Featured

- Get link

- X

- Other Apps

Blue Cross Blue Shield Qualifying Life Event

If you are losing health care coverage provided by an employer you will have up to 60 days before and after this qualifying life event to enroll in a health plan. By Blue Cross and Blue Shield of Kansas.

7 Tips To Help Guide You Through The Special Enrollment Period

7 Tips To Help Guide You Through The Special Enrollment Period

You have a new dependent either through marriage domestic partnership birth or adoption or been granted court-appointed testamentary child support order or other court order of a child or qualified dependent.

Blue cross blue shield qualifying life event. These are called qualifying life events. This website is operated by Blue Cross Blue Shield North Carolina and is not the Health Insurance Marketplace website at HealthCaregovThis website does not display all Qualified Health Plans available through HealthCaregovTo see all available Qualified Health Plan options go to the Health Insurance Marketplace website at HealthCaregov. There are a few main types of qualifying life events.

You wont need to provide proof of a qualifying life event if you buy a BCBSIL health plan during this SEP. Rocky Mountain Hospital and Medical Service Inc. This can be during open enrollment or after open enrollment has ended.

It depends on the event since some allow you to enroll in a plan 60 days before and some 60 days after the event. If not you may have other choices. How long do I have to enroll in a plan after a qualifying event.

You need health coverage for a new baby. SEP Qualifying Life Event and Documentation You could lose your job-related health plan for many reasons. The summer season is replete with flowers veils cake and potentially a new Blue Cross Blue Shield health insurance plan.

Be a California resident Not be enrolled with Medicare coverage Submit a request for coverage during our annual open enrollment or experience a valid qualifying event and submit a request for. Talk to us and well let you know based on your individual situation. Common life events that may qualify for special enrollment include job loss early retirement loss of dependent status marriage divorce birth or adoption of a child or a move.

Qualifying life events include. This means you can still apply for a 2021 Blue Cross and Blue Shield of Texas BCBSTX Individual health plan for yourself and family during this time. Anthem Health Plans of Kentucky Inc.

Anthem Health Plans Inc. You wont need to provide proof of a qualifying life event if you buy a BCBSTX health plan during this SEP. You may qualify to buy a Blue Cross and Blue Shield of Texas BCBSTX health plan during the Special Enrollment Period SEP.

Anthem Health Plans of Maine Inc. Anthem Blue Cross and Blue Shield is the trade name of. Anthem Insurance Companies Inc.

After a qualifying life event you have a period of 60 days to change your plan or enroll in a new plan. If not you may have other choices. GET YOUR BCBSTX HEALTH PLAN Take a look at the health plans in your area.

Can I get help paying for my health plan if I qualify for a special enrollment. If not you may have other choices. How a qualifying life event works Your health insurance provider gives you the chance to make changes to your health insurance plan typically up to 60 days after a qualifying life event.

This means you can still apply for a 2021 Blue Cross and Blue Shield of Illinois BCBSIL Individual health plan for yourself and family during this time. HMO products underwritten by HMO Colorado Inc. You also may be able to select a plan up to 60 days in advance of some qualifying life events.

Review the following video and charts to see what life events qualify for a special enrollment period. For special enrollment youll need to enroll within the required time frame usually within 60 days of the life event. You may qualify to buy a Blue Cross and Blue Shield of Illinois BCBSIL health plan during the Special Enrollment Period SEP.

SEP Qualifying Life Event and Documentation You could lose your job-related health plan for many reasons. SEP Qualifying Life Event and Documentation You could lose your job-related health plan for many reasons. Change in family status These include getting married having a baby or adopting a child getting divorced or legally separated or death of a spouse or dependent.

Enrollment and effective dates vary by event and you may be asked to provide proof of the qualifying event. Qualifying Life Event You can only purchase a plan outside of Open Enrollment if you have one of the following qualifying life events. You can update your coverage or.

Wedding bells diapers and qualifying life events The summer season is upon us and to many people that brings one thing. Change in employment status. You need to change who your plan covers because of marriage or divorce.

Known as Special Enrollment Periods these exceptions help you make necessary updates to your health insurance coverage due to special circumstances. GET YOUR BCBSIL HEALTH PLAN Take a look at the health plans in your area. Certain life events like moving into the Independence Blue Cross coverage area allow you to apply for a health plan up to 60 days before a qualifying life event.

Eligibility and qualifying events checklist Effective 1119 General eligibility provisions In order to qualify for a Blue Shield of California Individual and Family Plan you must. For coverage starting in 2021. By Blue Cross and Blue Shield of Kansas.

You may qualify to buy a Blue Cross and Blue Shield of New Mexico BCBSNM health plan during the Special Enrollment Period SEP.

Https Individual Carefirst Com Carefirst Resources Pdf Qualifying Life Event Form Pdf

Blue Cross Blue Shield Association Statement On Federal Employee Health Care Coverage During The Government Shutdown

Blue Cross Blue Shield Association Statement On Federal Employee Health Care Coverage During The Government Shutdown

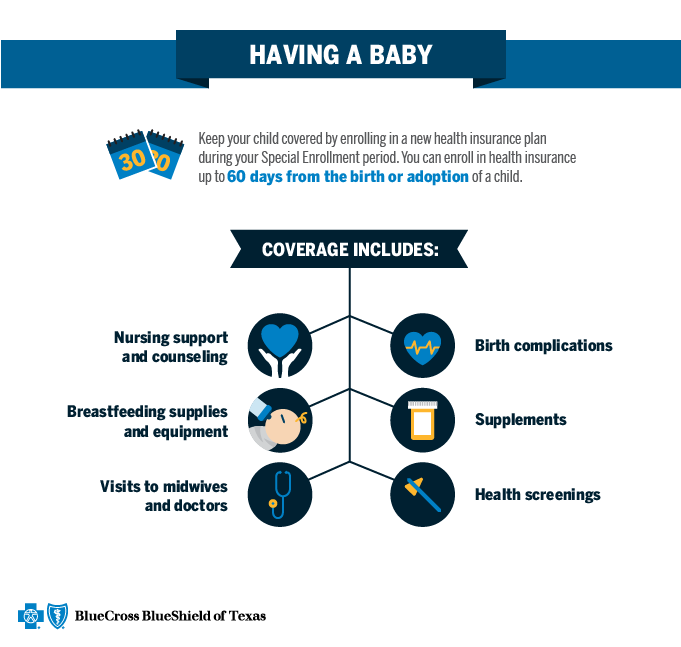

Qualifying Event Baby Blue Cross And Blue Shield Of Texas

Qualifying Event Baby Blue Cross And Blue Shield Of Texas

Qualifying Event Married Blue Cross And Blue Shield Of Texas

Qualifying Event Married Blue Cross And Blue Shield Of Texas

Fillable Online Qualifying Life Event Documents Blue Cross Blue Shield Fax Email Print Pdffiller

Fillable Online Qualifying Life Event Documents Blue Cross Blue Shield Fax Email Print Pdffiller

Open Enrollment Independence Blue Cross Ibx

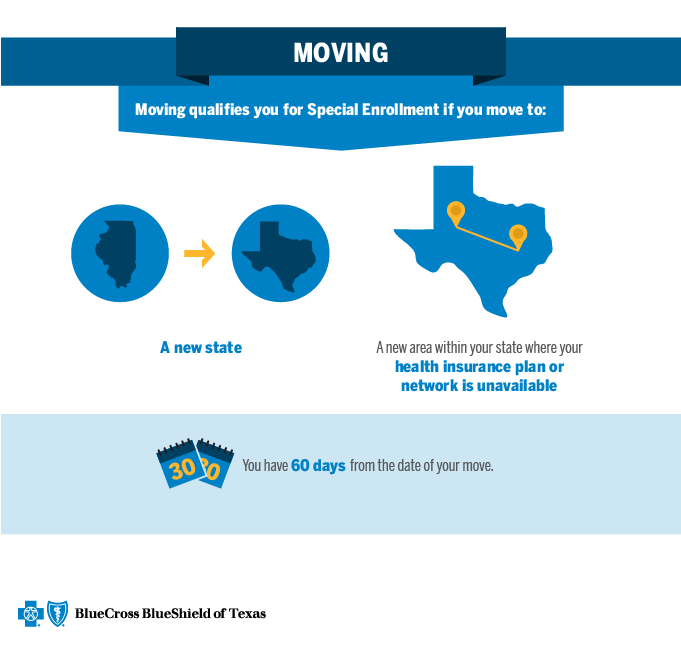

Qualifying Event Moving Blue Cross And Blue Shield Of Texas

Qualifying Event Moving Blue Cross And Blue Shield Of Texas

2020 Open Enrollment Dates For Covered California Hfc

2020 Open Enrollment Dates For Covered California Hfc

Beautiful Qualifying Event For Health Insurance Bcbs Images Penny Matrix

Beautiful Qualifying Event For Health Insurance Bcbs Images Penny Matrix

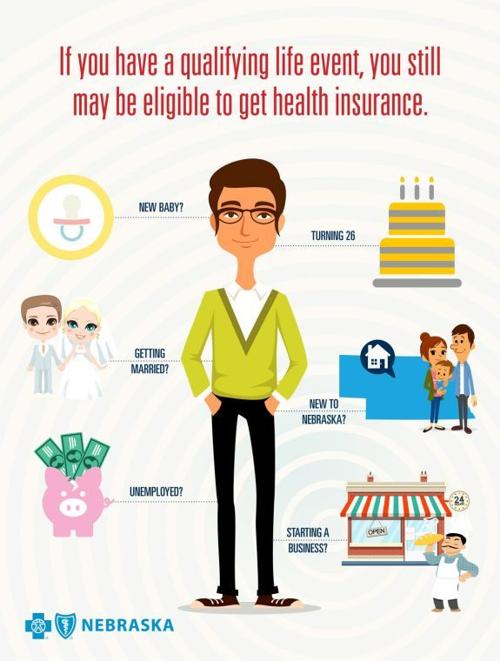

Health Insurance Enrollment Available With Certain Life Events Consumer Omaha Com

Health Insurance Enrollment Available With Certain Life Events Consumer Omaha Com

Https Www Azblue Com Media Azblue Files Individuals Shop Plans Special Enrollment Required Doc Pdf La En

Comments

Post a Comment