Featured

Small Group Insurance

This in turn is based on the location of the business the average age of your enrollees and even tobacco usage. What is Small Group Insurance.

Shopping For Small Business Group Health Insurance Made Easier

Shopping For Small Business Group Health Insurance Made Easier

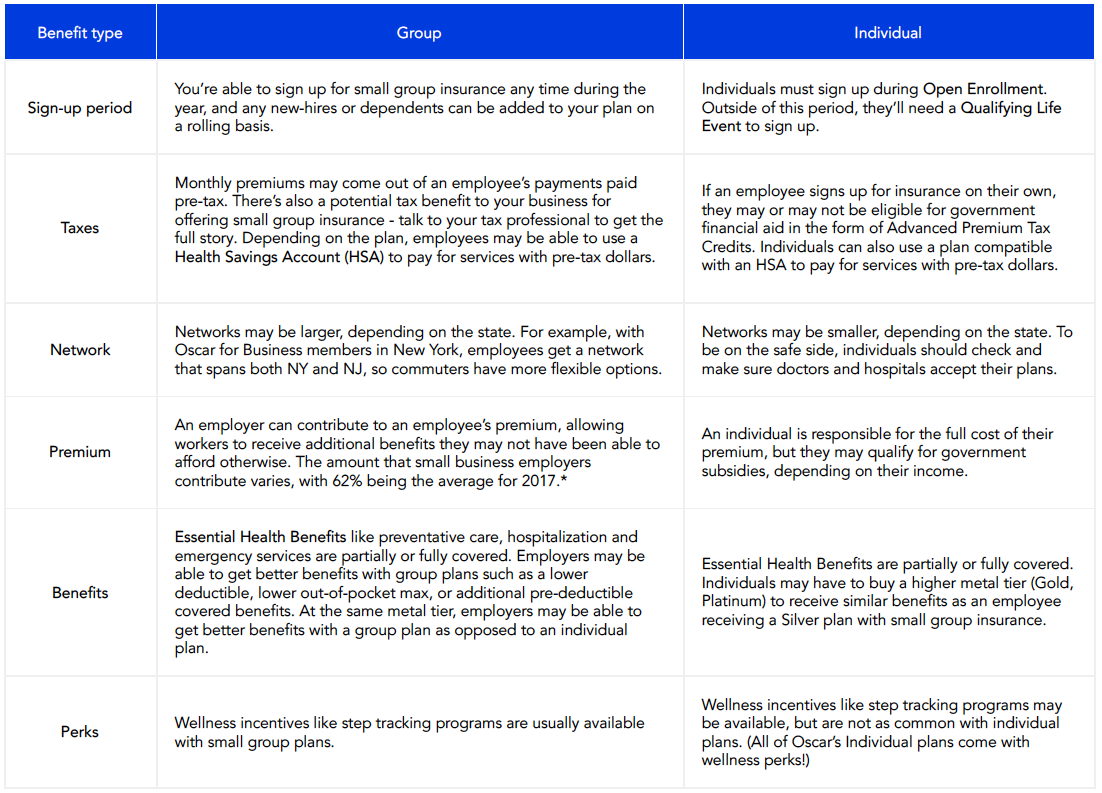

By contrast premiums for large group health plans are negotiated between the employer the employers broker or benefit consultant and the insurance company.

Small group insurance. Small group health insurance is usually a little easier to modify. Anthem Blue Cross and Blue Shield understands you need a plan as unique as your business and your employees. Self-insured funding built for small businesses Control rising health care costs with Aetna Funding Advantage SM health plans.

1300 small business health insurance plans from 70 carriers. Annons Health Insurance Plans Designed for Expats Living Working in Sweden. Monthly cost starts at.

What Makes Us UniqueIts More Than Just Insurance. Choosing small group health insurance for your employees is not an easy decision for any small business owner. Small Group Insurance 2-50 Employees Small businesses can get comprehensive coverage from CareFirst BlueCross BlueShield.

Monthly cost starts at. Even when the market is unstable prices on small group plans tend remain somewhat consistent over longer periods. For large group health insurance other factors are used to calculate group rates.

Small-group health insurance is medical insurance geared toward groups including businesses with 50 or fewer full-time equivalent employees. Small-group plans effective since January 2014 are compliant with the Affordable Care Acts requirement of health coverage. You can get the benefits typical for larger groups like surplus sharing fewer taxes and fees and high-cost claims protection.

In deciding whether to offer coverage to employees employers should consider current and future coverage costs. There are more options for small group businesses so that creating a comprehensive health plan to satisfy your employees is likelier and not as difficult to obtain. Under the Affordable Care Act small group insurance falls under many different factors that can and will impact rates.

All in one offering specially designed with your small business in mind. Because every group is different we take the time to find the right plan for your team whatever your needs may be. For group health coverage premiums are calculated for each employee who enrolls in the plan plus the cost to add a spouse andor dependents if applicable and then all of those individual premiums are added together to get the groups total premium.

Our flexible affordable options will help keep your employees healthy while also controlling your costs. Small businesses often offer small-group coverage to attract and retain employees. Annons Health Insurance Plans Designed for Expats Living Working in Sweden.

In most states the term small group applies to groups of 2 to 50 employees. Stability is another potential benefit of small group health insurance instead of individual plans. In four states they apply to groups with up to 100 employees.

Thats the amount that the business has to send to the insurance company each month or each quarter to pay for the insurance. And in California Colorado New York and Vermont it includes groups with up to 100 employees. Small group health insurance Pennsylvania is purchased through a group such as your workplace labor union or professional association.

Small Group Health Insurance in Tennessee Are you an employer in Tennessee that offers group. Thats why weve built plans with the total person in mind. Small-group plan benefits include improved ACA-compliant plan options with clearly defined benefits.

Traditional group health insurance can be a good choice for small businesses because its relatively easy to obtain and most employees are already familiar with how it works. Businesses that fall into the small group category all have the same coverage options available in the small group market and the. An insurance broker can help you get the most out of your small group health insurance plan at an affordable rate.

From 2015 to 2018 average per-person premium coverage on group plans only increased by 5 percent. Also small-group insurers have had only a minor increase 05 percentage points in. Self-funded health insurance With a self-insurance arrangement the business assumes the financial risk for providing health care benefits to employees.

As a result small-group insurers have had to pay only relatively minor amounts averaging 10 a year as mandatory rebates to consumers. Small group premiums are set by the insurance company and once set premiums are non-negotiable and cant be discounted.

5 Reasons To Consider Small Group Health Insurance

5 Reasons To Consider Small Group Health Insurance

Most Popular Small Group Health Insurance Plan

Most Popular Small Group Health Insurance Plan

What Benefits Are Included In A Small Group Health Insurance Plan

What Benefits Are Included In A Small Group Health Insurance Plan

Group Health Insurance For Small Business Owners Ixsolutions

Group Health Insurance For Small Business Owners Ixsolutions

Covered California Small Business Health Options Program Shop Health For California Insurance Center

Covered California Small Business Health Options Program Shop Health For California Insurance Center

Small Group Medial Insurance Oxlo Healthcare Insurance Solutions

Are You Ready To Offer Small Group Health Insurance Healthinsurance Org

Are You Ready To Offer Small Group Health Insurance Healthinsurance Org

5 Reasons To Consider Small Group Health Insurance

5 Reasons To Consider Small Group Health Insurance

Affordable Medical Offices Insurance Guide For Your Small Business Ehealth

Affordable Medical Offices Insurance Guide For Your Small Business Ehealth

Small Group Health Insurance Grew By 15 In Minnesota Last Year

Small Group Health Insurance Grew By 15 In Minnesota Last Year

Who Is Eligible For Group Health Insurance

Who Is Eligible For Group Health Insurance

5 Reasons To Consider Small Group Health Insurance

5 Reasons To Consider Small Group Health Insurance

Group Health Insurance For Small Business Get A Quote

Group Health Insurance For Small Business Get A Quote

7 Ways You Can Save Money On Small Business Health Insurance

Comments

Post a Comment