Featured

Income To Qualify For Obamacare Subsidy

This repayment waiver applies only to 2020. 23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520.

Income to qualify for obamacare subsidy. For some the savings could be significant. Supplemental Security Income child support food stamps Temporary Assistance for Needy Families TANF gifts workers compensation Veterans disability payments cash withdrawals from savings qualified withdrawals from Roth IRAs or proceeds from loans like student loans home equity loans or bank loans. Qualified lottery winnings and lump-sum income including inheritances tax refunds etc is only counted in the month its received if its less than 80000.

Cost Share Reduction Tier 1 limit. Premium subsidy eligibility on the other hand is based on annual income. The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019.

Generally speaking if you qualify for subsidies you will pay somewhere between 2 and 95 of your income toward your health insurance premiums no more. Please note that in states that expanded. You can be worth millions of dollars and still receive Obamacare subsidies if your income is below 45000 per individual or 95000 for a family of four for example.

If you made only tax-deductible contributions all of it is considered income. Again subsidies have increased for 2021 and will remain larger in 2022 due to the American Rescue Plan. You are currently living in the United States You are a US citizen or legal resident You are not currently incarcerated Your income is no more than 400 of the federal poverty level.

20 Zeilen Marketplace savings are based on your expected household income for the year you want. If you estimated your income at 30000 when you enrolled for 2020 and your income turned out to be 300000 maybe from trading GameStop or crypto you will still keep 100 of the subsidy as if your income was 30000. You can check the federal poverty level guidelines each year to figure out what the minimum income level is.

The Obamacare subsidy will come in. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan.

For a household of two its 68960 in annual income note that this is based on the 2020 poverty level numbers as the prior years amounts are always used but are compared with the enrollees current income. Including the right people in your household. Theres no income limit for this waiver of subsidy repayment.

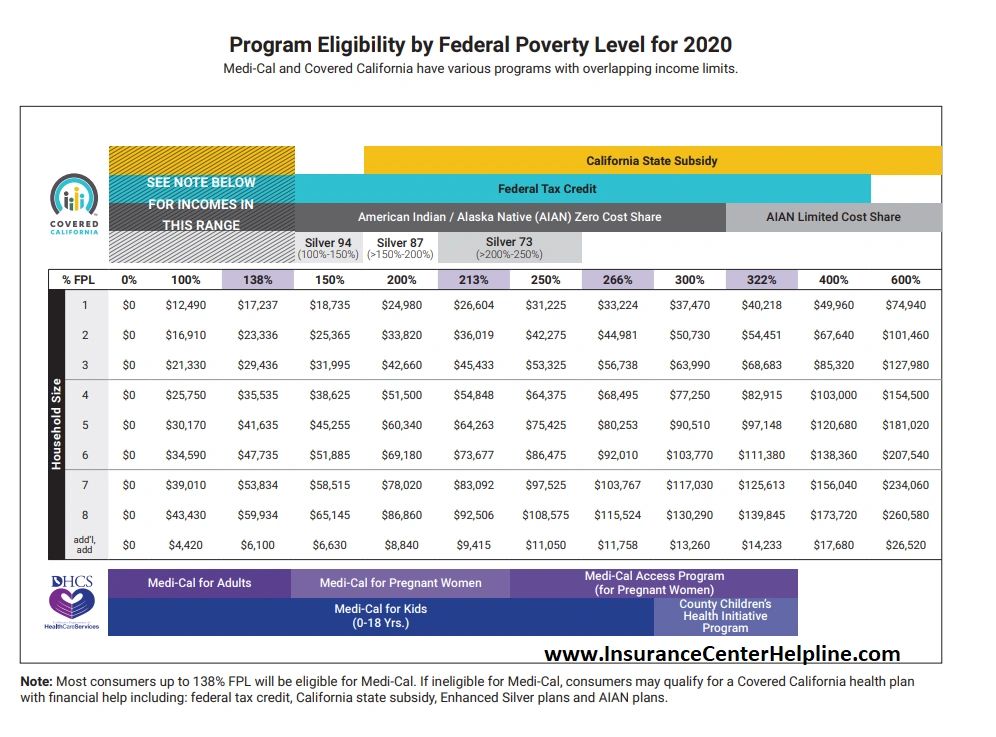

If you made non-deductible contributions see IRS Form 8606 Do Roth IRA distributions count as income for Obamacare. Learn more about who to include in your household. The chart below provides the qualifying income ranges in 2021 for the 48 contiguous.

Well make it easy. The dollar amount of this changes every year but for 2020 it is 12490 for an individual and 25750 for a family of four. But if their income is 58800 they qualify for a subsidy of 1327 per month in order to make contributions to an HSA theyll need to buy an HSA-qualified plan the cheapest of which is about 6month in premiums after the subsidy is applied.

Larger amounts are prorated over a longer timeframe Medicaid eligibility is based on monthly income. Withdrawals from a traditional IRA or SEP-IRA generally count as income. You need not include.

Obamacare subsidies work on a sliding scale and they make sure your monthly premiums are a fixed percentage of your annual income. A 64-year-old who earns 30000 for example would see monthly premiums drop to 85 from 195 for a. How do you know if you qualify for a premium subsidy on your ACA policy.

9 Zeilen Lowest eligible income 100 FPL. For a family of four applying for 2021 coverage 400 of the poverty level is 104800 in annual income. The minimum income for ObamaCare is 100 of the federal poverty level.

Uninsured Americans also qualify. Further in those states that have not expanded Medicaid those with household income of at least 100 percent of the federal poverty line qualify for a subsidy. The discount on your monthly health insurance payment is also known as a premium tax credit.

This tool provides a quick view of income levels that qualify for savings. To qualify for Obamacare subsidies you must meet the following criteria.

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Obamacare Subsidies Made Easy Healthtn Com

Obamacare Subsidies Made Easy Healthtn Com

What Is The Maximum Income To Qualify For Obamacare Subsidies

What Is The Maximum Income To Qualify For Obamacare Subsidies

Obamacare Health Insurance Income Requirements Il Health Insurance

Obamacare Health Insurance Income Requirements Il Health Insurance

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

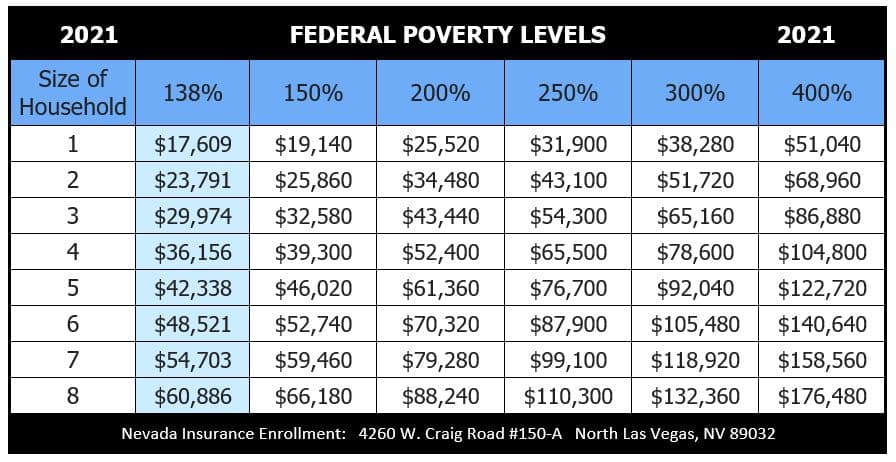

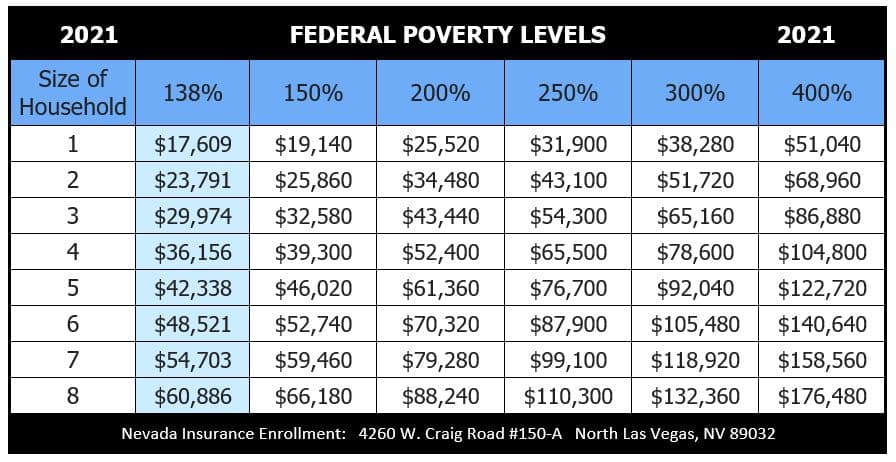

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Comments

Post a Comment