Featured

- Get link

- X

- Other Apps

California New Hire Forms

All California employers must report all of their new or rehired employees who work in California to the New Employee Registry within 20 days of their start-of-work date which is the first day of work. Taking the leap of hiring your first employee is exciting and naturally a little nerve-wracking especially because California employment law requires you to complete several steps before your new hires first day.

California New Hire Forms 2018 Elegant New Hire Forms 60c9e89db166 Greeklikeme Form Pa Excel Word Pd Models Form Ideas

California New Hire Forms 2018 Elegant New Hire Forms 60c9e89db166 Greeklikeme Form Pa Excel Word Pd Models Form Ideas

The W-4 form works as an alternative to the typical new hire reporting form.

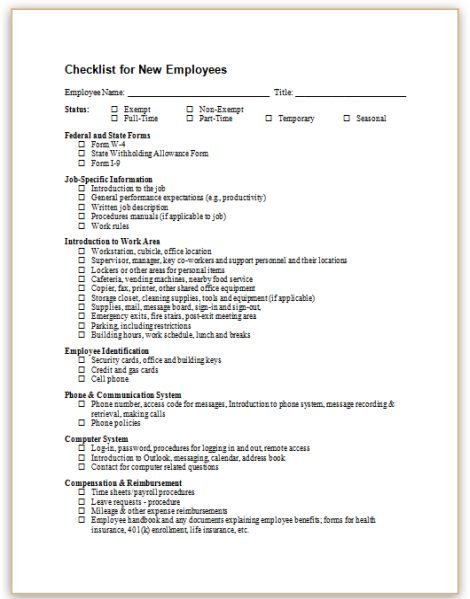

California new hire forms. Form Wage Theft Prevention Act. Any employee that is rehired after a separation of at least 60 consecutive days must also be reported within 20 days. Use this checklist when hiring a new employee to ensure that you have completed all legally required forms.

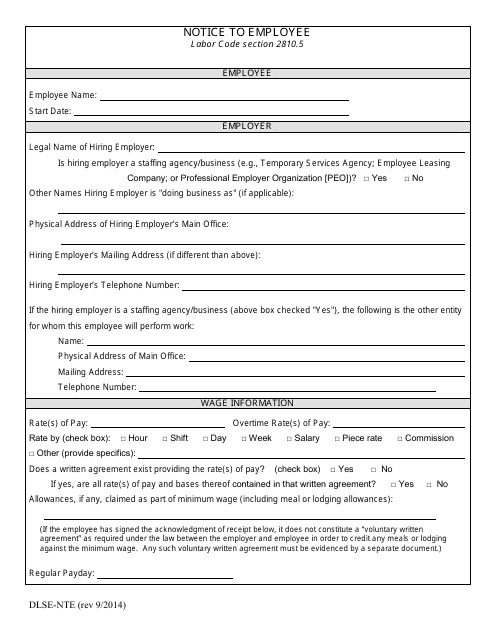

Wage and Employment Notice to Employees Labor Code section 28105 Form. Day-care or nursery school record. The New Employee Registry and Independent Contractor Reporting at 916-657-0529 call the Taxpayer Assistance Center at 888-745-3886 or visit your local Employment Tax Office which is listed in the California Employers Guide DE 44 and on our web page at wwweddcagovOffice_Locator.

Job Description Form - CalHR 651 Note. New Hire Checklist California. See Employee Withholding Forms.

The California Employment Development Department EDD requires employers to provide new hires with its own Disability Insurance Provisions pamphlet DE 2515 within five days of hire. Signed Job Offer Letter. The Department of Fair Employment and Housing DFEH requires California.

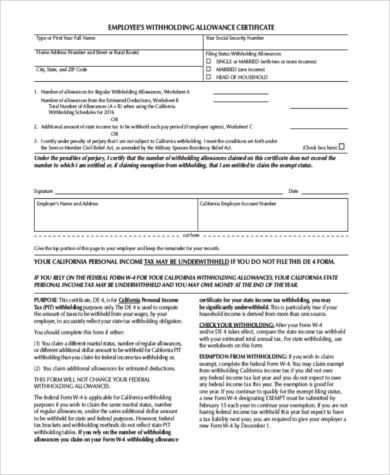

Included in each packet are the following items required items are in bold. To obtain additional DE 34 forms. California employers must provide new employees with both IRS Form W-4 and state Form DE 4 for California personal income tax PIT withholding.

Note that the State of California has made the DE 4 State Withholding Allowance Certificate mandatory it used to be optional. Use this form to give employees notice of their rights under the California Family Rights Act CFRA and to designate leave as CFRA to provide conditional approval of the request for CFRA leave if more information is necessary or to deny the request. Use Form I-9 for verifying the identity and employment authorization of individuals hired for employment in the United.

New Employee Forms for 2021. Group Legal Services Insurance Plan. A list of required forms is available in our Employee Orientation Checklist.

The EDDs Paid Family Leave Insurance pamphlet DE 2511 must also be given to employees upon hire. California has its own tax withholding form. Clinic doctor or hospital record.

State and federal law requires California employers to provide the following new hire documents to their employees at the time of hire. California law requires that new employees receive or complete a significant amount of paperwork specific to California at the time of hire. You will need to make sure to add the employees start-of-work date the Federal Employer Identification Number and the California employer payroll tax account number to the W-4 form.

The EDDs Paid Family Leave Insurance pamphlet DE 2511 must also be given to employees upon hire. Notice to Employee Labor Code section 28105 Spanish Vietnamese Available on the DLSE Publications page. Group Legal Enrollment Authorization Form 200550.

The new hire has signed the following forms. Sexual Harassment Pamphlet Form DFEH 185 or equivalent a. For your convenience we have assembled a complete packet of forms and pamphlets in a ready to use personnel file folder to use when hiring a new employee in California.

The California Employment Development Department EDD requires employers to provide new hires with its own Disability Insurance Provisions pamphlet DE 2515 within five days of hire. California New-Hire Forms 1. Provided at time of Orientation.

Employees filing an out-of-class grievance should complete a Job Description Form and submit it to their personnel office along with their grievance form. If you want hard copy forms for your new hires check out our New Hire Packets available for purchase in our store. Theres a lot to keep track of when making a new hire in California so you can use this checklist to help you as you hire new employees.

Group Legal Other Enrollment Authorization Form 200635. Provide required forms and pamphlets. Latest draft released 12020 3.

File New Employee s. School record or report card. Provide new hire with employee handbook and obtain signed acknowledgment of receipt.

I-9 Form and Supporting Documents. CFRA Sample Policy - 50 or More Employees. California has its own tax withholding form.

Required Employment Forms in California for new hires. New hire checklist for California employers 1. Employers who report electronically must submit two files each month that are not less than.

Latest draft released 32019 2. If youve taken care of all these forms and the I-9 identification - you should be all set to hire. Employees must complete Form W-4.

We hope this guide helped you find all the information you need about new hire forms. Making sure you apply for an Employer Identification Number and preparing for payroll taxes should be some of the first steps. Purchase this form through the CalChamber Store.

Https Www Edd Ca Gov Pdf Pub Ctr De1296nbae Pdf

Dlse Form Dlse Nte Download Printable Pdf Or Fill Online Notice To Employee California Templateroller

Dlse Form Dlse Nte Download Printable Pdf Or Fill Online Notice To Employee California Templateroller

California Required Forms Pamphlets For New Hires Berry Fritzinger Law P C

California Required Forms Pamphlets For New Hires Berry Fritzinger Law P C

California New Hire Forms 2018 Unique Employee New Hire Form Template Yun56 Co Forms Michigan Models Form Ideas

California New Hire Forms 2018 Unique Employee New Hire Form Template Yun56 Co Forms Michigan Models Form Ideas

Elegant California New Hire Forms 2018 Models Form Ideas

Elegant California New Hire Forms 2018 Models Form Ideas

Us I9 Form 2018 Brilliant New Hire Employee Details Form Template Sample Vlashed California Models Form Ideas

Us I9 Form 2018 Brilliant New Hire Employee Details Form Template Sample Vlashed California Models Form Ideas

Https Www Edd Ca Gov Pdf Pub Ctr De1296nba Pdf

Free 8 Sample Employee Forms In Pdf Ms Word Excel

Free 8 Sample Employee Forms In Pdf Ms Word Excel

California State Tax Form 2018 Brilliant New Hire Checklist Full Version Employee Forms Pinterest Form Models Form Ideas

California State Tax Form 2018 Brilliant New Hire Checklist Full Version Employee Forms Pinterest Form Models Form Ideas

California Employers Association New Hire Packet

California Employers Association New Hire Packet

California New Hire Forms 2018 Awesome New Sales Performance Appraisal Form Fo52 Documentaries For Change Models Form Ideas

California New Hire Forms 2018 Awesome New Sales Performance Appraisal Form Fo52 Documentaries For Change Models Form Ideas

Comments

Post a Comment