Featured

Medicare HMO PPO Medicare also has both PPO and HMO options. The premium charge of an HMO plan is towards the lower end in comparison to PPO where the cost of the premium is comparatively high.

Medicare Advantage Ppo与hmo 有何区别 健康 2021

Medicare Advantage Ppo与hmo 有何区别 健康 2021

Finden Sie es heraus.

Hmo ppo 区别. Therefore the implementation of HMO and PPO came at the right time. Was beinhaltet das HMO-Modell. If youre in good health with no special medical needs on the horizon check out an HMO.

在医疗费用成本比重今年涨至15的情况下每个人都在寻找省钱的办法 警告以前是HMO health maintenance organizations计划便宜而PPO preferred provider organizations计划灵活现在情况不那么简单了. Both medical concepts though distinct in their functionalities aim at offering quality healthcare to different classes of people. Finden Sie es direkt auf Comparis heraus.

Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care. With the growing need for managed care plans HMO and PPO plans have gained popularity over. Finden Sie es heraus.

Whats an HMO plan. Coverage for out-of-network services. Many HMO providers are paid on a per-member basis regardless of the number of times they see a member.

The PPO premium was 596 a month. PPOs differ from HMOs in that PPO plans will usually provide some coverage for these types of services but coverage for in-network providers will be much better. Managed-care plans try to reduce medical care costs without sacrificing quality care.

Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. HMOs and PPOs also have many of the same required payments. The monthly premiums for an HMO and a PPO are not all that different.

Anzeige Welche Leistungen sind im HMO-Modell inbegriffen. The main differences between an HMO and a PPO come down to. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network.

Costs The additional coverage and flexibility you get from a PPO means that PPO plans will. Which Is Right for You. With that patients can be confident of not breaking the bank anytime they get ill.

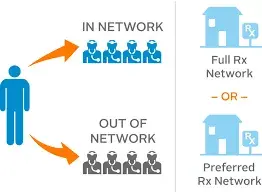

Preferred Provider Organization PPO While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan. The average HMO premium last year was 572 a month for one person according to the Kaiser Family Foundation. An HMO plan is based on a network of hospitals doctors and other health care providers that agree to coordinate care within a network in return for a certain payment rate for their services.

Finden Sie es direkt auf Comparis heraus. The difference between HMO and PPO is that HMO restricts the use of services of the medical services within the network only while PPO puts in no such control. Was beinhaltet das HMO-Modell.

HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. Size of plan network.

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国常见医保计划的含义和区别 自由微信 Freewechat

美國常見醫保計劃的含義和區別 醫療保險 洛杉磯華人工商 華人商家 華人商家折扣 華人商家名企認證 華人名企認證 華人社區生活指南 華人生活指南

美國常見醫保計劃的含義和區別 醫療保險 洛杉磯華人工商 華人商家 華人商家折扣 華人商家名企認證 華人名企認證 華人社區生活指南 華人生活指南

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

美国健康保险hmo Ppo Pos 还有epo到底有什么区别 知乎

Comments

Post a Comment