Featured

- Get link

- X

- Other Apps

Fein Number California

Once you have registered your business with the EDD you will be issued an eight-digit employer payroll tax account number example. While there are several factors that go into your businesss standing with the government one of the most important and easiest to remedy is ensuring that you have your employer identification number EIN also known as a federal employer identification number FEIN and can accurately supply it while you are filing your taxes.

Https Edd Ca Gov Payroll Taxes Cbt Payroll Tax Account Number Payrolltaxaccountnumber Pdf

To speak to our Corporate and Enterprise Sales Team.

Fein number california. It is the equivalent of a social security number for businesses. An Employer Identification Number is also known as a Federal Tax ID Number and it is used to identify business entities. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number.

EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. A FEIN number is also used in a companys dealings with its insurance carrier. A sales tax number is issued by your state and is different from an EIN Number.

It is one of the corporates which submit 10-K filings with the SEC. The employer identification number EIN for Uber Technologies Inc is 452647441. Generally businesses need an EIN.

You may apply for an EIN in various ways and. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. What Is a FEIN Number.

You can apply for a sales tax number directly with your secretary of state. Citizens have a Social Security number SSN. 916 653-6814 Social Media Facebook.

It is one of the corporates which submit 10-K filings with the SEC. Generally businesses need an EIN. Alex Padilla California Secretary of State 1500 11th Street Sacramento California 95814 Office.

Though it is known as an employer identification number you do not need to have employees in order to get an EIN. Federal Tax ID Number Search Experts. EIN Employer Identification Number An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

916 653-6814 Social Media Facebook. Also known as a State Employer Identification Number or SEIN it functions much like an EIN or Employer Identification Number does at the national level identifying your company to the IRS like a. You may apply for an EIN in various ways and now you may apply online.

Generally businesses need an EIN. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. Businesses on the other hand are assigned federal employer ID numbers for identification purposes.

Alex Padilla California Secretary of State 1500 11th Street Sacramento California 95814 Office. There is a free service offered by the Internal Revenue Service and you can get your EIN immediately. As a business owner you need this nine-digit number to file tax returns apply for licenses and permits or open a bank account.

A California EIN or employer identification number is issued by the IRS to different business entities. This 9-digit number often called a tax ID number classifies a company for tax reporting and other business purposes. It is also known as a Federal Tax ID Number or Tax ID Number TIN.

In the United States the government requires businesses to have a Federal Employer Identification Number FEIN. You may apply for an EIN in various ways and now you may apply online. What Is a Fein Number in Insurance.

An EIN Number stands for Employer Identification Number and it will be issued by the IRS to your California LLC. Your employer payroll tax account number is required for all EDD interactions to ensure your account is accurate. State ID number California refers to the number that will be assigned to your company in California to identify your company for tax purposes in the state.

000-0000-0 also known as a State Employer Identification Number SEIN or state ID number. The employer identification number EIN for Maplebear Inc. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

Is a corporation in San Francisco California. It helps the IRS identify your business for tax and filing purposes. Uber Technologies Inc is a corporation in San Francisco California.

An EIN is to your California LLC what a Social Security Number is to a person.

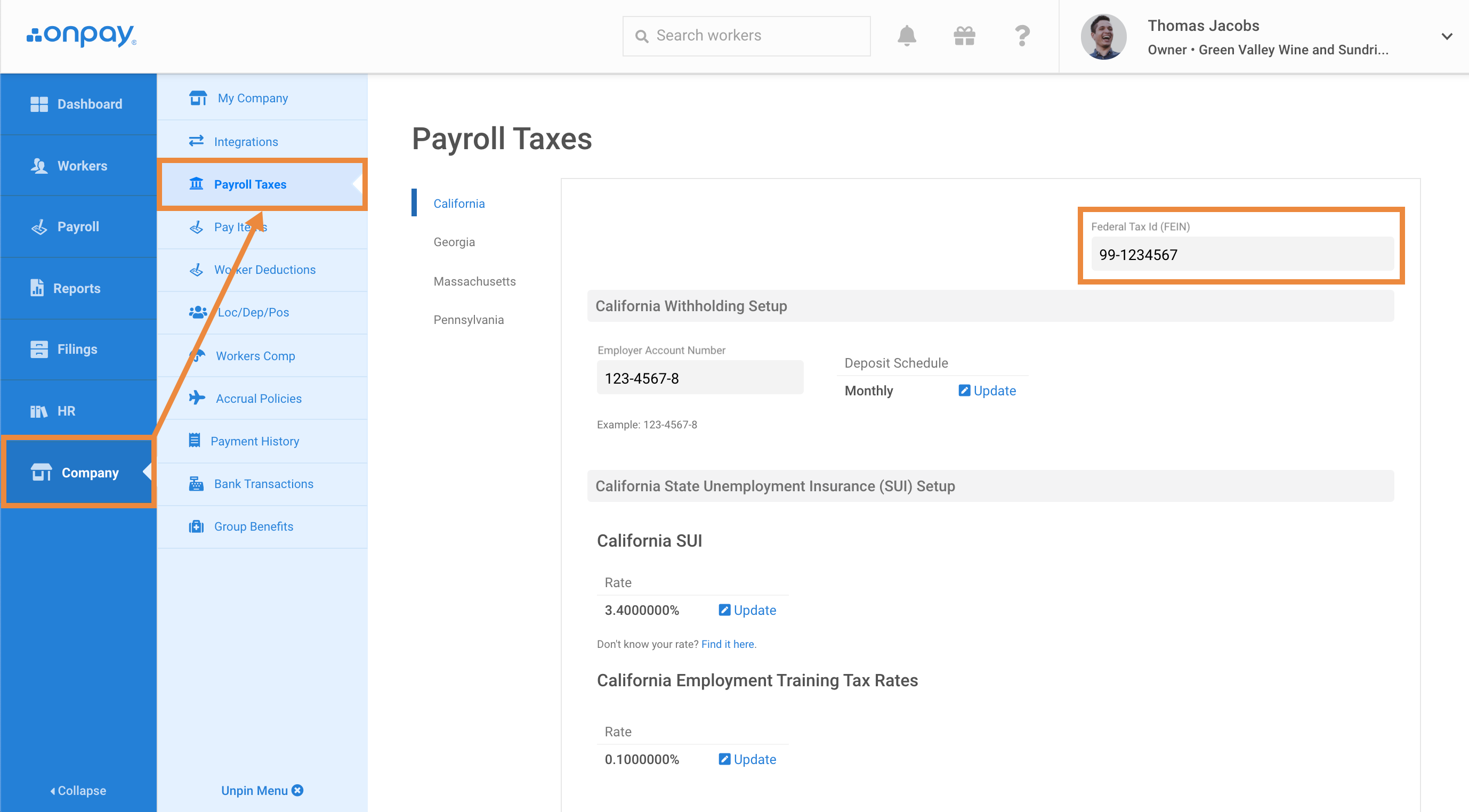

About Your Federal Employer Id Number Fein Help Center

About Your Federal Employer Id Number Fein Help Center

How To Apply For An Ein For Your Llc Online Step By Step Llc University

How To Apply For An Ein For Your Llc Online Step By Step Llc University

Tax Id Number Apply Online Federal Ein Application Com

Tax Id Number Apply Online Federal Ein Application Com

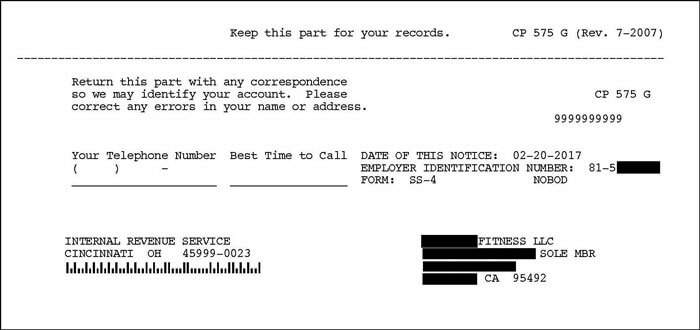

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Https Www Documents Dgs Ca Gov Sam Samprint New Sam Master Sam 20revision 20folders Rev428 Chap8400 8422 190 Pdf

How To Get My Employers Tax Id Number Quora

How To Register For A Sales Tax Permit In California Taxvalet

How To Register For A Sales Tax Permit In California Taxvalet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

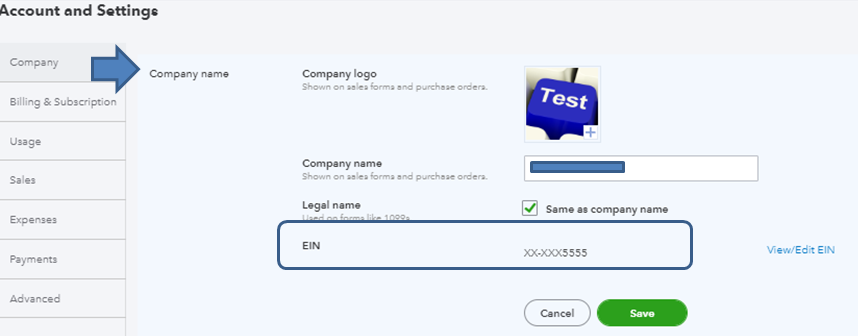

Where Can I Find A Business Fein Number

Where Can I Find A Business Fein Number

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

4 Ways To Find A Federal Tax Id Number Wikihow

4 Ways To Find A Federal Tax Id Number Wikihow

Comments

Post a Comment