Featured

- Get link

- X

- Other Apps

California Hsa Tax 2020

But dont forget these numbers include employer contributions. Those district tax rates range from 010 to 100.

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

California and New Jersey are the two states that do not offer tax-free contributions at the state level while all states are exempt from federal government taxes on HSA contributions.

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

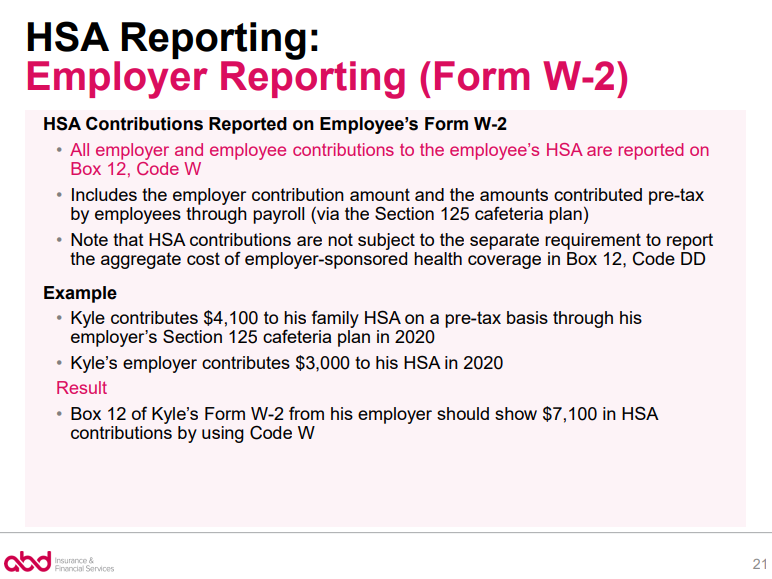

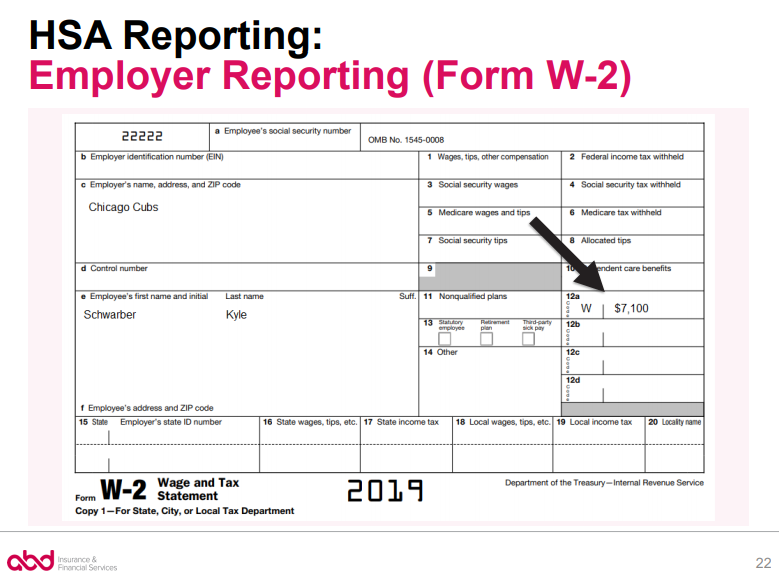

California hsa tax 2020. For families that number goes up to 7100. For example suppose you earned 50k in California 47k plus 3k HSA contributions in Minnesota and the California income tax. Employer contributions to your Health Savings Account are reported on Form W-2 Wage and Tax Statement Box 12 with a code W An amount entered here will flow to Line 7 Column C of California Schedule CA.

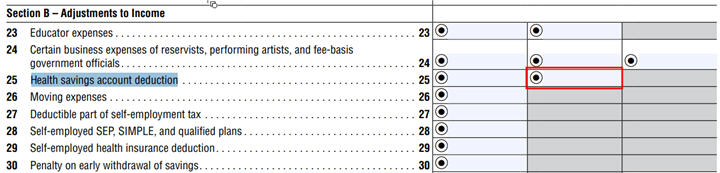

Federal law allows taxpayers a deduction for contributions to an HSA account. California tax return forms are available on the California tax forms page or the California Department of Revenue. However distributions made from an HSA that are used for non-qualified medical expenses are includible in gross income and are subject to an additional tax of 20 percent.

The contribution for any particular tax year can be made as late as April 15th of the following year. California Senate Bill 173 introduced by state Senator Maldonado would generally make the California tax treatment of Health Savings Accounts similar to IRAs. Now because the HSA contributions are earned outside of California you are not really taxed on them.

Distributions from an HSA for qualified medical expenses are not includible in gross income. As of the 2005 tax year six statesAlabama California Maine New Jersey Pennsylvania and Wisconsindid not exempt HSA dollars from state taxes. You first calculate your California state income tax with income from both MN and CA including the HSA contributions because California sees it as part of your total income.

But currently besides California and New Jersey Alabama. However the employee and employer HSA contributions are standard taxable compensation for California state income tax purposes subject to state withholding and payroll taxes. Some areas may have more than one district tax in effect.

Contributions made on behalf of an eligible individual by an employer are excluded from W-2 wages. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The top individual income tax rate in California is 123 on annual incomes over 599012 for single taxpayers and married or RDP taxpayers who file separate returns.

Therefore California by default adds the total amount of the HSA contribution back to the federal income on the assumption that you were a California. 3550 an increase of 50 from 2019 Family. The maximum the IRS allows one to deposit into an HSA account each year is not related to the calendar year HSA-compatible health plan deductible.

Giving HSAs tax favored status in California would help assist small employers and families to lower the. 2020 HSA contribution limit. See Form W-2 - Entering in Program.

7100 an increase of 100 from 2019 Catch-up contributions for those age 55 and older remains at 1000. Eligible individuals can make a tax-deductible contribution of 3450 for individual plans 6900 for a family plan and those over fifty-five years of age can add an additional 1000. However California does not permit this deduction.

Because a tax-free rollover from an MSA to an HSA is unavailable under California law any distribution from an MSA that is rolled into an HSA must be added to AGI on the taxpayers California return. But lets take what we can get. In 2019 the annual contribution limit for self-only coverage is 3500 and 3550 for 2020.

The rules are different for the IRS and for the Franchise Tax Board. If youre 55 and older and not enrolled in Medicare you can also make an annual catch-up contribution of 1000. The statewide tax rate is 725.

In 2020 the maximum annual contribution an individual can make to an HSA is 3550. The tax helps to fund the states behavioral health system. The amount is then added to the income total on Line 16 of California Form 540.

Before the official 2021 California income tax brackets are released the brackets used on. Thats 50 whole big ones more than 2019. In 2020 the maximum annual HSA contribution you can make as an individual is 3550.

For family coverage two or more people the 2019 annual HSA limit is 7000 and 7100 in 2020. Sellers are required to report and pay the applicable district taxes for. And the distribution is subject to the MSA 125 percent.

The limits are as follows. For families in 2020 that number is 7100. As such a California tax payer who rolls over an MSA distribution into an HSA must add the amount to AGI on the California tax return.

You will need to manually adjust the California income account for the fact that both your employer and TurboTax made the add-back. The state has a total of nine tax brackets as of the 2020 tax year. The undersigned certify that as of June 28 2019 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content.

The California tax brackets on this page were last updated from the California Franchise Tax Board in 2020. The federal tax return permits contributions to an HSA to be deducted from federal income tax up to a limit. Jackies employee and employer HSA contributions through payroll are pre-tax and tax-free respectively for federal income tax purposes.

Lets take a look at how it works. Please contact us if any of our California tax data is incorrect or out of date. Then you multiply it by the percentage of your California income over your total income.

California Department of Tax and Fee Administration. HSAs are confusing as is but in California they can be even more complex. Health Savings Account HSA Contributions Differences Between Federal and California Law Contributions.

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

Form 8889 Instructions Information On The Hsa Tax Form

Form 8889 Instructions Information On The Hsa Tax Form

Tax Treatment Of Health Savings Accounts Hsa 2020

Tax Treatment Of Health Savings Accounts Hsa 2020

Tax Treatment Of Health Savings Accounts Hsa 2020

Tax Treatment Of Health Savings Accounts Hsa 2020

Hsa Form W 2 Reporting Abd Insurance Financial Services

Hsa Form W 2 Reporting Abd Insurance Financial Services

Hsa Form W 2 Reporting Abd Insurance Financial Services

Hsa Form W 2 Reporting Abd Insurance Financial Services

Why Do California And New Jersey Tax Hsas Impersonal Finances

Why Do California And New Jersey Tax Hsas Impersonal Finances

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa Definition

Irs Releases Hsa Contribution Limits For 2020 Primepay

Irs Releases Hsa Contribution Limits For 2020 Primepay

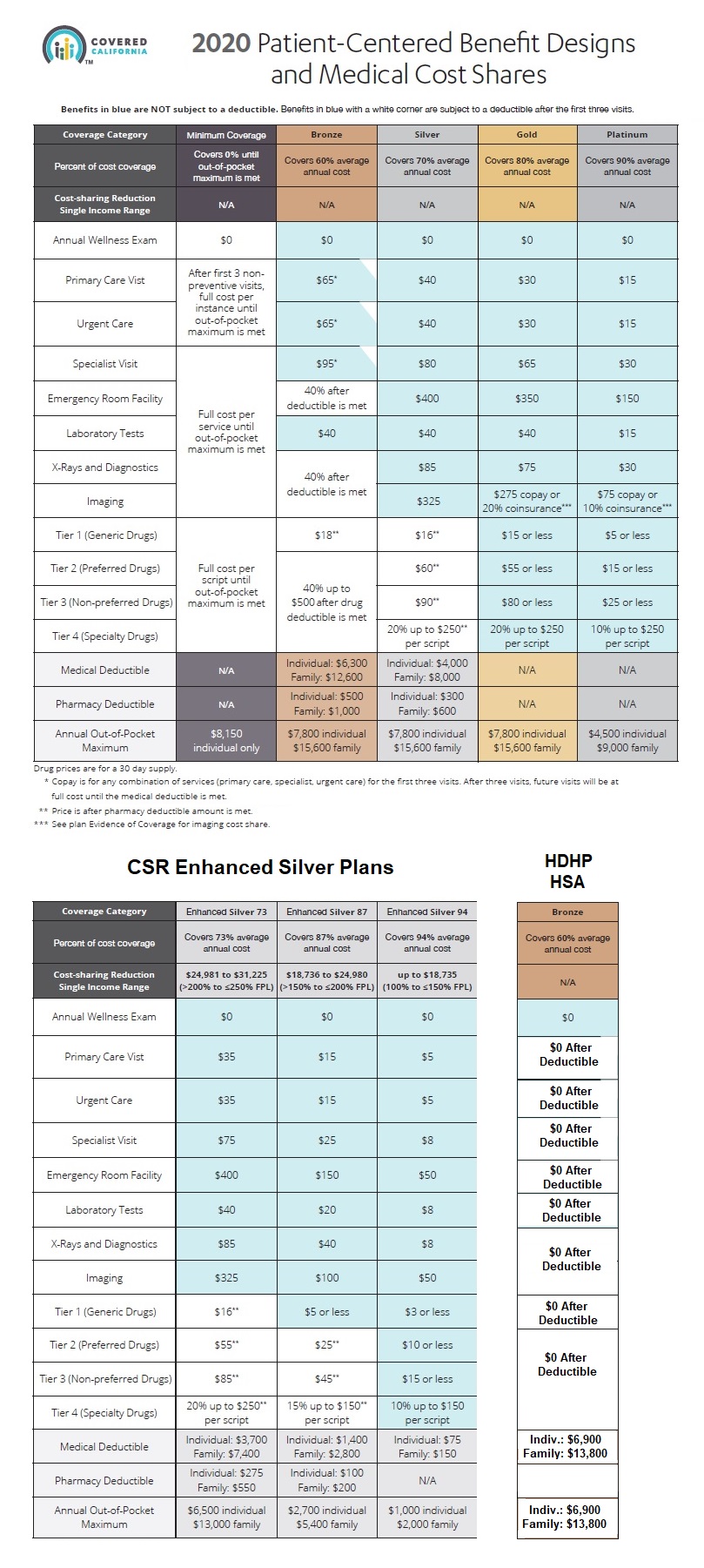

Covered California Plan Summaries Imk

Covered California Plan Summaries Imk

What Is The California State Tax Rate For 2020

What Is The California State Tax Rate For 2020

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

Comments

Post a Comment