Featured

Blue Cross Blue Shield Hmo Or Ppo

Blue Cross offers associates a Health Maintenance Organization HMO medical plan option and High Deductible Health Plan HDHP Preferred Provider Organization PPO medical plan option. You pick your winner.

Https Www Bcbsks Com Customerservice Providers Publications Institutional Manuals Pdf Quick Guide To Bcbs Member Id Cards Pdf

And both can be winners at meeting your healthcare needs.

Blue cross blue shield hmo or ppo. Select Blue Cross Blue Shield Global or GeoBlue if you have international. Blue Cross Medicare Advantage and Blue Cross Medicare Advantage Dual Care plans are HMO HMO-POS PPO and HMO Special Needs Plans provided by Health Care Service Corporation a Mutual Legal Reserve Company HCSC an independent licensee of the Blue Cross and Blue Shield Association. Select Blue Cross Blue Shield Global or GeoBlue if you have international.

Other benefits of the Blue Options family of plans. Enrollment in Blue Cross Blue Shield of Massachusetts depends on contract renewal. Blue Plus is a licensed nonprofit HMO.

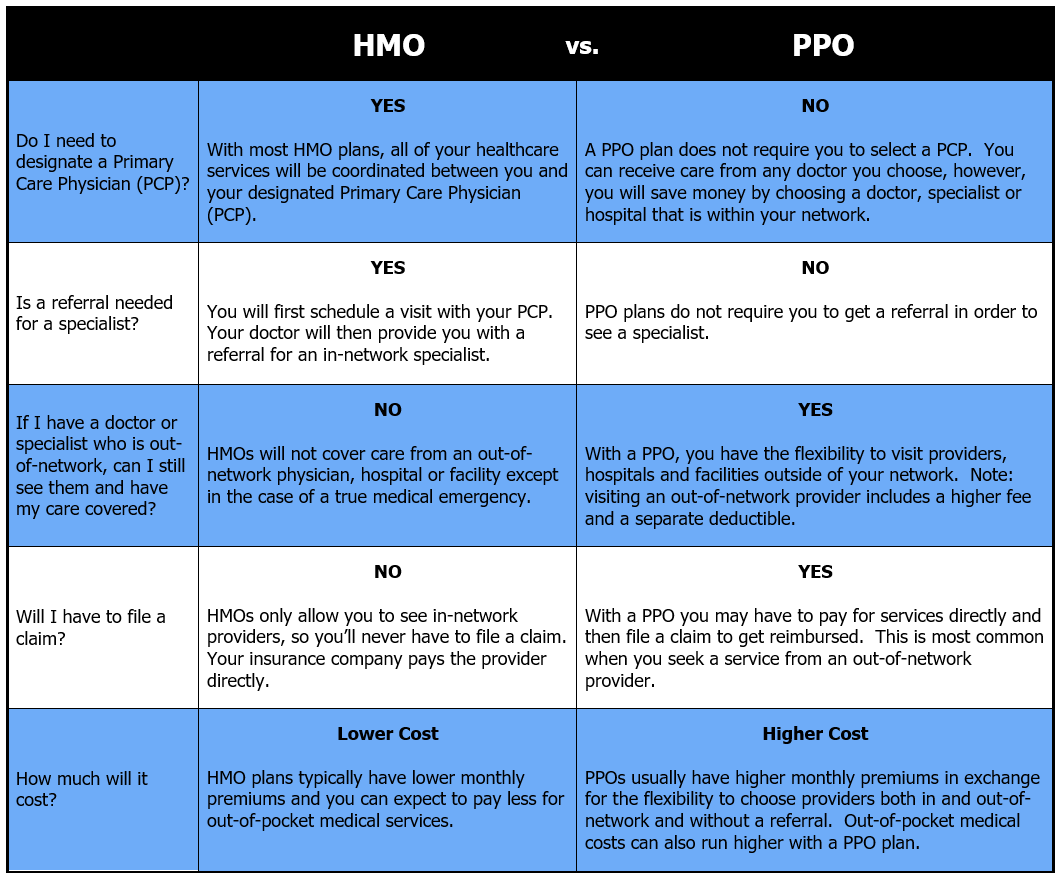

All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. Referrals are needed to see specialists. A clear concise guidethat simply and directly explains some of the big picture issues you face moving forward with your Medicare decisions.

Auto-enrolled into a Health Reimbursement Arrangement HRA with Blue Cross contributions with option of enrolling into a Health Care FSA FSA andor Dependent Care FSA Slightly higher costs per paycheck compared to the PPO plan Copay only needed for most medical services and purchasing prescriptions. Access to office visits prescriptions emergency room visits and mental health care for a copayment similar to other HMO Blue andor PPO Blue. HMO plan must access covered services through a network of physicians and facilities as directed by their PCP.

HMO stands for health maintenance organization. HEDIS HMO and PPO Reports - Blue Cross Blue Shield of Illinois HEDIS HMO and PPO Reports Each year Blue Cross and Blue Shield of Illinois BCBSIL reports audited Health Care Effectiveness Data and Information Set HEDIS results. HMO plans may be a good choice and offer a cost-efficient way to maintain your health care if you and your family go to the doctor often.

Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal. Blue Cross Blue Shield PPO plans give you and your family access to quality healthcare and provide you protection from illness and injury. HEDIS is a nationally standardized set of measures related to important areas of care and service.

You simply pay a fixed copayment each time you visit your PCP. Blue Plus HMO plans are available to people who qualify for Minnesota medical assistance. Outside the United States.

These plans can help you pay for health care if you have limited income or a disability. Outside the United States. Employers can add the BlueCard Program to Horizon PPO which offers members the in-network level of benefits outside of New Jersey when receiving services from doctors other health care professionals and hospitals that participate with the many other Blue Cross andor Blue Shield Plans across the country.

It is an affiliate of Blue Cross and Blue Shield of Minnesota. The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment. With PPO plans you may select any physicians and hospitals.

One kind might work better for you than another. With the PPO plan you have the option of selecting Blue Cross Blue Shield PPO network or out-of-network non-preferred providers. The choice is always yours to make but you may be responsible for much higher out-of-pocket costs when you seek care out of the PPO network.

Itll depend on how often you visit the doctor where you go to get your care and how much you can pay for it. Blue Cross Blue Shield members can search for doctors hospitals and dentists. The monthly payment for an HMO plan is lower than for a PPO plan with a comparable deductible and out of pocket maximum.

Rocky Mountain Hospital and Medical Service Inc. HMO Blue Texas - Blue Cross Blue Shield of Texas HMO Blue Texas The BCBSTX HMO product is health care coverage that provides benefits only when services are received from providers in the HMO Blue Texas network when prescribed directed or authorized by the members Primary Care Physician PCP or the HMO. Blue Cross Blue Shield members can search for doctors hospitals and dentists.

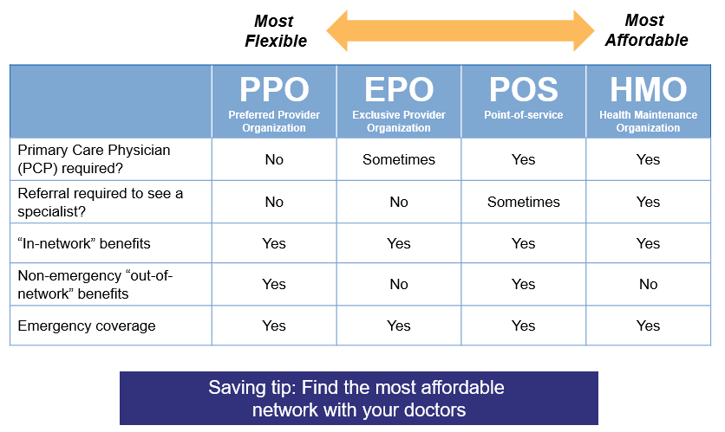

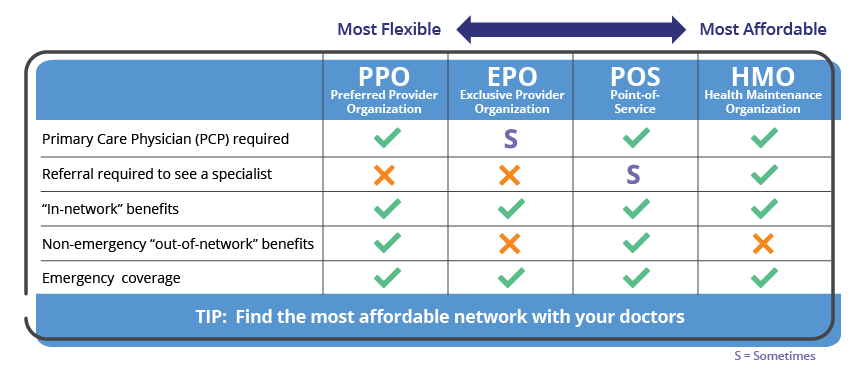

When you do this the cost of the care will be covered at the POS benefit level which is lower than in-network coverage. In the United States Puerto Rico and US. Take a look at this infographic to see the differences.

In the United States Puerto Rico and US. Blue Cross Blue Shield of Massachusetts is a HMO and PPO Plan with a Medicare contract. Its up to you to decide each year which type of plan works best for you.

PPO stands for preferred provider organization. With a Blue Cross and Blue Shield of Texas HMO POS plan you also have the choice to go outside the network or see a specialist without a PCP referral. Anthem Blue Cross and Blue Shield is the trade name of.

Anthem Blue Cross and Blue Shield is a DSNP plan with a Medicare contract and a contract with the state Medicaid program. Blue Plus members in a Minnesota health care program must choose a doctor from the Blue Plus. Popular Blue Shield PPO plans include Active Start and Essential Plan.

What Is A PPO Health Insurance Plan. The difference between them is the way you interact with those networks. The comprehensive coverage and easy to understand benefits of HMO Blue andor PPO Blue plans.

All health care plans arent the same. Blue Cross offers open access PPO plans to employer groups. HMO products underwritten by HMO Colorado Inc.

Integrity Urgent Care Accepts Blue Cross Blue Shield Advantage Hmo Insurance Integrity Urgent Care Blog Bryan College Station Copperas Cove

Integrity Urgent Care Accepts Blue Cross Blue Shield Advantage Hmo Insurance Integrity Urgent Care Blog Bryan College Station Copperas Cove

Blue Essentials Accesssm Benefit Plan

Blue Essentials Accesssm Benefit Plan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Ppo Blue Cross And Blue Shield Of Texas

Ppo Blue Cross And Blue Shield Of Texas

Five Things To Look For On Your Bcbs Id Card Blue Cross Blue Shield

Five Things To Look For On Your Bcbs Id Card Blue Cross Blue Shield

Https Www Bcbstx Com Provider Pdf Id Card Quick Guide Pdf

Https Provider Bluecrossma Com Providerhome Wcm Connect E86b35d3 A1f1 44f8 B458 105ded18fffc Mpc 110415 1c Final Member Id Card Quick Tip Pdf Mod Ajperes

Did Your Blue Cross Ppo Get Discontinued

Did Your Blue Cross Ppo Get Discontinued

How To Update Your Pcp Or Medical Group Blue Cross And Blue Shield Of Illinois

How To Update Your Pcp Or Medical Group Blue Cross And Blue Shield Of Illinois

Blue Review Blue Cross And Blue Shield Of Texas Blue Advantage Hmosm Versus Blue Cross Medicare Advantage Ppo Sm Blue Cross And Blue Shield Of Texas Bcbstx Would Like To Remind The Provider Community That Blue Advantage Hmo And Blue

Medi Share Review Why We Switched From Blue Cross

Medi Share Review Why We Switched From Blue Cross

Comments

Post a Comment