Featured

- Get link

- X

- Other Apps

How To Get My 1095 B Form Online

Click the green Start a new application or update an existing one button. Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095-B for state filing tax purposes.

Download all 1095-As shown on the screen.

How to get my 1095 b form online. You will need your ID card first please get your ID card at this link if you do not have it yet. If you did not receive your 1095-B form in the mail you can get your form either through the carrier portal or by calling the carrier and requesting a new form. For Medicaid this includes individuals whose coverage is through Local Departments of Social Services LDSS Human Resources Administration HRA or NY State of Health.

For those that previously received their Form 1095-B in the mail you can receive a copy of your Form 1095-B by going out to the Aetna Member Website in the Message Center under the Letters and Communications tab or by sending us a request at Aetna PO BOX 981206 El Paso TX 79998-1206. Data Entry Accounting CS. Consumers enrolled in Medicaid Child Health Plus and Essential Plan EP may request a copy of Form 1095-B from the NYS Department of Health.

Contact Your Insurer Directly Theres only one place where you can get a copy of your 1095 tax form. You can find the name of the health care provider in Part III of the Form 1095-B. Under Your Existing Applications select your 2020 application not your 2021 application.

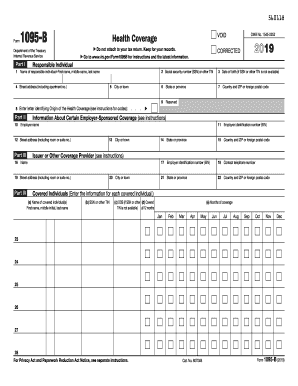

Under the Tax Cuts and Jobs Act the amount of the individual shared responsibility payment is reduced to zero for months beginning after December 31 2018. Carriers send 1095-B forms directly to enrollees so brokers do not have access to these forms. Select Tax Forms from the menu on the left.

If the taxpayer expects to receive Form 1095-A from the Marketplace you should wait to file the taxpayers Individual Income Tax Return until after Form 1095-A has been received. Form 1095-B is used by providers of minimum essential health coverage to file returns reporting information for. You just select the option that you had health insurance all year for 2016 and that is it.

To obtain your 1095-B form online from your Aetna Navigator Account please follow the instructions provided below. MassHealth members who still want a copy of their federal tax form can request a copy. This form shows the type of health coverage you have any dependents covered by your insurance policy and the dates of coverage for the tax year.

However it is informational only and the form is not needed to file your tax return. An easy way to get your 1095-B federal tax form from MassHealth. If you need a replacement IRS Form 1095-B call 1-800-MEDICARE.

Information to populate Form. Click your name in the top right and select My applications coverage from the dropdown. The Form 1095-B will report the months of MEC a Medi-Cal beneficiary received during the calendar year.

Simply complete the fields below to verify your identity and get access to your 1095-B federal tax form. Get screen-by-screen directions with pictures PDF or follow the steps below. SSISSP recipients can also request their Form 1095-B be sent to their named tax preparer through their local county human service agency.

Contact them directly ONLY your insurer will have access to it and can provide you with a copy. You should receive Form 1095-B from your employer. Can I have my Form 1095-B sent to my tax preparer.

You can just keep the Form 1095-B for your records. Qualifying Health Coverage Notice PDF 85KB PDF 466 KB Get this notice in Spanish PDF 105 KB PDF 290 KB. Get screen-by-screen directions with pictures PDF 306 KB.

Information about Form 1095-B Health Coverage including recent updates related forms and instructions on how to file. We will continue to provide the 1095-B form to members who live in the. Health Coverage is a tax form that is used to verify that you and any covered dependents have health insurance that qualifies as minimum essential coverage.

Forms 1095-B and 1095-C or other documentation used to determine healthcare coverage should not be attached to the return but should be kept for your records. Contact the health care provider if you have questions about the Form 1095-B they sent you. Copyright 2021 Deloitte.

Simply contact your county human service agency and they will be able to help you. A Form 1095-B is an IRS document that shows you had health insurance coverage considered Minimum Essential Coverage during the last tax year. As a result MassHealth will not mail the 1095-B tax form to members since it is no longer needed for tax filing.

Click here if you purchased your. Subscribers filing taxes in one of these states such as NJ or DC are encouraged to retain a copy of their 1095B for their state tax records. Beneficiaries should keep Form 1095-B for their records as proof they received health coverage during the tax year.

DHCS will send your MEC information to the IRS and beneficiaries are not required to provide Form 1095-B to the IRS if they chose to file their taxes. Log in to your HealthCaregov account. How to find Form 1095-A online.

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

1095 B Submit Your 1095 B Form Onlinefiletaxes Com

Where Do I Find My 1095 Tax Form Healthinsurance Org

Where Do I Find My 1095 Tax Form Healthinsurance Org

1095 B Forms Official Irs Version Zbp Forms

1095 B Forms Official Irs Version Zbp Forms

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

When Do I Get My 1095 B For Proof Of Health Insurance

When Do I Get My 1095 B For Proof Of Health Insurance

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Comments

Post a Comment