Featured

- Get link

- X

- Other Apps

500 Dollar Deductible

If you choose a low deductible amount then. The average homeowners insurance deductible is 500.

How Much Can You Save By Raising Your Auto Insurance Deductible

How Much Can You Save By Raising Your Auto Insurance Deductible

When you enter these types of agreements you do not own the vehicle and thus are required to maintain the physical.

500 dollar deductible. Insurance companies in high-risk areas will often ask you to have a. In general a lower deductible means a higher monthly premium and vice versa. You can raise or lower a 500 deductible car insurance policy depending on your financial needs.

For dollar amount deductibles a specific amount would come off the top of your claim payment. An auto insurance deductible is what you pay out of pocket on a claim. Dollar Amount Deductible.

500 Deductible Insurance Policy What does it mean A 500 deductible insurance policy means that you must pay 500 toward car repairs before your car insurance coverage pays the rest of your car damage costs. Deductible amounts typically range from 500 to 1500 for an individual and 1000 to 3000 for families but can be even higher. Whats the downside of a high deductible.

If your car repairs are less than your 500 deductible you wont be able to file a claim. A low deductible of 500 means your insurance company is covering you for 4500. If you have a 500 deductible and need 3000 in repairs your insurance company will pay 2500 toward the repairs.

It is up to you whether it matters that you keep a 500 deductible during the duration of the loan or if you are firm on a higher deductible. Lets say an unknown driver has inadvertently sideswiped a car costing the owner 800 of damage. You choose your deductible amount which typically ranges from 250 2500 for renters and 500 and upwards for homeowners.

If your deductible says 5001500 that means each individual on the plan has a maximum 500 deductible. Well talk about health plans with high deductibles later When a family has coverage under one health plan there is an individual deductible for each family member and family deductible that applies to everyone. For example if your personal property coverage is 5000 and your deductible rate is 10 then you would have a 500 deductible.

This is also a question you want to ask the lending company before you apply for a vehicle loan. This deductible amount is a common choice for drivers. A higher deductible of 1000 means your company would then be covering you for only 4000.

For instance if you have a 500 deductible and 3000 in damage from a covered accident your insurer would pay 2500 to repair your car. Second the deductible amount will impact your car insurance premium. A deductible based on dollar amount is going to have a set amount that you must pay out of pocket when you file a claim for a covered loss.

Youre responsible for the remaining 500. By and large increasing the dollar deductible from 200 to 500 could potentially reduce collision and comprehensive coverage premium costs by 15 to 30 whereas increasing the deductible to 1000 may save 40 or more. This information may not be told to you until you are signing the final documents.

Some will offer a percentage of your policys property coverage. Plus there are times when your deductible will be chosen for you. Youll be responsible for the remaining 500 and the repair shop wont fix.

For example if your policy states a 500 deductible and your insurer has determined that you have an insured loss worth 10000 you would receive a claims check for 9500. A home insurance deductible is an amount a homeowner pays out-of-pocket toward a claim before the insurer pays for the remainder. First consider the dollar amount you want to be responsible for paying.

My deductible is only 25000 with 2000 co-pay for routine office visits but the monthly premium is 1086 for just me. The second number refers to the maximum deductible. In most situations when you file a claim you will pay the deductible so choose an amount youre comfortable paying out-of-pocket.

The owner has a 1000. A deductible is the amount youre responsible for paying for health care before your insurance takes over. You should cover any repairs close to your deductible amount as theyre considered small.

What is a deductible. Its one of the most common car insurance questions and may be the easiest to answer. A 500 deductible means youll pay 500 out of pocket after an accident and your insurer will pay for the rest of the damages up to your policy limits.

Usually these dollar amount deductibles can range from 500 up to 4000 depending on your policy and age of your home. Im in reasonably good health for an old lady so the insurance company has made a nice profit on my account so far I pay in more than they pay out for all my covered stuff but that could change at any time if I were to have a major injury or long time illness. If you have a loan or lease on your vehicle you might be required to maintain at least a 500 deductible.

Since a lower deductible equates to more coverage youll have to pay more in your monthly premiums to balance out this increased coverage. Do not choose a deductible thats higher than what youre able to pay. Despite the evidence that a 500 deductible may not be the way to go its still a pretty standard deductible.

Most renters insurance carriers have a dollar amount deductible meaning theyll work with you to set a specific amount like 500. Not every lender requires this and it is at the banks discretion if you decide you do not want to have to change to a 500 deductible.

What Is A Homeowners Insurance Deductible Valuepenguin

How Much Can You Save By Raising Your Auto Insurance Deductible

How Much Can You Save By Raising Your Auto Insurance Deductible

The Appropriate Insurance Deductible Insurance Shark

The Appropriate Insurance Deductible Insurance Shark

Auto Dent Specials Save Up To 500 On Hail Damage Repair

Auto Dent Specials Save Up To 500 On Hail Damage Repair

Should I Have A 500 Or 1000 Auto Insurance Deductible Insuramatch

Should I Have A 500 Or 1000 Auto Insurance Deductible Insuramatch

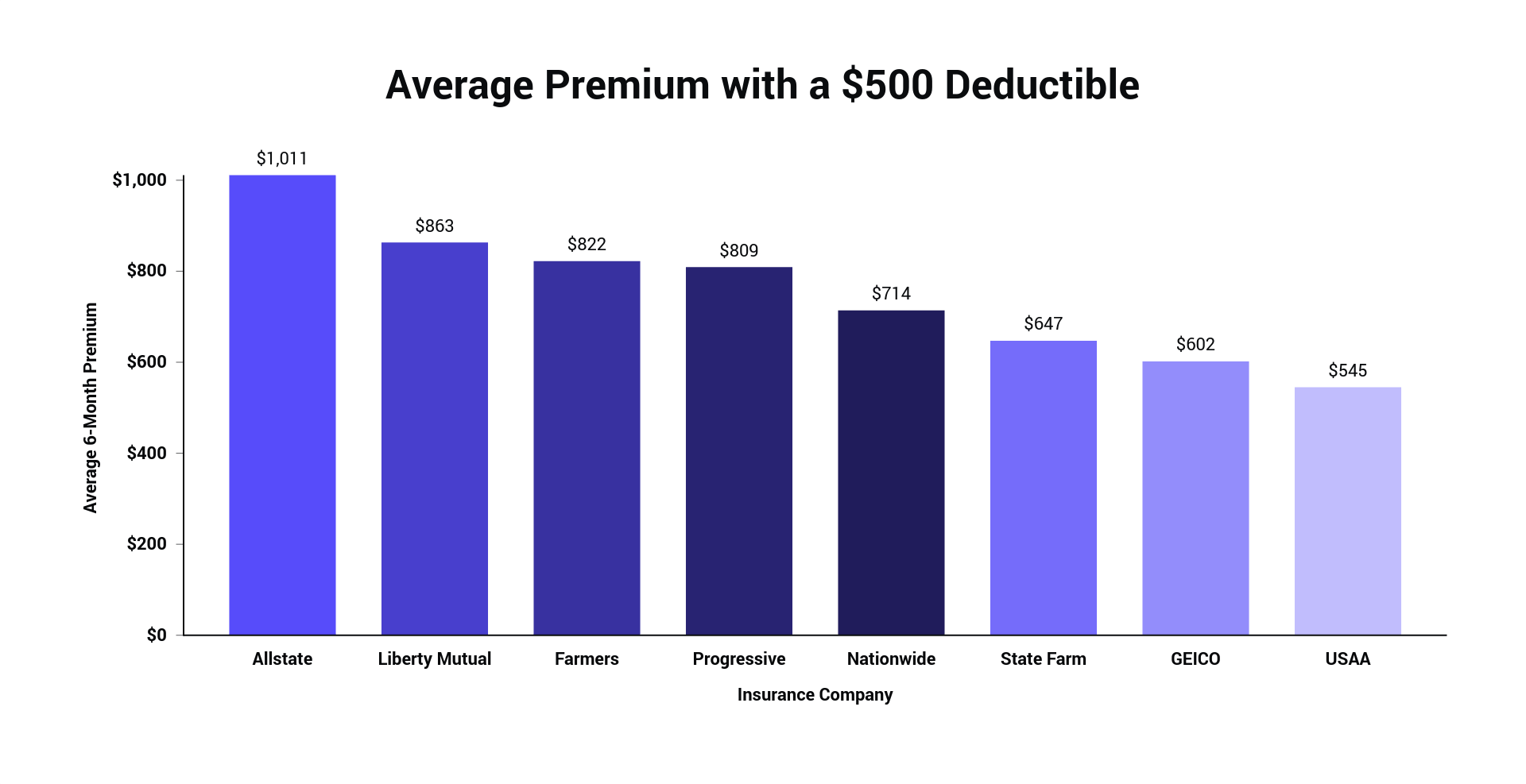

Best Car Insurance With A 500 Deductible The Zebra

Best Car Insurance With A 500 Deductible The Zebra

How Much Can You Save By Raising Your Auto Insurance Deductible

How Much Can You Save By Raising Your Auto Insurance Deductible

What Is An Auto Insurance Deductible How Does It Work We Explain It

What Is An Auto Insurance Deductible How Does It Work We Explain It

Raise Deductible To Save On Auto Insurance Insurancequotes

Raise Deductible To Save On Auto Insurance Insurancequotes

Raise Deductible To Save On Auto Insurance Insurancequotes

Raise Deductible To Save On Auto Insurance Insurancequotes

The Appropriate Insurance Deductible Insurance Shark

The Appropriate Insurance Deductible Insurance Shark

Comments

Post a Comment