Featured

- Get link

- X

- Other Apps

Covered Ca Premium Assistance Chart

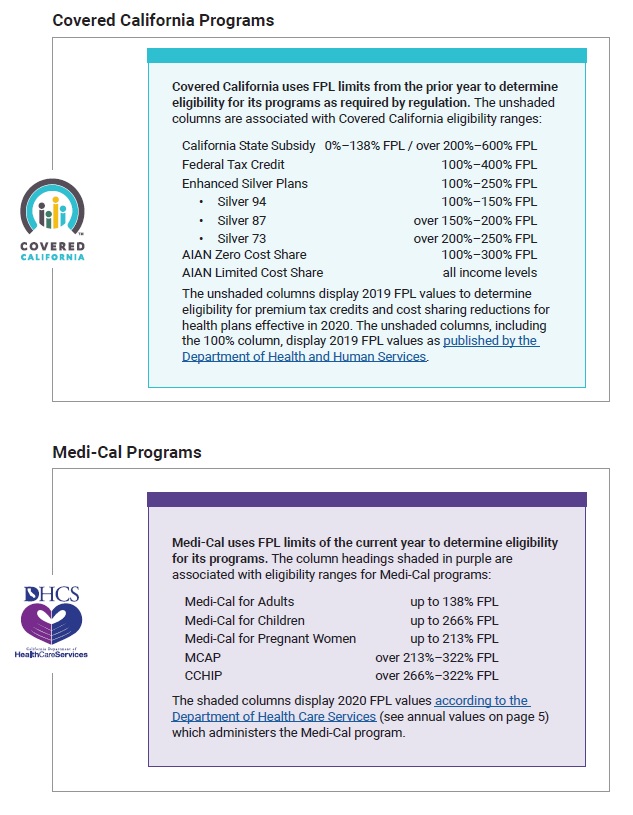

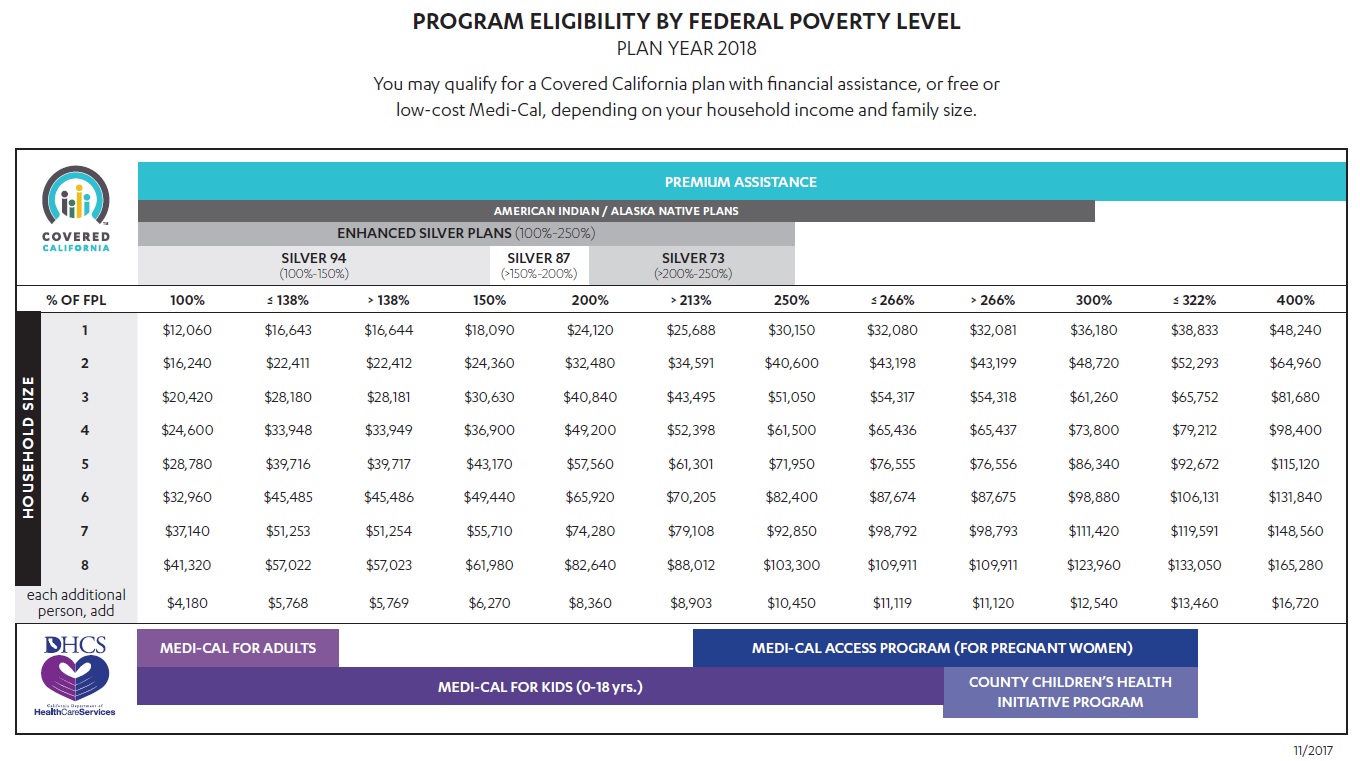

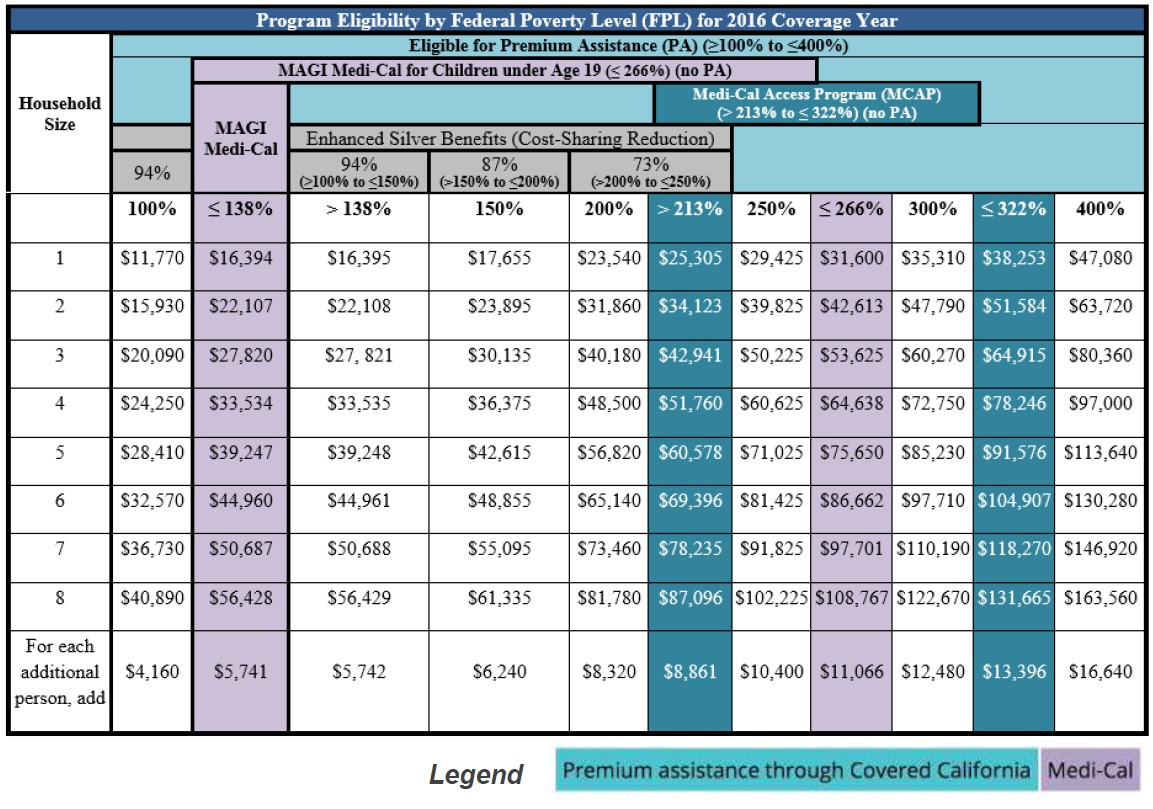

An eligible individual is a taxpayer whose household income - modified adjusted gross income MAGI - is between 138 percent and 600 percent of the federal poverty level FPL. 1 Applies for coverage through the single streamlined application for insurance.

Covered California Health Insurance Income Guidelines

968 406 400 450 400 14 968 1020.

Covered ca premium assistance chart. Their net premium for their Bronze plan after the California State Premium Assistance is. Starting in the Summer of 2021 we will redetermine your. IRS Form 8962 will be used to calculate the consumers eligibility for and the amount of Premium Tax Credit PTC or financial assistance they are eligible to receive to help make their health insurance coverage more affordable.

B The state advance premium assistance amount with respect to any coverage month shall be the difference between. Under the law maximum contributions to premiums will be based on modified adjusted gross income while estimates in this calculator are based on the annual income entered by the user. 1 The amount equal to the lesser of.

An estimated 23000 Covered California enrollees whose annual household income. Covered California Premium Assistance Who is Eligible for Premium Assistance. Whether you qualify for financial assistance depends on your household income and family size.

Covered California and Medi-Cal use the same application. For some plans there may be costs like copays coinsurance and deductibles for diagnosis and treatment. Click here to check your eligibility for premium assistance.

Consumers at 400 FPL or higher may receive a federal premium tax credit to lower their premium to a maximum of 85 percent of their income based on the second-lowest-cost Silver plan in their area. When their net premium is reduced from 12000 to 3140 thats nearly 9000 in subsidy from the state of California. The price is based on your estimated income for the coverage year your ZIP code your household size and your age.

Remember Open Enrollment begins in November and as the individual. To learn more or be notified about the COVID-19 vaccine. Doctor Visits and Urgent Care are both going up 5 from 30 per visit to 35 per visit.

Calculating Premium Assistance Subsidy Eligibility For The Covered California Advance Premium Tax Credit. For Gold Plans that require a percentage payment for. See the chart on page 2 for more information.

Compare brand-name Health Insurance plans side-by-side and find out if you qualify. The premiums in this calculator reflect the Covered California statewide average for the second most affordable silver plan adjusted for premium inflation and age rating. This chart is the Federal Poverty.

Premium assistance is paid by the federal government directly to the health plan an individual or family chooses through Covered California. An estimated 663000 Covered California enrollees who currently receive federal financial help. Current Covered California consumers who will receive subsidies will pay an estimated 119 less per month per household on average which translates to 1428 per year.

The chart below also lists several qualified. At tax filing time the amount of premium assistance an enrollee a taxpayer received in advance during the benefit year or APTC will be reconciled with the amount of premium. The consumers information on the IRS Form 8962 is compared to the amount of APTC or financial assistance the consumer may have already received.

See our related story about Covered California Open Enrollment Notices for the 2015 open enrollment and the latest Anthem story. If you are a low- or moderate-income Californian you may get help buying insurance from Covered California through monthly subsidies that lower your premium costs so that you pay less for top-quality brand-name insurance. Modeling assumes uninsured population characteristics match Covered California membership including plan choice.

If they have received too. Below is a very useful chart that explains what types of income you should include on your Covered California Health Insurance application. For Gold Plans that have a copay for Imaging including CT PET Scans and MRIs the copay is dropping from 275 down to 150.

They will be eligible to receive an average of an additional 15 per household per month which will help them save an average of 5 percent on their current premiums. Use the Shop Compare tool to find the best Health Insurance Plan for you. If you received unemployment benefits anytime in 2021 report this to Covered California.

Covered California administrative data of. A The monthly premiums for such month for one or more qualified health plans offered in Californias individual market which cover the applicable. 2020 State Premium Assistance Draft Program Design Document Covered California c An applicable return filer shall be eligible for state advance premium assistance only if the applicable return filer.

See the charts below for financial help. This article was originally written for the Fall 2013 open enrollment season. OutreachandSalescoveredcagov or Low to help determine if you qualify Income Guidelines use through October 2016 You may be eligible for Medi-Cal -Income Health Plan.

70000 1020 16000 12000 3140. Please feel free to contact us at 818 350-2675 with any further questions or if you would like free assistance in completing the income portion of your Covered California Health Insurance application properly. The threshold for Medi-Cal 138 FPL jumped from 17237 on the September chart up to 17609 on the new revised income table.

The new higher income amount concurs with the issued Medi-Cal income table for 2020.

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Chart 2016 Covered Ca Shop Small Business Health Insurance Benefit Agents

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Covered California Updates Medi Cal Income Eligibility Levels

Covered California Updates Medi Cal Income Eligibility Levels

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

Individual Health Insurance Eligibility Covered California

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Comments

Post a Comment