Featured

What's A Copay

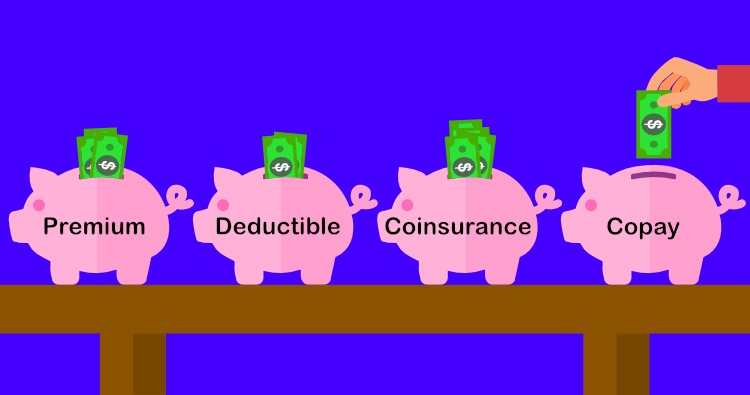

The amount can vary by the type of service. On a traditional co-pay plan you and your employer pay a monthly premium to cover the cost of your health insurance.

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

I left this one for last because it is the wild card.

What's a copay. You need to pay this amount as the percentage of the sum insured amount in the policy document. Product and Drug Manufacturers offering copay cards to pay copayments charged by pharmacists and equipment vendors. Medications your health care provider prescribes to treat non-service-connected conditions and.

Co-pay plans also have a. A reproduction of an original work. To find out how copays work with.

It is in contrast to any graphic or pictorial aspects of a publication article or another kind of composition. Specifically when you need a medication and the pharmacy tells you how much you owe. You may want to consider buying your over-the-counter medications on your own.

Discounting products and services and applying the discount only to copayment amounts. A copay is a fixed amount you pay for a health care service usually when you receive the service. A copay is a form of cost-sharing between a health insurance provider and the individual receiving care.

Insurance providers often charge co. The remaining balance is covered by the persons insurance company. It is a standard part of many health insurance plans.

Youll pay a copay for. Then when you go to the doctor or pick up a prescription you pay a fixed cost called a co-pay and the insurance company generally covers the rest. Billing but not collecting a copayment.

Meaning unlike the deductible max out-of-pocket. A copay is a flat fee you pay whenever you receive certain health care services or get prescription drugs Copays may apply before and after you hit your deductible A copay is different from coinsurance which only applies after reaching your deductible and is the percentage of your. A copay is a fixed set amount of money you must pay each time you visit the doctor or purchase medication when using your health insurance plan.

A copay short for copayment is a fixed amount a healthcare beneficiary pays for covered medical services. Copay refers to when policyholders have to bear a fixed part of their expenses towards medical treatment while the rest is borne by the insurer. A copay is the amount of money you pay when you go to a doctor or health care facility or when you pick up a prescription.

You may have a copay before youve finished paying toward your deductible. Copays can vary by insurance plan and according to the type of health care provider you see. Those in publishing often refer to the main text of an article as body copy as opposed to titles subheads.

Your plan determines what your copay is for different types of services and when you have one. A health insurance copay or copayment is a set fee you pay for a doctor visit or prescription. A copay is a fixed out-of-pocket amount paid by an insured for covered services.

You typically pay it at your appointment or when you pick up a prescription. Copay accumulator programs is a term that was created by Pharmacy Benefit Managers PBMs to describe a way of counting how much assistance patients receive from pharmaceutical manufacturers. Learn more about copays and when to pay them below.

But at its most basic a copay is a set amount of money you can expect to pay when you receive an eligible health care service. Copay is the fourth and final health plan component. Over-the-counter medications like aspirin cough syrup or vitamins that you get from a VA pharmacy.

Copay or copayment is usually an amount you need to pay at the time of claim settlement while the insurer will pay the remaining amount. Copays are fixed fees charged by health care providers when the service is provided. Broadly defined copy is text within a publication or composition.

This can either be as. These programs apply only to your medications.

/whats-the-difference-between-copay-and-coinsurance-1738506_final-4c635a490ace4b8d9ab16ac6fa61d192.jpg) Differences Between Copay And Health Coinsurance

Differences Between Copay And Health Coinsurance

Small Business Health Insurance Copayment

Small Business Health Insurance Copayment

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Copay Vs Deductible What S The Difference

Copay Vs Deductible What S The Difference

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Coinsurance And Medical Claims

Coinsurance And Medical Claims

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

So What S The Difference Between A Premium Deductible Copay Coinsurance And Max Out Of Pocket

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Comments

Post a Comment