Featured

Maximum Subsidy For Obamacare

You must make your best estimate so you qualify for the right amount of savings. At the lowest income level the max subsidy we could have qualified for was about 5282 which would have resulted in lower insurance costs with better coverage.

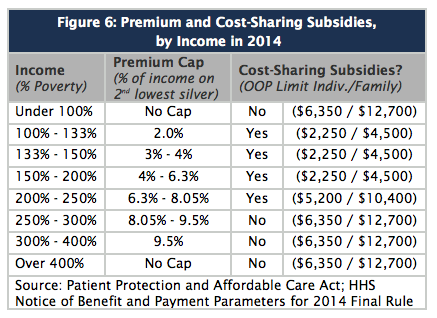

2018 Cost Sharing Reduction Subsidies Csr

2018 Cost Sharing Reduction Subsidies Csr

For a family of four it is somewhat difference and the minimum income should be around the 25100 mark while the maximum is 100400.

Maximum subsidy for obamacare. See Stay Off the ACA Premium Subsidy Cliff. Fortunately subsidy clawback limits apply in 2022 if you got extra subsidies. The maximum healthcare subsidy is around 7000 - 8000.

In this case youre better off asking for the subsidy upfront during enrollment. You get to keep the other 1228. So if the plan is 5000 your subsidy is 35244.

A 60-year-old female with the same 30000 in income however would. 23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies. When you fill out a Marketplace application youll need to estimate what your household income is likely to be for the year.

Now if your family is really big and there are 8 members the minimum income will be 42380 while. The subsidies cover the majority of the premiums for people who are subsidy-eligible. You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below.

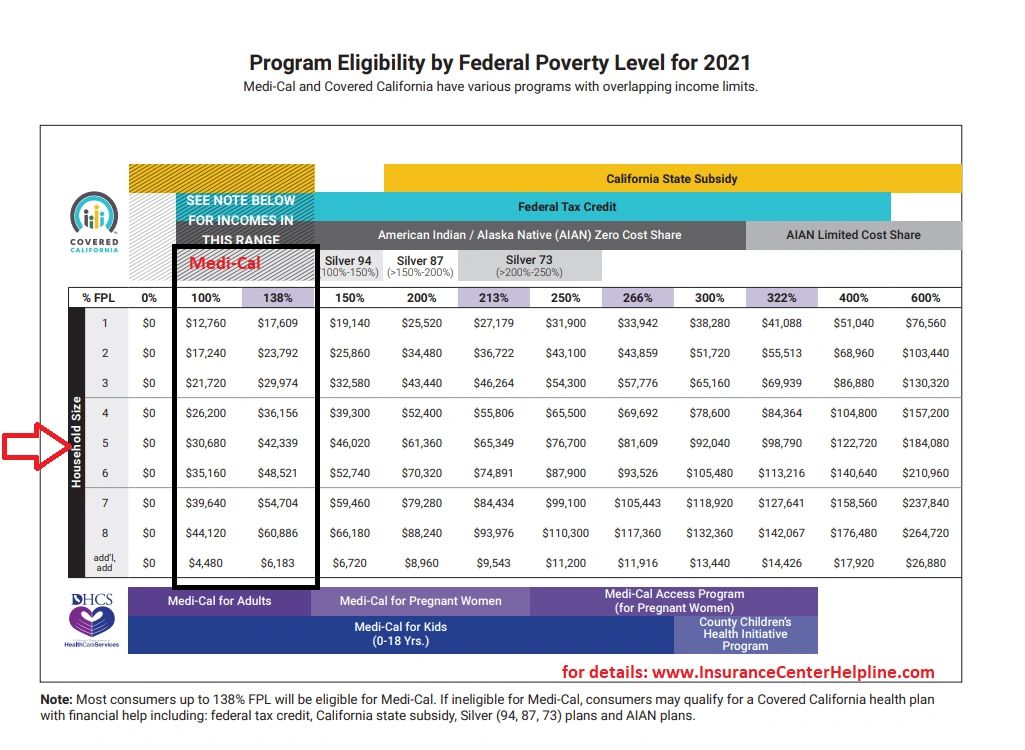

For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. Obamacare Subsidy Eligibility Obamacare offers subsidies also known as tax credits that work on a sliding scale. 4 What if you want a more expensive plan.

The average healthcare subsidy under Obamacare is roughly 5000 per person. 4 There are several criteria that determine whether youre eligible for a slice of that pie. What is the maximum income for ObamaCare.

They limit the amount you pay in monthly premiums to a percentage of your annual income. Between 2019 and 2029 annual spending on these subsidies under Obamacare is expected to grow from 737 billion to 13 trillion. This cap ranges from 650 to 2700 based on income.

Most people are eligible for subsidies when they earn 400 or less of the federal poverty level. In 2021 However your liability is capped between 100 and 400 of the FPL. Obamacare promises you wont pay more than 978 of your income a year or 464746 for the second-lowest Silver plan.

For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. This pushes your income to 50000. Marketplace savings are based on your expected household income for the year you want coverage not last years income.

86 of the people who were enrolled in exchange plans nationwide as of early 2020 were receiving premium subsidies. Your subsidy is the cost of the plan minus 464746. Instead we cancelled our insurance outright.

If your MAGI goes above 400 FPL even by 1 you lose all the subsidy. The extra 20000 income lowers your health insurance subsidy by 2578 but because your repayment cap is 1350 you only need to pay back 1350. The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019.

Deducting for this subsidy the remaining monthly premiums ranged from 129 to 439 a month among the 71 plans available. The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520. According to Connect for Health Colorados subsidy calculator you qualify for a subsidy of 688month and the lowest-priced plan is 211month after the subsidy is applied.

The benchmark plan second-lowest-cost silver plan is about 430month which amounts to 98 percent of your income. This subsidy calculator is provided by My1HR a licensed Web Based Entity WBE which is certified by the Centers for Medicare and Medicaid Services CMS to connect consumers directly with the federal health insurance Exchange at HealthCaregov. 9 Zeilen Income Limits for 2021 ACA Tax Credit Subsidies on healthcaregov.

Enter the required information into the fields below then calculate your results. And the subsidies covered an average of 85 of their premium costs.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

State And Federal Subsidies For California In 2020 Health For California Insurance Center

State And Federal Subsidies For California In 2020 Health For California Insurance Center

Don T Fall Off The Affordable Care Act Subsidy Cliffs Root Of Good

Don T Fall Off The Affordable Care Act Subsidy Cliffs Root Of Good

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

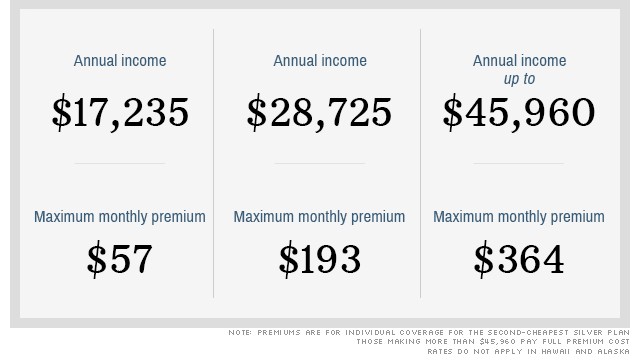

What You Ll Actually Pay For Obamacare

What You Ll Actually Pay For Obamacare

Comments

Post a Comment