Featured

Is Epo Better Than Hmo

People have no idea what an EPO is says Jerry Flanagan lead staff attorney at Consumer Watchdog an advocacy organization that recently filed a class action. The premiums and deductibles for this plan are quite high but it offers great flexibility than other plans.

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

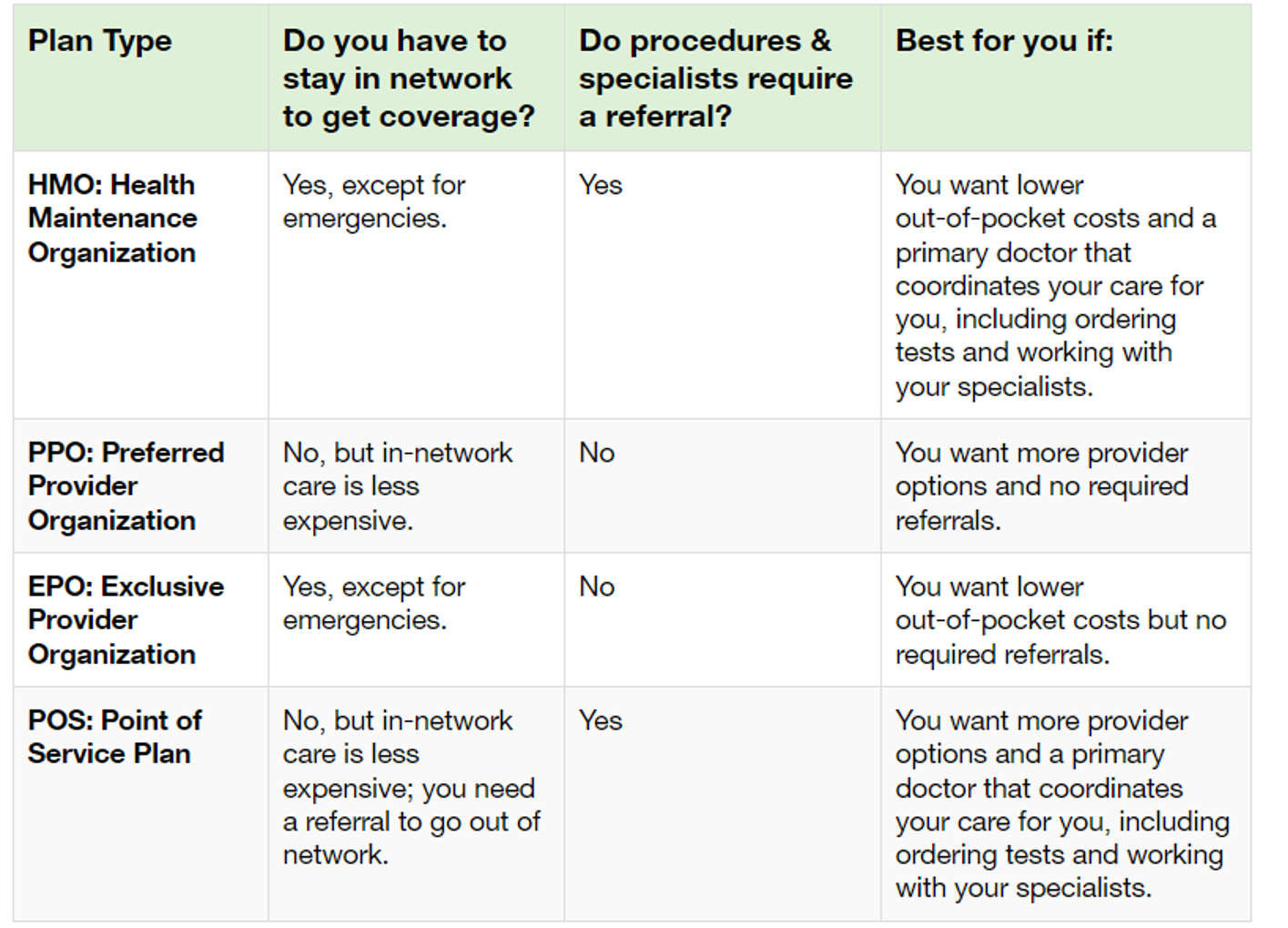

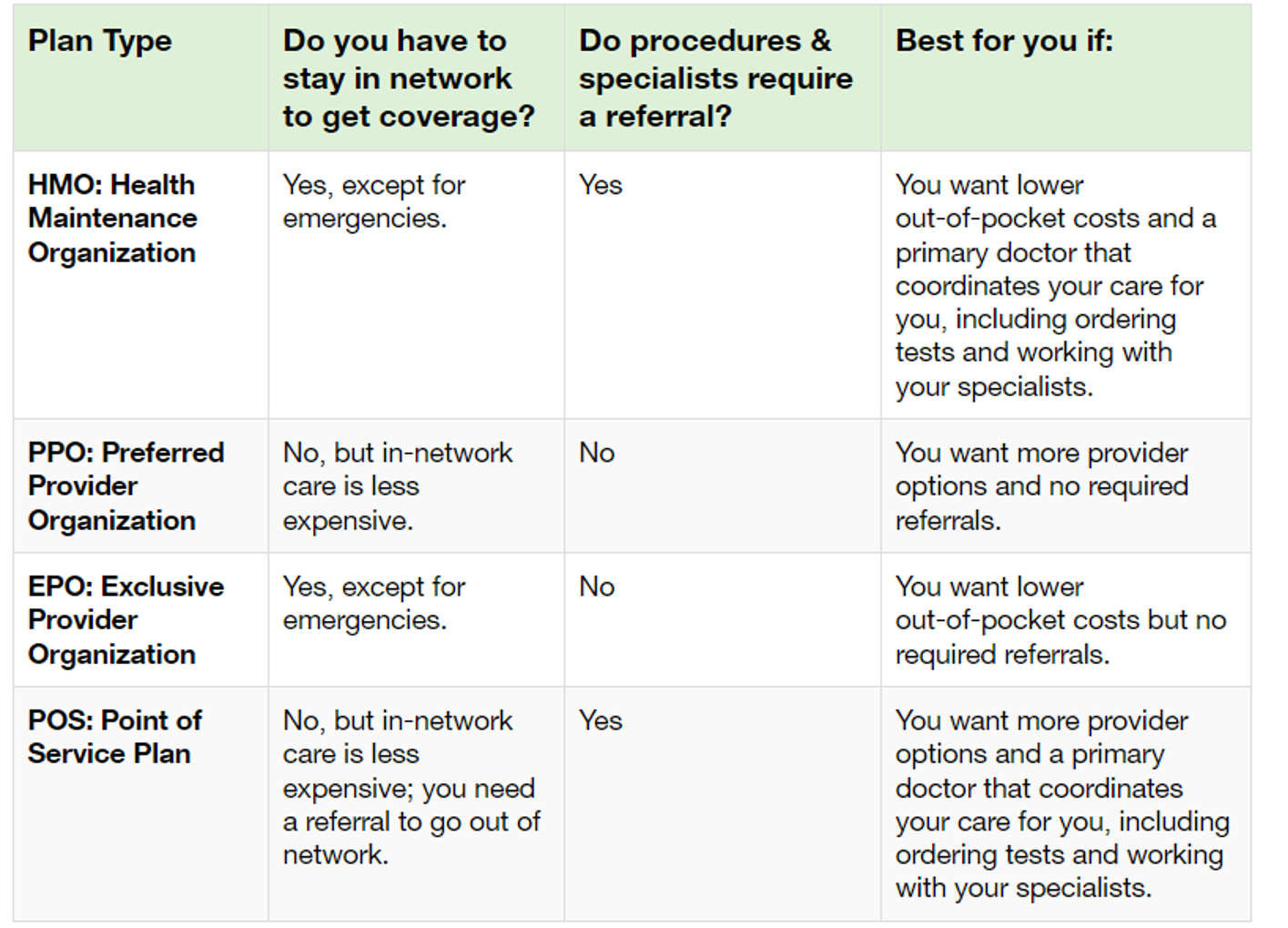

EPO Exclusive Provider Organization An EPO plan is less common than HMOs and PPOs but shares features of both.

Is epo better than hmo. Nearly half of the enrollees in employer-based health plans are in PPO. Point of Service A POS plan is also less-common and its a somewhat-complicated mix between an HMO and a PPO. Like a PPO you do not need a referral to get care from a specialist.

And while they offer less flexibility than a PPO EPO plans are generally a little less expensive. This type of plan gives you a little more freedom than an HMO plan. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO.

But like an HMO you are responsible for paying out-of-pocket if you seek care from a. Exactly let me tell you how. A PPO health insurance plan stands for preferred-provider organization.

You are more than welcome to disagree with me. How does that relate. But like an HMO you are responsible for paying out-of-pocket if you seek care from a doctor outside your plans network.

EPOs are similar to HMOs in that you must stay within your network emergency care is an exception however with an EPO you generally do not need to select a Primary Care Physician nor receive a referral to see a specialist. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

HMO is Chrysler PPO is Bentley. The insurance company pays out based only on the services rendered for EPO plans as opposed to a monthly payment schedule for those on an HMO plan. On average EPO plans cost less than a comparable HMO plan.

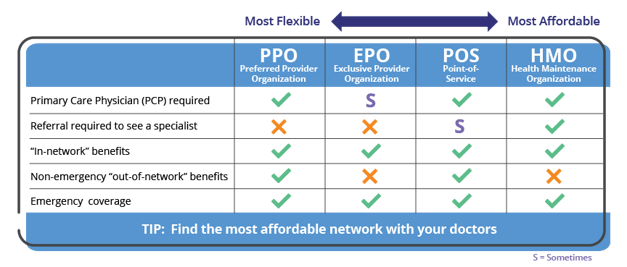

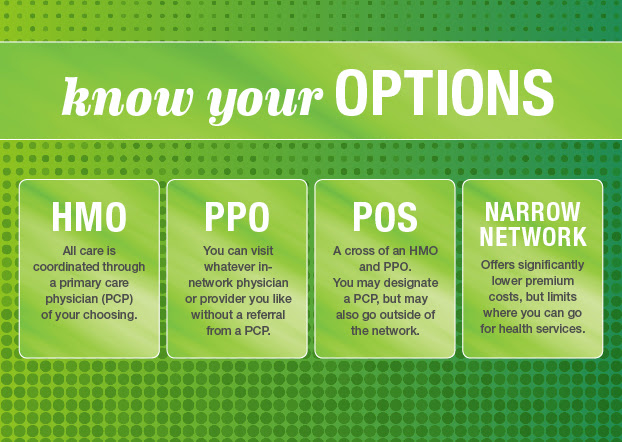

There are a number of different types of networks with HMO PPO EPO and POS being some of the most common. They may or may not require referrals from a primary care physician. That is only my personal opinion.

You can self-refer to an in-network provider when a medical need arises. You and the doctor get zero reimbursement if you go out-of-network. Generally you do not need to select a Primary Care Physician like EPO as the PPO network is.

It is no doubt a Bentley is a better car than Chrysler. Like HMOs EPOs cover only in-network care but networks are generally larger than for HMOs. Costs are kept low because providers charge a fee that has been negotiated with your EPO plan ahead of time.

An EPO plan is less expensive up front than a PPO but dont celebrate too quickly to have discovered this option. For some however an HMO health maintenance organization or PPO preferred provider organization might be a better fit. However Bentley is 100 better than a Chrysler M300 for me only if it is free.

Premiums are higher than HMOs but lower than PPOs. Like PPO insurance you can go directly to a specialist and bypass the need for a referral from your primary care physician. What is the difference between HMO and EPO health insurance.

Both types of plans typically have co-payments due at the time of the office visit as well as yearly deductibles. What is a EPO Health Plan. Then there are EPOs.

A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. But an EPO plan is like an HMO plan in that youre responsible for paying all your out-of-pocket costs if you go out-of-network. An Exclusive Provider Organization EPO is a lesser-known plan type.

EPO is short for Exclusive Provider Organization.

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Individual And Family Health Plans Wilson Consulting Group

Individual And Family Health Plans Wilson Consulting Group

The Insurance Basics Cf Foundation

The Insurance Basics Cf Foundation

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between Hmo And Ppo What You Need To Know

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

What S The Difference Between Hmo Ppo Pos And Epo Insurance Justworks

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

Comments

Post a Comment