Featured

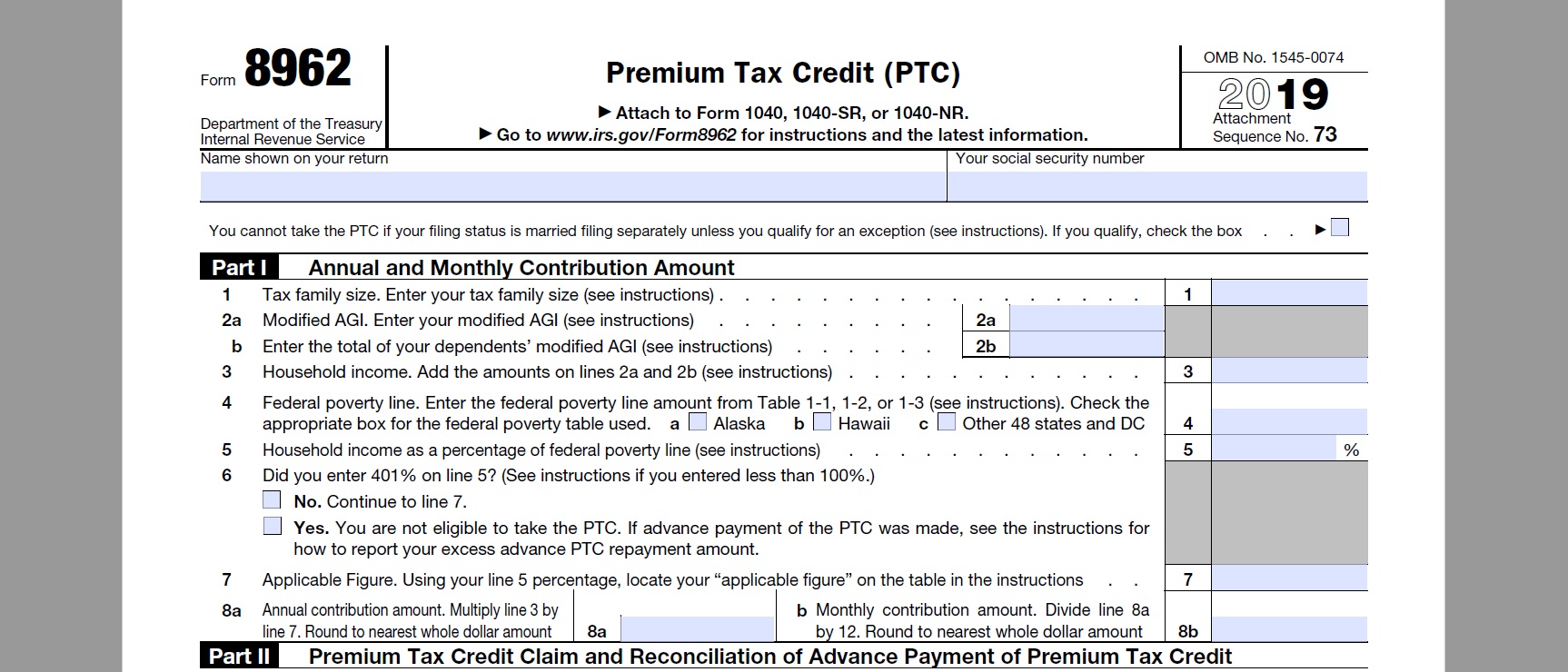

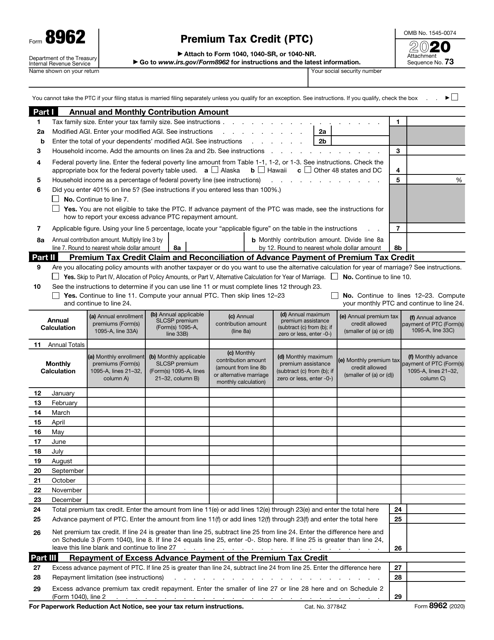

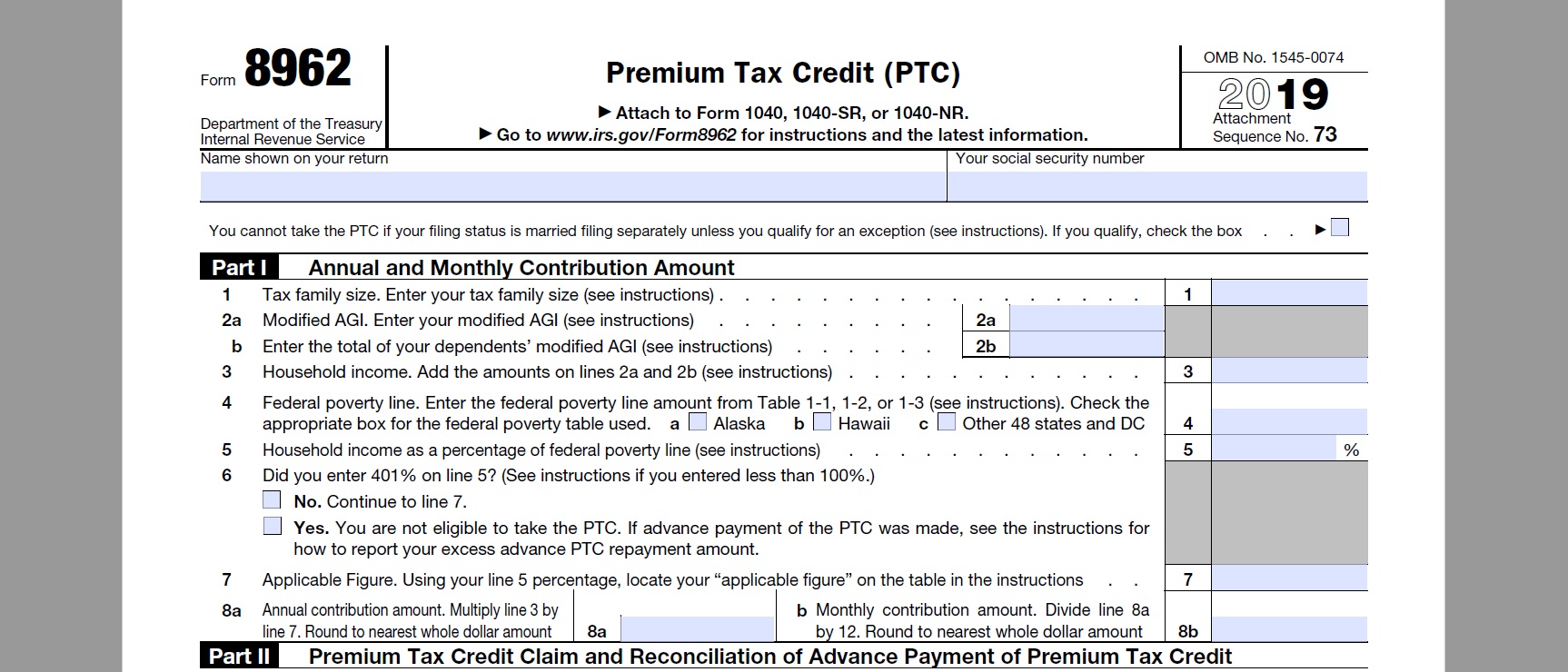

8962 Form 2020

For 2020 the 2019 federal poverty lines are used for this purpose and are shown below If you moved during 2020 and you lived in Alaska andor. Instructions for Form 8962 Premium Tax Credit PTC 2020 12142020.

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 8962 Fill Online Printable Fillable Blank Pdffiller

Stimulus Checks Medicare.

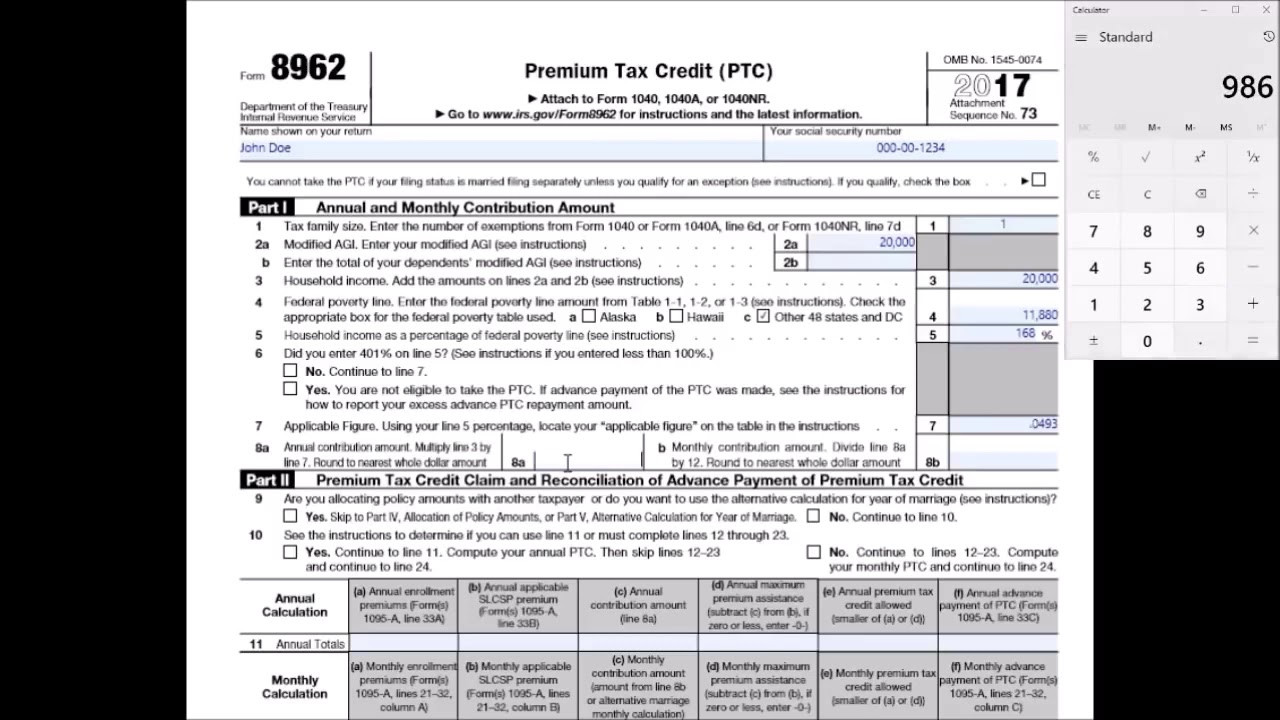

8962 form 2020. 73 Your social security number You cannot take the PTC if your. The information below has not been verified for the 2020 tax year as the IRS Pub. If thats the case and four allocations arent enough you can read the instruction on expanding the form.

Well help you create or correct the form in TurboTax. If the IRS sends a letter about a 2019 Form 8962. Premium Tax Credit PTC 2020 11172020 Inst 8962.

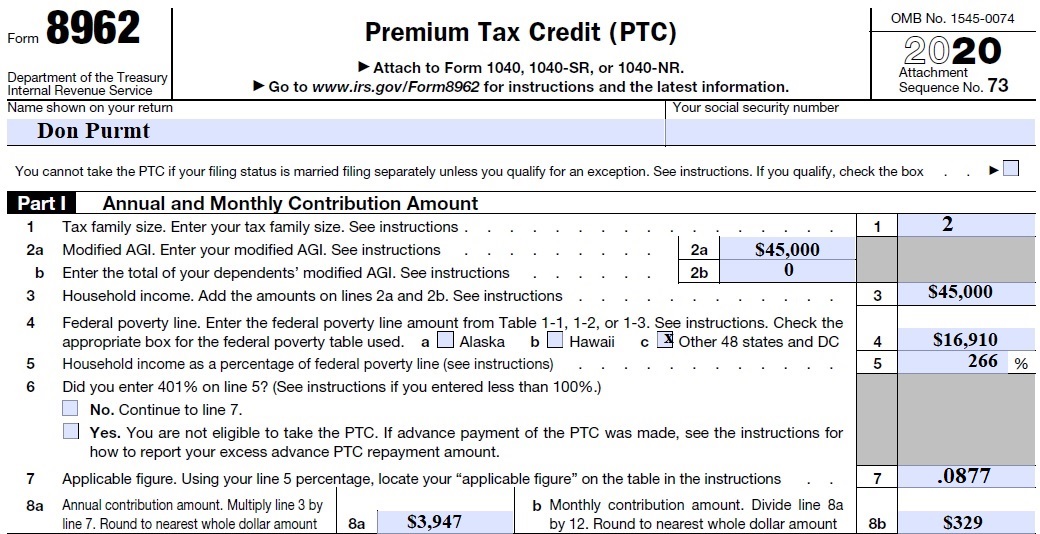

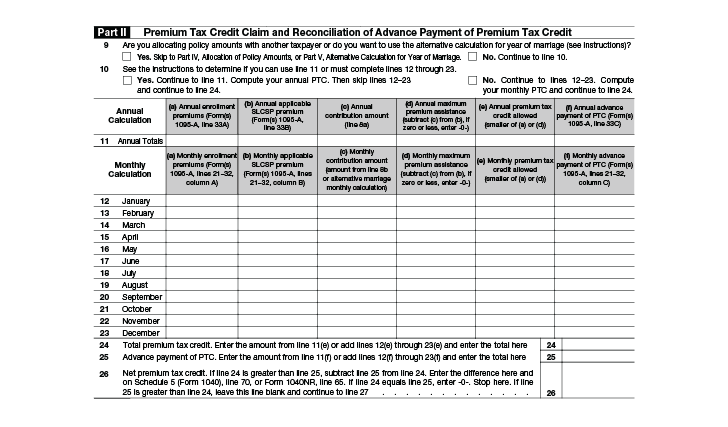

The purpose of Form 8962 is to allow filers to calculate their Premium Tax Credit PTC amount and to reconcile that amount with any advance payments of the Premium Tax Credit APTC that have been made for the filer throughout the year. The IRS continues to process prior year tax returns and correspond for missing information. Taxpayers must fill form 8962.

Download and print the Form 8962 and instructions for a paper return. About Form 8962 Premium Tax Credit Internal Revenue Service. The IRS is requesting Form 8962 for 2020.

Check the box to indicate your state of residence in 2020. More About 8962 Form for 2020 Most taxpayers need to file form 8962 printable blank if they have health care coverage for the year such as coverage from an employers plan Medicare or Medicaid. 2020 Form 8962 Form 8962 OMB No.

974 has not yet been released by the IRS The amount of excess premium tax credit repayment calculated on Line 29 of Federal Form 8962 Premium Tax Credit PTC has a different calculation if there was a self-employed health insurance deduction claimed on Line 16 of Schedule 1 Form. Taxpayers must also file form 8962 if they are using a Marketplace health insurance plan. Purpose of Form Use Form 8962 to figure the amount of your premium tax credit PTC and reconcile it with advance payment of the premium tax credit APTC.

The standard IRS form 8962 for 2020 contains four fields for allocations but there may be more for example when its an interaction between families with many children. IRS 8962 Form Premium Tax Credit 2020-2021 Steps to Fill out Online 8962 IRS Form An individual needs 8962 Form to claim the Premium Tax Credit. Not everyone can file Form 8962 and claim the Premium Tax Credit.

Go to wwwirsgovForm8962 for instructions and the latest information. Consult a tax advisor if you are not sure which category you fall into. Enter on line 4 the amount from Table 1-1 1-2 or 1-3 that represents the federal poverty line for your state of residence for the family size you entered on line 1 of Form 8962.

If youre mailing in a paper tax return and you received advance payments of your health insurance. The Internal Revenue Service has announced that taxpayers with excess APTC for 2020 are not required to file Form 8962 Premium Tax Credit or report an excess advance Premium Tax Credit repayment. It is used to report your credit amount on your tax return and reconcile the advance credit payments made on your behalf.

How to Fill Out Form 8962 - Premium Tax Credit 1095A Health Insurance Covered CaliforniaCalifornia covers topics like. If you did not e-file your return with the Form 8962 for the Premium Tax Credit the IRS might send you a letter asking for this information. The 8962 form will be e-filed along with your completed tax return to the IRS.

Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. 1545-0074 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Name shown on your return 2020 Attach to Form 1040 1040-SR or 1040-NR. Form 8962 is used to calculate the amount of premium tax credit youre eligible to claim if you paid premiums for health insurance purchased through the.

2020 Instructions for Form 8962 Premium Tax Credit PTC Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Taxpayers who received the benefit of APTC prior to 2020 must file Form 8962 to reconcile their APTC and PTC for the pre-2020 year when they file their federal income tax return even if they otherwise are not required to file a tax return for that year. Form 8962 Premium Tax Credit is required when someone on your tax return had health insurance in 2020 through Healthcaregov or a state marketplace and took the Advance Premium Tax Credit to lower their monthly premium.

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

Irs Form 8962 Download Fillable Pdf Or Fill Online Premium Tax Credit Ptc 2020 Templateroller

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

Premium Tax Credit Form 8962 And Instructions

Premium Tax Credit Form 8962 And Instructions

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

Irs 2019 Health Insurance Subsidy Tax Credit Reconciliation

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Irs Form 8962 Accounts Confidant

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

How To Fill Out Form 8962 Step By Step Premium Tax Credit Ptc Sample Example Completed Youtube

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2020 Premium Tax Credit Ptc Internal Revenue Service

Irs Form 8962 Calculate Your Premium Tax Credit Ptc Smartasset

Irs Form 8962 Calculate Your Premium Tax Credit Ptc Smartasset

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

How To Fill Out Obama Care 8962 Premium Tax Credit Forms If Single Youtube

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

8962 Form 2021 Irs Forms Zrivo

8962 Form 2021 Irs Forms Zrivo

Comments

Post a Comment