information regarding your.

It is common for health insurance companies to individually review cases and use established criteria in determining whether or not to cover a breast reduction surgery. While the process can vary depending on the insurance provider patients interested in having breast reconstruction surgery covered by their insurance will typically have to furnish their insurance provider with a letter of medical necessity which states that procedure is required in order to resolve an underlying health problem. Do not throw away receipts from your chiropractor More often than not the excess weight in the breast region causes a lot of stress on the back and the neck region.

Getting an Answer from Your Insurance Company. Some insurance companies wont cover breast reduction unless the surgeon plans to remove at least 500 grams more than one pound of breast tissue on both sides even though studies have shown that the amount of tissue removed is unrelated to relief of symptoms. Patients who meet the insurance guidelines necessary to get approved for a breast reduction can expect to experience specialist consultations lab tests and photographs of their breasts that will be submitted to the insurance company for review.

Rarely will an insurance company pay for a cosmetic procedure. Medicare will pay for breast reduction in the case of hypertrophy as long as your doctor states that it is the primary cause of your pain or other symptoms. It is one of the few plastic surgery procedures that is covered by insurance.

As a result most women visit a licensed chiropractor to seek relief from pain caused by this stress. But getting it covered is not always as straightforward as it sounds. Insurance companies dont want to have to pay for a procedure that 20-30 of women might actually ask for were it offered.

Breast reductions can be covered under insurance if certain criteria have been met. Hence the patient needs to show valid medical reasons for opting for breast reduction surgery. Some of these can include upper back shoulder and neck pain rashes under the breasts and grooves on the shoulders due to your bra.

Will Medicare Cover Breast Reduction Surgery Coco Ruby Plastic Surgery

Will Medicare Cover Breast Reduction Surgery Coco Ruby Plastic Surgery

Will Insurance Cover My Breast Reduction Guilford Breast Reduction The Langdon Center

Will Insurance Cover My Breast Reduction Guilford Breast Reduction The Langdon Center

How To Get Breast Reduction Surgery Covered By Your Insurance Aesthetica Blog

How To Get Breast Reduction Surgery Covered By Your Insurance Aesthetica Blog

I M Getting A Breast Reduction How To Get The Process Started With Insurance Coverage Life She Has

I M Getting A Breast Reduction How To Get The Process Started With Insurance Coverage Life She Has

Breast Reduction And Insurance Coverage Aristocrat Plastic Surgery

Breast Reduction And Insurance Coverage Aristocrat Plastic Surgery

Is Breast Reduction Covered By Health Insurance Asps

Is Breast Reduction Covered By Health Insurance Asps

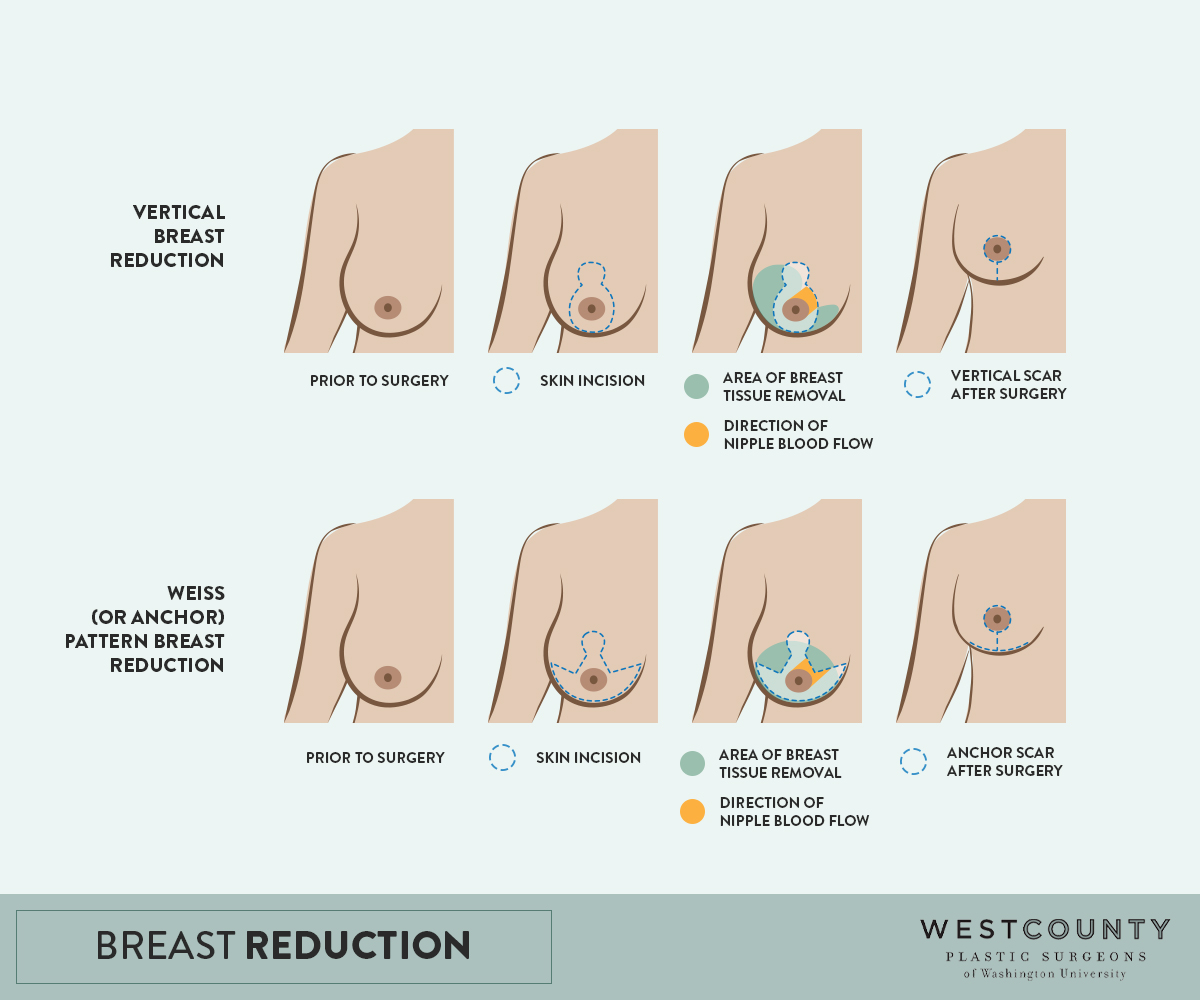

Breast Reduction In St Louis Missouri West County Plastic Surgeons

Breast Reduction In St Louis Missouri West County Plastic Surgeons

Breast Reduction Are You A Candidate Cost Recovery Etc

Breast Reduction Are You A Candidate Cost Recovery Etc

Breast Reduction Insurance Will My Surgery Be Covered

Breast Reduction Insurance Will My Surgery Be Covered

What Makes Breast Reduction Medically Necessary Andres Taleisnik Md

What Makes Breast Reduction Medically Necessary Andres Taleisnik Md

Breast Reduction My Insurance Will Pay For That Dr Michaels Blog

Breast Reduction My Insurance Will Pay For That Dr Michaels Blog

Is Breast Reduction Covered By Insurance Dr Scot Glasberg

Is Breast Reduction Covered By Insurance Dr Scot Glasberg

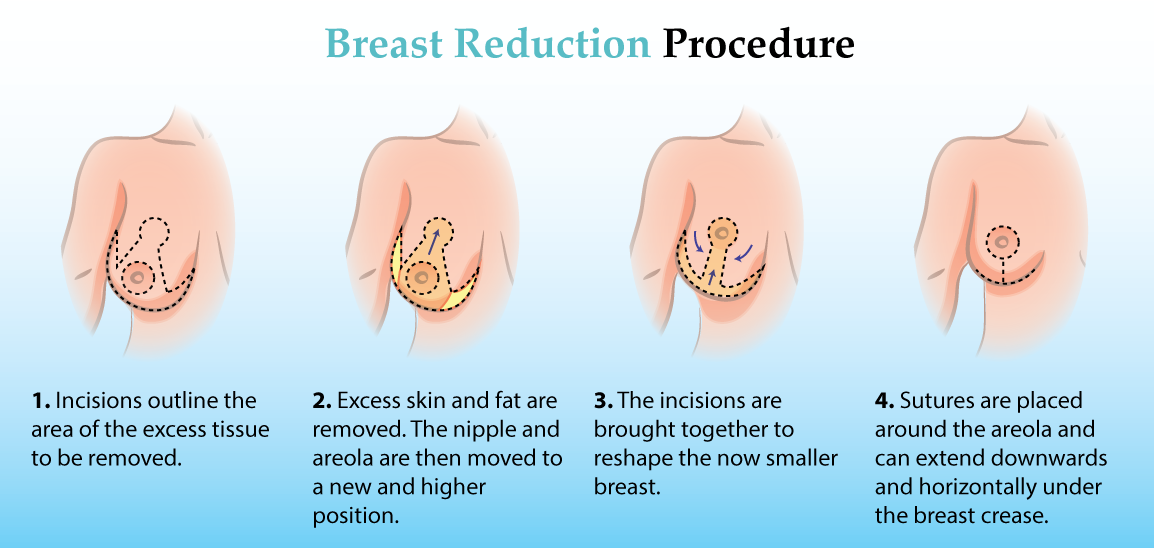

Breast Reduction Faqs Washington University Physician

Breast Reduction Faqs Washington University Physician

Comments

Post a Comment